Overhearing a person at a table near me at a cafe talk about how she bought $400 worth of doge at a penny

"These are the headlines for doge right now ... This app does a background check it's super legit ... I'll help you."

I hear convos like this at least once a week.

"These are the headlines for doge right now ... This app does a background check it's super legit ... I'll help you."

I hear convos like this at least once a week.

I'm also an incredible eaves dropper. This convo is happening like at least 12 feet away from me.

I know how to zero in when people mention anything crypto related.

I know how to zero in when people mention anything crypto related.

Moved closer for Alpha purposes.

"Bitcoin is at 56,000 a share, so if it goes to that ..."

Unclear what crypto she is referring to here, possibly doge or Eth. Either way, frightening.

Unclear what crypto she is referring to here, possibly doge or Eth. Either way, frightening.

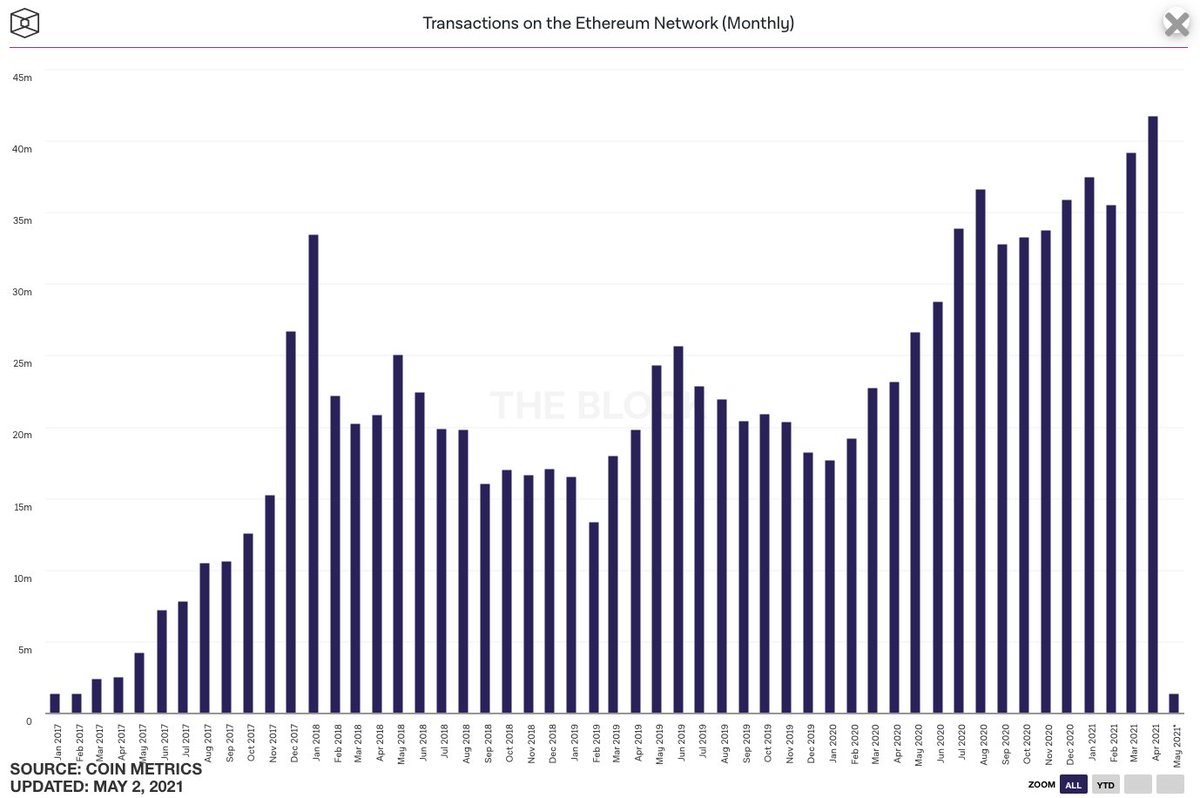

"Everything is showing that this [crypto] is going to be the way to pay for stuff. It's the coolest thing ever. Right now ... this is the circulating supply ... it is insane."

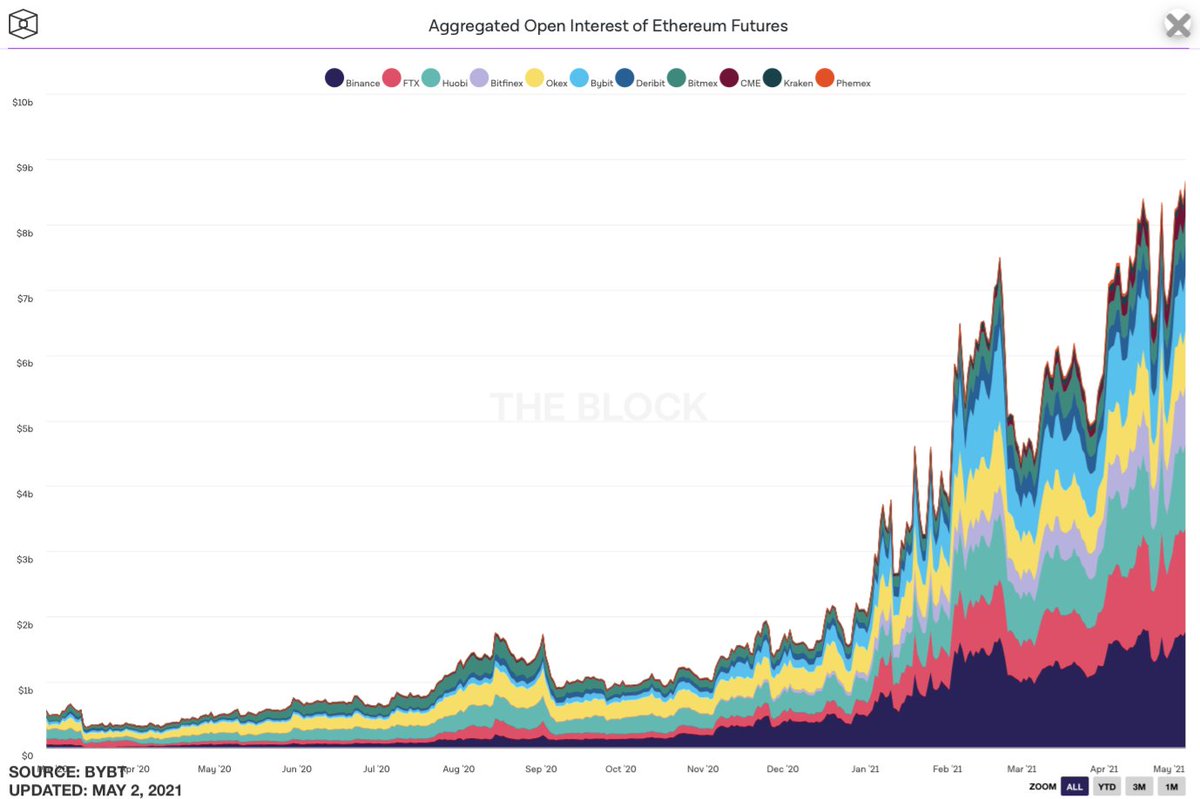

"There's no reason for anything bad to happen ... Ethereum is way more legit [than doge]."

Few.

Few.

• • •

Missing some Tweet in this thread? You can try to

force a refresh