Next "Green Palm Resort" at Gadap Karachi, No mention of any SNTN # or Sales Tax amount.

I had an idea they have exemptions in Agriculture domain but this Blanket did'nt knew

75/n

I had an idea they have exemptions in Agriculture domain but this Blanket did'nt knew

75/n

Complaint done on 13 Apr, Reply came on 14 Apr-21.

They have Blanket Exemption under current laws & its mind boggling, with Zero Farming done its PURE BUSINESS & Should be charged under laws as other Services are

76/n

They have Blanket Exemption under current laws & its mind boggling, with Zero Farming done its PURE BUSINESS & Should be charged under laws as other Services are

76/n

Next "Miss Hen" at Gulistan e Jauhar Karachi.

Again no Mention of any SNTN # or Sales Tax Amount nor mentioned that amounts inclusive of Sales tax

77/n

Again no Mention of any SNTN # or Sales Tax Amount nor mentioned that amounts inclusive of Sales tax

77/n

Complaint done on 3rd Apr, Reply came on 19 Apr-21

Restaurant is registered with SRB for Sales Tax & was warned to issue proper Sales Tax Invoices as a sample was given after compliance

78/n

Restaurant is registered with SRB for Sales Tax & was warned to issue proper Sales Tax Invoices as a sample was given after compliance

78/n

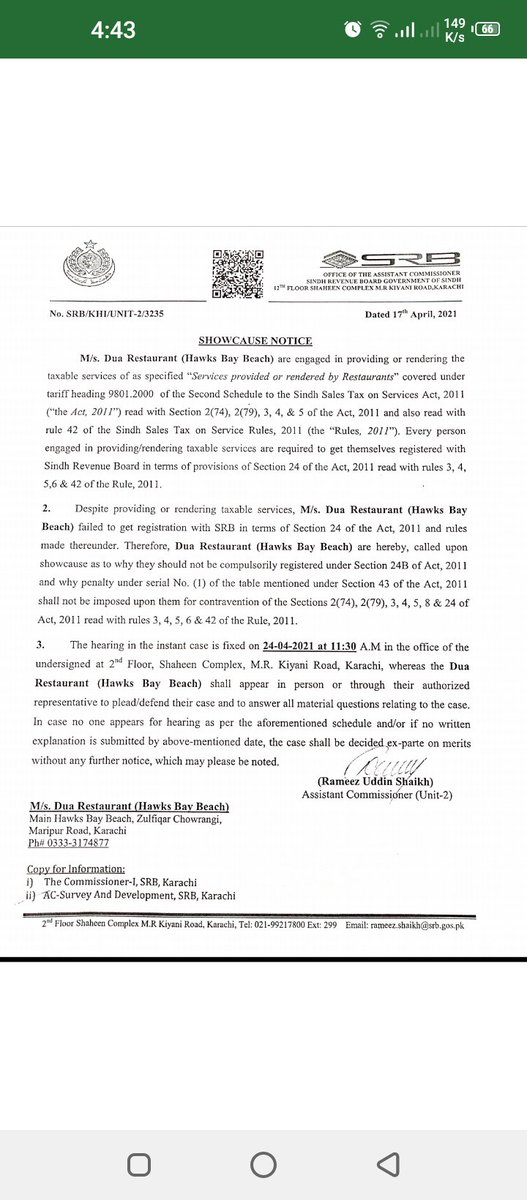

Next "Dua Restaurant" at Hawksbay Karachi.

Again no mention of any SNTN # nor Sales Tax Amount so asked if they are registered or not

79/n

Again no mention of any SNTN # nor Sales Tax Amount so asked if they are registered or not

79/n

Complaint done on 29 Mar, Reply came on 19 Apr-21.

Restaurant not registered with SRB, Procedure for Cumpolsary registration started & a Show cause notice issued for proceedings of imposition of penalty too

80/n

Restaurant not registered with SRB, Procedure for Cumpolsary registration started & a Show cause notice issued for proceedings of imposition of penalty too

