In India, 'RBI' is responsible for 'Monetary Policy' through which it controls 'Inflation' and Economic Growth'.

In this thread, I am going to focus mainly on the role of RBI and how it uses ‘CRR’ and ‘SLR’ as two major tools to control economy. 🧵👇

(1/n)

In this thread, I am going to focus mainly on the role of RBI and how it uses ‘CRR’ and ‘SLR’ as two major tools to control economy. 🧵👇

(1/n)

Let us first understand few basics before we dig into the details. (2/n)

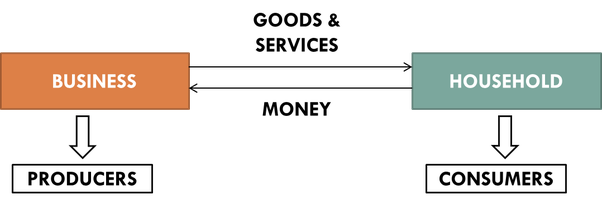

👉The Businesses:

They are the producers of the goods and services. Any business would be happy if it is growing and the prices of the goods and services sold are ever rising. They would be more interested in ‘Economic growth’. (3/n)

They are the producers of the goods and services. Any business would be happy if it is growing and the prices of the goods and services sold are ever rising. They would be more interested in ‘Economic growth’. (3/n)

👉The Households:

These are the people who are consumers and they spend money to buy goods/ services which are sold by the businesses. Any consumer would be happy if the prices of goods/ services are low. Hence, they would be interested in ‘Less Inflation’. (4/n)

These are the people who are consumers and they spend money to buy goods/ services which are sold by the businesses. Any consumer would be happy if the prices of goods/ services are low. Hence, they would be interested in ‘Less Inflation’. (4/n)

As the prices of goods and services rise, there will be economic growth in nominal sense but then there will also be inflation which is perceived as a problem in developing countries like India. (5/n)

Hence, there has to be a proper balance between these two: ‘Economic growth’ and ‘Inflation’.

It is the job of 'Reserve Bank of India' to do this. (6/n)

It is the job of 'Reserve Bank of India' to do this. (6/n)

Let us understand few more basic concepts before we dig in deeper.

A. More the demand of any commodity, the businessman will increase the price. Less the demand of any commodity, the businessman will decrease the price to attract the consumers. (7/n)

A. More the demand of any commodity, the businessman will increase the price. Less the demand of any commodity, the businessman will decrease the price to attract the consumers. (7/n)

B. RBI is the apex bank and it controls the money supply in the economy. It basically mints the money and controls all the commercial banks. (8/n)

C. More the money supply in the economy would mean more money in the hands of the people.

More money would cause increase in the purchasing power and hence the demand would increase.

Now, you know that this will cause the price to increase (read point A). (9/n)

More money would cause increase in the purchasing power and hence the demand would increase.

Now, you know that this will cause the price to increase (read point A). (9/n)

D. On the contrary, lesser money supply would cause the purchasing power of the people to fall.

Hence, there will be fall in the demand. And fall in the demand will cause the prices to fall (read point A). (10/n)

Hence, there will be fall in the demand. And fall in the demand will cause the prices to fall (read point A). (10/n)

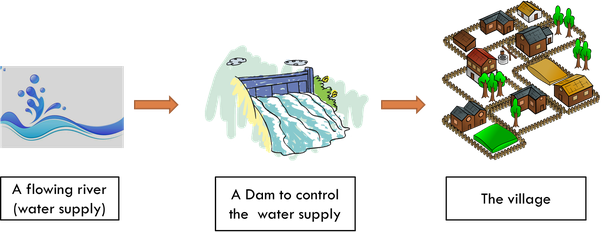

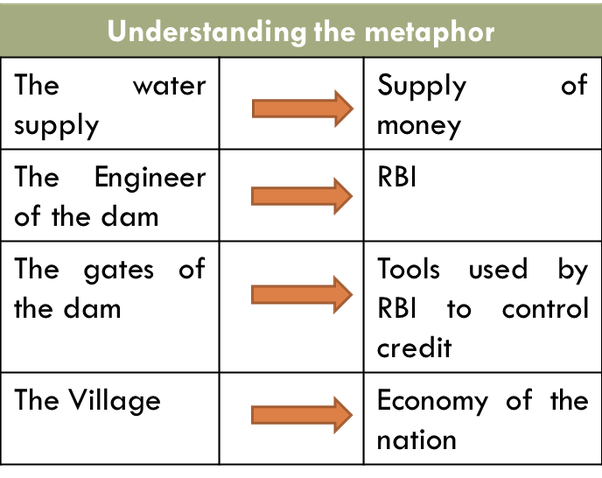

There is a flowing river whose water is being controlled by a dam. The engineer of the dam controls the gates of the dam to make sure that the water level is under control. (13/n)

Whenever, there is lack of water in the village, the gates of the dam are opened by the engineer to ensure that the people do not run out of water.

Also, care has to be taken by the engineer as opening all the gates would cause flood like situation in the village. (14/n)

Also, care has to be taken by the engineer as opening all the gates would cause flood like situation in the village. (14/n)

Also, whenever, there is excessive rain, the engineer makes sure that the gates are well locked to avoid any excess supply of water. (15/n)

This is how the economy of the country is being controlled by RBI.

