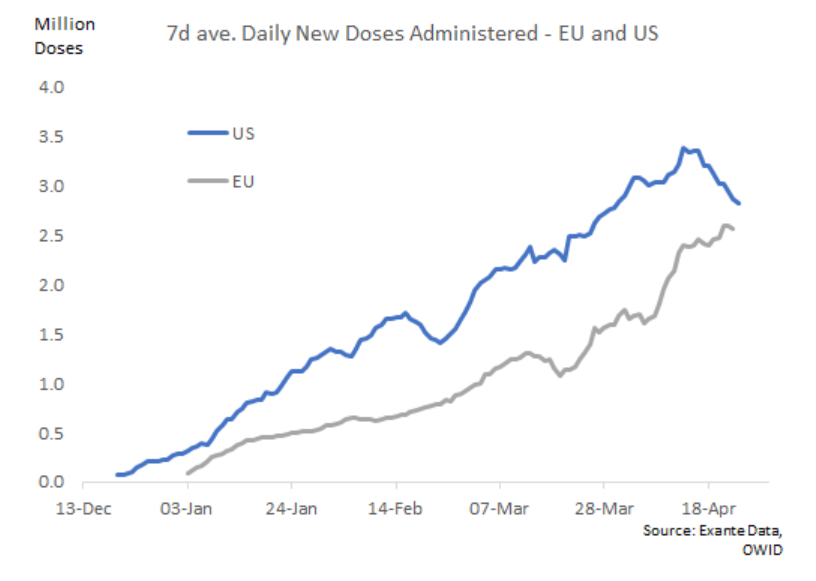

My tweet from yesterday has generated A LOT of debate. In fact, almost 1 million people have looked at the basic chart I circulated (showing with EU catching up to the pace of vaccine administrations the US first achieved in March).

https://twitter.com/jnordvig/status/1388485744642166785

It has also generated some misinterpretation. I did not mean to imply that any country was ‘winning’ against any other country. In this battle, it is all countries against the virus, and we should all celebrate when more countries join the winning side.

In terms of what it means to be ahead, clearly it is not just about a good pace for a few days. It is about the speed at which you can reach a critical level of overall immunity in the population; at which put the virus will be on a sustained declined (including after reopening).

I would say the following. The key criteria for 'winning' is vaccinating enough of the population that the virus is firmly on the back-foot (Rt < 1 if you will). Israel achieved that in early February. UAE achieved in March, and the US arguably achieved it during April.

In general, when doses administered amount to 40-60% of the population, there is evidence points to a turning point, meaning that reopening can happen while the virus is still on the decline.

If the EU countries deliver vaccines in the region 1% of the population per day over the coming months (which we have hit on peak days recently), we should see overall doses jump from around 30-35% currently to 60% or above by end-May.

Once the EU countries get into that 40-60% zone, which have proved a turning point for other countries (including essentially all US states), we should start to see clear results, allowing broad-based re-opening.

https://twitter.com/ExanteData/status/1388780474399698946

At that point, the EU will be clearly on the winning side of the virus battle too. Extrapolating the current vaccine trajectory (assuming no fresh setbacks) we should get there in 4-6 weeks.

END

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh