Head of Global Policy Research at Piper Sandler. Former founding partner of Cornerstone Macro and Federal Reserve senior staff member.

How to get URL link on X (Twitter) App

2) The labor force participation rate dropped again.

2) The labor force participation rate dropped again.

Powell mentioned 3 tightening episodes that did not result in recessions: 1965, 1984, and 1994.

Powell mentioned 3 tightening episodes that did not result in recessions: 1965, 1984, and 1994.

Both QT and rate hikes are ways to tighten policy. The purpose of policy tightening is to raise borrowing costs. QT does that, and fed funds rate hikes do that too as they propagate across the yield curve. 2/6

Both QT and rate hikes are ways to tighten policy. The purpose of policy tightening is to raise borrowing costs. QT does that, and fed funds rate hikes do that too as they propagate across the yield curve. 2/6

Of course, inflation is way above target and needs to come down. But oil prices are raising fast. Among other consequences, gas prices are at the highest in many years.

Of course, inflation is way above target and needs to come down. But oil prices are raising fast. Among other consequences, gas prices are at the highest in many years.

First, that line of thinking implies that Powell misrepresented his and the FOMC's views in the past several months in order to get the nomination. I find that hard to believe, to put it mildly. 2/5

First, that line of thinking implies that Powell misrepresented his and the FOMC's views in the past several months in order to get the nomination. I find that hard to believe, to put it mildly. 2/5

However, "most" FOMC participants also believe that substantial further progress has been made towards the inflation goal.

However, "most" FOMC participants also believe that substantial further progress has been made towards the inflation goal.

The problem is that there are other things that "contaminate" TIPS yields and that muddle the waters. Specifically, these things are risk premiums and liquidity premiums.

The problem is that there are other things that "contaminate" TIPS yields and that muddle the waters. Specifically, these things are risk premiums and liquidity premiums.

2. The market's estimate of the neutral rate (the expected FFR 7-10 years ahead) collapsed and continues to move down (left). Most of it is lower inflation expectations not lower expected real rates (right).

2. The market's estimate of the neutral rate (the expected FFR 7-10 years ahead) collapsed and continues to move down (left). Most of it is lower inflation expectations not lower expected real rates (right).

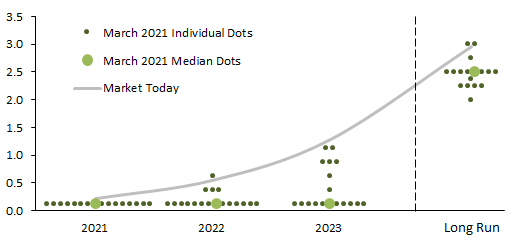

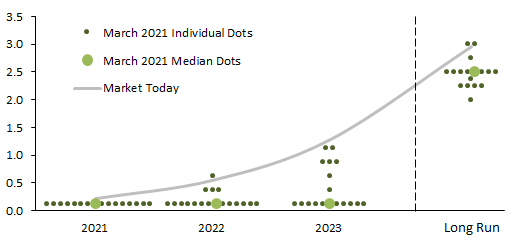

The market is 100% buying that the Fed will raise rates sooner and faster than previously thought (it always did, and even more so after the FOMC). Look at the higher expected trajectory for the FFR for the first four years. 2/6

The market is 100% buying that the Fed will raise rates sooner and faster than previously thought (it always did, and even more so after the FOMC). Look at the higher expected trajectory for the FFR for the first four years. 2/6

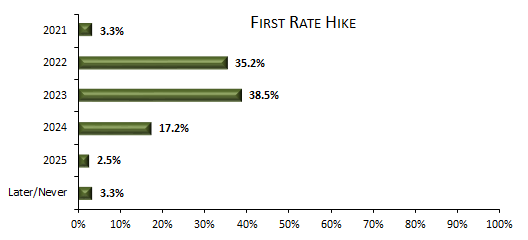

Second, the odds of 2022 liftoff are about flat since December, but the odds of 2023 liftoff have increased to about 70%, according to primary dealers. A bit less according to broader market participants. 2/6

Second, the odds of 2022 liftoff are about flat since December, but the odds of 2023 liftoff have increased to about 70%, according to primary dealers. A bit less according to broader market participants. 2/6

2/8 Monetary policy works via financial markets, and financial markets price interest rates in part based on expectations of what the Fed will do in the future.

2/8 Monetary policy works via financial markets, and financial markets price interest rates in part based on expectations of what the Fed will do in the future.

2/5 This notwithstanding, 77% or respondents see the Fed raising rates before the end of 2013. I read this, coupled with the modest forecast for inflation, as a sign that investors do not fully believe that the Fed is committed to its new average inflation targeting framework.

2/5 This notwithstanding, 77% or respondents see the Fed raising rates before the end of 2013. I read this, coupled with the modest forecast for inflation, as a sign that investors do not fully believe that the Fed is committed to its new average inflation targeting framework.