80/n

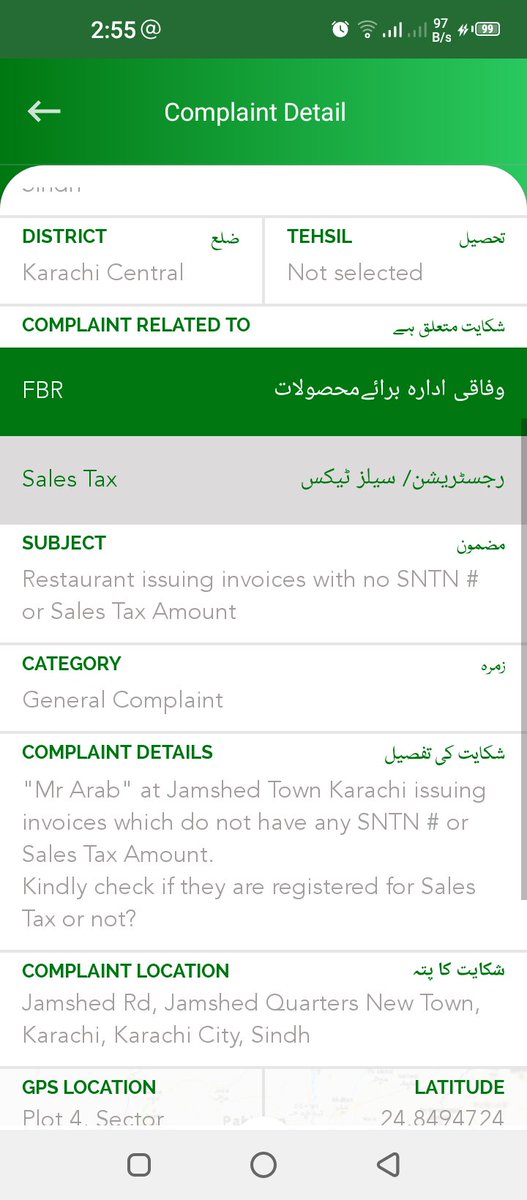

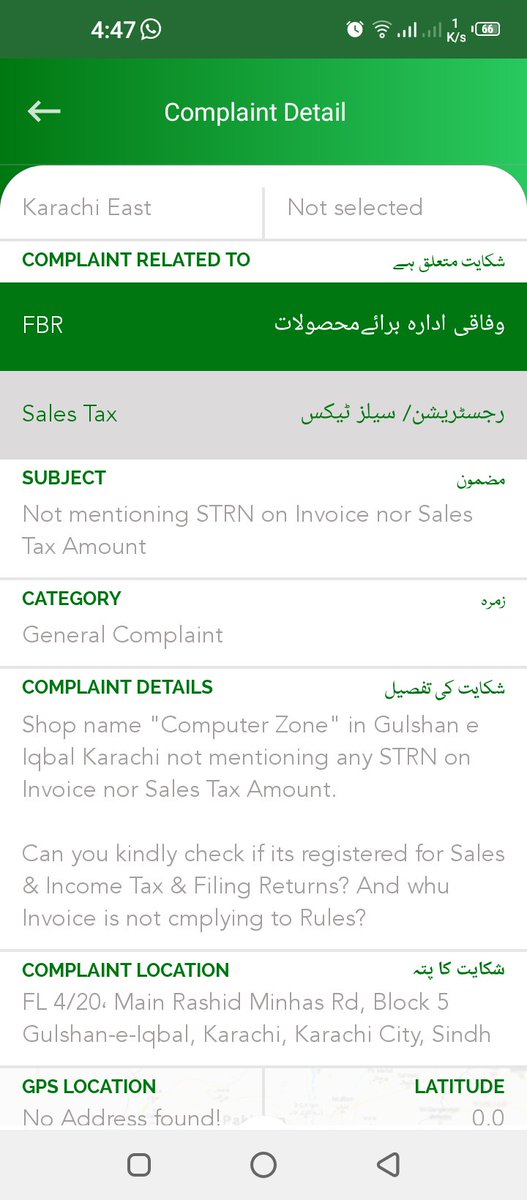

Next "Computer Zone" at Nipa Karachi.

No mention of any GST # or GST Amount on Invoice nor any FBR POS Invoice #

So asked if they are registered with FBR for Sales Tax

81/n

No mention of any GST # or GST Amount on Invoice nor any FBR POS Invoice #

So asked if they are registered with FBR for Sales Tax

81/n

Complaint done on 27 Mar Reply came on 12 Apr-21

Such a big Posh Area Shop not registered with FBR & an Audit has been called to ascertain the amount of penalty to be imposed

82/n

Such a big Posh Area Shop not registered with FBR & an Audit has been called to ascertain the amount of penalty to be imposed

82/n

This is the first for me, Direct Fraud with FBR POS.

"leather Point" Chain store Wazirabad Outlet issuing Fake Invoices other than FBR POS one as they are linked with it.

Direct Cheating!

83/n

"leather Point" Chain store Wazirabad Outlet issuing Fake Invoices other than FBR POS one as they are linked with it.

Direct Cheating!

83/n

Complaint done on 03 Apr, Reply came on 21 Apr-21.

Penalty Proceedings with Show cause notice issued is started

84/n

Penalty Proceedings with Show cause notice issued is started

84/n

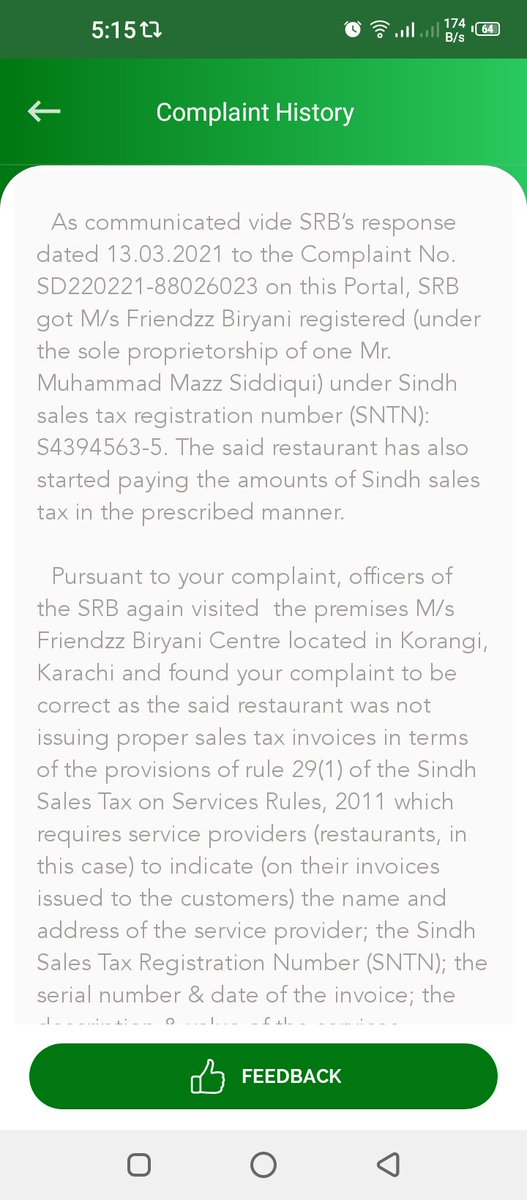

Next "Friends Biryani" Korangi Karachi, after they were forced to register on my previous complaint, they started to issue Kachi Invoices instead of what they were issuing earlier computerised invoices, with no SNTN # nor Sales Tax Amount

85/n

85/n

Complaint done on 03 Apr reply came on 23 Apr-21.

Penalty proceedings by issuance of a show cause notice started for non complying again & again after being reminded by SRB

(Abba Biryani going viral on social media now a days is them after a Partnership Dispute)

86/n

Penalty proceedings by issuance of a show cause notice started for non complying again & again after being reminded by SRB

(Abba Biryani going viral on social media now a days is them after a Partnership Dispute)

86/n

Next "Raees" restaurant at Landhi Karachi.

Again no SNTN # or Sales Tax Amount on Invoice so asked if they are registered or not with SRB

87/n

Again no SNTN # or Sales Tax Amount on Invoice so asked if they are registered or not with SRB

87/n

Complaint done on 05 Apr Reply came on 24 Apr-21

Show cause notice for Compulsory Registration & Imposition of Penalty issued

88/n

Show cause notice for Compulsory Registration & Imposition of Penalty issued

88/n

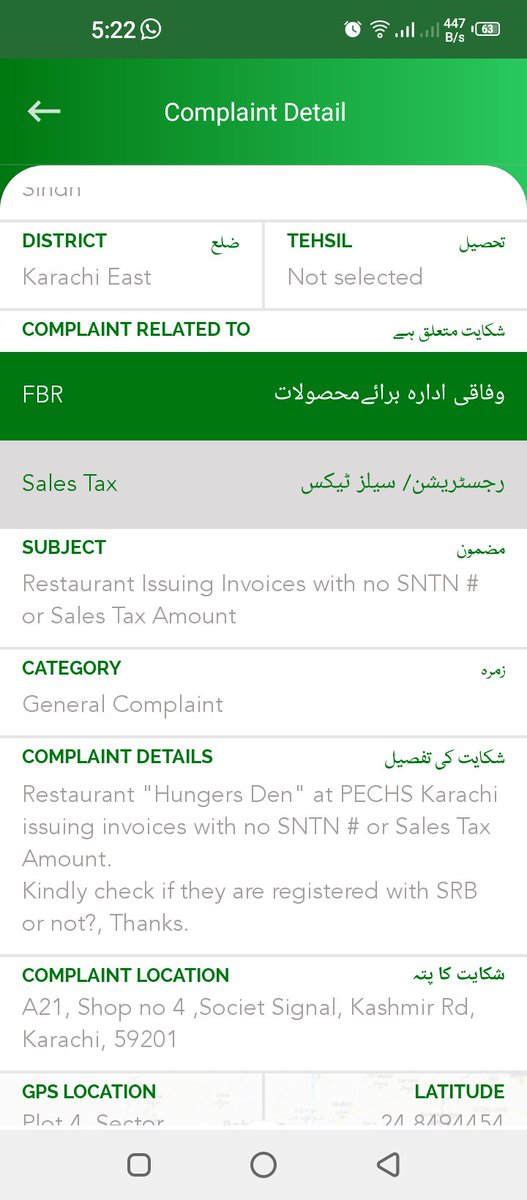

Next "Hungers Den" at PESCH Karachi.

No mention of SNTN # or Sales Tax Amount so asked if they are registered with SRB or not

89/n

No mention of SNTN # or Sales Tax Amount so asked if they are registered with SRB or not

89/n

Comolaint done on 05 Apr Reply came on 20 Apr-21

Restaurant not registered & not needed to be as Non AC & Recently opened in Feb

But Sales # Quoted 6-10k a Month with Utility Bills at 7-10k is an Absolute Joke seriously

90/n

Restaurant not registered & not needed to be as Non AC & Recently opened in Feb

But Sales # Quoted 6-10k a Month with Utility Bills at 7-10k is an Absolute Joke seriously

90/n

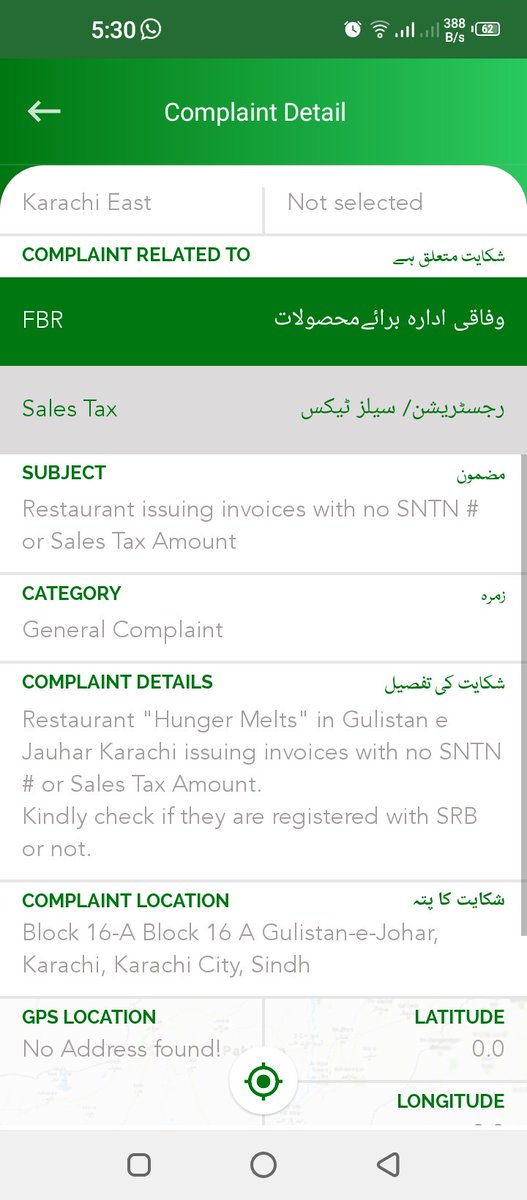

Next "Hunger Melts" at Gulistan e Jauhar Karachi.

Again no mention of SNTN # or Sales Tax Amount on Invoice so asked if they are registered with SRB or not

91/n

Again no mention of SNTN # or Sales Tax Amount on Invoice so asked if they are registered with SRB or not

91/n

Complaint done on 08 Apr Reply came on 23 Apr-21

Show cause notice for compulsory registration & imposition of penalty issued

92/n

Show cause notice for compulsory registration & imposition of penalty issued

92/n

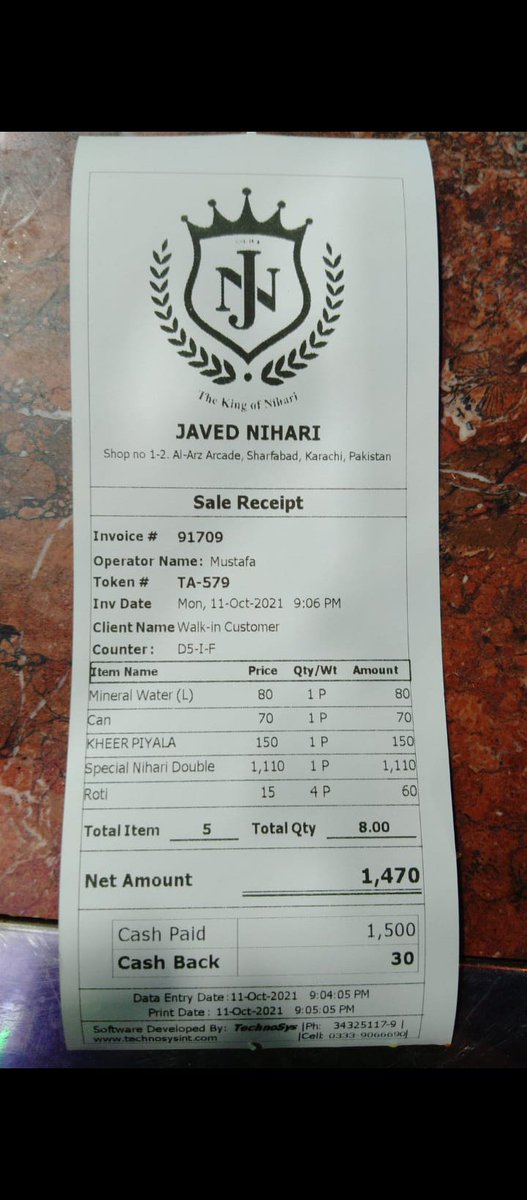

Next "Zest Steak & Grill" at Sharfabad Karachi.

No mention of SNTN # or Sales Tax Amount so asked if they are registered with SRB or not

93/n

No mention of SNTN # or Sales Tax Amount so asked if they are registered with SRB or not

93/n

Complaint done on 03 Apr Reply came on 23 Apr-21

Show cause notice for compulsory registration & impsition of penalty issued

94/n

Show cause notice for compulsory registration & impsition of penalty issued

94/n

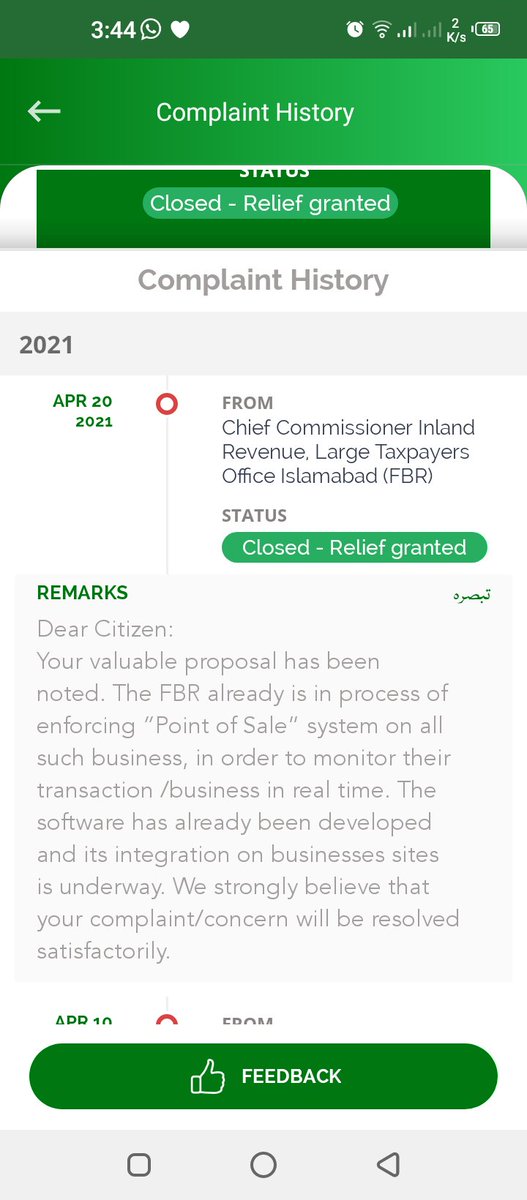

Chief Commisionar Inland Revenue Large Tax Payer Isl gave a Weird Reply that your valuable suggestion is noted & all such business would be linked to FBR POS, like what is this reply?

96/n

96/n

So I again did a complaint for "BechTree" that what sort of Stupid reply was that from Commisionar Inland Revenue Isl? I want specifics, why is their no penalty or showcause notice to the Store?

97/n

97/n

Another General Reply from the commissionar, Inland Revenue Isl, he is not providing Case Sepcifics if the Store is in Litigation Provide the Case # if not A showcause of Penalty must be given & compulsory Registration as the Deadline is long past.

Will complaint again

98/n

Will complaint again

98/n

Next "Pharma Plus Pharmacy" at Susan Road Faislabad, again not mentioning GST # nor linked with FBR POS

99/n

99/n

Complaint Done 20 Apr, Reply on 30 Apr-21

Came to know from this that It is a Registered Income Tax Payer since 2017 & is not liable & exempt as Medical Store for GST under Sixth Schedule of Sales Tax Act

100/n

Came to know from this that It is a Registered Income Tax Payer since 2017 & is not liable & exempt as Medical Store for GST under Sixth Schedule of Sales Tax Act

100/n

Complaint done 16 Apr, Reply on 26 Apr-21

Again came to know that Labs are exempted from Services Sales Tax in Islamabad

102/n

Again came to know that Labs are exempted from Services Sales Tax in Islamabad

102/n

Next "Springs Store" Super mart at Tipu Sultan Road Karachi.

Issuing invoices which do not have FBR POS #

103/n

Issuing invoices which do not have FBR POS #

103/n

Complaint on 08 Apr, Reply on 10 Apr-21

Case sent to Concrned Commissionar Inland Revenue for Detailed Investigation & Legal Action to be taken if any

Will ask after Eid again what happened to the case & final report of commissionar

104/n

Case sent to Concrned Commissionar Inland Revenue for Detailed Investigation & Legal Action to be taken if any

Will ask after Eid again what happened to the case & final report of commissionar

104/n

Next "Markitt" at Tipu Sultan Road Karachi.

Invoice with no NTN # no GST # nor linked with FBR POS

105/n

Invoice with no NTN # no GST # nor linked with FBR POS

105/n

Complaint done 08 Apr, Reply came on 30 Apr-21

Case sent to concerned commisionar for detailed investigation

Again no evidence of inquiry or report given, will ask again after Eid what happened to the case

106/n

Case sent to concerned commisionar for detailed investigation

Again no evidence of inquiry or report given, will ask again after Eid what happened to the case

106/n

Next "Saveway Super Mart" at Gulshan e Iqbal Karachi

Invoice do not have any GST # nor linked with FBR POS

107/n

Invoice do not have any GST # nor linked with FBR POS

107/n

Next "Shaheen Shinwari & BBQ" at Jauhar Mor Karachi

Issuing invoices with no SNTN # or Sales Tax Amount

109/n

Issuing invoices with no SNTN # or Sales Tax Amount

109/n

Complaint dont 07 Apr Reply on 26 Apr-21

Although it pertained too SRB but was transfered to FBR Zonal Commisionar by Director FBR

FBR in their report has called for an Income Tax Audit after their Physical Inspection 😬

Have to do again to SRB for Sales Tax

110/n

Although it pertained too SRB but was transfered to FBR Zonal Commisionar by Director FBR

FBR in their report has called for an Income Tax Audit after their Physical Inspection 😬

Have to do again to SRB for Sales Tax

110/n

Next Shop "Budget Bazar" at KDA Karachi

Issuing invoices with no GST # or Sales Tax Amount nor linked with FBR POS

111/n

Issuing invoices with no GST # or Sales Tax Amount nor linked with FBR POS

111/n

Complaint on 08 Apr, Reply on 26 Apr-21

Notice issue for Mandatory Registration with FBR POS started

112/n

Notice issue for Mandatory Registration with FBR POS started

112/n

Next "Childrens Hospital" at Gulshan Chowrangi Karachi

Issuing invoices with no SNTN # nor Sales Tax Amount

113/n

Issuing invoices with no SNTN # nor Sales Tax Amount

113/n

Conplaint done 08 Apr, Reply on 30 Apr-21

It was transfered to FBR Zone by Director FBR instead of SRB due to which an even more SHOCKING thing came to light that Hospital is not even Registered for Income Tax!

114/n

It was transfered to FBR Zone by Director FBR instead of SRB due to which an even more SHOCKING thing came to light that Hospital is not even Registered for Income Tax!

114/n

Next "Meet n Eat" at Gulshan e Iqbal Karachi

Issuing invoices with no SNTN # nor any Sales Tax Amount

115/n

Issuing invoices with no SNTN # nor any Sales Tax Amount

115/n

Complaint on 12 Apr, Reply on 30 Apr-21

Restaurant started on 15 Mar-21 & a Non AC one so not mandatory for Registration under Thresholds for now

116/n

Restaurant started on 15 Mar-21 & a Non AC one so not mandatory for Registration under Thresholds for now

116/n

Next "The Elet" at Sindhi Muslim Karachi.

Issuing invoices with no SNTN # nor any Sales Tax Amount

117/n

Issuing invoices with no SNTN # nor any Sales Tax Amount

117/n

Complaint on 12 Apr, Reply on 30 Apr-21

Restaurant now made to Registered & compliant with SRB Invoice Evidence provided

118/n

Restaurant now made to Registered & compliant with SRB Invoice Evidence provided

118/n

Next "Al Reef Shawarma" at Bahadrabad Karachi

Issuing invoices with no SNTN # nor Sales Tax Amount

119/n

Issuing invoices with no SNTN # nor Sales Tax Amount

119/n

Complaint on 08 Apr, Reply on 28 Apr-21

Showcause notice for Registration & Imposition of Penalty issued

120/n

Showcause notice for Registration & Imposition of Penalty issued

120/n

Next "Bob the Burger" at Gulistan e Jauhar Karachi.

Issuing invoices with no SNTN # nor Sales Tax Amount

121/n

Issuing invoices with no SNTN # nor Sales Tax Amount

121/n

Complaint on 08 Apr, Reply on 24 Apr-21

Owner was Rude & Non Coperative didn't even produce an NTN, Notice for Compulsory Registration with SRB & Imposition of Penalty Given.

Have complained again this time to FBR to check its INCOME TAX Registration

122/n

Owner was Rude & Non Coperative didn't even produce an NTN, Notice for Compulsory Registration with SRB & Imposition of Penalty Given.

Have complained again this time to FBR to check its INCOME TAX Registration

122/n

Next is "Imtiaz Super Store" Gulshan e Iqbal Branch Karachi.

Issuing invoices with no FBR POS Invoice #

So asked they are a Tier-1 Business why still not linked with FBR POS System

123/n

Issuing invoices with no FBR POS Invoice #

So asked they are a Tier-1 Business why still not linked with FBR POS System

123/n

Complaint on 05 Apr, Reply on 06 May-21

Concerned Commisionar IR said show cause issued & proceedings for Registration on FBR POS system started

Will Inquire about again where the processed reached starting from Qayumabad one which I complained in Jan & reply came in Feb

124/n

Concerned Commisionar IR said show cause issued & proceedings for Registration on FBR POS system started

Will Inquire about again where the processed reached starting from Qayumabad one which I complained in Jan & reply came in Feb

124/n

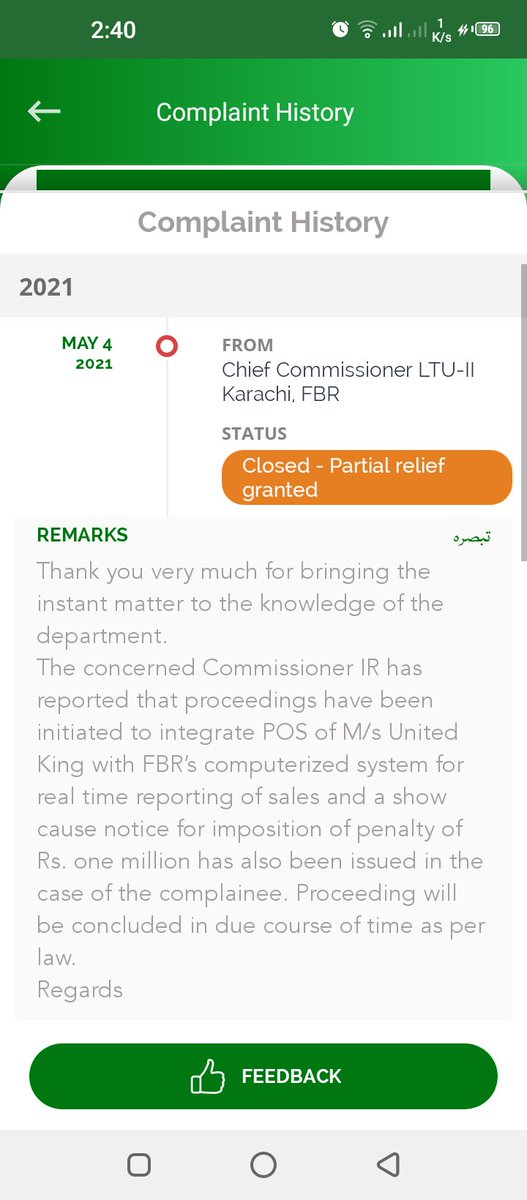

Next is "United King" Nimco & Bakery Brand Stadium Road Karachi branch.

Issuing invoices with no FBR POS Invoice # so Inquired they are a Tier-1 business so why still not linked with FBR POS system?

125/n

Issuing invoices with no FBR POS Invoice # so Inquired they are a Tier-1 business so why still not linked with FBR POS system?

125/n

Complaint on 08 Apr, Reply on 04 May-21

Show cause notice for Registrstion process & for a fine of 1 Million PKR served for not still linked with FBR POS

126/n

Show cause notice for Registrstion process & for a fine of 1 Million PKR served for not still linked with FBR POS

126/n

Next "Pak Wheels" issuing invoices which do not have any SNTN # for Services nor any Services Sales Tax Amount

127/n

127/n

Complaint on 12 Apr, Reply on 04 May-21

Show cause notice for violating 4 Diff sections of Sindh Services Sales Tax issued for Imposition of Penalty, they are not even registered with SRB for the mentioned sections of services which they are giving lol

128/n

Show cause notice for violating 4 Diff sections of Sindh Services Sales Tax issued for Imposition of Penalty, they are not even registered with SRB for the mentioned sections of services which they are giving lol

128/n

Next is "Crispy Cravings" restaurant at Maskan Karachi.

Issuing invoices which do not have any SNTN # or Services Sales Tax Amount

129/n

Issuing invoices which do not have any SNTN # or Services Sales Tax Amount

129/n

Complaint 16 Apr, Reply 08 May-21

Restaurant is registered with SRB & are Warned to issue proper Sales Tax Invoices an evidence of compliance provided

130/n

Restaurant is registered with SRB & are Warned to issue proper Sales Tax Invoices an evidence of compliance provided

130/n

Complaint 16 Apr, Reply 08 May-21

Notice for mandatory registration with SRB & for Imposition of Penalty issued

132/n

Notice for mandatory registration with SRB & for Imposition of Penalty issued

132/n

Next "Lahore Center" at DHA Lahore.

Issuing invoices with no Sales Tax Amount mentioned & not linked with FBR POS system either

133/n

Issuing invoices with no Sales Tax Amount mentioned & not linked with FBR POS system either

133/n

Complaint 16 Apr, Reply 06 May-21

Notice has been served for explaining their position in both regards

134/n

Notice has been served for explaining their position in both regards

134/n

Next "Mehran Sajji" at Hasan Square Karachi

Issuing invoices with no Sales Tax amount mentioned nor is it mentioned that invoices are inclusive of taxes

135/n

Issuing invoices with no Sales Tax amount mentioned nor is it mentioned that invoices are inclusive of taxes

135/n

Complaint 16 Apr, Reply 08 May-21

Notice issued for imposition of penalty for not issuing proper Sales Tax Invoices

136/n

Notice issued for imposition of penalty for not issuing proper Sales Tax Invoices

136/n

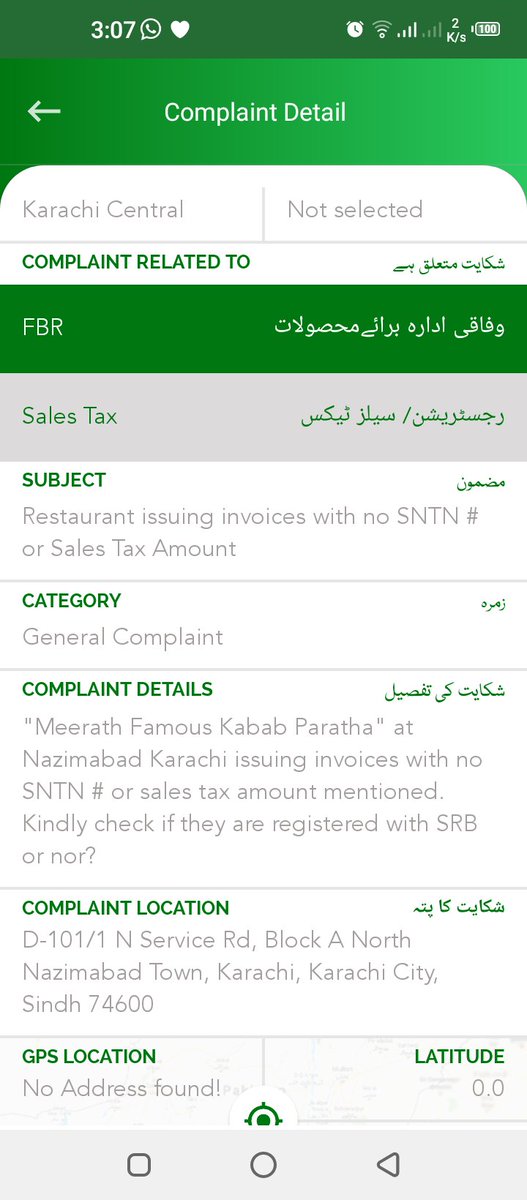

Next "Meeruth Famous Kabab Paratha" at Nazimabad Karachi

Issuing invoices with no SNTN # nor any Sales Tax Amount

137/n

Issuing invoices with no SNTN # nor any Sales Tax Amount

137/n

Complaint 20 Apr, Reply 08 May-21

Restaurant is not registered with SRB & is issued Show Cause notice for compulsory registration & for imposition of penalty issued

138/n

Restaurant is not registered with SRB & is issued Show Cause notice for compulsory registration & for imposition of penalty issued

138/n

Complaint 20 Apr, Reply 07 May-21

Notice for mandatory registration & imposition of penalty issued

140/n

Notice for mandatory registration & imposition of penalty issued

140/n

Next "Allah wali Biryani" at Shahrah e Quaideen Karachi.

Issuing invoices which do not have any SNTN # nor any Services Sales Tax Amount

141/n

Issuing invoices which do not have any SNTN # nor any Services Sales Tax Amount

141/n

Complaint 24 Apr, Reply 08 May-21

Notice for Mandatory Registration with SRB & for Imposition of Penalty issued

142/n

Notice for Mandatory Registration with SRB & for Imposition of Penalty issued

142/n

Complaint 24 Apr, Reply 07 May-21

Notice for Registration with Punjab Revenue Authority issued

144/n

Notice for Registration with Punjab Revenue Authority issued

144/n

Next is "Rahat Bakers" Branch at Cantt Lahore.

Issuing invoices with no GST # nor any Sales Tax Amount

145/n

Issuing invoices with no GST # nor any Sales Tax Amount

145/n

Complaint 24 Apr, Reply 05 May-21

Notice issued to explain their position on mentioned issue.

Have filed another complaint about them to Inquire why they are not linked with FBR POS yet

146/n

Notice issued to explain their position on mentioned issue.

Have filed another complaint about them to Inquire why they are not linked with FBR POS yet

146/n

Next "Chicken Broast" at Chakri Point Motorway Rawalpindi.

Issuing invoices with no PNTN # nor Any services sales tax amount

147/n

Issuing invoices with no PNTN # nor Any services sales tax amount

147/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh