Thread: Interesting results from the NY Fed’s March surveys. Bottom line, the surveys confirm that the #Fed is getting only half of its message across to investors.

First, both primary dealers and market participants see high odds of early and fast liftoff. 1/6

First, both primary dealers and market participants see high odds of early and fast liftoff. 1/6

Second, the odds of 2022 liftoff are about flat since December, but the odds of 2023 liftoff have increased to about 70%, according to primary dealers. A bit less according to broader market participants. 2/6

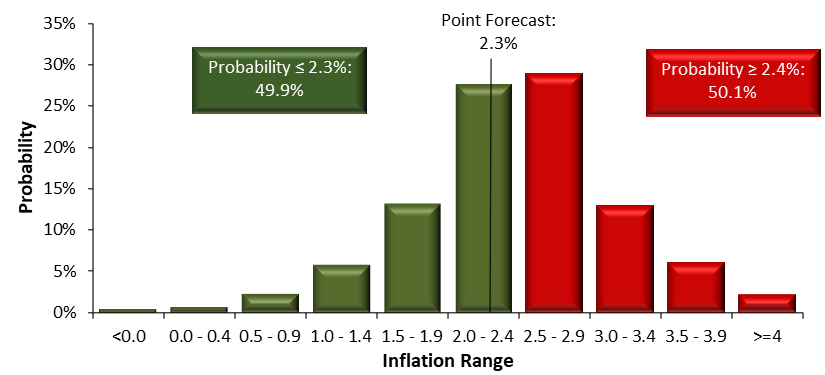

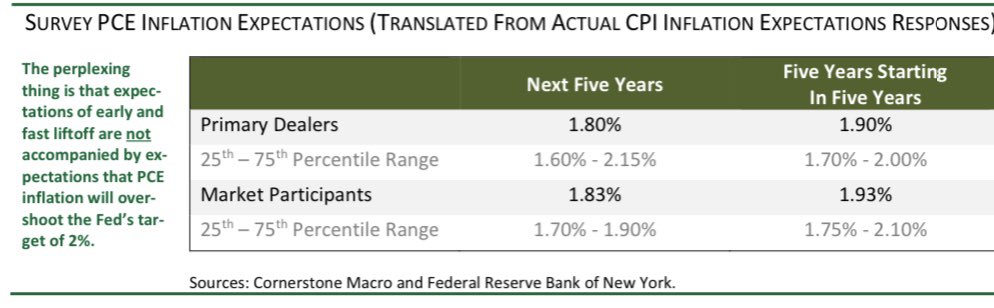

What is perplexing is that investors believe in early/fast liftoff despite seeing PCE inflation not even at target as a base case for the next 5 years or the subsequent 5 years.

Table shows PCE inflation translated from original CPI inflation in the surveys. 3/6

Table shows PCE inflation translated from original CPI inflation in the surveys. 3/6

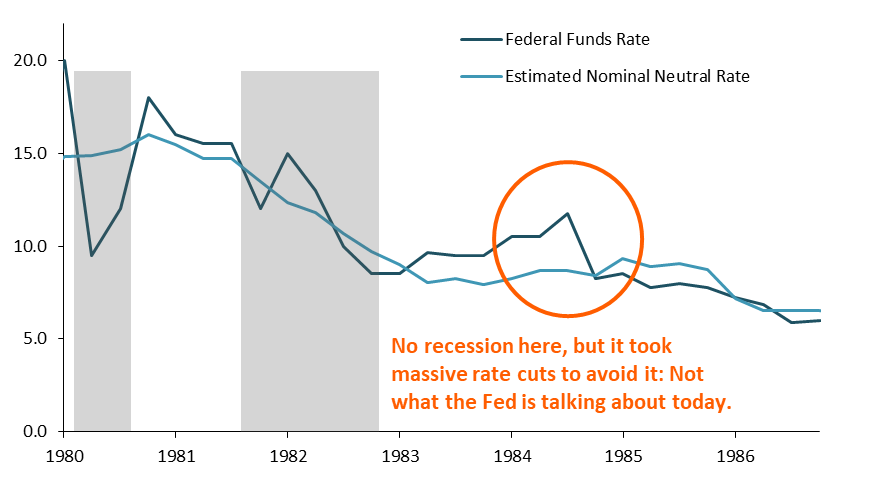

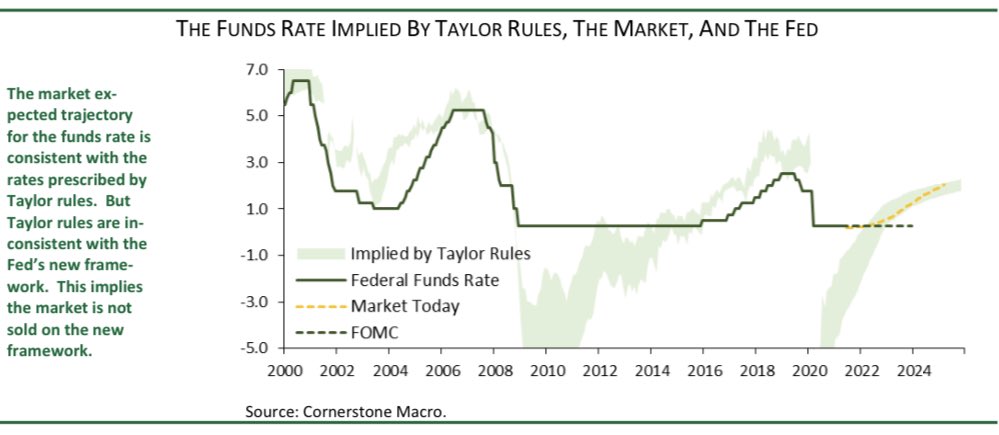

These results are in line with what we get from market prices. Expectations for the funds rate are in line with traditional Taylor rules, but those Taylor rules are not compatible with the new #Fed framework. 4/6

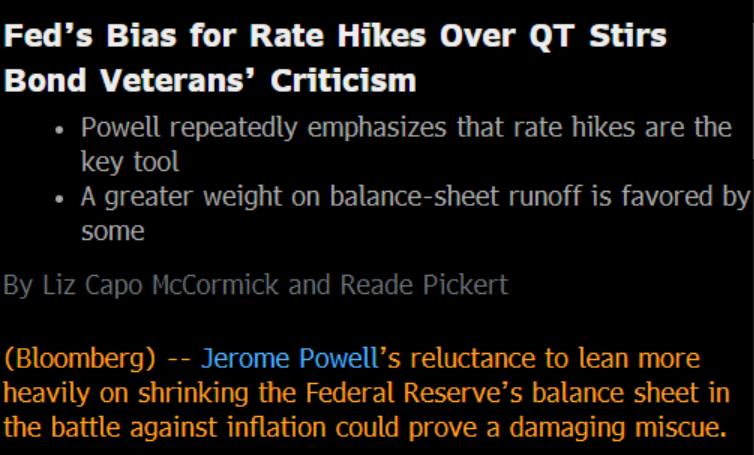

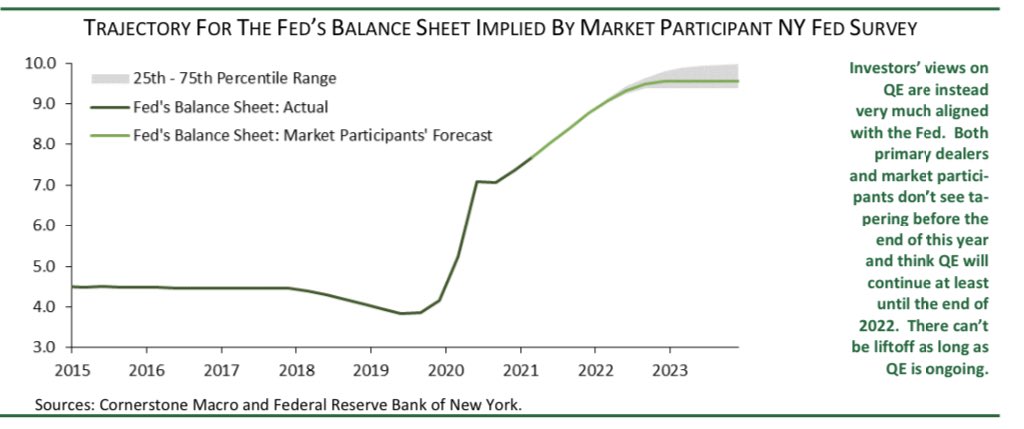

So, investors are out of sync with the #Fed on rate policy. However, they are very much in sync when it comes to QE: no taper this year, and slow taper to end QE at the end of 2022 at the earliest. 5/6

Expectations of early and fast liftoff unnecessarily tighten mon pol. The Fed should do its best to correct them. One way would be to emphasize that QE has to end before liftoff can occur.

Fed Exit Sequence:

1.QE

2.Taper QE

3.End QE

4.Wait some time

5.Lift off

6/6

Fed Exit Sequence:

1.QE

2.Taper QE

3.End QE

4.Wait some time

5.Lift off

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh