1/21 - Stability and growth through bonds:

How they're designed, how they've worked so far, and the role of reserve vs liquidity bonds

A 🧵👇👇👇👇👇👇👇👇👇👇👇👇

How they're designed, how they've worked so far, and the role of reserve vs liquidity bonds

A 🧵👇👇👇👇👇👇👇👇👇👇👇👇

2/21 - Bonds have become the cornerstone of Olympus

Today they are our primary treasury accumulation mechanism; and, with the passage of a recent proposal, they're slated to remain in that role

scattershot.page/#/olympusdao.e…

Today they are our primary treasury accumulation mechanism; and, with the passage of a recent proposal, they're slated to remain in that role

scattershot.page/#/olympusdao.e…

3/21 - But there was actually a time when bonds weren't in the picture at all

The initial design here centered solely on a sales contract, which would sell and buy directly to/from users

The initial design here centered solely on a sales contract, which would sell and buy directly to/from users

4/21 - Bonds arose from a larger emphasis on liquidity, and a search for mechanisms to accumulate it

Through that search, I feel like I stumbled upon a seriously powerful mechanism

Through that search, I feel like I stumbled upon a seriously powerful mechanism

5/21 - Bonds have several characteristics that are beneficial to our currency aspirations

Even at such a small state, they've exhibited an ability to manifest shockingly consistent price action

Even at such a small state, they've exhibited an ability to manifest shockingly consistent price action

6/21 - The most important of those characteristics are their pricing mechanism

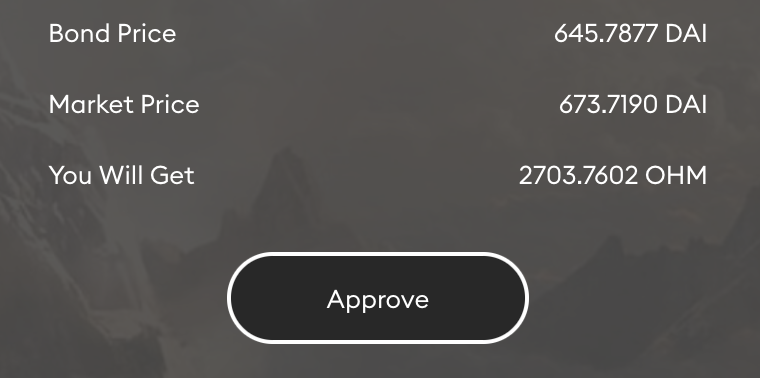

Bonds trade without any market data. No price feed, no oracles, nothing

Instead, prices are derived from their demand. More demand = higher price; less demand = lower price

Bonds trade without any market data. No price feed, no oracles, nothing

Instead, prices are derived from their demand. More demand = higher price; less demand = lower price

7/21 - This makes every bond market a derivative of $OHM

They function similar to futures; bonds are generally bought when the bond price is lower than market price minus expected yield for the term

Even at under a $100m market cap, an efficient market seems to be forming

They function similar to futures; bonds are generally bought when the bond price is lower than market price minus expected yield for the term

Even at under a $100m market cap, an efficient market seems to be forming

8/21 - This dynamic compounds with new bond markets

We have more and more prices (market price + staking yield, LP yield - reduced risk, LP bond price, DAI bond price, etc) all working to converge on the same number

We're forcing the market to come to a consensus on price

We have more and more prices (market price + staking yield, LP yield - reduced risk, LP bond price, DAI bond price, etc) all working to converge on the same number

We're forcing the market to come to a consensus on price

9/21 - Why does this matter?

Well, its much easier to stick to and stabilize in a range when everyone agrees that that should be the range

A positive trading environment forms; people will dip buy the lows and spike sell the highs, protecting the range

Well, its much easier to stick to and stabilize in a range when everyone agrees that that should be the range

A positive trading environment forms; people will dip buy the lows and spike sell the highs, protecting the range

10/21 - Liquidity bonds assist immensely here as well. Spikes generally get sold to roll over bonds (sell OHM to create more LP)

This has the effect of bringing price back to the range. But the range is now more liquid. It becomes harder and harder to move out of it

This has the effect of bringing price back to the range. But the range is now more liquid. It becomes harder and harder to move out of it

11/21 - Those bonds also lock more funds in the treasury, and build up more rewards for stakers

Both of these inspire more confidence in the protocol and drive more demand, helping the growth cycle continue

Both of these inspire more confidence in the protocol and drive more demand, helping the growth cycle continue

12/21 - With the introduction of DAI bonds, we will be reducing the role of liquidity bonds (at least for now)

You may wonder, doesn't that mean something is going wrong?

You may wonder, doesn't that mean something is going wrong?

13/21 - No! It means something has gone right

We're reaching a point of protocol owned liquidity where, though it will always be important and we will always accumulate, we don't need to focus so heavily on it

It's a matter of priorities; and priorities change based on scarcity

We're reaching a point of protocol owned liquidity where, though it will always be important and we will always accumulate, we don't need to focus so heavily on it

It's a matter of priorities; and priorities change based on scarcity

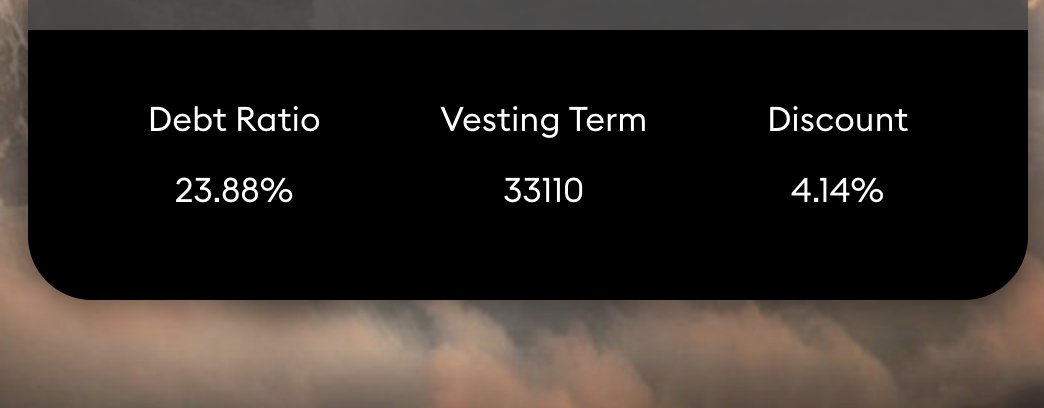

14/21 - With a push toward DAI bonds, we can accumulate far more rewards -- we discount the LP we own to account for price risk; with DAI, that risk is 0

Our focus now shifts from strengthening the present market to securing the future market

Our focus now shifts from strengthening the present market to securing the future market

15/21 - I'm honestly excited to see this in action, because the capital efficiency upgrade is astounding (nearly 30:1)

16/21 - This should strengthen the current trend imposed by liquidity bonds, but with the option of less market suppression or more reward accrual (right now we're going for a midpoint skewed to the former)

17/21 - Now, the market seems to agree on an $800 price range right now, but this won't necessarily be the case next week or next month or next year

18/21 - But, the longer we stay here, and the more assets we accumulate relative to circulating supply, the more fairly- (or under-) valued we become (more about this soon😉)

19/21 - The range is self-reinforcing; a cyclical loop making a stronger and stronger case that where it has been is where it should be

And if where it has traded is where it will continue to trade...well, that sounds a whole lot like a floating currency

And if where it has traded is where it will continue to trade...well, that sounds a whole lot like a floating currency

20/21 - tldr;

- bonds help the market choose a price

- bonds help the market hold that price

- bonds make that price more legitimate

- bonds help the market choose a price

- bonds help the market hold that price

- bonds make that price more legitimate

21/21 - be sure to watch (or participate) as we launch DAI bonds tomorrow

If you have any questions, pop into the discord and I or another ohmie will be happy to chat and discuss

discord.gg/OlympusDAO

If you have any questions, pop into the discord and I or another ohmie will be happy to chat and discuss

discord.gg/OlympusDAO

• • •

Missing some Tweet in this thread? You can try to

force a refresh