Here, the role of RBI is similar to that of the engineer of the dam. The water supply is akin to the money supply. (16/n)

Here, the role of RBI is similar to that of the engineer of the dam. The water supply is akin to the money supply. (16/n)

The gates of the dam are various tools used by RBI to control the money supply in the economy. The village here would be the economy of the nation. (17/n)

So, basically RBI controls the money supply and maintains a balance between ‘Inflation’ and ‘Economic growth’.

This can be done using various tools. Let us discuss 'CRR' and 'SLR' here. (18/n)

This can be done using various tools. Let us discuss 'CRR' and 'SLR' here. (18/n)

1] What is CRR?

Ravi is a salaried person. He is married and has a 4 year old daughter.

Unfortunately, the daughter meets with an accident and she needs to be operated. (19/n)

Ravi is a salaried person. He is married and has a 4 year old daughter.

Unfortunately, the daughter meets with an accident and she needs to be operated. (19/n)

Ravi was never prepared for such contingency. He approaches his father for the money. The father gives Ravi the needed money for the operation along with a life saving advice-

“Son, always keep some portion of your salary aside for such unforeseen contingencies.” (20/n)

“Son, always keep some portion of your salary aside for such unforeseen contingencies.” (20/n)

Now every time Ravi gets his monthly salary, he keeps 10% of it with his father for future contingencies.

You see, here father is Reserve Bank of India (RBI) and son is Commercial Bank. (21/n)

You see, here father is Reserve Bank of India (RBI) and son is Commercial Bank. (21/n)

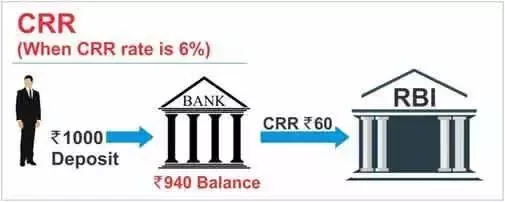

Commercial banks keep a ‘certain portion’ of their deposits with RBI in the form of cash reserves in order to meet up with the liquidity crisis.

This ‘certain portion’ is known as CRR (Cash Reserve Ratio). (22/n)

This ‘certain portion’ is known as CRR (Cash Reserve Ratio). (22/n)

When RBI increases CRR, more amount of cash would be required to be kept with RBI by the commercial banks from their public deposits.

This will lead to lesser money in the economy and hence fall in growth and inflation.

Opposite will happen when RBI decreases CRR. (23/n)

This will lead to lesser money in the economy and hence fall in growth and inflation.

Opposite will happen when RBI decreases CRR. (23/n)

2] What is SLR?

Mr. Sharma loves to eat. Given a chance, he could finish a whole jar of cookies all by himself.

One fine day Mrs. Sharma realises that her husband was getting too fat eating all those unhealthy stuff. (24/n)

Mr. Sharma loves to eat. Given a chance, he could finish a whole jar of cookies all by himself.

One fine day Mrs. Sharma realises that her husband was getting too fat eating all those unhealthy stuff. (24/n)

She decides to keep all the cookies in a cookie jar which could be locked using a timer.

Every time Mr.Sharma tried to eat cookies, to his disappointment the jar was locked. (25/n)

Every time Mr.Sharma tried to eat cookies, to his disappointment the jar was locked. (25/n)

This really helped Mr. Sharma in killing his temptation to eat those delicious cookies and hence kept him healthy.

However, whenever he followed a healthy schedule, Mrs. Sharma would allow him to cheat and eat those cookies. This was the deal between them. (26/n)

However, whenever he followed a healthy schedule, Mrs. Sharma would allow him to cheat and eat those cookies. This was the deal between them. (26/n)

Here, Mr. Sharma is Commercial Bank and Mrs. Sharma is RBI. The cookies locked in the jar is the SLR. (27/n)

SLR is statutory liquidity ratio.

A certain portion of the deposit received by commercial banks from public has to be kept by commercial banks with themselves so that the same reserve could be used in case of future contingencies. (28/n)

A certain portion of the deposit received by commercial banks from public has to be kept by commercial banks with themselves so that the same reserve could be used in case of future contingencies. (28/n)

SLR is kept by banks in the form of gold, cash and other securities which can not be used by commercial banks for further lending.

This way, RBI is controlling the temptation of commercial banks to lend that portion to public. (29/n)

This way, RBI is controlling the temptation of commercial banks to lend that portion to public. (29/n)

As Mrs.Sharma controlled Mr.Sharma in eating the cookies from the jar.

Whenever need arises, commercial banks can use the amount of SLR as Mr. Sharma was allowed to eat the cookies after following a healthy schedule. (30/n)

Whenever need arises, commercial banks can use the amount of SLR as Mr. Sharma was allowed to eat the cookies after following a healthy schedule. (30/n)

Higher the SLR, higher would be the deposit kept for contingencies.

Hence Banks would not be able to lend more money.

Lesser money in the hands of public would mean lesser purchasing power.

Decrease in purchasing power would bring down demand and hence reduce the prices. (31/n)

Hence Banks would not be able to lend more money.

Lesser money in the hands of public would mean lesser purchasing power.

Decrease in purchasing power would bring down demand and hence reduce the prices. (31/n)

That's how RBI uses 'CRR' and 'SLR'. (32/32)

Tagging @Vivek_Investor, @FI_InvestIndia, @datta_arvind for better reach 🙏

Tagging @Vivek_Investor, @FI_InvestIndia, @datta_arvind for better reach 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh