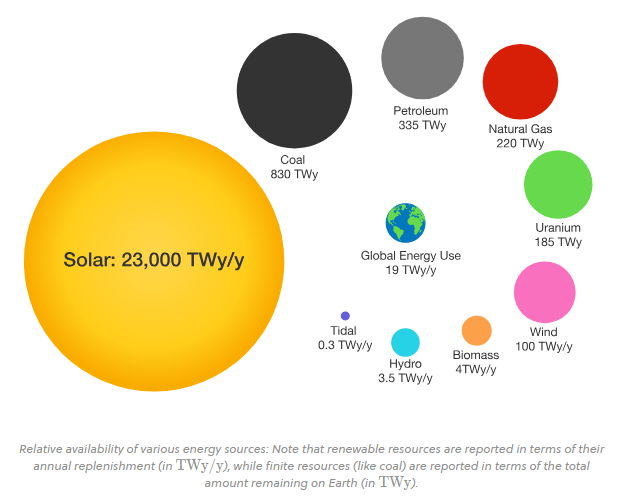

The world's total wind resources are 100TWy/y. Harvesting 100% of it would require we stop all wind blowing on earth (converting it to rotating wind blades) - not remotely possible. Global energy use is currently 19TWy/y, and will likely double in the next 30-50yrs.

You can therefore forget powering the world's economy purely with wind. Hydro resources are limited to 3.5 TWy/y, and are mostly already exploited. Anyone that suggests tidal as a possible solution - at just 0.3 TWy/y - knows laughably little about energy economics.

Energy resources across fossil fuels & uranium above are understated as they are only currently known/proved reserves & resources. We will find a lot more if and when there is a need and financial incentive to do so. But they will eventually run out/EROI will fall below 1x.

Musk is right that in the very long term, solar power is the only way forward for the human race. I think he is right on that, but 50-100yrs early (the same argument could have been made to leave coal in the ground in the 18th Century at the dawn of the Industrial Revolution).

However, it will need to be done. The bull case for fossil fuels is that having enough energy is going to be a much greater challenge than there being too much. The only metric to watch is how fossil fuel costs compare to mass storage-enabled solar. Everything else is noise.

Inclusive of the cost of mass storage, including dealing with seasonal variations, fossil fuels currently have a cost advantage of approximately 10 to 1 in my rough estimation. Coal and natural gas can produce electricity for a wholesale cost of about 2.5c/KWh.

So long as there is such a stark cost advantage, and no other viable scalable alternatives, all the politiking and sustainability activism in the world will make no difference, assuming people don't want to go back to Middle Ages' lifestyle, which is a pretty safe assumption.

The visual is courtesy of Brilliant brilliant.org

• • •

Missing some Tweet in this thread? You can try to

force a refresh