$IPOE/@SoFi: Putting the “Social” in Social Finance 🏦👬

So what exactly differentiates SoFi from other traditional & digital banks?

It's not their financial products, their tech prowess, or their top notch executive management.

The Power of Community!

Time for a thread ⬇️🧵

So what exactly differentiates SoFi from other traditional & digital banks?

It's not their financial products, their tech prowess, or their top notch executive management.

The Power of Community!

Time for a thread ⬇️🧵

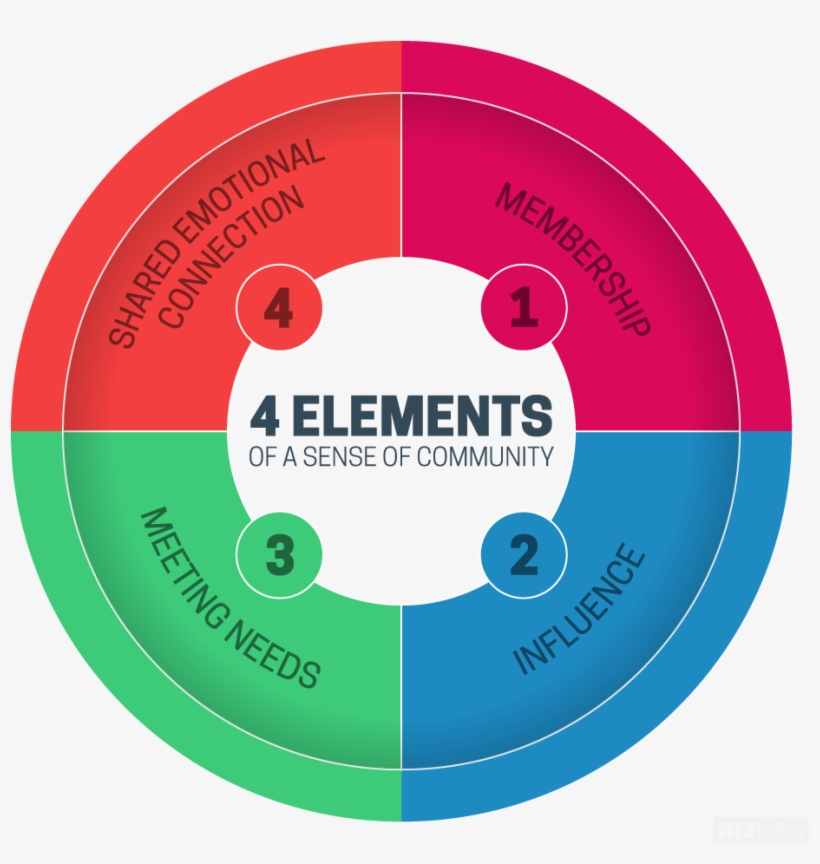

First off, what defines a community?

1) Membership

2) Influence

3) Meeting Needs

4) Shared Emotional Connections

1) Membership

2) Influence

3) Meeting Needs

4) Shared Emotional Connections

Brand communities are powerful because they tap into the social and emotional needs of human beings. They create tight-knit associations between a person's identity and the brands they choose to support.

Marketers have known that communities are a powerful source of brand advocacy, but creating them or connecting with them has been a difficult process.

It's so so difficult to create a relationship with your customer that goes beyond just transactions. Those who succeed, kill it!

It's so so difficult to create a relationship with your customer that goes beyond just transactions. Those who succeed, kill it!

Community marketing is the connection of a brand to a specific community, using a platform to communicate, exchange values and create mutual meaning. The platform does not have to be digital, and communities do not have to be started from scratch.

What are the benefits of community marketing?

1) Better Customer Experience

2) More Relevance and Loyalty

3) Word of Mouth Growth

4. Brand and Customer Humanization

1) Better Customer Experience

2) More Relevance and Loyalty

3) Word of Mouth Growth

4. Brand and Customer Humanization

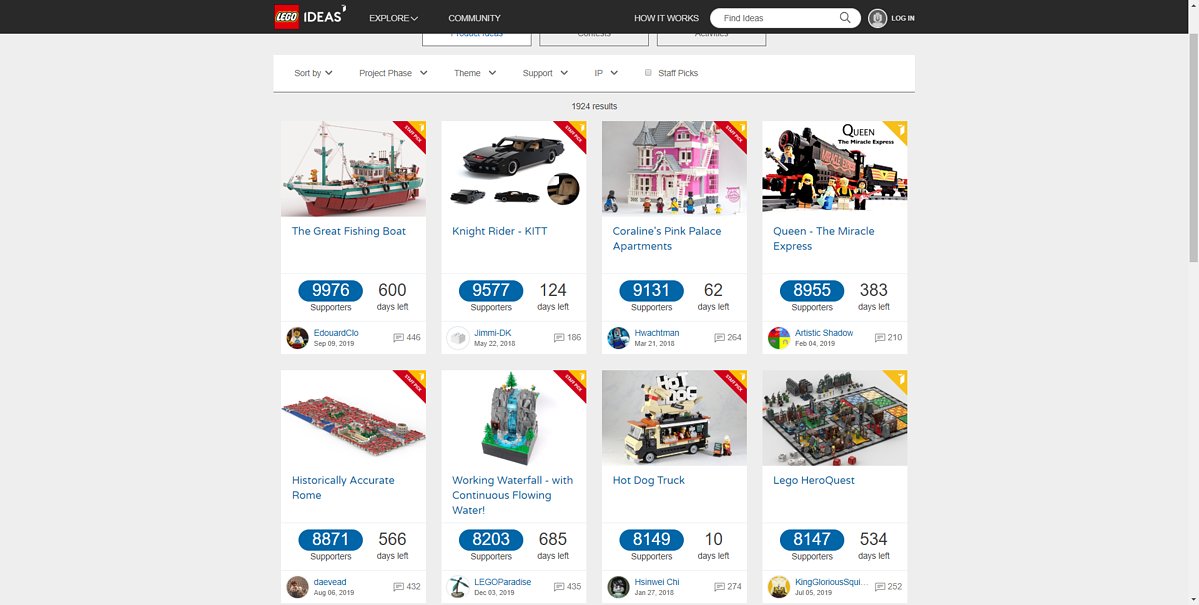

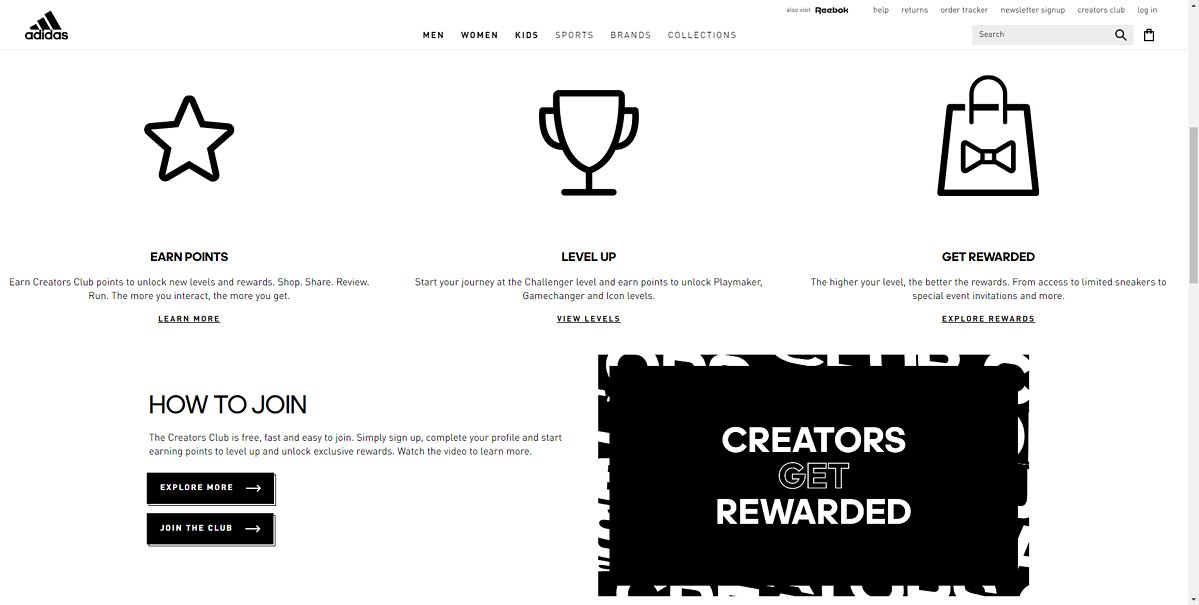

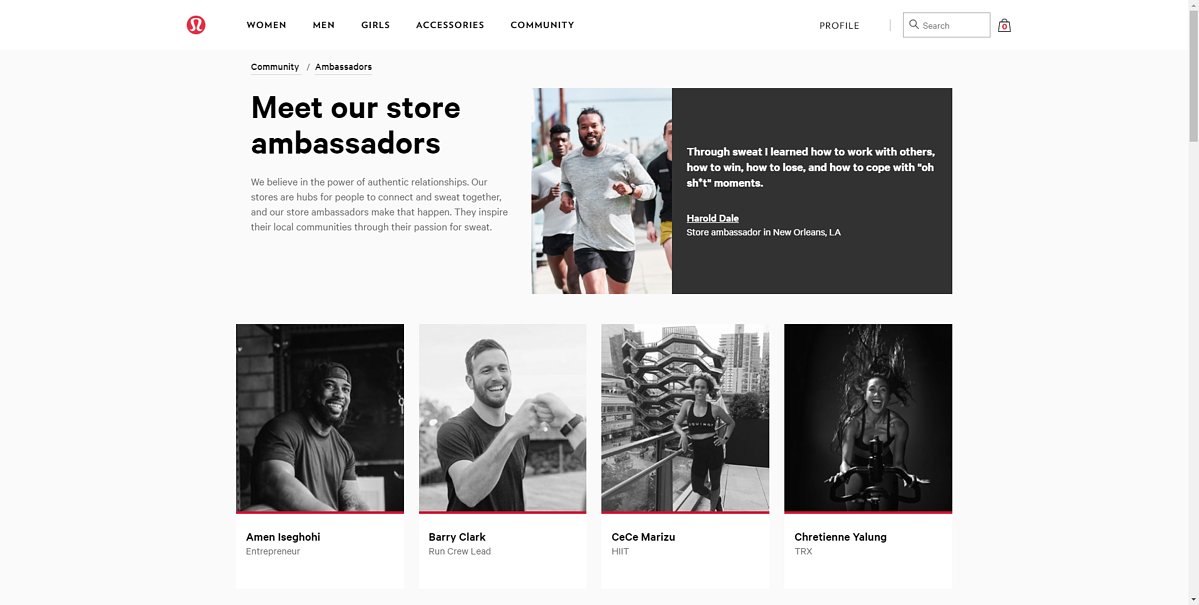

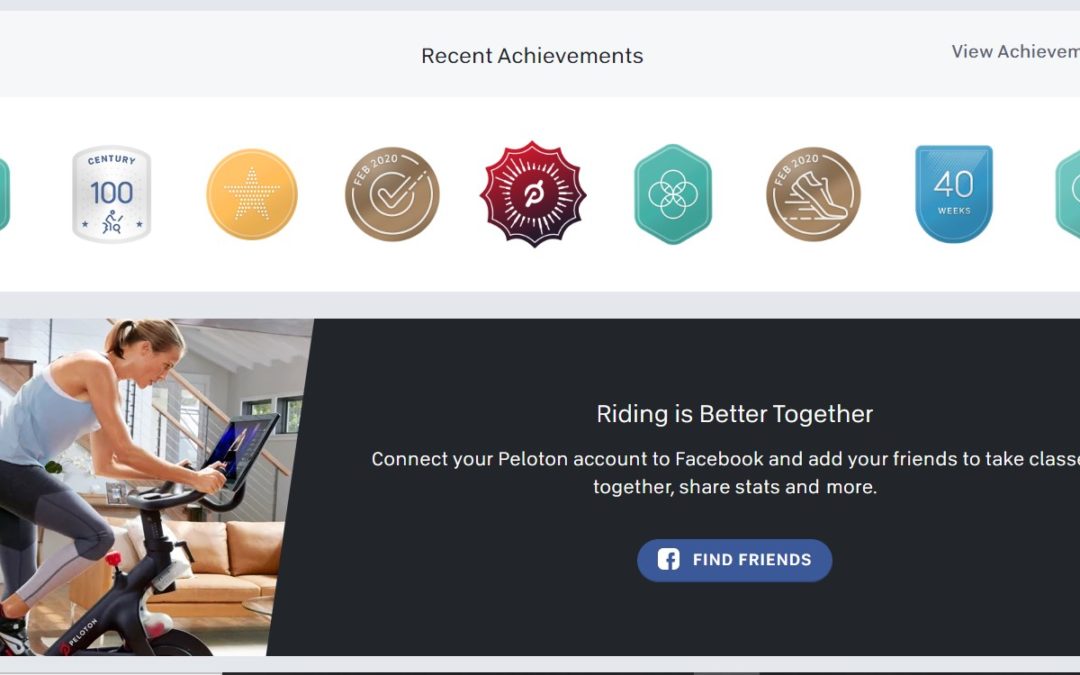

What are some examples of brands killing it in community marketing?

1) Lego Ideas

2) Lululemon

3) Adidas

4) Peloton

1) Lego Ideas

2) Lululemon

3) Adidas

4) Peloton

What are the tactics involved in community marketing?

1) Create advocacy and ambassador programs

2) Establishing closed online platforms to connect to communities that need a digital place to coalesce

3) Support a social cause (and mean it)

4) Host private events

5) Gifting

1) Create advocacy and ambassador programs

2) Establishing closed online platforms to connect to communities that need a digital place to coalesce

3) Support a social cause (and mean it)

4) Host private events

5) Gifting

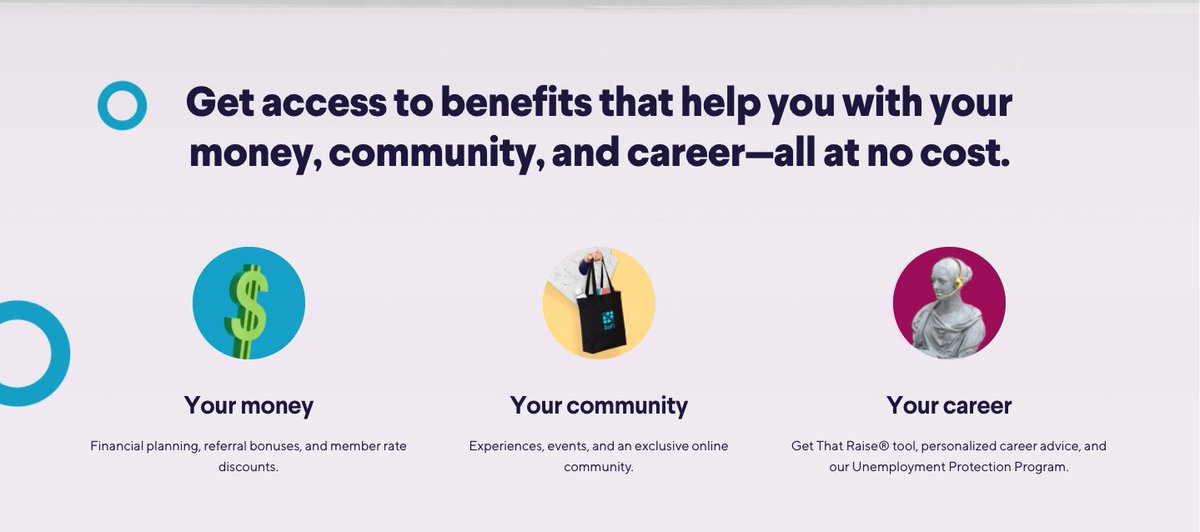

So let's see how #Sofi is leading the FinTech space in community marketing!

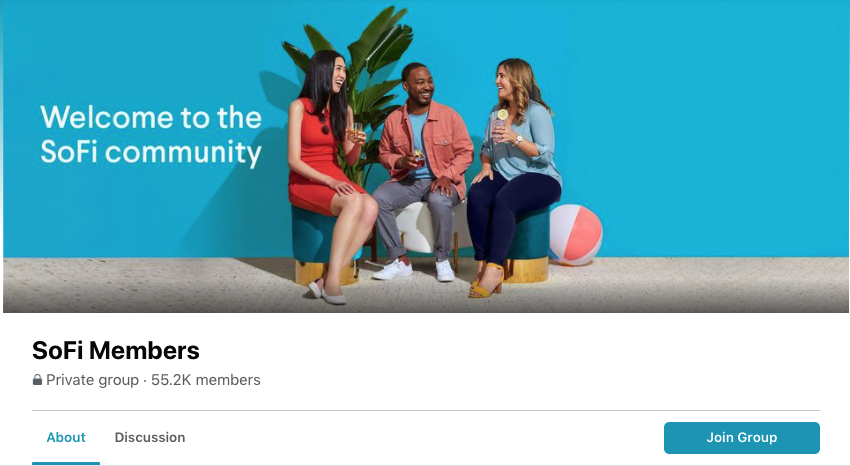

With over 55k members, I took a deep-dive in SoFi's Members Facebook Group and analyzed their engagement in the past 3 weeks.

This is a closed group strictly for SoFi members, where they can communicate and interact on a daily basis not just on financial matters but anything.

This is a closed group strictly for SoFi members, where they can communicate and interact on a daily basis not just on financial matters but anything.

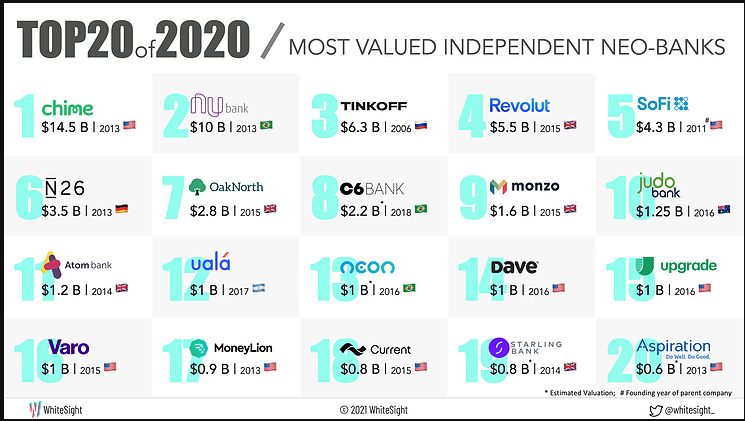

I took a look at the top 20 Neobanks to see who was taking a similar approach.

I googled "bank name + Facebook member group".

I googled "bank name + Facebook member group".

Apart from SoFi, the only two that came up were Chime and UK-based Monzo.

Both of them COMBINED had less members than SoFi's group (around 34k members).

To my knowledge, none of the traditional banks have such an extent of community (where members can interact with one another)

Both of them COMBINED had less members than SoFi's group (around 34k members).

To my knowledge, none of the traditional banks have such an extent of community (where members can interact with one another)

So what makes that Facebook group special?

SoFi has perfected it where members can communicate with one another, share experiences, ask questions, and engage in discussions about all things financial literacy, investment, saving and more.

SoFi has perfected it where members can communicate with one another, share experiences, ask questions, and engage in discussions about all things financial literacy, investment, saving and more.

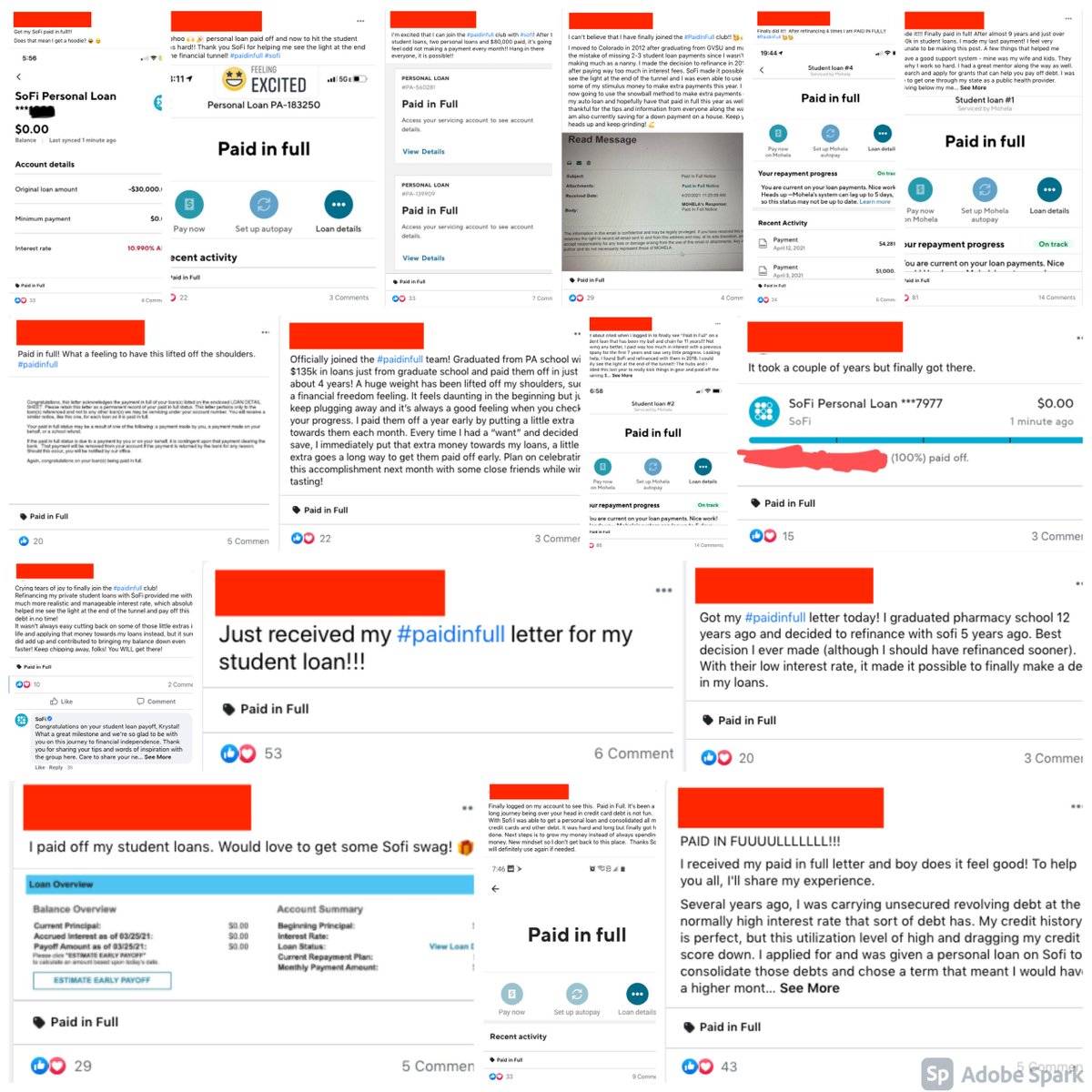

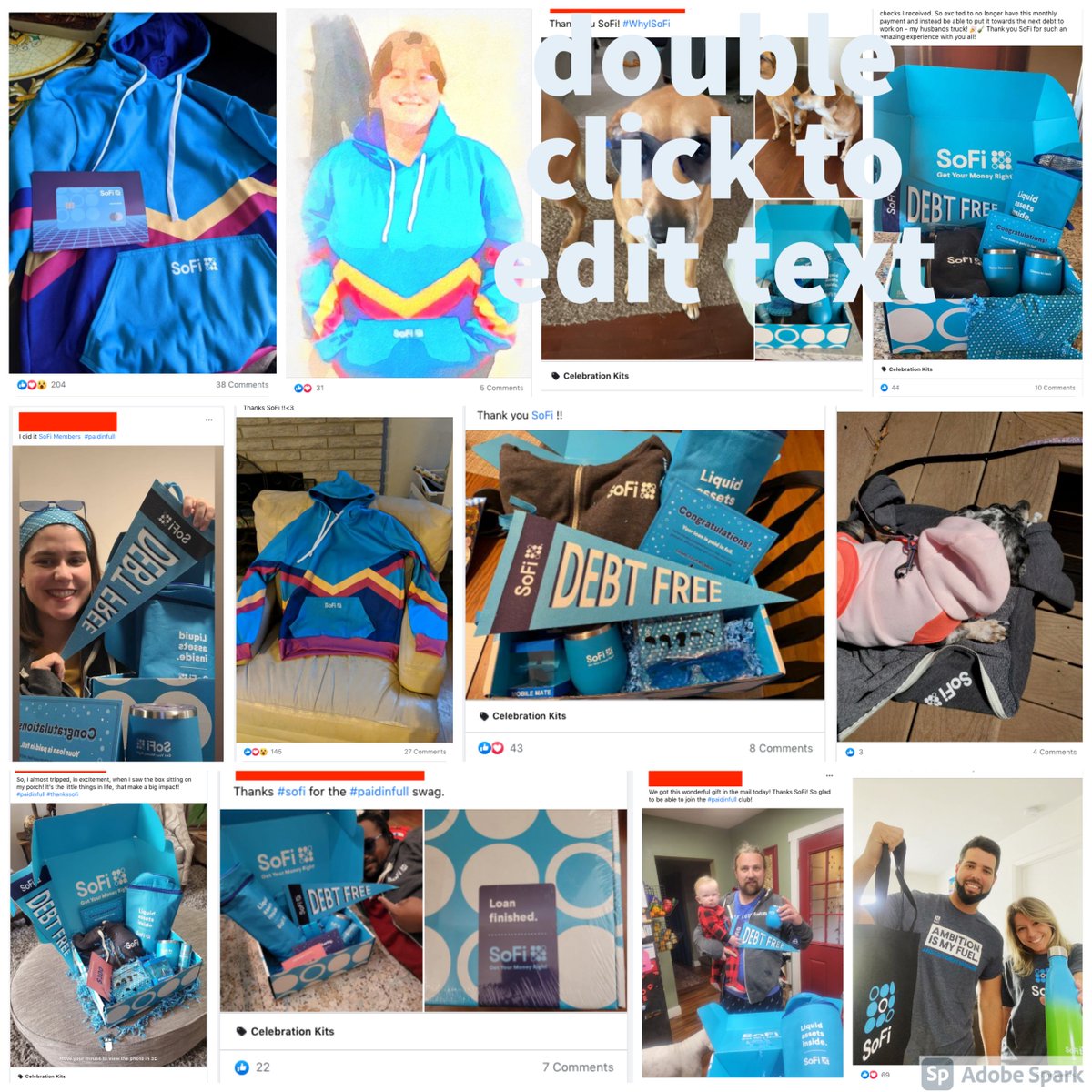

#Sofi members proudly sharing their Paid in Full experience, showing off that they've fully paid all their student loans.

Members go out of their way to post about it. No pressure or ask from SoFi for them to do so.

Community!

Members go out of their way to post about it. No pressure or ask from SoFi for them to do so.

Community!

For those who have fulfilled all their student loan payments, #Sofi sends them swag! Whether its hoodies, stickers, flags, and more.

Once again, members go out of their way to post about it (while wearing SoFi swag). No better brand advocacy than your members wearing your gear!

Once again, members go out of their way to post about it (while wearing SoFi swag). No better brand advocacy than your members wearing your gear!

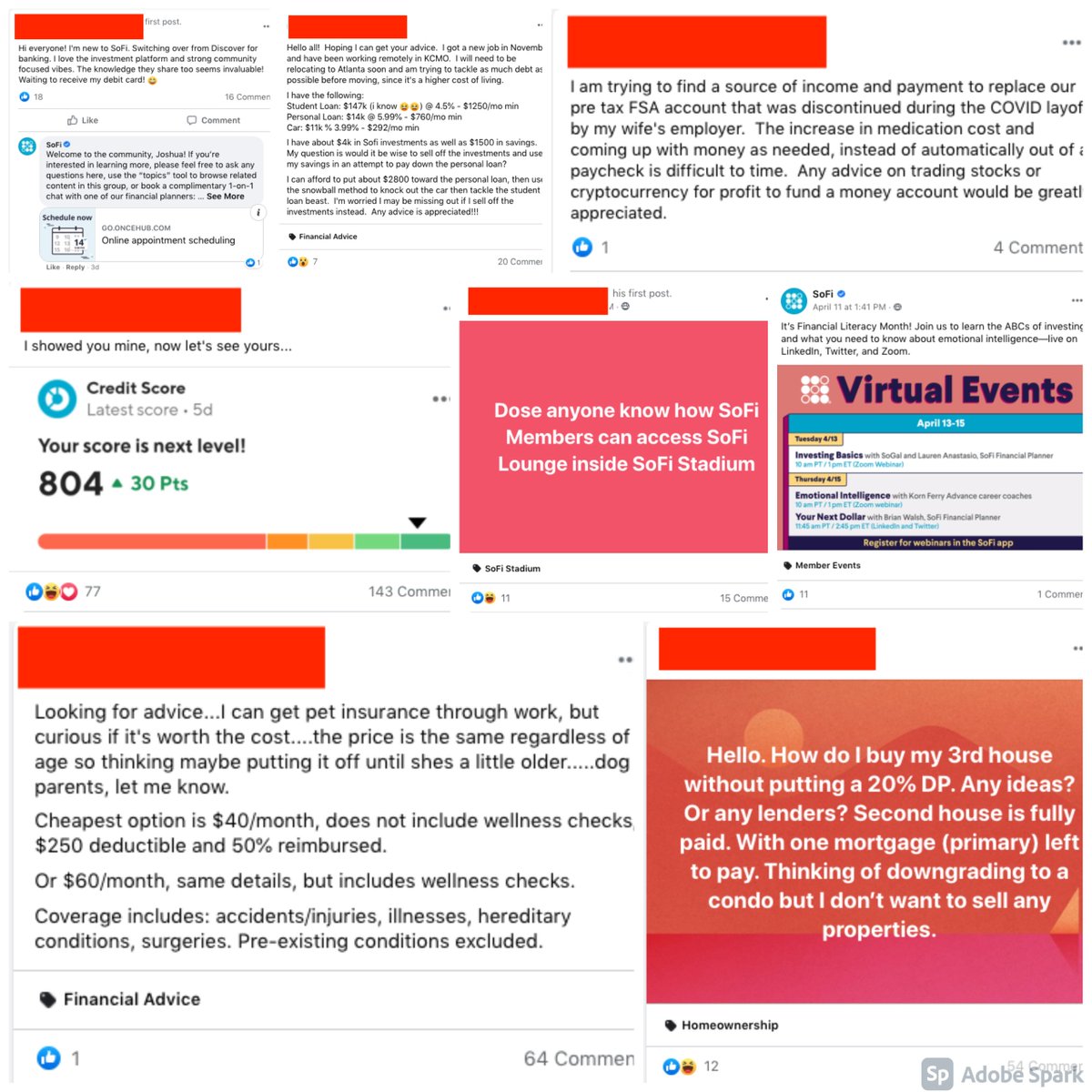

A community is a place where members can exchange questions and engage with each other whenever they have any issue, concern, or story to share!

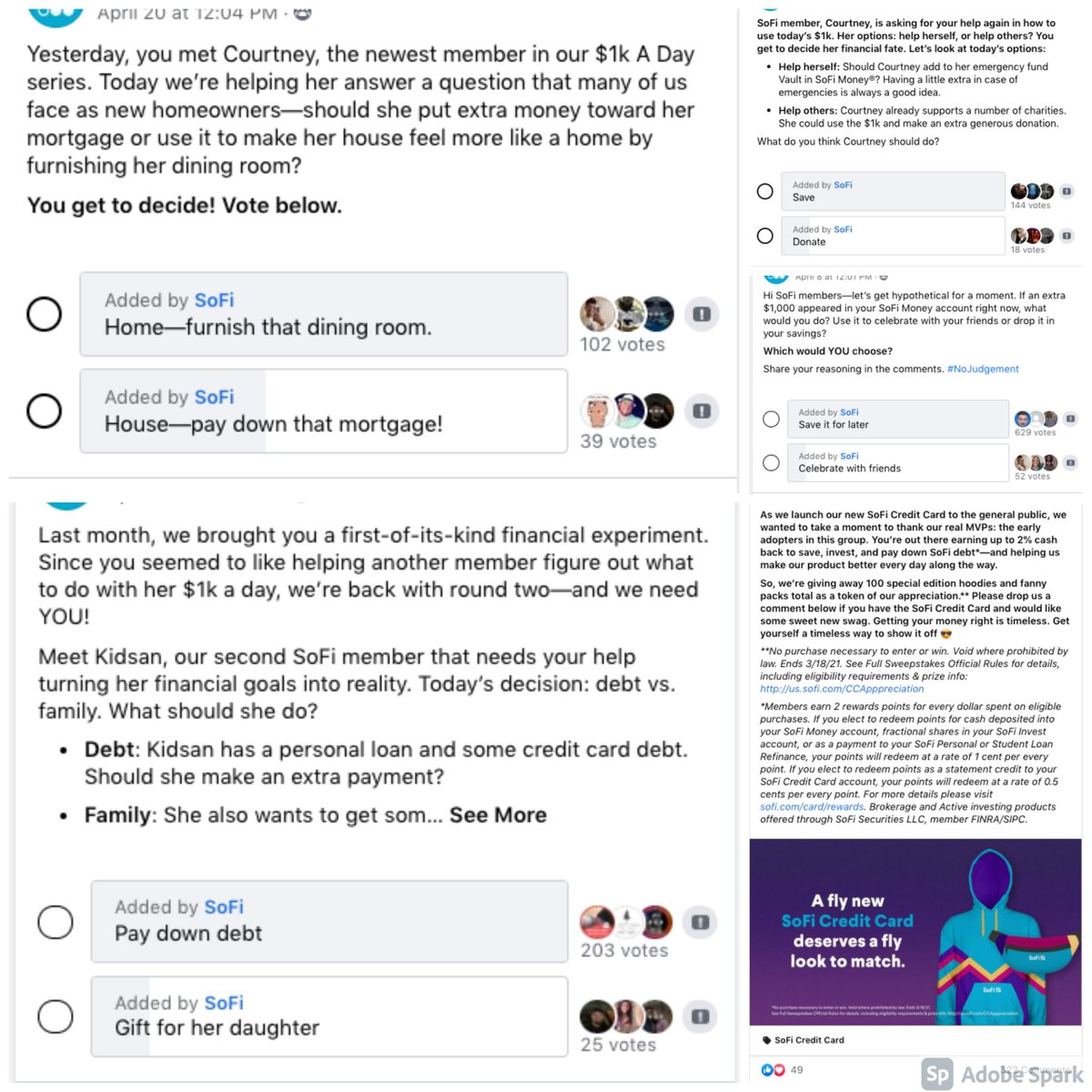

#Sofi has also done a great job in utilizing the group to engage with their members and stimulate discussions, mostly around financial literacy and education.

You can see the engagement from members below.

You can see the engagement from members below.

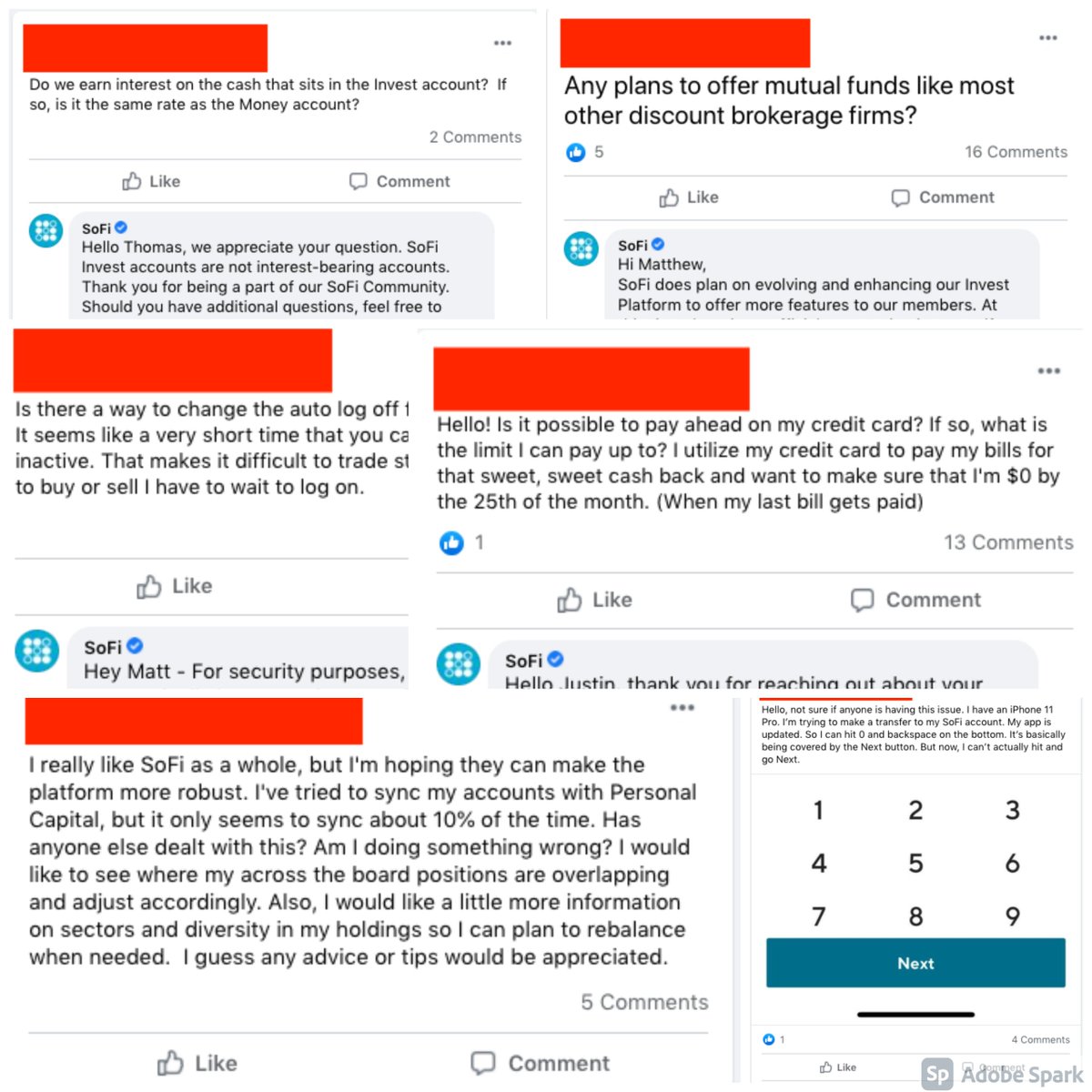

Finally, #Sofi has also done a great job in utilizing this group as an additional avenue for customer service.

Answering member inquiries and concerns in only a matter of minutes to hours.

Answering member inquiries and concerns in only a matter of minutes to hours.

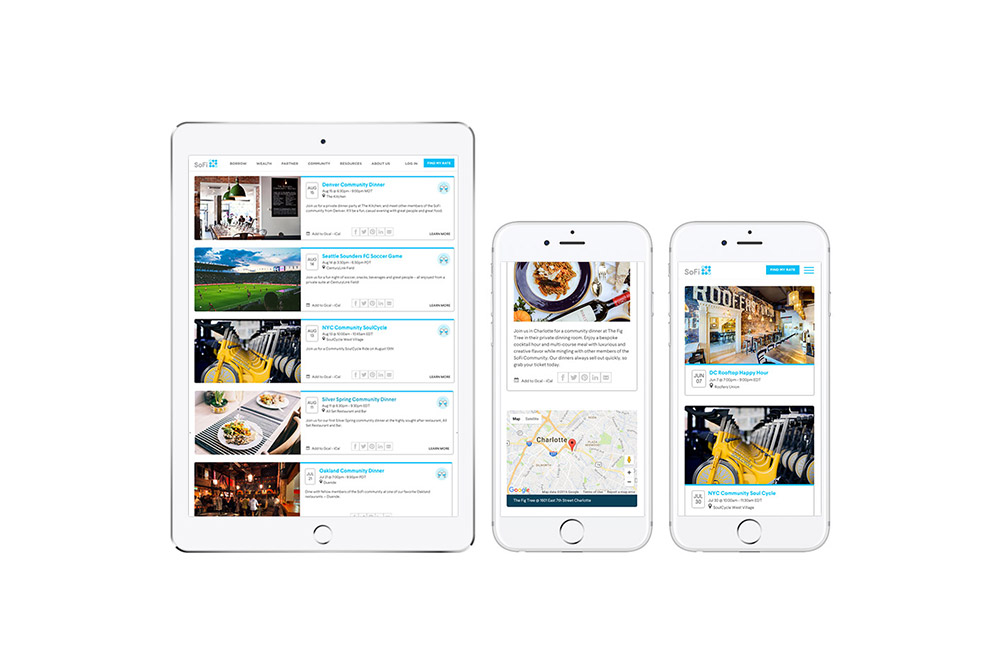

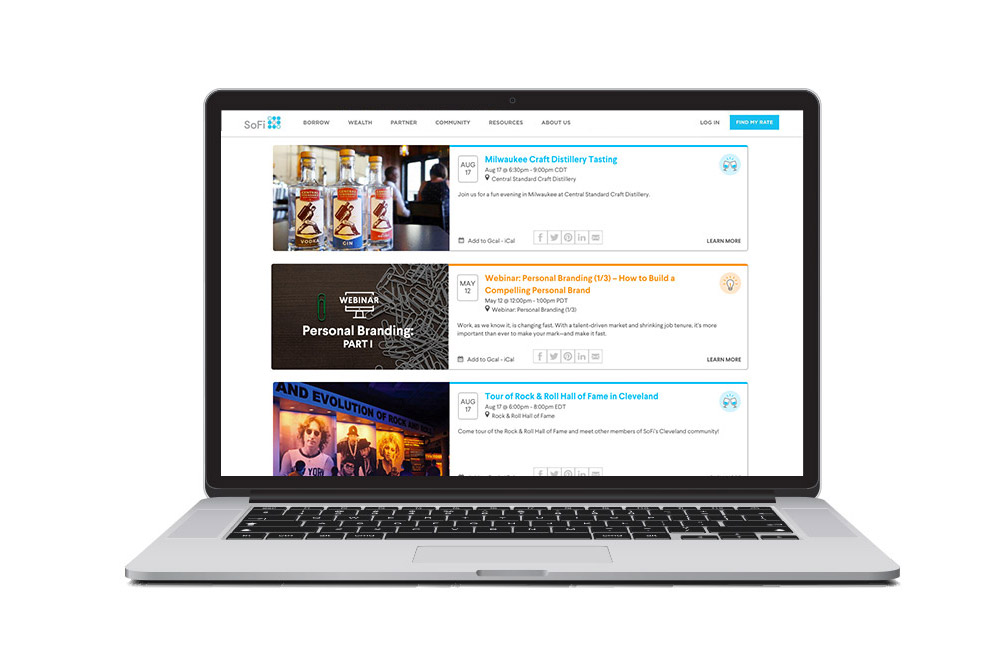

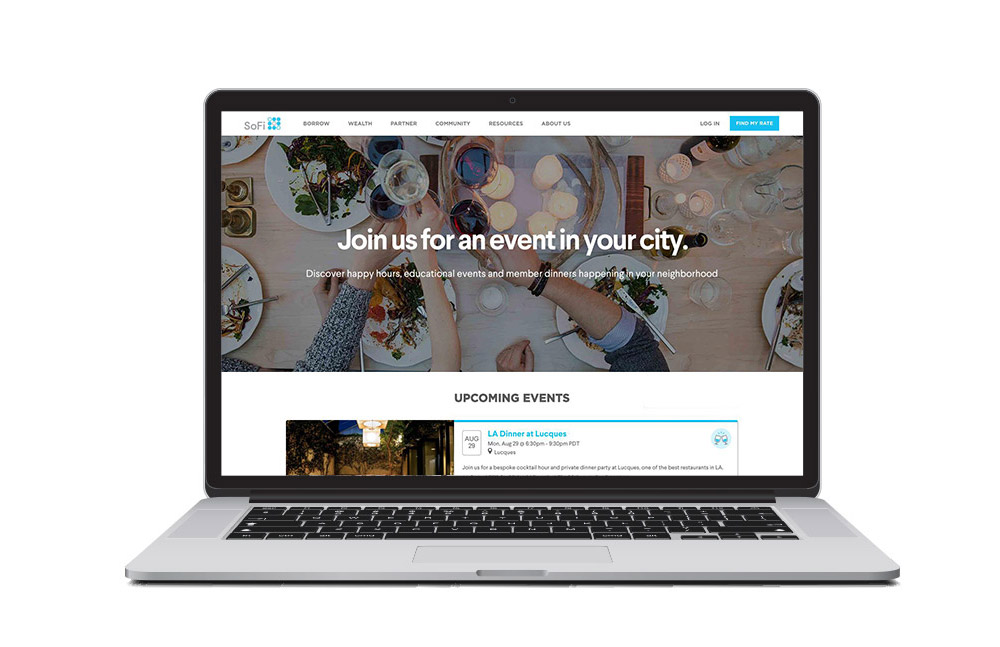

#Sofi Experiences:

Pre-pandemic, SoFi regularly hosted group dinners, professional workshops, happy hours, volunteer opportunities, and even singles events, SoFi members had the opportunity to build connections across all 50 states.

sofi.com/experiences/

Pre-pandemic, SoFi regularly hosted group dinners, professional workshops, happy hours, volunteer opportunities, and even singles events, SoFi members had the opportunity to build connections across all 50 states.

sofi.com/experiences/

#Sofi experiences hosted over 100 virtual events for their members as a replacement to in-person due to the pandemic.

Link previous to virtual events: youtube.com/c/SoFi/videos

Link previous to virtual events: youtube.com/c/SoFi/videos

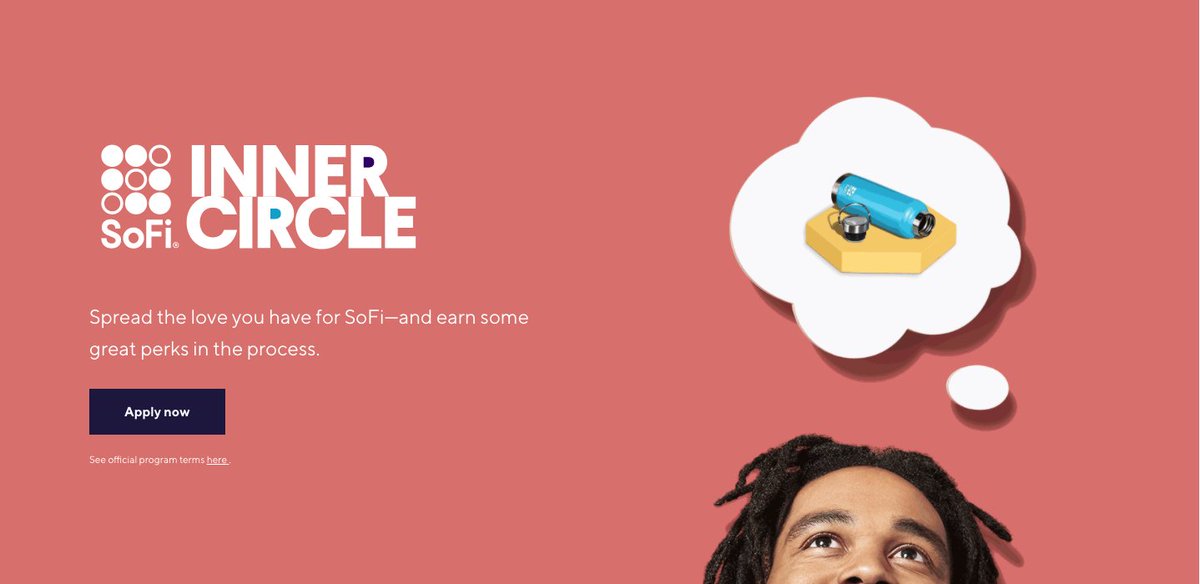

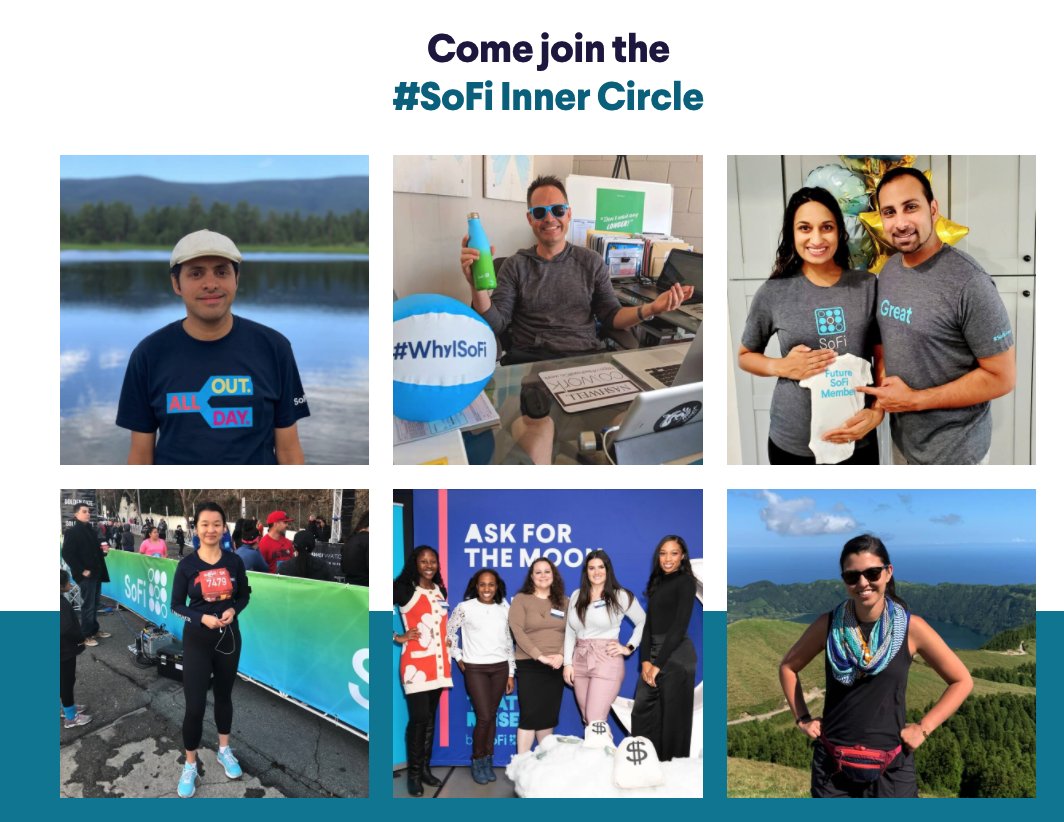

#Sofi Inner Circle

SoFi created the Inner Circle, their brand ambassador program where members can earn special access to events, limited-edition swag, and other perks in exchange for representing the SoFi brand.

Member -> Advocate -> Ambassador

sofi.com/inner-circle/

SoFi created the Inner Circle, their brand ambassador program where members can earn special access to events, limited-edition swag, and other perks in exchange for representing the SoFi brand.

Member -> Advocate -> Ambassador

sofi.com/inner-circle/

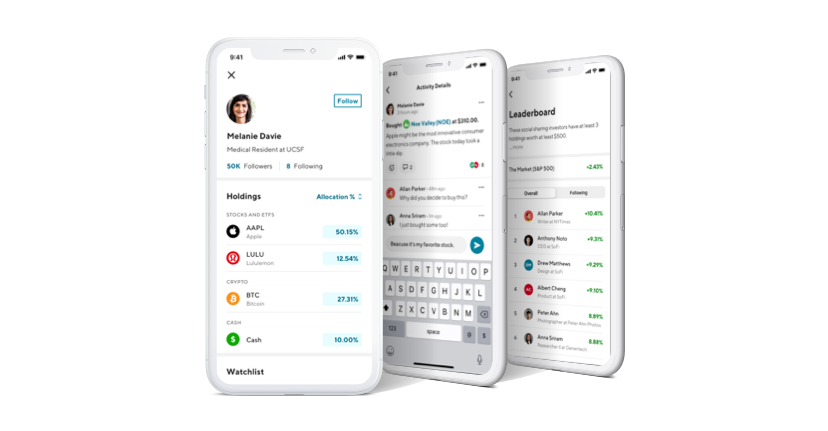

Finally, when #Sofi introduced the investing/brokerage feature, they of course added the social feature.

Members have the ability to discover/follow other members’ investment holdings, watchlists, and SoFi activity.

Members have the ability to discover/follow other members’ investment holdings, watchlists, and SoFi activity.

To wrap it up, #Sofi is not for everyone.

It's not built for the financial/trading savvy who has a high net worth bank account with Chase and 7 figure trading account with Fidelity.

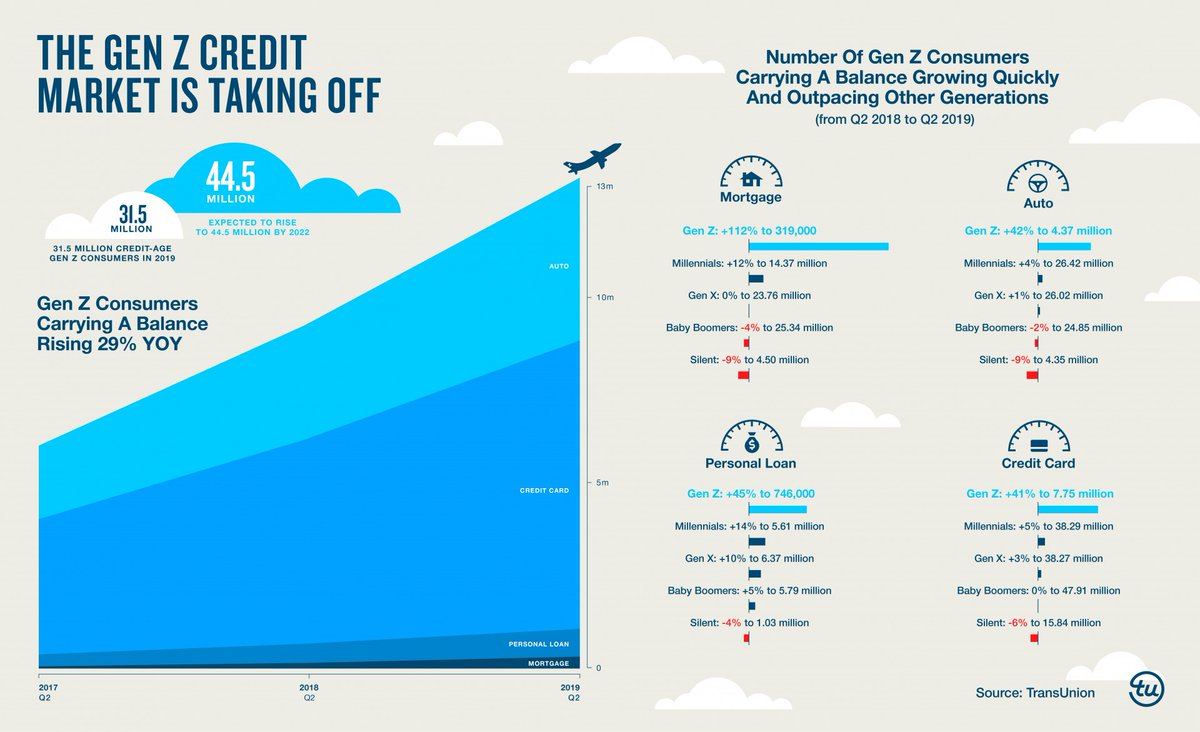

It's built for the next generation: Most Millennials, Gen Z and Gen Alpha.

It's not built for the financial/trading savvy who has a high net worth bank account with Chase and 7 figure trading account with Fidelity.

It's built for the next generation: Most Millennials, Gen Z and Gen Alpha.

Gen Z and Alpha are born connected around digital communities. They're on Reddit, TikTok, Discord, and Snapchat.

They're always connected. They like to share, compete, rank, and engage as a community.

And that's why, if correctly executed, #SoFi will be the future of banking!

They're always connected. They like to share, compete, rank, and engage as a community.

And that's why, if correctly executed, #SoFi will be the future of banking!

Disclaimer: I'm long $IPOE/@SoFi. This thread is not investment advice.

Sources:

- SoFI's Facebook Group: facebook.com/groups/1767919…

- duel.tech/blog/community…

- blog.playvox.com/top-10-custome…

- jennalynn.design/sofi-community…

Sources:

- SoFI's Facebook Group: facebook.com/groups/1767919…

- duel.tech/blog/community…

- blog.playvox.com/top-10-custome…

- jennalynn.design/sofi-community…

• • •

Missing some Tweet in this thread? You can try to

force a refresh