THREAD: $PM

@BillBrewsterSCG highlighting $PM as an under-discussed quality growth company encouraged me to further share my thoughts on their transition towards Reduced-Risk Products.

I will discuss the background, ESG angle, and why I am bullish on this growth story.

(1/x)

@BillBrewsterSCG highlighting $PM as an under-discussed quality growth company encouraged me to further share my thoughts on their transition towards Reduced-Risk Products.

I will discuss the background, ESG angle, and why I am bullish on this growth story.

(1/x)

https://twitter.com/BillBrewsterSCG/status/1388160029518438409

As an intro, I encourage anyone interested to learn more about the industry to listen to this Odd Lots episode where @TheStalwart & @tracyalloway discuss w/ Gene Hoots & @lhamtil how tobacco stocks became one of the greatest investments in history.

(2/x)

podcasts.apple.com/fr/podcast/how…

(2/x)

podcasts.apple.com/fr/podcast/how…

Everyone is not comfortable investing in tobacco & that's fine. In the podcast, @lhamtil makes a great case on "where to draw the line". I would add that smokers didn't wait for Big Tobacco to get their nicotine fix, with consumption dating back to 5,000 - 3,000 BC.

(3/x)

(3/x)

With that out of the way, let's deep dive into the development of Reduced-Risk Products (RRPs) at $PM. You may remember that there was a lot of buzz on vaping in the early 2010s, and Big Tobacco wasn't particularly big in it.

(4/x)

(4/x)

Vaping was quite the disruptor: no regulation on marketing & distribution, no excise tax. Easy to launch a new brand w/ minimal investments. It gained traction w/ consumers looking for safer alternatives, but plateaud as the experience was not satisfactory for most.

(5/x)

(5/x)

Enter Philip Morris International, the largest tobacco company in the world ex. China, with no presence in the US following the spin-off from $MO in 2008. Brands include Marlboro, L&M, Parliament, Chesterfield, etc; and the co has a strong presence in emerging markets.

(6/x)

(6/x)

At the 2014 investor day, $PM highlighted its goal of "developing & commercializing Reduced-Risk Products", while maintaining its combustible leadership, and declared that commercialization for "Platform 1" was on track for city test phase, along with E-Vapor products.

(7/x)

(7/x)

Platform 1 (known as IQOS) is an electrically-heated tobacco system, where real tobacco sticks are heated by a resistor to generate tobacco vapor. $PM created this category, betting big on it to get the reduced-risk benefits of vaping, but w/ much better XP for smokers.

(8/x)

(8/x)

Indeed, with a consumption experience replicating that of a cig and with real tobacco rather than e-liquid, IQOS could provide smokers with much more satisfaction than vaping, while providing similar risk-reduction. This was later referenced as "Heat-not-Burn" (HnB).

(9/x)

(9/x)

This was a bold move as no other similar product existed on the market (although I remember reading of similar developments in the 80s in "Barbarians at the Gate"!), but approached prudently with a small-scale, test & learn commercialization approach through city tests.

(10/x)

(10/x)

2 years later, at the 2016 investor day, $PM showed that it took this category very seriously, highlighting its Business Model evolution from the attractive, linear combustible category to the exponential, disruptive growth potential of RRPs.

(11/x)

(11/x)

First results were encouraging: 1 million consumers had already switched to IQOS in less than 2 years, so geographical expansion could begin.

(12/x)

(12/x)

By 2018, IQOS had reached over 15% share of market in Japan (the first test market) in less than 3 years. This is a huge achievement, as consumers are very loyal to their brand and reluctant to switch to new products, and underlines the potential of the HnB category.

(13/x)

(13/x)

HnB is great for consumers, who have access to a very satisfactory and much safer than cigs. But is it great for $PM as well? Of course, and this is why I think this is a great opportunity. Let's have a look at unit economics.

(14/x)

(14/x)

First, the marginal contribution on converted IQOS users is much higher than what $PM generates on its premium brand Marlboro: from +20% to +333% in selected markets. Not only is $PM winning smokers from competition, but switching its own smokers is margin-accretive.

(15/x)

(15/x)

Why is that? Most of cigs revenues go to government as excise tax. HnB is also subject to it. By highlighting the reduced-risk potential of HnB, $PM can negotiate better excise tax terms on IQOS consumables, giving it higher margins and better price productivity.

(16/x)

(16/x)

As an added bonus, IQOS allows them to create new revenue streams through e.g. accessories sale for the IQOS device. Along with services, this helps lock-in smokers into the IQOS ecosystem.

(17/x)

(17/x)

To date, $PM has invested more than $8B in RRPs. In product development of course, but also in toxicological & clinical assessments (much like pharmaceutical companies) to prove the risk-reduction potential of its platform.

(18/x)

(18/x)

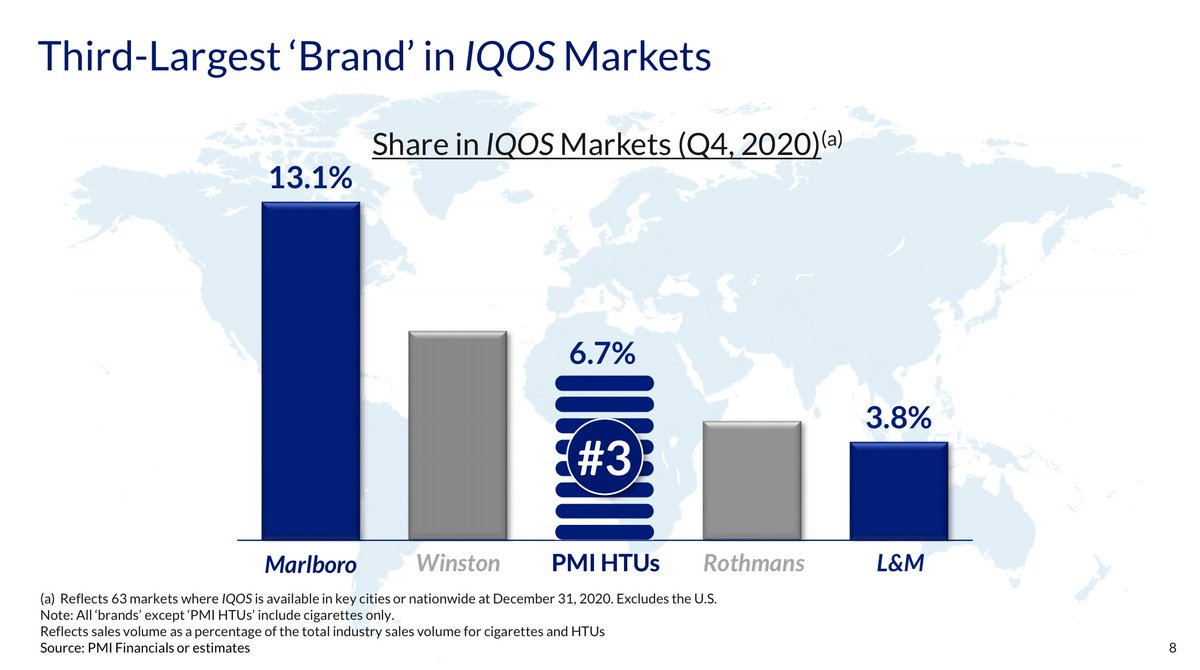

Results for IQOS have been incredible: 19m users in 66 markets to date. HTUs (IQOS consumables) are already the third largest brand in markets where IQOS is present...

(19/x)

(19/x)

... and market share is growing fast across all market archetypes, highlighting the value proposition of IQOS, not only for tech-savvy Japanese consumers, but for all smokers around the world.

