Selected quotes from Part II of @FossGregfoss’s salient paper:

‘Why Every Fixed-Income Investor Needs to Consider Bitcoin as Portfolio Insurance’

0/ “Bitcoin is the best asymmetric trade I have seen in my 32yrs of trading.”

‘Why Every Fixed-Income Investor Needs to Consider Bitcoin as Portfolio Insurance’

0/ “Bitcoin is the best asymmetric trade I have seen in my 32yrs of trading.”

1/ “Owning Bitcoin does not increase portfolio risk, it reduces it. You are actually taking MORE risk by not owning bitcoin, than you are if you have an allocation.

It is imperative that all investors understand this, and I hope to lay out the arguments why..”

It is imperative that all investors understand this, and I hope to lay out the arguments why..”

2/ “The GFC just transferred excess leverage in the financial system to the balance sheet of the governments.

Perhaps there was no choice but there is no question that in the ensuing decade, we had the chance to pay down the debts that we had pulled forward. We did not do that.”

Perhaps there was no choice but there is no question that in the ensuing decade, we had the chance to pay down the debts that we had pulled forward. We did not do that.”

3/ “Deficit spending increased, quantitative easing was employed whenever there was a hint of financial uncertainty, and now, in my opinion, it is too late. IT IS PURE MATHEMATICS.”

4/ “The global response to the Covid pandemic has ensured that our kids’ futures are doomed to eternal Fiat currency debasing. Again, simple math.”

5/ “Unfortunately, most people are intimidated by math. They prefer to rely on subjective opinions and comforting assurances from politicians and central authorities that it is okay to print more ‘money’ out of thin air.”

6/ “I believe the credit markets will have a very different take and this could happen in short order.

We need to be prepared, and we need to understand WHY. ‘Slowly, then suddenly’ is a reality in credit markets.”

We need to be prepared, and we need to understand WHY. ‘Slowly, then suddenly’ is a reality in credit markets.”

7/ “I want to state three truisms:

•Bitcoin = math + code = truth

•Money has always been technology for making our work/energy/time today available for consumption tomorrow.

•We are headed in a dangerous direction and we are lucky to have this tool.”

•Bitcoin = math + code = truth

•Money has always been technology for making our work/energy/time today available for consumption tomorrow.

•We are headed in a dangerous direction and we are lucky to have this tool.”

8/ “The bond markets are far larger, and far more susceptible to contagion, than are the equity markets.

According to the IIF, in 2018 total global debt was about US$250T. Within that pool, the largest borrowers are Federal, State, Provincial and Municipal Governments.”

According to the IIF, in 2018 total global debt was about US$250T. Within that pool, the largest borrowers are Federal, State, Provincial and Municipal Governments.”

9/ “The publicly traded instruments, the Bonds, have varying terms to maturity. The fixed income obligations are issued in terms as short as 30 days (t-bills) up to lengths as long as 100yrs.”

10/ “Government bonds are the most widely held fixed-income instrument. Every insurance company, pension fund, and most large and small institutions own government bonds.”

11/ “it is NO LONGER the case that Govies are risk-free, and opens some real dangers for investors as well as risk managers.”

12/ “A negative-yielding bond is no longer an investment.. if you buy a bond with a negative yield, and hold it until maturity, it will have cost you money, to store your “value” at a negative yield.

At last count, there was close to US$19T of negative-yielding debt globally.”

At last count, there was close to US$19T of negative-yielding debt globally.”

13/ “Most was ‘manipulated’ government debt, due to QE by Central Banks, but there is negative-yielding corporate debt too.

Imagine having the luxury of being a corporation and issuing bonds where you got money back. Those CFOs should focus on that anomaly all day long!”

Imagine having the luxury of being a corporation and issuing bonds where you got money back. Those CFOs should focus on that anomaly all day long!”

14/ “Going forward, interest rate risk due to inflation will be one directional. Higher.

And due to bond math, when interest rates rise, bond prices fall.”

And due to bond math, when interest rates rise, bond prices fall.”

15/ “But there is a brewing bigger risk than inflation for Govie bonds…Credit risk.

Credit risk is the implicit risk of owning a credit obligation that has the risk of defaulting.”

Credit risk is the implicit risk of owning a credit obligation that has the risk of defaulting.”

16/ “When G-20 government balance sheets were in decent shape, and operating budgets were balanced, and accumulated deficits were reasonable, the implied risk of default by a government was almost zero”

17/ “That is for two reasons. Firstly, their ability to tax to raise funds to pay their debts. Secondly, and more importantly, their ability to print Fiat money.”

18/ “How could a Federal government default, if it could just print money to pay down its borrowings?

In the past that argument made sense, but eventually printing money will/has become a credit boogie man.”

In the past that argument made sense, but eventually printing money will/has become a credit boogie man.”

19/ “Bond markets and rates are the grease of the financial plumbing system and for that reason central banks are very sensitive to how the liquidity is working.”

20/ “Liquidity is reflected in the bid/offer spread as well as the size of trades that can be executed.

When confidence wanes and fear rises, bid/ offer spreads widen, and trade sizes diminish as market makers withdraw from providing their risk capital to grease the plumbing.”

When confidence wanes and fear rises, bid/ offer spreads widen, and trade sizes diminish as market makers withdraw from providing their risk capital to grease the plumbing.”

21/ “What tends to happen is everybody is moving in the same direction. Generally, that direction is as sellers of risk or buyers of protection.

Dealers will retreat from the market because they don’t want to be left holding a bag of risk for which there are no buyers”

Dealers will retreat from the market because they don’t want to be left holding a bag of risk for which there are no buyers”

22/ “Perhaps the most important component of the credit markets is the banking system. Confidence in the banking system is paramount. ..there are a few open market rates that measure the confidence in the system as well being the basis for floating-rate debt facilities.”

23/ “During the GFC, these funding rates were sounding the alarm bells when equity markets were hitting all-time highs..

When in doubt, look to the financial markets to determine stresses, not to equity markets that can get a little irrational when the punch bowl is spiked.”

When in doubt, look to the financial markets to determine stresses, not to equity markets that can get a little irrational when the punch bowl is spiked.”

24/ “As stated previously, the turmoil in the GFC essentially transferred excess leverage in the financial system to the balance sheets of Governments.

The can was kicked to the Govies. Printed money was the painkiller. Unfortunately, we are now addicted to the pain medicine.”

The can was kicked to the Govies. Printed money was the painkiller. Unfortunately, we are now addicted to the pain medicine.”

25/ “To help investors evaluate credit risk and thus price credit on new issue debt, there are rating agencies who perform the “art” of applying their knowledge and intellect to rating a given credit.

The two largest rating agencies are S&P and Moody’s.”

The two largest rating agencies are S&P and Moody’s.”

26/ “Notwithstanding their bungling of the credit evaluations of most structured products in the GFC, investors continue to look to them not only for advice, but also for investment guidelines as to what determines ‘investment grade’ credit versus ‘non-investment grade’ credit.”

27/ “Many pension fund guidelines are set using these subjective ratings, which can lead to lazy, and dangerous behaviour such as forced selling when a credit rating is breached.”

28/ “For the life of me, I can not figure out how someone determines the investment merits of a credit instrument without considering the price (or contractual return) of that instrument!”

29/ “Rating scales: S&P / Moody’s highest rating to lowest rating: AAA/Aaa, AA/ Aa, A/A, BBB/Baa, BB/Ba, CCC/Caa & D for default. Within each category there are positive and negative fine tunings of opinion. Any credit rating of BB+/Ba+ or lower is deemed ‘non-investment grade’”

30/ “The respective ratings for governments are also very, if not completely subjective. While total debt/GDP metrics are a good starting point for relative leverage, it ends there.”

31/ “The ability to tax, raise taxes and print money is paramount. Since it is arguable that we have reached the point of diminishing returns in taxation then the ability to print is the only saving grace.”

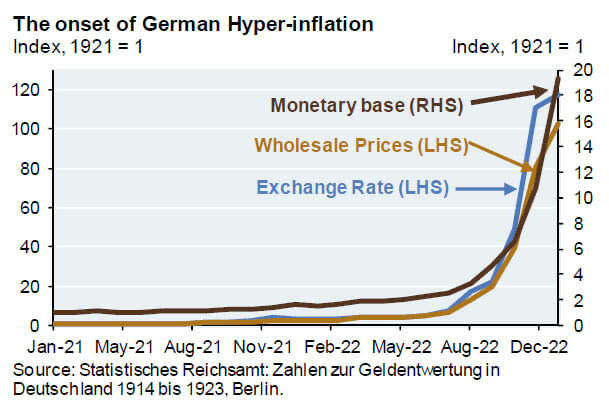

32/ “That is until investors refuse to take freshly printed and debased Fiat as payment….This has happened in plenty of Fiat abusing jurisdictions…”

33/ “If readers remember their physics formulas for distance, the change in price is like the change in distance, duration is like the velocity, and convexity is like acceleration.”

34/ “A ten-year bond would have an approximate 8yr duration for example. Ignoring convexity, this means that if rates change by 100bps, the price of the bond will change by 8%.”

35/ “Until now, most of these ‘fun’ credit moves were confined to the corporate bond markets. But enter stage right, the new breed of sovereign risk…CREDIT.”

36/ “The border between ‘investment grade’ and ‘non-investment grade’ debt is a sweet spot for many credit market participants. The reality is that this inefficient and arbitrary designation, still sets the border for how many players can participate..”

37/ “The correlation between equity markets and credit markets is causal.

When you are long credit you are short volatility.”

When you are long credit you are short volatility.”

38/ “When Central Banks decide to intervene in the equity markets to stabilize prices and reduce vol, it is not because they care about equity holders, it is because they need to stop the negative feedback loop and.. the seizing of credit markets.”

39/ “Credit Default Swaps (CDS) spreads and contracts are a relatively new financial engineering tool. They can be thought of as default insurance contracts where you can own the insurance and effectively be short the credit.”

40/ “I believe it was Warren Buffet who said, CDS enables you to buy fire insurance on your neighbour’s home and then you try and help him burn his house down. That is a little harsh, but it is not altogether untrue.“

41/ “What is not so well worn, is CDS on sovereign credits.

This is relatively new, and in my opinion, could be the most dangerous component of sovereign debt going forward.”

This is relatively new, and in my opinion, could be the most dangerous component of sovereign debt going forward.”

42/ “Inflation risk considerations for sovereigns will become overwhelmed by credit concerns.

Most sovereign bond fund managers and economists are still focused on interest rate risk rather than the brewing credit focus.”

Most sovereign bond fund managers and economists are still focused on interest rate risk rather than the brewing credit focus.”

43/ “Are we headed down the same path with sovereigns, where an implosion in CDS is contagious and blows all MMTers out of the water?”

44/ “I am certain most MMTers have never traded credit. They also appear to be poor at math. This is a dangerous combination because in credit markets it starts as a slow drip, and then it becomes a flood. Slowly then suddenly…”

45/ “In a debt/GDP spiral, the Fiat currency is the error term. That is pure mathematics. It’s a spiral to which there is no mathematical escape. If you are holding a Fiat obligation, it is debasing as fast as the MMTers can ‘finance spending in the same way: by creating money’.”

46/ 𝘊𝘳𝘦𝘥𝘪𝘵 𝘸𝘪𝘵𝘩𝘰𝘶𝘵 𝘥𝘦𝘧𝘢𝘶𝘭𝘵 𝘪𝘴 𝘭𝘪𝘬𝘦 𝘳𝘦𝘭𝘪𝘨𝘪𝘰𝘯 𝘸𝘪𝘵𝘩𝘰𝘶𝘵 𝘏𝘦𝘭𝘭.

–Howard Marks

–Howard Marks

47/ “All pension Funds, life insurance companies, mutual funds and individual investors need to understand the realities of credit exposure versus ‘manipulated’ interest rate exposure.”

48/ “Absolute interest rates can move higher because of inflationary concerns AND because of credit concerns. Credit concerns will overwhelm inflationary concerns, particularly if the deflationary impact of technological advances continues. “

49/ “However, technology does NOT solve credit risk in sovereigns/Fiats. What technology does solve is Store of Value problems with Fiats….BITCOIN.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh