As Biden lays out ambitious plans to stimulate the US economy and fight inequality with new money creation (spending) and money destruction (higher taxes on corporations, capital gains and the right), a firing squad of economists assembled to issue dire inflation warnings.

1/

1/

(If you'd like an unrolled version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:)

pluralistic.net/2021/05/01/may…

2/

pluralistic.net/2021/05/01/may…

2/

They're repeating the economic doctrine of the pasty 40 years, an austerity doctrine that focuses on the inflationary risks of "deficit spending" (when governments don't tax as much money out of the economy as they inject in the same year).

3/

3/

It's a doctrine that made a pretense to being a science, going to far as to create a fake "Nobel Prize" in economics in a bid for scientific credibility (the Nobel administrators eventually folded the economics prize into its administrative remit).

4/

4/

The "neoclassicals" used abstract equations to "prove" a bunch of economic truths that - purely coincidentally - made rich people much, much richer and poor people much, much poorer.

5/

5/

Tellingly, the most exciting development in economics of the past 50 years is "behavioral economics" - a subdiscipline whose (excellent) innovation was to check to see whether people actually act the way that economists' models predict they will.

(they don't)

6/

(they don't)

6/

It's this vain, discredited and shambolic group who have assembled behind leaders like Larry Summers to decry Biden's stimulus spending plans, insisting that we are flirting with hyperinflation and the collapse of the USD as a global reserve currency.

7/

7/

But economists aren't the last word in understanding stimulus and inflation. If you're trying to figure out whether Summers is right and inequality, poverty and crumbling infrastructure are the price of American stability, it's worth checking out the POLITICAL economists.

8/

8/

Here's a great place to start: @BrownUniversity economist @MkBlyth's interview with The Analysis, available in audio, video, and as a transcript:

theanalysis.news/interviews/mar…

9/

theanalysis.news/interviews/mar…

9/

Blyth doesn't dismiss Summers' inflationary fears out of hand, but he does say that Summers is vastly overestimating the likelihood that stimulus spending will trigger inflation - Summers says there's a 1-in-3 chance of inflation, while Blyth says it's more like 1-in-10.

10/

10/

To understand the difference, it's useful to first understand what we mean by inflation: "a general, sustained rise in the level of all prices."

It's not a short-term spike (like we saw with GPUs when everyone upgraded their gaming rigs at the start of the pandemic).

11/

It's not a short-term spike (like we saw with GPUs when everyone upgraded their gaming rigs at the start of the pandemic).

11/

It's also not an asset-bubble. House prices in Toronto are high, but that's not inflation. They're high because "Canada stopped building public housing in the 1980s and turned it into an asset class and let the 10 percent top earners buy it all and swap it with each other."

12/

12/

For inflation to happen in the wake of the stimulus, the spending would have to lead to too much money chasing not enough goods. Blyth gives some pretty good reasons to be skeptical that this will happen.

13/

13/

Start with the wealthy: they don't spend much, relative to their income. Their consumption needs are already met (that's what it means to be rich). You can only own so many Sub-Zero fridges, and even after you fill them with kobe beef and Veuve Cliquot, you're still rich.

14/

14/

What rich people do with extra money is SPECULATE. That's why top-level giveaways generate socially useless, destructive asset bubbles. Remember, these aren't inflation, which is good, because everyone agrees that inflation is hard to stop once it gets going.

15/

15/

They're speculative bubbles. We have a much better idea of how to prevent bubbles: transaction taxes, hikes to the capital gains tax, and high marginal tax rates at the top bracket.

16/

16/

Okay, fine, so the rich won't be able to spend us into inflation after a broad stimulus, but what about poor people? Well, the bottom 60% of the US is grossly indebted, suffocating under medical debt, student debt and housing debt. A LOT of that will disappear.

17/

17/

That will transfer a lot of stimulus money from poor people to rich people (who own the debt), which is why we need high capital gains and top-bracket taxation. But it will also sweep away a vast swathe of the financialized economy.

18/

18/

The point of long-term debt isn't to get paid off - it's to generate ongoing cash-flows that can be securitized and turned into bonds. Securitization converted "advanced" economies into shambling, undead debt-zombies.

pluralistic.net/2021/04/02/inn…

19/

pluralistic.net/2021/04/02/inn…

19/

It's securitization that led to the 2008 financial crisis, and it's securitization that sustains Wall Street's speculative acquisition of every single-family dwelling for sale in America as part of a bid to turn every home into an extractive slum.

20/

20/

Blythe explains that if the rich have nothing to buy and the poor use most of their stimulus to get out of debt, it will likely reorient the US economy to useful things: creating jobs to make stuff that people want to buy.

21/

21/

But what about the dollar's status as a global reserve currency? Won't all that stimulus send other countries scurrying around for another form of national savings? Blyth's answer is pretty convincing.

22/

22/

First, because there aren't any great alternatives: the European economy is growing at half the rate of the US. The Chinese economy is booming, but if you buy Chinese assets, there's a good chance you'll never be able to get them out of China.

23/

23/

Gold? Bitcoin? Leave aside the deflationary risk of pegging your currency to an inelastic metal or virtual token, leave aside the environmentally devastating effect of cryptocurrency (cryptos consume enough energy to offset the entire planetary solar capacity!).

24/

24/

Instead, think of the volatility of these assets, with their drunken, wild swings - countries that dump USD due to inflationary fears are hardly likely to switch to a crypto that can lose 20% of its value in a day.

25/

25/

And remember how much of that volatility is driven by out-and-out fraud, with major crypto exchanges and gold schemes imploding without warning, taking hundreds of millions of dollars with them. This is not a stable alternative to the dollar!

26/

26/

Beyond the lack of an alternative, there's another reason to believe that the USD will remain a global reserve, as Blyth elegantly explains.

Think of a Chinese company supplying the US market. Chances are, that's actually US company's subcontractor, getting paid in USD.

27/

Think of a Chinese company supplying the US market. Chances are, that's actually US company's subcontractor, getting paid in USD.

27/

These end up swapped with the Chinese central bank for Chinese money, because Chinese companies need to pay salaries, rent, and other expenses in Renminbi, not dollars. The Chinese central bank holds onto the USDs, using them as a national savings, a reserve currency.

28/

28/

If China were to dump all its USD holdings into the world economy, it would tank the US dollar - which is to say, it burn China's own national savings. China's central bank needs to do something with those dollar savings, so they buy 10-year US T-bills.

29/

29/

Same goes for Germany - net exporters depend on a net importer to buy their stuff, and primarily that's the USA. They are stuck in a form of "monetarily assured destruction," and a crisis of confidence is unlikely "because you’ve got nowhere else to take your confidence."

30/

30/

Next, Blyth takes up is the proposed increase in the corporate tax rate, and he says that investors are actually surprisingly okay with this - he reminds us of Buffett's maxim, "Only when the tide goes out do you discover who's been swimming naked."

31/

31/

A hike in the corporate tax rate has the potential to reveal which of the "great" firms "are just really good at tax optimization" rather than efficient production. It'll smash those unproductive firms to pieces that can be bought by good firms for pennies on the dollar.

32/

32/

The final issue that Blyth takes up is an excellent one for this #MayDay: the relationship of higher wages to inflation. When the US had large, centrally managed industries with large, centralized unions, there was the risk that higher prices would trigger higher wages.

33/

33/

But the US doesn't have a unionized workforce with guaranteed COLA inflationary rises - there's no "wage-price spiral" risk of higher prices leading to higher wages and then higher prices.

34/

34/

The neoclassical theory of wages is based on the "marginal productivity" and "higher than outside option" theories: wage-levels are the product of how much money they stand to make from your work, and how much someone else is willing to pay you to work for them.

35/

35/

But economists like Suresh Naidu describe how high-tech surveillance can disrupt this equilibrium: you can spy on workers instead of paying them more, can impose onerous conditions on them that wring them of everything they can produce.

36/

36/

This kind of #bossware was once the exclusive burden of low-waged, precarious workers, but thanks to the #ShittyTechnologyAdoptionCurve, it is working its way up the privilege gradient to increasingly elite workforce segments.

37/

37/

Digital micromanagement went from the factory floor to remote customer-support reps to office workers who are minutely surveilled by Office 365, all the way up to MDs and other elite professionals:

pluralistic.net/2021/02/24/gwb…

38/

pluralistic.net/2021/02/24/gwb…

38/

This has led to increased profits for firms - firms now take a larger share of their productivity gains, and workers see stagnant or declining wages. That excess profit represents slack in the system.

39/

39/

It means that even if companies' costs go up, they can hold prices steady - all they need to do is reduce their retained profits.

We've had 40 years of price stability at the expense of a living wage for working people.

40/

We've had 40 years of price stability at the expense of a living wage for working people.

40/

Higher wages are only inflationary if we assume that the 1% will continue to extract vast sums from their investments and use them to kick off destructive asset bubbles.

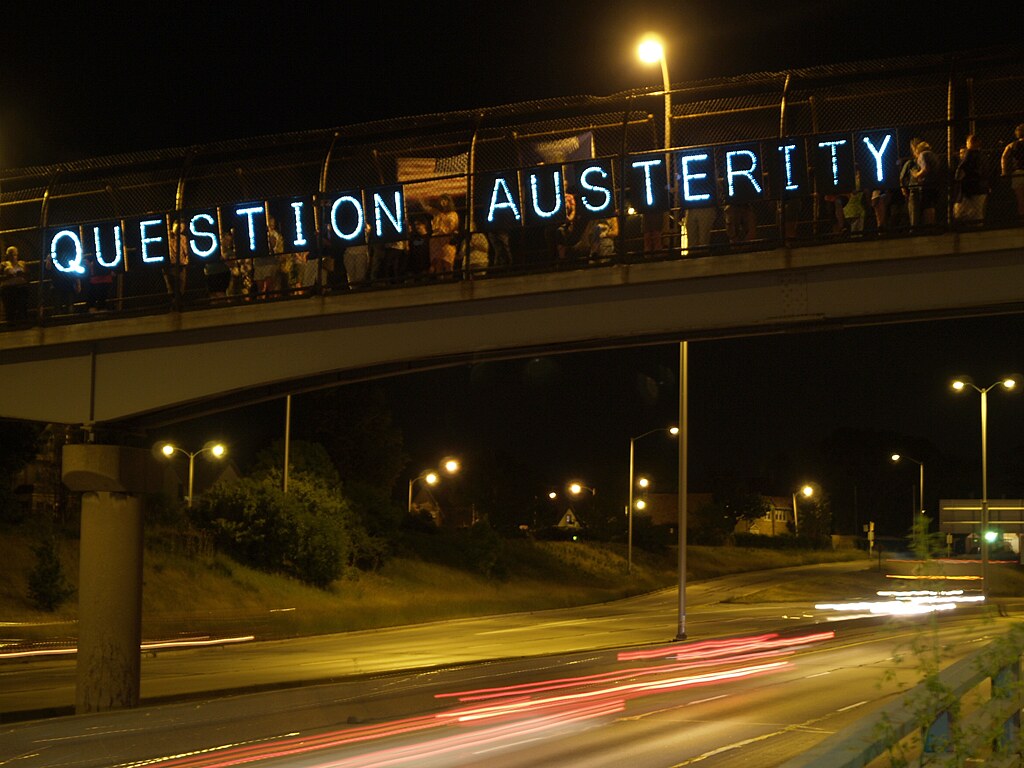

Image:

badsci

flickr.com/photos/7941730…

CC BY-SA:

creativecommons.org/licenses/by-sa…

eof/

Image:

badsci

flickr.com/photos/7941730…

CC BY-SA:

creativecommons.org/licenses/by-sa…

eof/

• • •

Missing some Tweet in this thread? You can try to

force a refresh