#Iowa's HSB 272 ("An Act relating to tax collection and penalties, tax permits and loans made by state-chartered banks") is the kind of bureaucratic maneuver Woody Guthrie's meant with, "Some will rob you with a six-gun, and some with a fountain pen."

legis.iowa.gov/legislation/Bi…

1/

legis.iowa.gov/legislation/Bi…

1/

On its face, the bill is a completely ordinary piece of tax-code cleanup, purging some superannuated rules and consolidating others. But as Iowa law prof @ChrisOdinet writes for @creditslips, there's a clever gotcha hidden in that bloodless language.

creditslips.org/creditslips/20…

2/

creditslips.org/creditslips/20…

2/

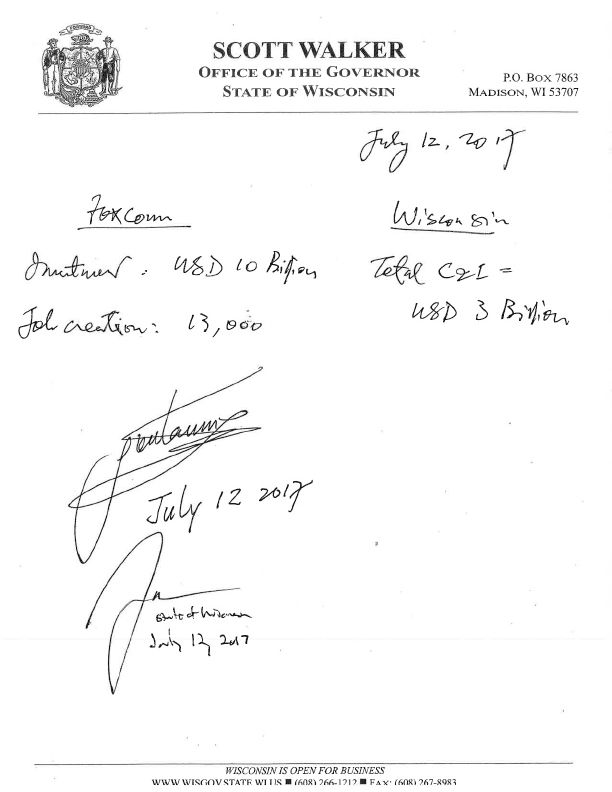

Here's where the knife slips in: "The general assembly of Iowa hereby declares… it does not want any of the provisions of any of the amendments contained in Public Law No. 96-221 (94 stat. 132), sections 521, 522 and 523 to apply with respect to loans made in this state…"

3/

3/

Eliminating Sec 521 means that out-of-state banks chartered by the FDIC would no longer be bound by Iowa's usury laws. That opens the door to "partnerships between a handful of state-chartered banks and so-called '#fintech' nonbank lenders making triple digit loans."

4/

4/

As the @trashfuturepod folks like to remind us, any time you read the word "fintech," substitute "unregulated bank."

And as Odinet writes, this rent-a-bank scheme has led to "unique legal and policy problems."

papers.ssrn.com/sol3/papers.cf…

5/

And as Odinet writes, this rent-a-bank scheme has led to "unique legal and policy problems."

papers.ssrn.com/sol3/papers.cf…

5/

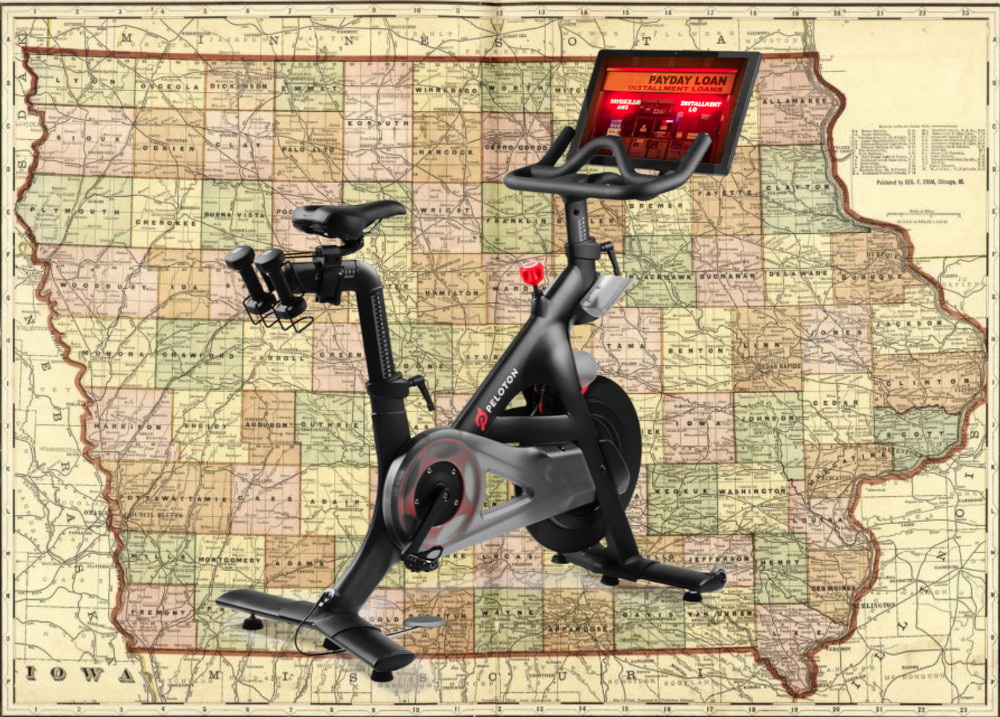

So far, so normal: corruption buried in an obscure tax-bill. But then it gets weird. It turns out that this maneuver to legalize loan-sharking in Iowa is the result of lobbying by…Peloton! (yes, THAT @onepeleton!).

6/

6/

Peleton makes a luxury "smart" exercise bike and many people who want to own such a thing can't afford it, so Peleton has partnered with a fintech company called @affirm, which finances the $3k needed to buy a Peleton bike.

7/

7/

And Affirm is a predatory lender. While it advertises "0% down, 0% APR, 0% hidden fees," its website offers this warning (in 10.5 point grey-on-white type):

8/

8/

"Your rate will be 0–30% APR based on credit, and is subject to an eligibility check. Options depend on your purchase amount, and a down payment may be required…Affirm Plus financing is provided by Celtic Bank, Member FDIC."

affirm.com

9/

affirm.com

9/

So Affirm has a rent-a-bank scheme with Iowa's Celtic Bank, and eliminating Section 521 will let it make loans in Iowa so long as they meet standards in California. That's a good deal if you want to advertise "0% down, 0% APR, 0% hidden fees," and charge "0-30%."

10/

10/

Odinet points out that Affirm's 30% APR is pretty low by the usury standards of fintech companies, but "it opens the door to much higher cost lending by firms like Elevate Credit, Opportunity Financial, and more--all of whom use the rent-a-bank model."

11/

11/

If you'd like an unrolled version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2021/04/24/pel…

pluralistic.net/2021/04/24/pel…

Image:

Thomas Hawk (modified)

flickr.com/photos/thomash…

CC BY-NC:

creativecommons.org/licenses/by-nc…

Peloton (fair use):

onepeloton.com/bike

Library of Congress (public domain):

loc.gov/resource/g4153…

eof/

Thomas Hawk (modified)

flickr.com/photos/thomash…

CC BY-NC:

creativecommons.org/licenses/by-nc…

Peloton (fair use):

onepeloton.com/bike

Library of Congress (public domain):

loc.gov/resource/g4153…

eof/

• • •

Missing some Tweet in this thread? You can try to

force a refresh