0) The first call option token built on @umaprotocol settled last Friday. It was a call on $UMA with a $35 strike (UMAc35-0421) that expired worthless. I tallied up some trading stats and have some observations to share…

1) The contract settled using @umaprotocol’s Optimistic Oracle. A price of $25.672 for $UMA/USD was proposed with no dispute and approximately 2hours after expiry the contract had settled and users could redeem their collateral.

etherscan.io/tx/0x243c4b69f…

etherscan.io/tx/0x243c4b69f…

2) Outside of the initial 1MM call option tokens minted there were another 141k (~$3.5mm) minted by users. These were assumed to be sold to the @SushiSwap pool as covered call strategies.

3) Looking at the @SushiSwap pool, users did the following

*Bought 159k UMAc35-0421 (~$4.0 MM)

(avg price 0.057 UMA)

*Sold 287k UMAc35-0421 (~$7.1 MM)

(avg price 0.052 UMA)

(Raw data here: docs.google.com/spreadsheets/d…)

*Bought 159k UMAc35-0421 (~$4.0 MM)

(avg price 0.057 UMA)

*Sold 287k UMAc35-0421 (~$7.1 MM)

(avg price 0.052 UMA)

(Raw data here: docs.google.com/spreadsheets/d…)

4) Netting this with what was minted the "sells" were really

*141k covered call strategies

*146k (287-141) unwind of calls that were bought previously

*13k (159-141) calls were bought and expired worthless

*141k covered call strategies

*146k (287-141) unwind of calls that were bought previously

*13k (159-141) calls were bought and expired worthless

5) @umaprotocol was the only LP and this was created for the benefit of its community. The liquidity was purposely left open longer than rationally should be as an experiment and users took advantage of it. From April 19th onwards the pool only saw selling - about 150k calls

6) Users long call options used the bid to unwind at a great price. Other users decided the price of the call was too high and arbed it down, and felt more confident doing it as expiry approached. In fact, 110k of the 141k calls minted were created after April 20th.

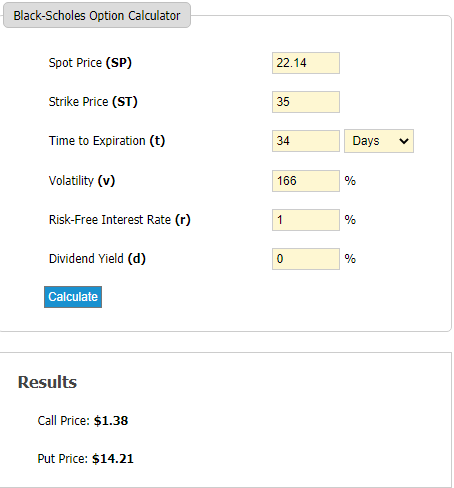

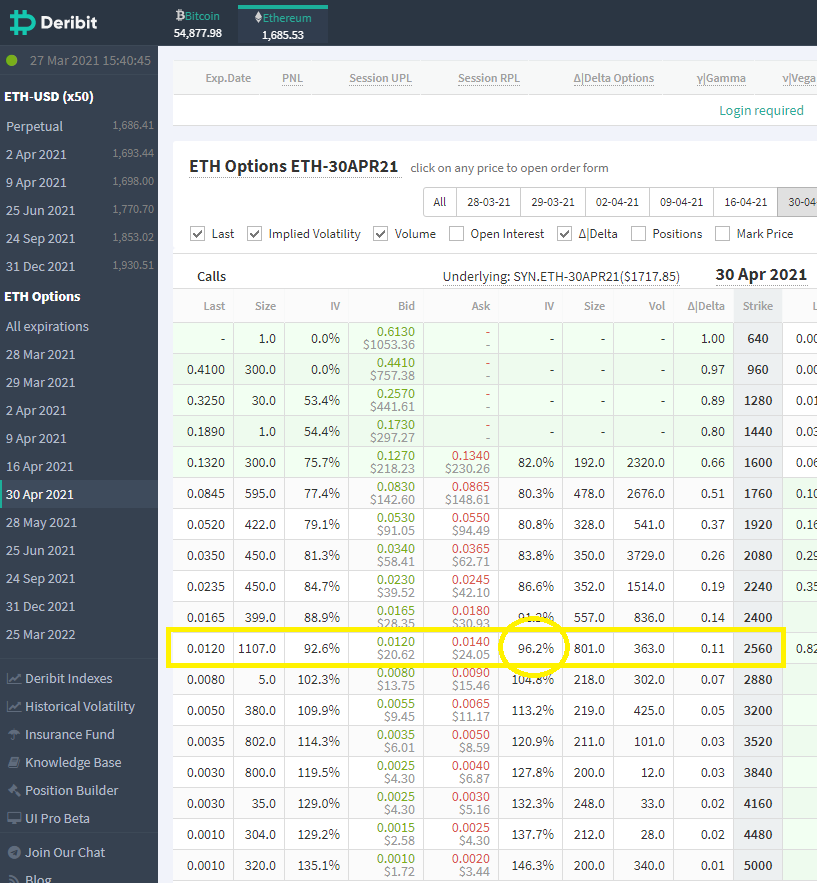

7) The UMA call option still had a bid of ~3% (~$0.75) right up to expiry when $UMA was trading ~$10 (or ~30%) below the $35 strike.

Altogether it was a useful exercise that showed interest in this market and showed people were paying attention.

Altogether it was a useful exercise that showed interest in this market and showed people were paying attention.

8) To see all the live call option tokens ($UMA, $BAL, $SUSHI, $UNI) go to mysynths.finance. Also check out our latest thoughts on how Uniswap v3 could enhance liquidity for options and other synths.

medium.com/uma-project/ul…

medium.com/uma-project/ul…

• • •

Missing some Tweet in this thread? You can try to

force a refresh