(20/x)

(20/x)

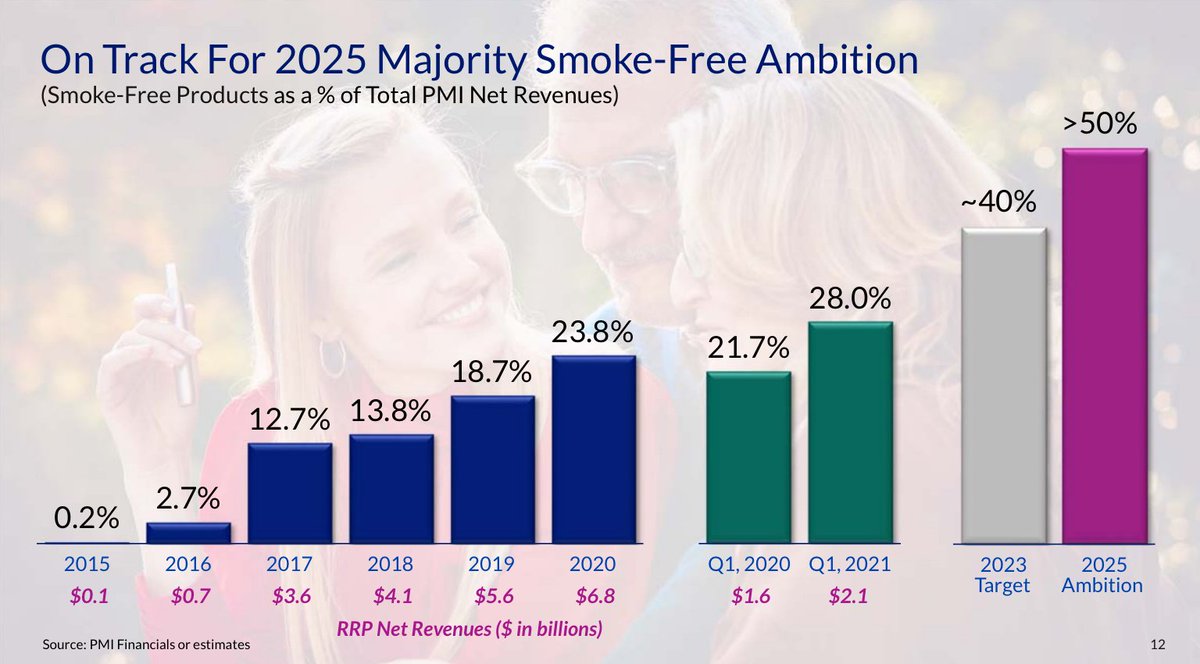

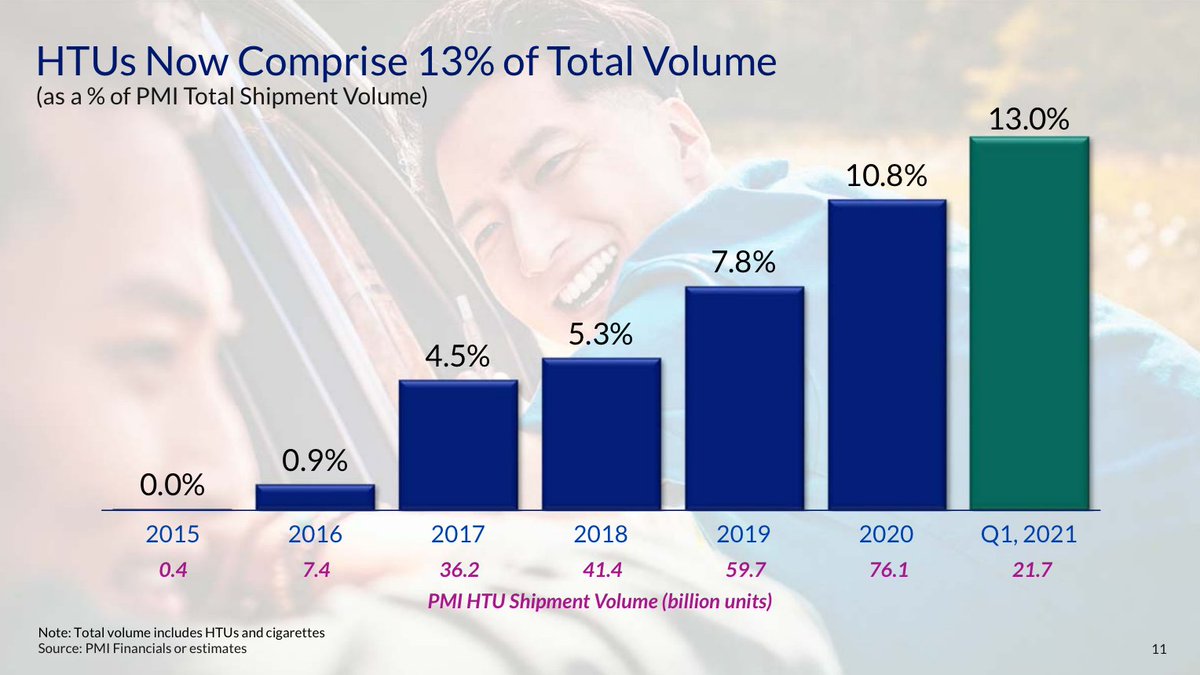

HnB already reached 24% of $PM net revenues and consumables 13% of total volumes, yet it is barely scratching the surface: HnB is still only 4.5% of the nicotine retail sales (but already surpassing E-Vapor at 1.6%). $PM is targeting >50% of revenues from RRPs by 2025.

(21/x)

(21/x)

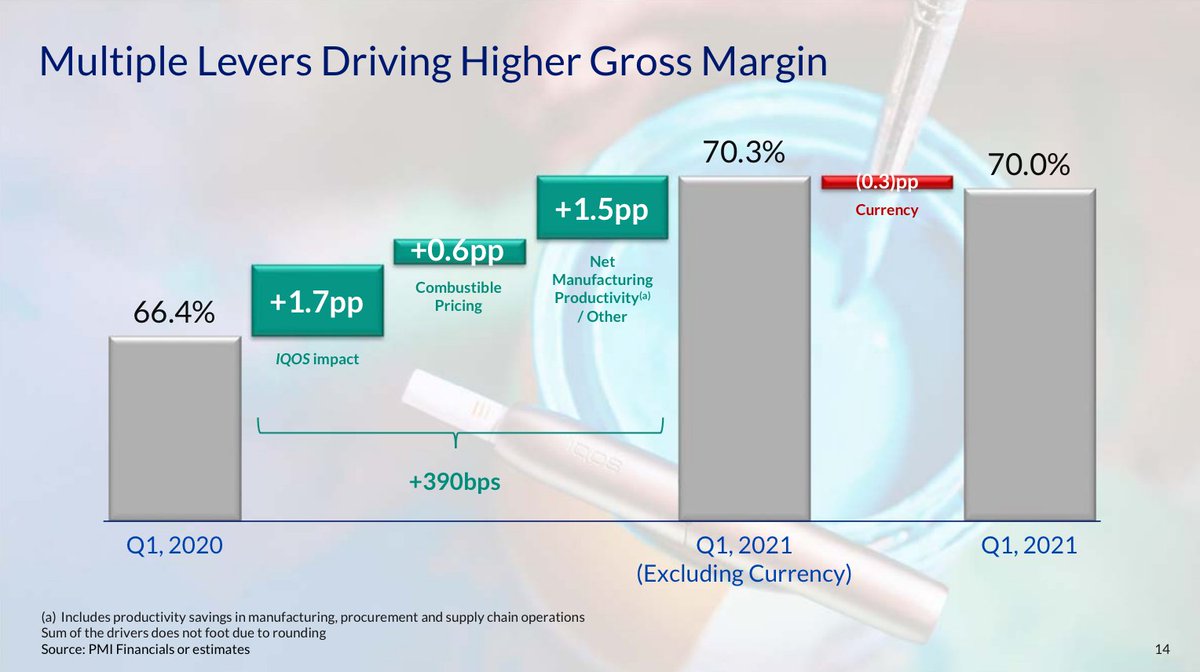

The attractive economics of IQOS start reflecting in the income statement: better gross margins (remember those attractive unit economics?), and leverage on the fixed infrastructure costs kicking in.

(22/x)

(22/x)

Also, learnings and experience from first markets improve efficiency for new markets, with months to break-even reduced from 25 to 11. In more mature markets, acquisition & retention cost per user drops year after year, demonstrating the operating leverage.

(23/x)

(23/x)

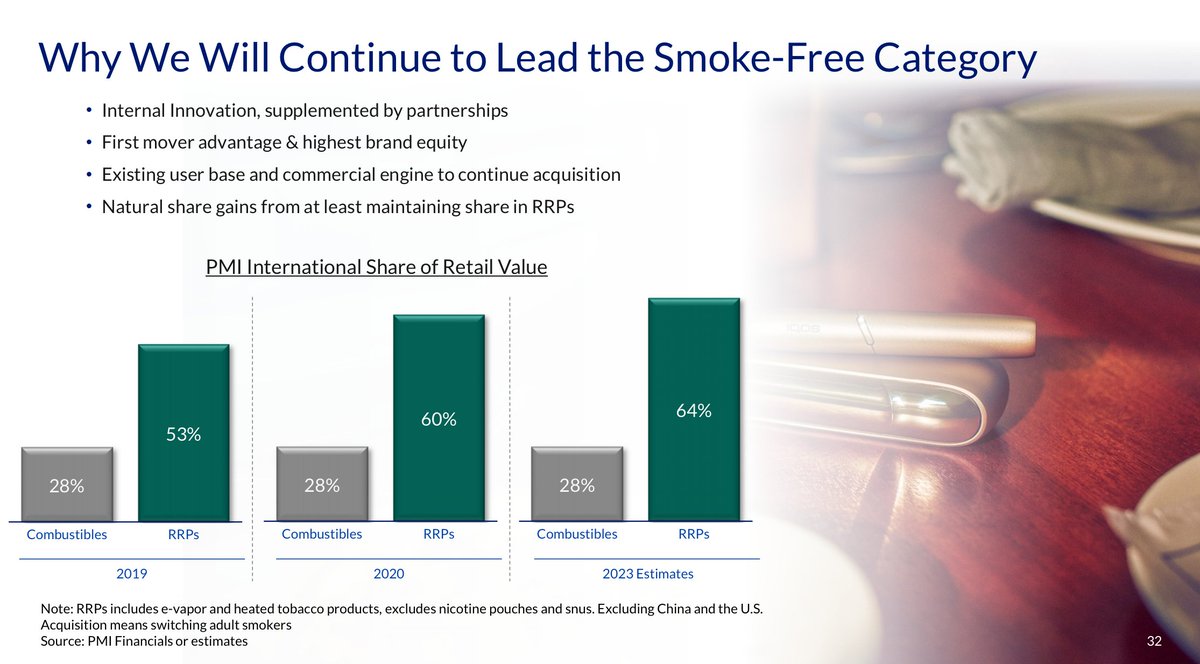

What about competition? $BTI, $IMBBY and $JAPAY have been more focused on e-vapor so far. British American Tobacco has launched Glo, an HnB product, but $PM is leaving everyone behind and maintaining over 80% category share in HnB since 2018...

(24/x)

(24/x)

... and $PM expects to maintain its leadership in RRPs, leveraging its first-mover advantage, better innovation, and existing user base. The company is about to get serious in e-vapor, and will also launch 2 new RRP platforms in the coming years.

(25/x)

(25/x)

To conclude, $PM is turning into an ESG/growth story, largely dominating the RRP product category through its big bet on HnB. This is great for consumers, who have access to very satisfactory reduced-risk products, and for $PM, which benefits from better unit economics.

(26/x)

(26/x)

At 15x EPS, this is an attractively valued consumer defensive stock, insulated from risks impacting traditional CPG names (private labels, DTC brands, etc). $PM targets >9% EPS growth, which I believe it can achieve given the superior economics highlighted above.

(27/x)

(27/x)

Add in a 5% dividend yield, and one could expect >14% annualized. Main risks include currency (EM exposure), and regulation/change in taxation regimes on HnB.

THE END

THE END

• • •

Missing some Tweet in this thread? You can try to

force a refresh