As another corporate tax code rewrite looms, both sides of the debate will present opinions as facts. I look at how much US companies pay in taxes, relative to non-US companies. At 25-27%, US statutory tax rates are in the middle of the pack: bit.ly/3v2W9oT

But US companies pay less in effective tax rates than companies elsewhere in the world, largely because of the bloat in the US tax code. bit.ly/3v2W9oT

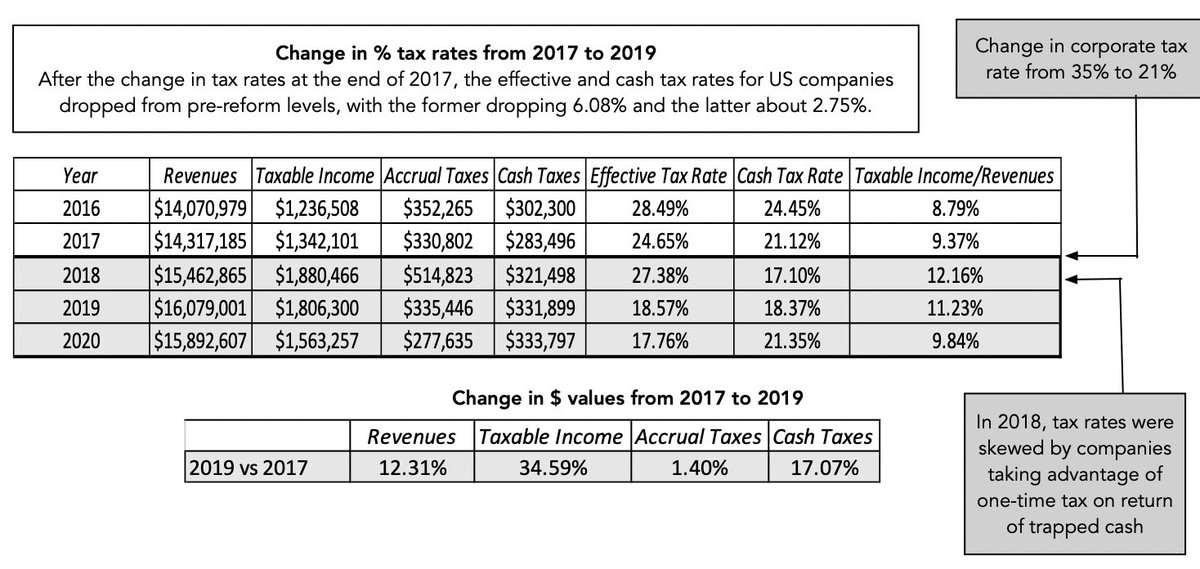

But the 2017 tax reform act rates is not to blame, for lower taxes. While effective tax rates dropped in its aftermath, taxable income increased, as did cash taxes paid. bit.ly/3v2W9oT

And the differences across US industries in tax burden are a testimonial to how these credits and deductions create inequitable burdens across industries. bit.ly/3v2W9oT

Bottom line. Focus less on raising corporate tax rates, and more on removing the bloat in the tax code. In short, corporate taxes are for generating revenues, not an instrument for punishing bad & rewarding good companies. bit.ly/3v2W9oT

• • •

Missing some Tweet in this thread? You can try to

force a refresh