A world with bitcoin is a world with an electric grid that can accommodate a higher share of renewable energy.

(Why do we think so? Read here: wintonark.medium.com/bitcoin-mining…)

(Why do we think so? Read here: wintonark.medium.com/bitcoin-mining…)

https://twitter.com/sqcrypto/status/1384901045134974978

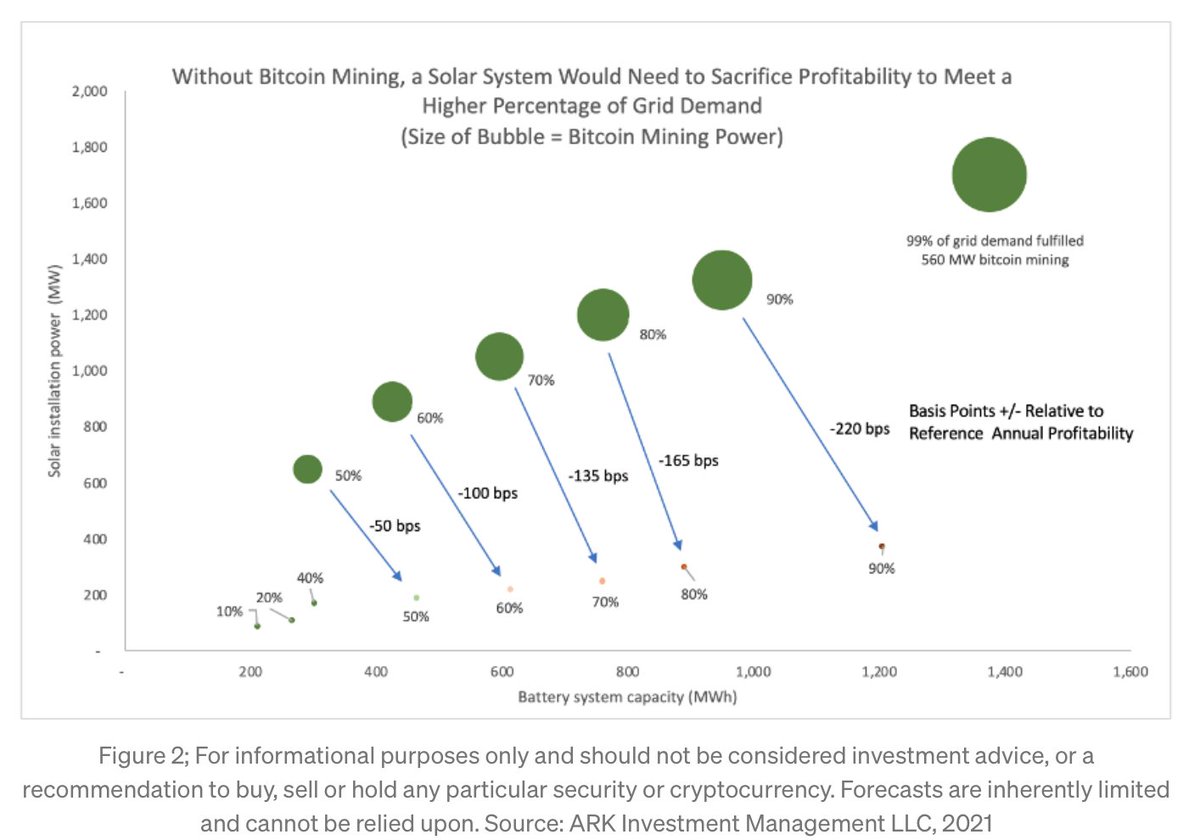

A solar-battery system alone experiences decaying profitability as it attempts to accommodate a larger share of grid demand.

Paired with a bitcoin miner, however, the system can be effectively overpowered to hit baseload quality dispatch rates without hurting system profitability

Paired with a bitcoin miner, however, the system can be effectively overpowered to hit baseload quality dispatch rates without hurting system profitability

Since the bitcoin-battery-solar system overbuilds solar (relative to battery) in order to provide baseload-competitive electricity, there is a likely second-order impact in furthering solar along its cost decline curve.

• • •

Missing some Tweet in this thread? You can try to

force a refresh