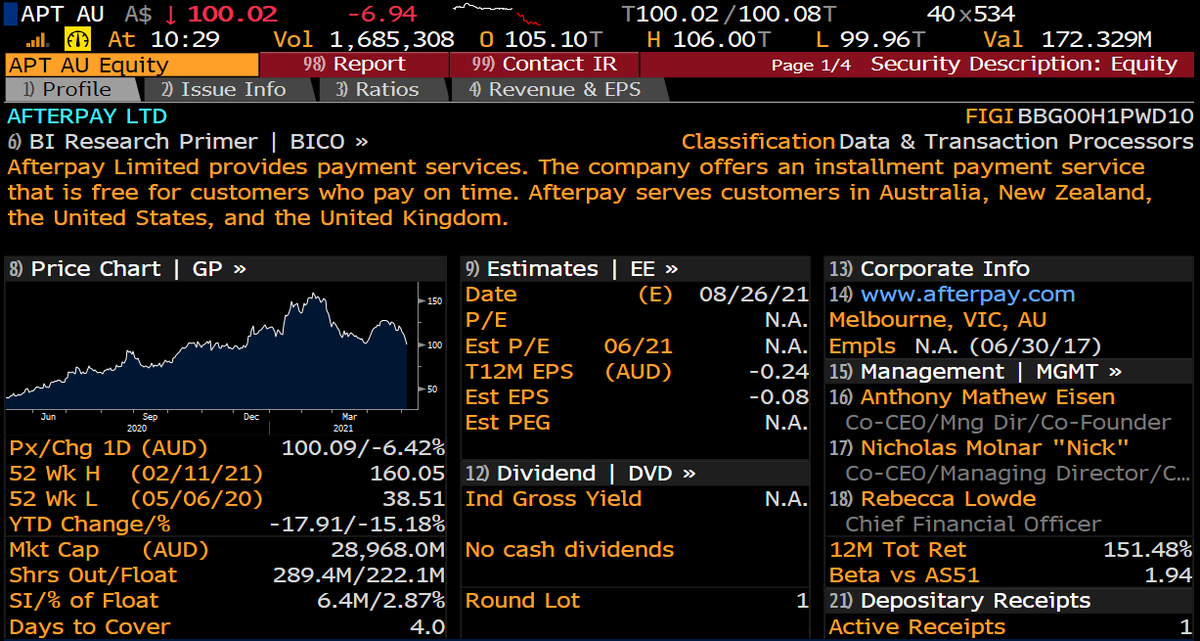

Afterpay traded sub $100 today, almost 40% off its highs. The APT gif brigade seems to have vanished.

Valuation still in loon down. While label solutions offered by merchants will crush margins long term. ADS is one company offering this functionality to merchants (long ADS).

Valuation still in loon down. While label solutions offered by merchants will crush margins long term. ADS is one company offering this functionality to merchants (long ADS).

"I'd like to pay with APT"

"Did you know our membership card can offer you the same BNPL terms, but you get free points you can redeem for 1% off your next purchase".

"Ok cool that works too".

BNPL is just rebranded POS consumer finance. Will be rapidly commoditized.

"Did you know our membership card can offer you the same BNPL terms, but you get free points you can redeem for 1% off your next purchase".

"Ok cool that works too".

BNPL is just rebranded POS consumer finance. Will be rapidly commoditized.

Merchants have every incentive to switch to offering white labeled solutions. They save on 4-7% merchant fee charged by APT; control the data collection on their customers; and share in the financing economics. They will still offer external BNPL but steer customers off it.

The retailers that succeed in doing this will have a substantial cost advantage over merchants that do not, and will be able to reinvest those savings into lower prices, increased marketing, etc. Market forces will work to squeeze out merchants relying on APT BNPL over time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh