Commodity Supercycles.

Hit the 're-tweet' & help us educate more investors.

A micro thread 🧵👇

Hit the 're-tweet' & help us educate more investors.

A micro thread 🧵👇

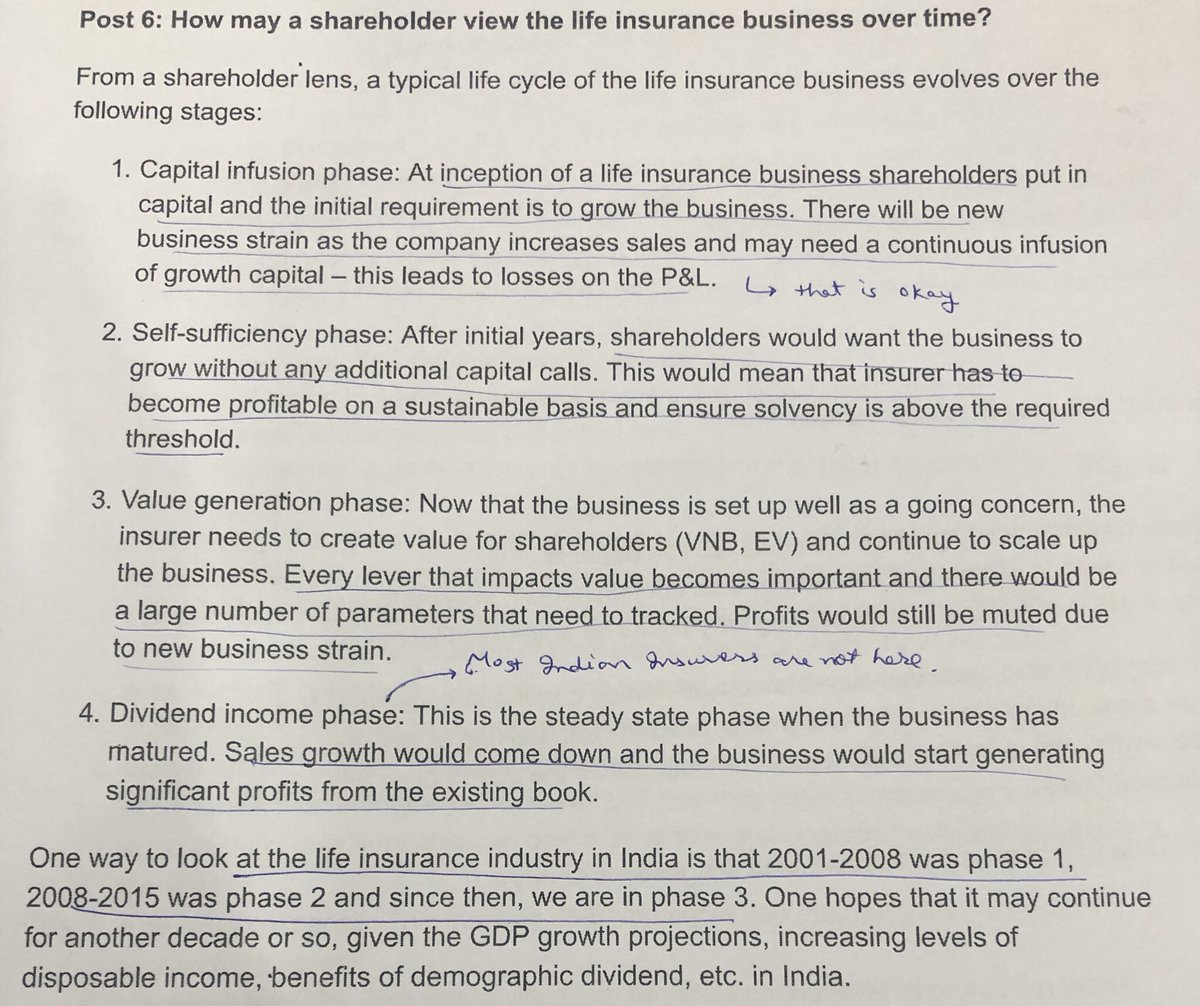

1/ What is a commodity supercycle?

They are near decade long periods where commodities trade well above their price trend

supercycles are rare

Going back 100 years, Only 3-4 supercycles have been identified & each was tied to a transformational period of economic development.

They are near decade long periods where commodities trade well above their price trend

supercycles are rare

Going back 100 years, Only 3-4 supercycles have been identified & each was tied to a transformational period of economic development.

2/ A one-two year rally in commodity prices is NOT a supercycle, rather could just a rebound from an imp. event as what even happened after the 2008 great recession.

3/ Two commodity supercycles have occurred since the end of World War II.

The 1st started in the mid of 1960s & lasted through the 1970s.

Likely driven by a collapsing US dollar, higher inflation & 2 oil price shocks.

The 1st started in the mid of 1960s & lasted through the 1970s.

Likely driven by a collapsing US dollar, higher inflation & 2 oil price shocks.

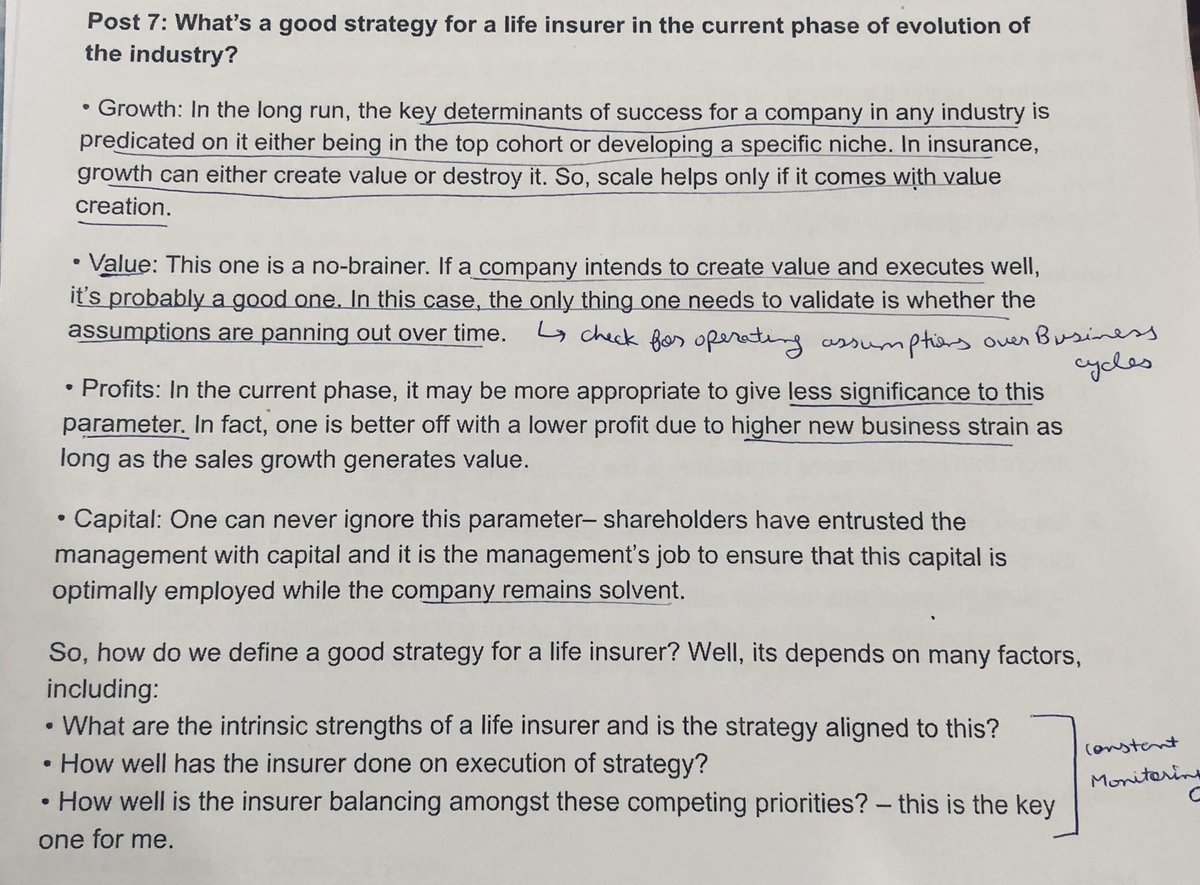

4/ Why US dollar is an important monitorable?

Raw materials are almost always priced in US dollars.

When the value of the dollar drops, it costs more dollars to buy commodities. At the same time, it costs a lesser amount of other currencies when the dollar is moving lower.

Raw materials are almost always priced in US dollars.

When the value of the dollar drops, it costs more dollars to buy commodities. At the same time, it costs a lesser amount of other currencies when the dollar is moving lower.

5/ The last supercycle lasted from the mid-1990s until the 2008 financial crisis.

Reason? 'BRIC'

During this time, Brazil, Russia, India & China (BRIC: 40% of the world's population) were on a path of rapid industrialisation, which required an abnormal amount of raw materials.

Reason? 'BRIC'

During this time, Brazil, Russia, India & China (BRIC: 40% of the world's population) were on a path of rapid industrialisation, which required an abnormal amount of raw materials.

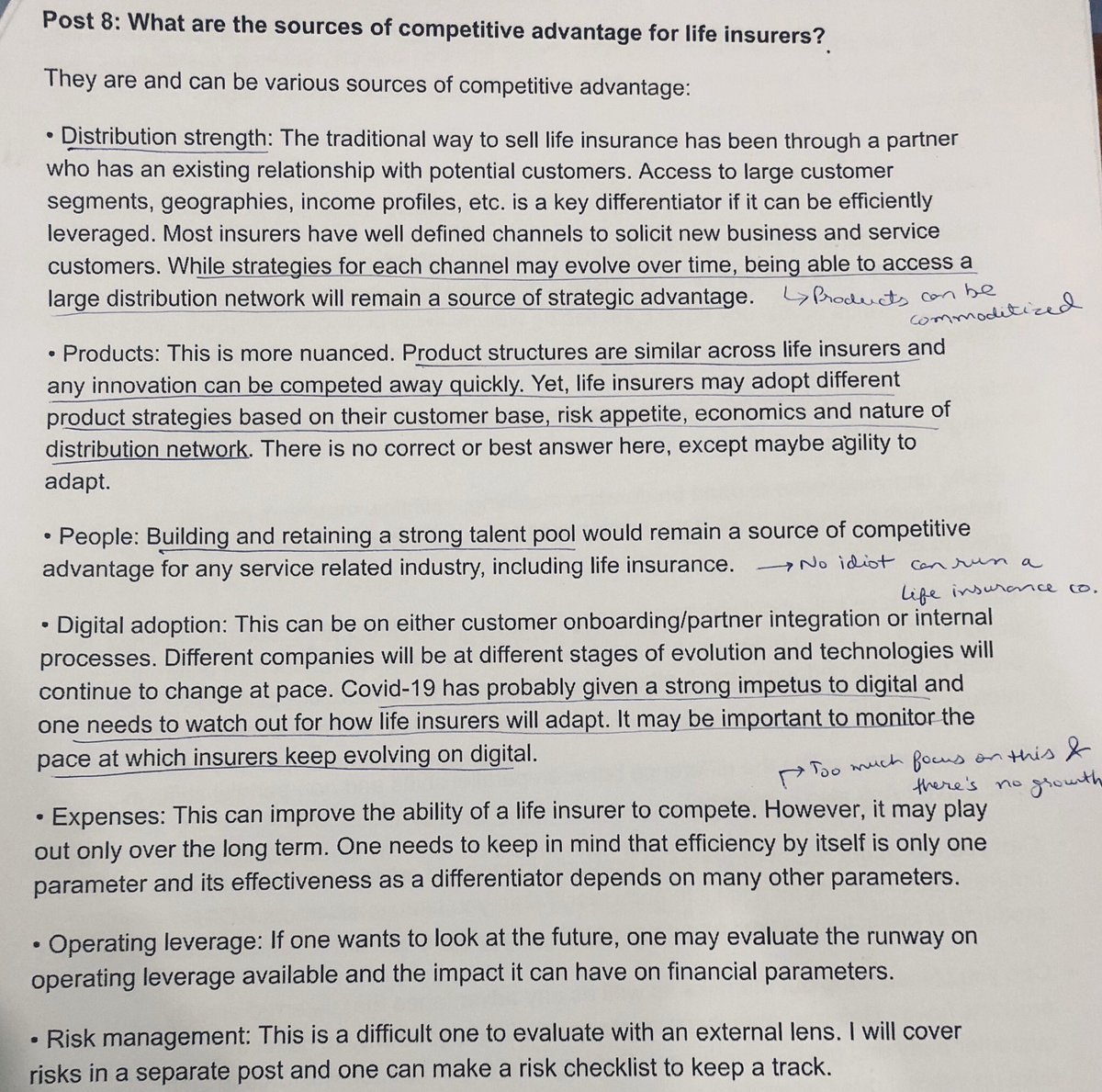

6/

So, How many people predicted the last supercycles? Not many.

Supercycles are best defined in hindsight.

So, it will be years from now before we truly know whether we are witnessing the start of a new commodity supercycle.

End of Thread.

So, How many people predicted the last supercycles? Not many.

Supercycles are best defined in hindsight.

So, it will be years from now before we truly know whether we are witnessing the start of a new commodity supercycle.

End of Thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh