I've been off radar all day and come home to this bomb shell. I shall digest it properly tomorrow, but a few points have jumped out to me.

Warning: I have not read the entire disclosure yet.

1/6

Warning: I have not read the entire disclosure yet.

1/6

https://twitter.com/steve_packham/status/1384967680441167873

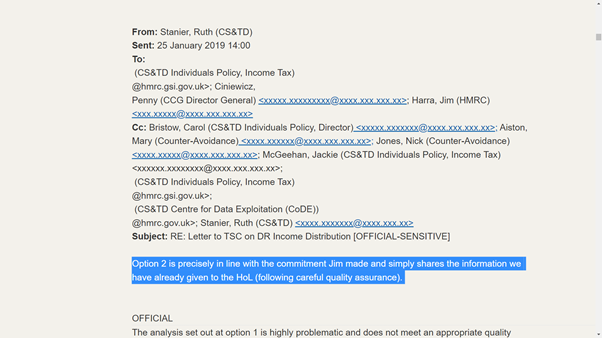

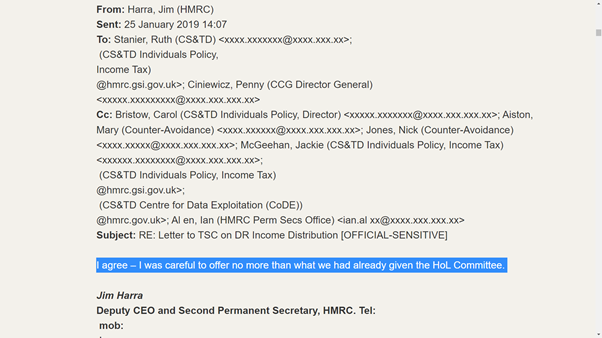

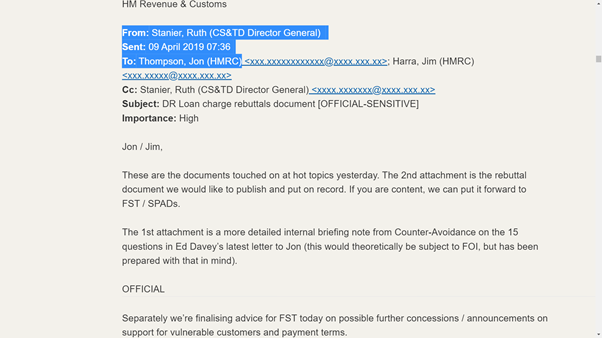

Perhaps this is the nub of the issue: HMRC see contractors as the enemy and the loan charge was just one part of this battle.

2/6

2/6

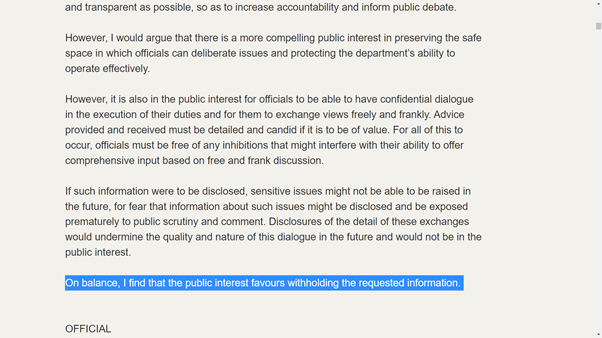

It also seems that Jesse Norman was initially prepared to remove the loan charge from “unprotected years” … but HMRC counselled him against that.

3/6

3/6

I am not sure I fully agree with any of the reasons given by HMRC for objecting to what was Jesse’s initial views. But he was obviously persuaded by them.

4/6

4/6

Objection 1 - correct but it would significantly reduce the unfairness of the loan charge

Objection 2 - Yes removing an unfair tax charge could cost money. But is that a reason not to remove it?

Objection 3 - See tweet 6

5/6

Objection 2 - Yes removing an unfair tax charge could cost money. But is that a reason not to remove it?

Objection 3 - See tweet 6

5/6

Objection 3 - The UK tax code proves that complexity is not a bar to introducing a tax rule that HMRC want. However, it would not have been at all complex to remove unprotected years from the loan charge.

It is quite clear HMRC did not want to (see tweet 1 above).

6/6

It is quite clear HMRC did not want to (see tweet 1 above).

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh