LOL if you think the hashrate drop was the reason for the dump you’re ngmi.

https://twitter.com/woonomic/status/1383672529995190281

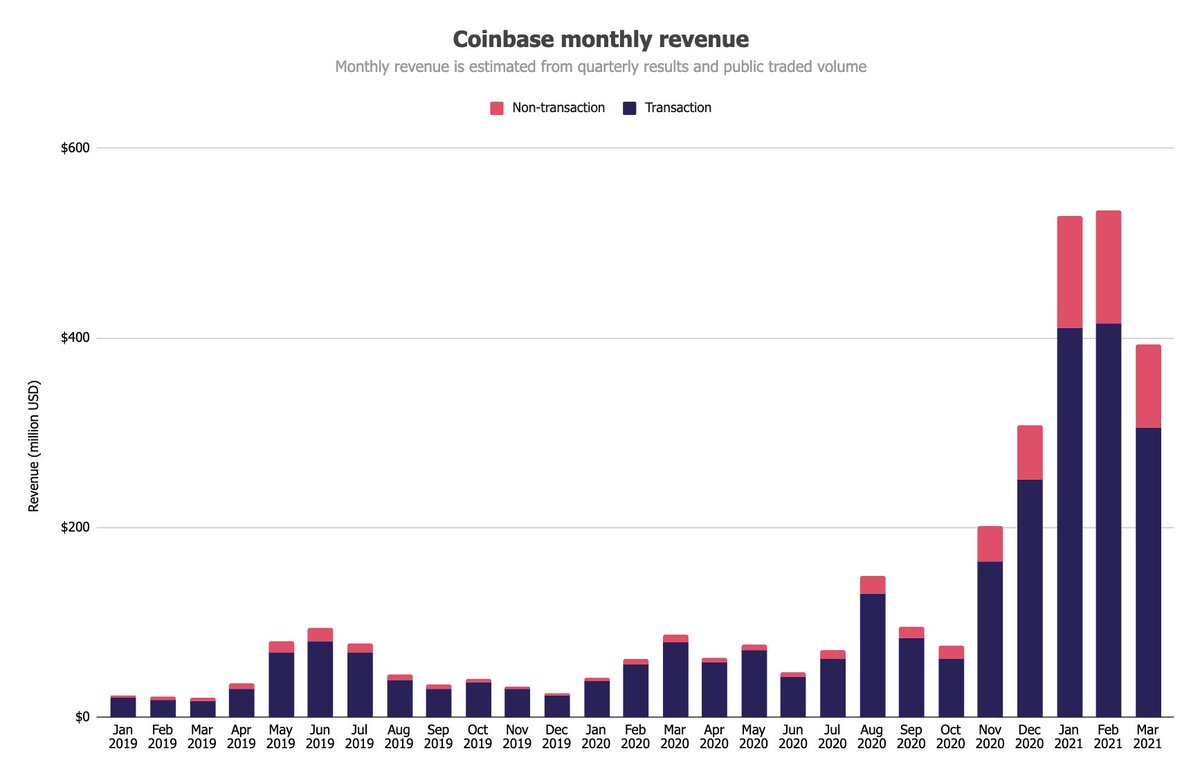

For those looking for some explanation, corrections are natural after massive run ups. Weekends with low liquidity are perfect, some dumb catalyst to spook traders off and down we go. Markets were bid up for Coinbase and that ended up disappointing as well. Not surprising

The best advice in this market is to stop looking for reasons and always be ready for large 20% down moves that have always happened. Stop massively overleveraging and you're gonna be fine homies. Hashrate has nothing to do with these, just market exhaustion

To clarify, I meant stop looking for simple explanations to things that can be explained by market structure. Weekends are low liq, markets have been running up for weeks, everyone was overleveraged and a lot of negatives narratives converge. That's your explanation, not hashrate

• • •

Missing some Tweet in this thread? You can try to

force a refresh