It's official: Biden will commit to reduce US greenhouse gas emissions 50-52% below 2005 levels by the end of the decade. He'll make the commitment at 8am EST today as the virtual climate summit with world leaders kicks off.

nytimes.com/live/2021/04/2…

#ClimateAction #EarthDay2021

nytimes.com/live/2021/04/2…

#ClimateAction #EarthDay2021

https://twitter.com/JesseJenkins/status/1385045915736608777

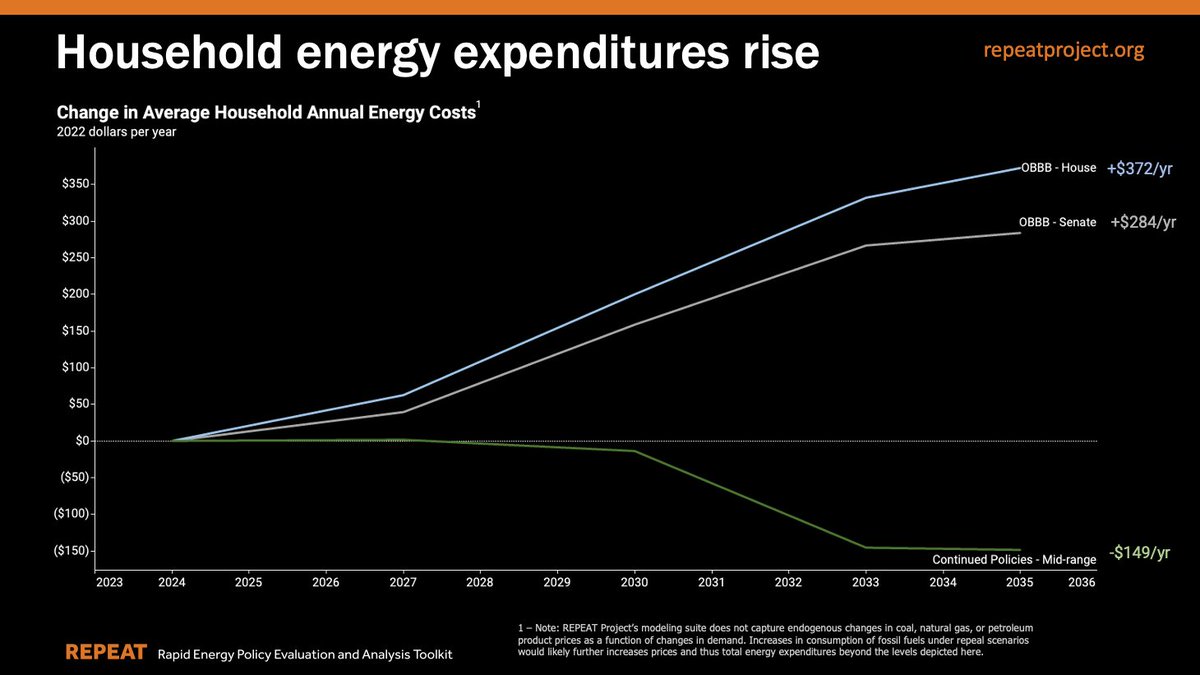

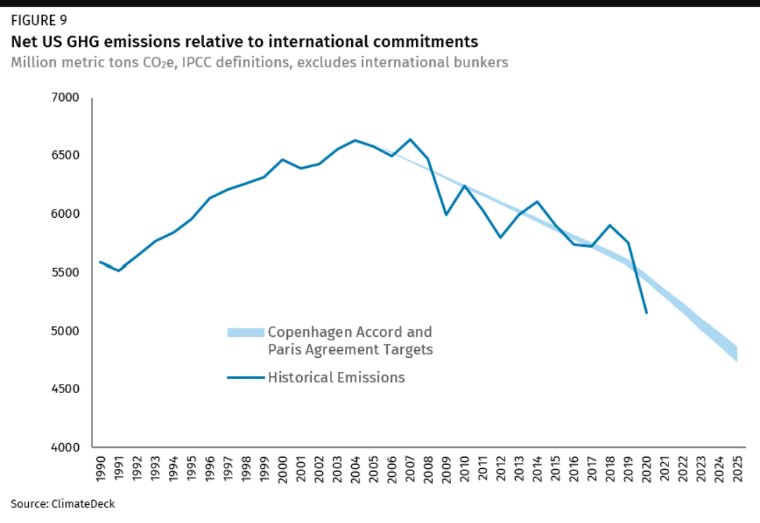

This goal is almost double the commitment the Obama Admin set for 2025 (25-28% below 2005) and requires accelerating the pace of emissions declined observed over the last decade. See below for progress to date (via @rhodium_group). 2030 goal requires ~3,200 MMT CO2 equivalent.

Making this goal a reality will require steep reductions in fossil fuel use across all sectors.

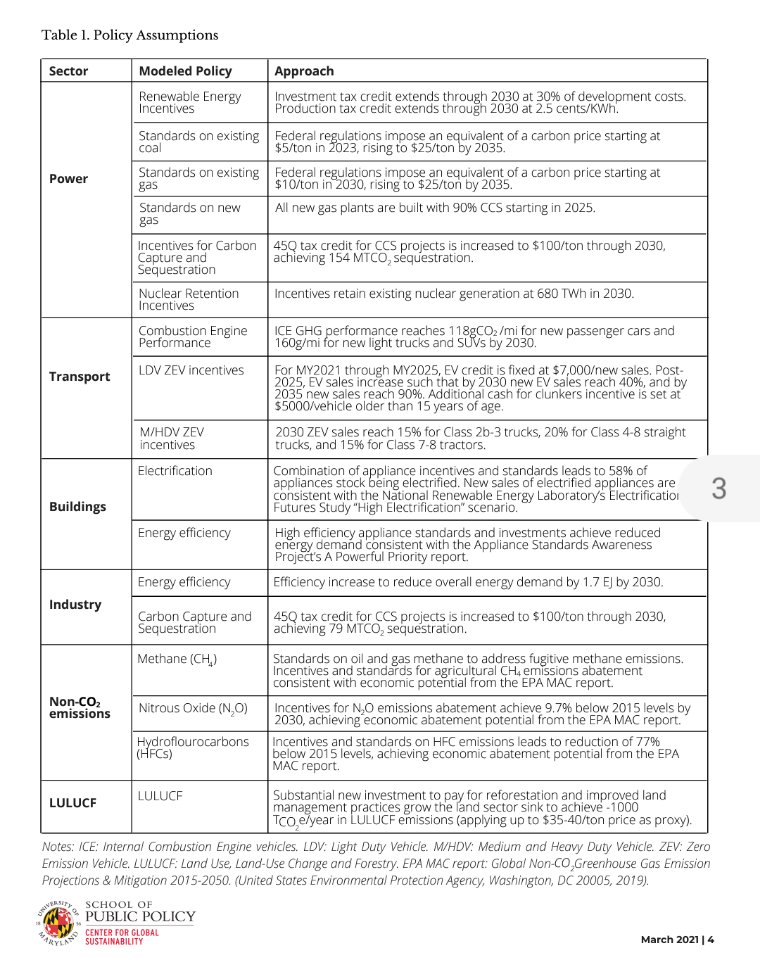

We'd have to virtually eliminate coal from power generation by 2030, ramp up clean sources (to more than double today's share), and cut electricity emissions to 75-80% below 2005.

We'd have to virtually eliminate coal from power generation by 2030, ramp up clean sources (to more than double today's share), and cut electricity emissions to 75-80% below 2005.

EV sales & internal combustion vehicles efficiency need to soar. UMD estimated we'd need EV sales to reach 40% of light duty and 15% of medium and heavy by 2030 while the efficiency of gasoline cars and trucks keeps rising.

More would be needed in industry, buildings, land use.

More would be needed in industry, buildings, land use.

The Biden goal is more ambitious than trajectory in @Princeton Net-Zero America study, which applied straight-line emissions constraint reaching 0 by 2050. That permitted 57% of 2005 in 2030 and 44% of 2005 in 2035, so crossing the 50% mark circa 2032/33.

This is a couple years faster than the Net-Zero America study trajectory. We did not optimize our trajectory, just applied a straight line to 2050. So Biden's 2030 pledge is consistent with the path to net-zero emissions. For more on what that looks like: NetZeroAmerica.princeton.edu

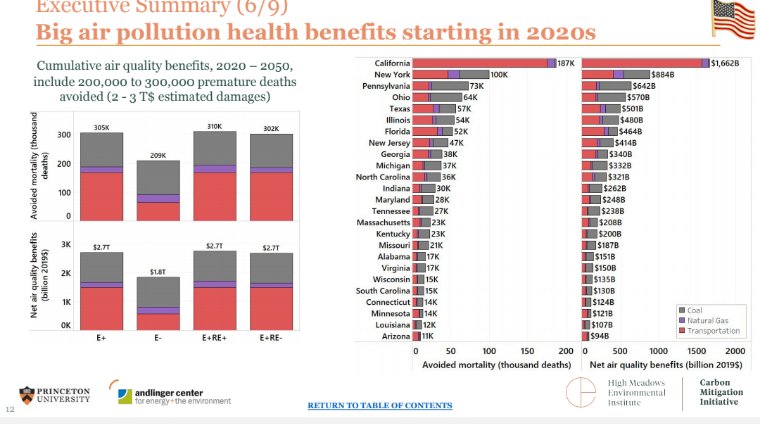

It is important to note that while the changes required to get on path to net-zero are transformative, they are affordable and achievable, we found in the Net-Zero America study. The incremental cost through 2030 is modest (less than 3%) and balanced by health benefits.

Getting on the path to net-zero will mean mobilizing on the order of $2.5 trillion in additional capital investment in clean energy and climate solutions this decade. That's not a cost, it's an investment, paid back over time. Incremental expenditures on energy are <$300b we est.

Finally, for more on the kinds of policies that could mobilize that capital, ensure a just transition and put us on path to net-zero, see @theNASEM report, Accelerating Decarbonization of the U.S Energy System that I was part of: nap.edu/resource/25932…

/End.

/End.

PS links to the resources referenced in this thread:

UMD GCAM group on 51% by 2030 NDC cgs.umd.edu/research-impac…

@rhodium_group 2020 GHGs rhg.com/research/preli….

@Princeton Net-Zero America netzeroamerica.princeton.edu

@theNASEM Accelerating Decarbonization nap.edu/resource/25932…

UMD GCAM group on 51% by 2030 NDC cgs.umd.edu/research-impac…

@rhodium_group 2020 GHGs rhg.com/research/preli….

@Princeton Net-Zero America netzeroamerica.princeton.edu

@theNASEM Accelerating Decarbonization nap.edu/resource/25932…

Oh, and p.p.s., here is the White House fact sheet on the 2030 emissions goals whitehouse.gov/briefing-room/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh