24 reasons $ETH is extraordinarily undervalued...👇🏻

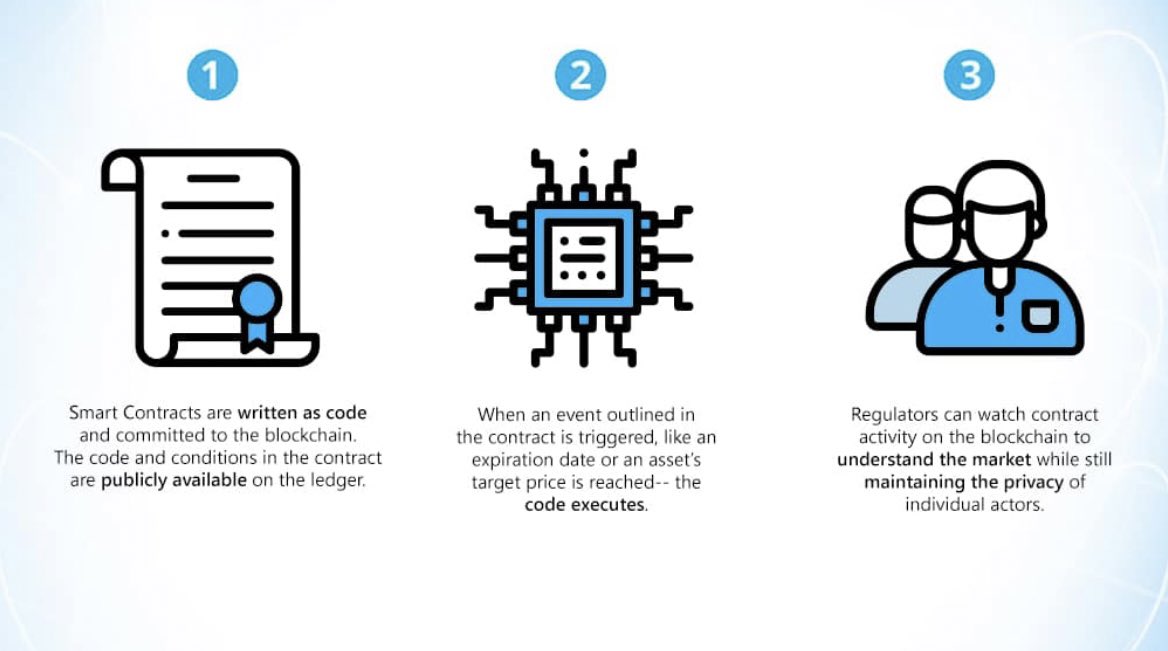

1. Smart Contracts

Smart contracts are programmable money. We can transact, schedule payments, earn interest, lend/borrow, & do much more with them

Txs are confirmed by a global network of computers on an immutable ledger, verifiable on-chain

The possibilities are endless.

Smart contracts are programmable money. We can transact, schedule payments, earn interest, lend/borrow, & do much more with them

Txs are confirmed by a global network of computers on an immutable ledger, verifiable on-chain

The possibilities are endless.

2. DeFi

What is built on $ETH is getting more complex & intuitive for users by the day, with a total of $80B locked in DeFi, up from $16B in January

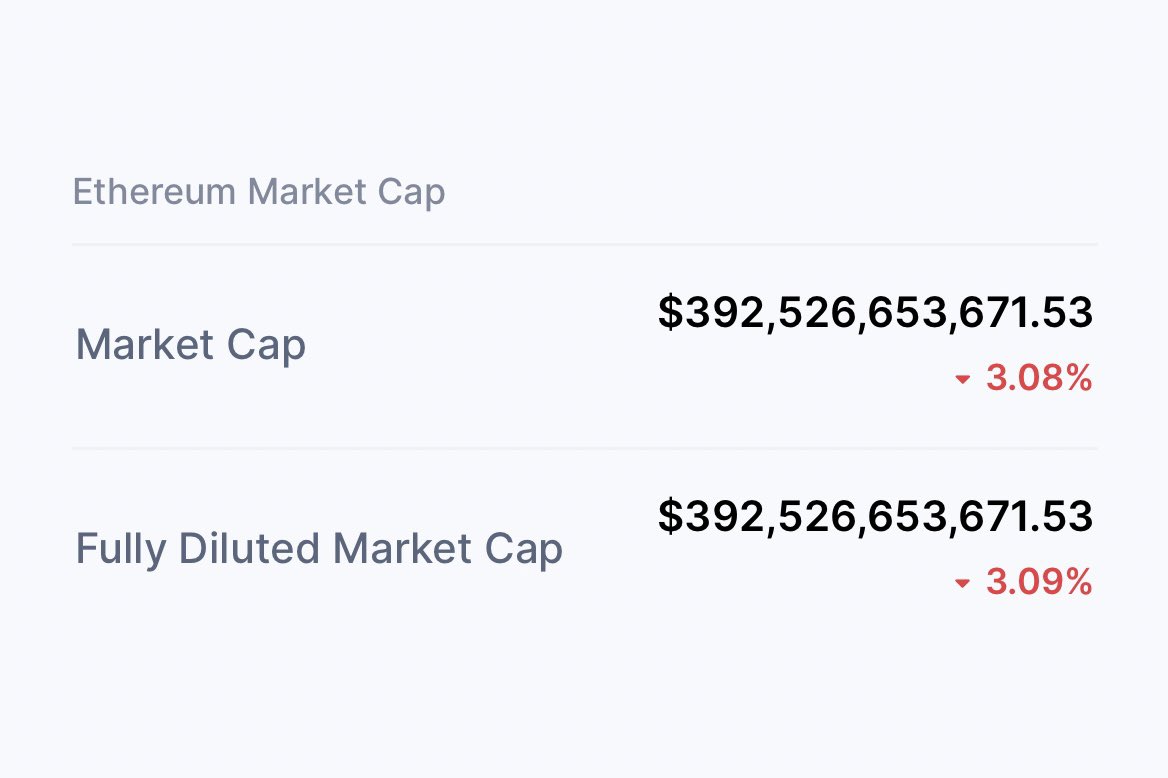

$ETH market cap just surpassed the Bank of America, which is not even the largest bank in the US

With DeFi, we are our OWN banks

What is built on $ETH is getting more complex & intuitive for users by the day, with a total of $80B locked in DeFi, up from $16B in January

$ETH market cap just surpassed the Bank of America, which is not even the largest bank in the US

With DeFi, we are our OWN banks

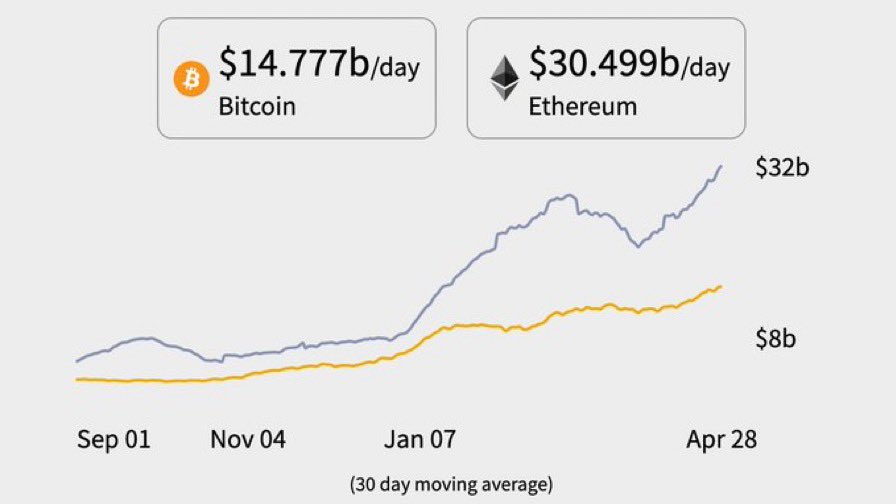

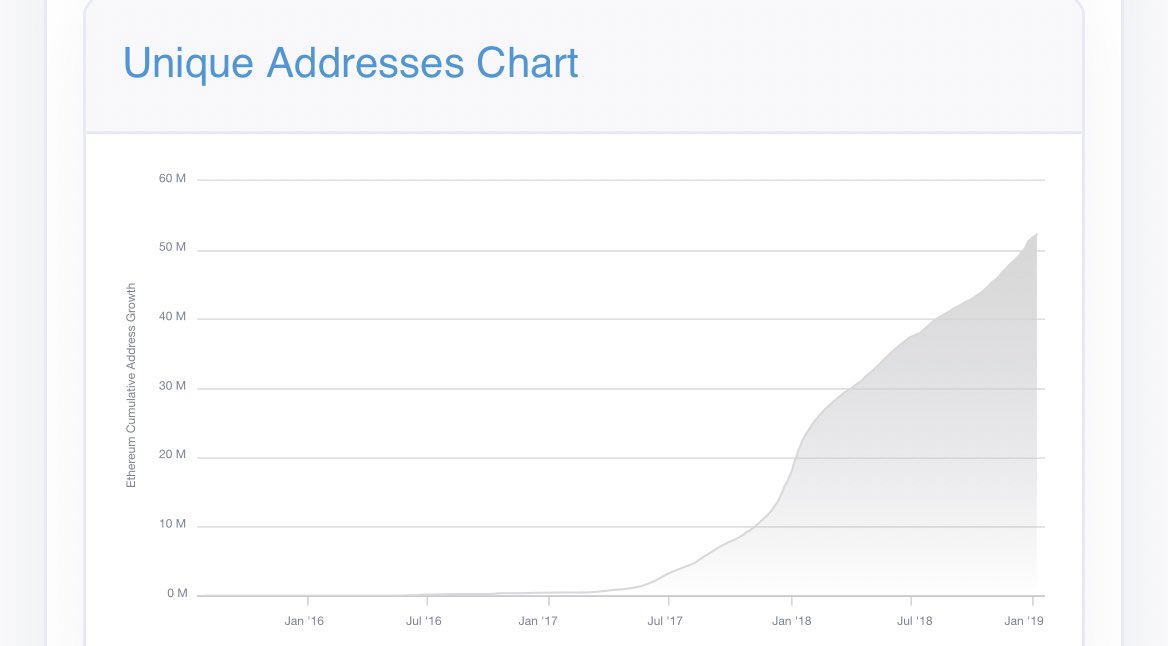

3. Network Usage

-Unique addresses on $ETH has reached over 50M

-Total transactions on $ETH are reaching new all time high levels every day

-Average value transacted on $ETH is now consistently more than double that of $BTC

-PayPal settles $2.5B daily (market cap of $300B)

-Unique addresses on $ETH has reached over 50M

-Total transactions on $ETH are reaching new all time high levels every day

-Average value transacted on $ETH is now consistently more than double that of $BTC

-PayPal settles $2.5B daily (market cap of $300B)

4. Revenue

Miners are raking in fees from transactions on the blockchain, making even $BTC look little in comparison

In January of this year, $ETH miners earned a record $830M worth of fees

This is extremely attractive to both the efficiency and security of the network

Miners are raking in fees from transactions on the blockchain, making even $BTC look little in comparison

In January of this year, $ETH miners earned a record $830M worth of fees

This is extremely attractive to both the efficiency and security of the network

5. The “Triple-Halvening”

This concept refers to the upcoming equivalent of 3 halving events for $ETH, which will result in a 90% drop in sell pressure from miners

I’ll point to some tweets from @SquishChaos to explain this in further depth below:

This concept refers to the upcoming equivalent of 3 halving events for $ETH, which will result in a 90% drop in sell pressure from miners

I’ll point to some tweets from @SquishChaos to explain this in further depth below:

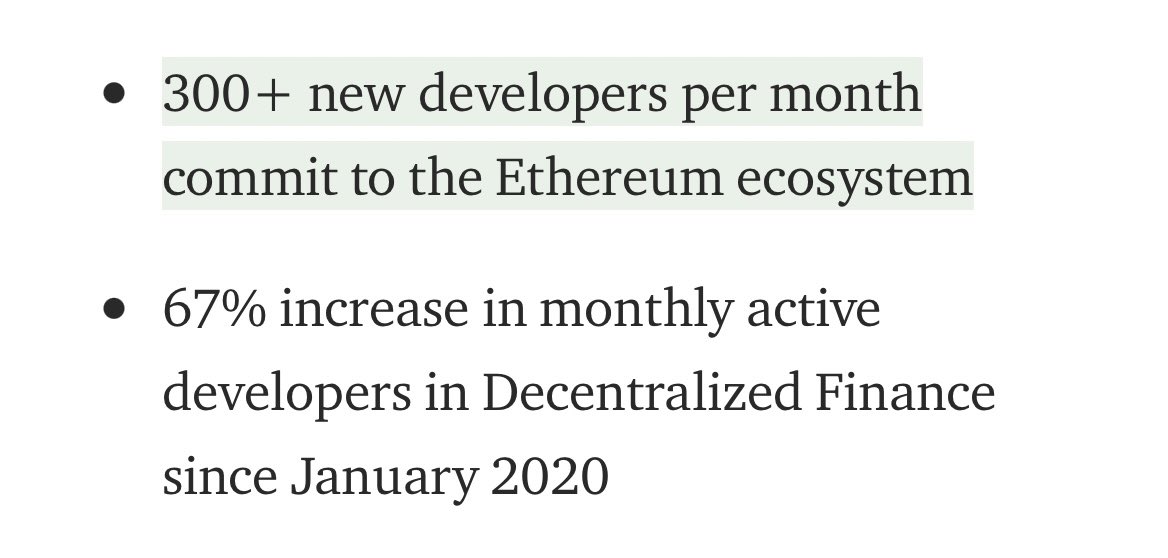

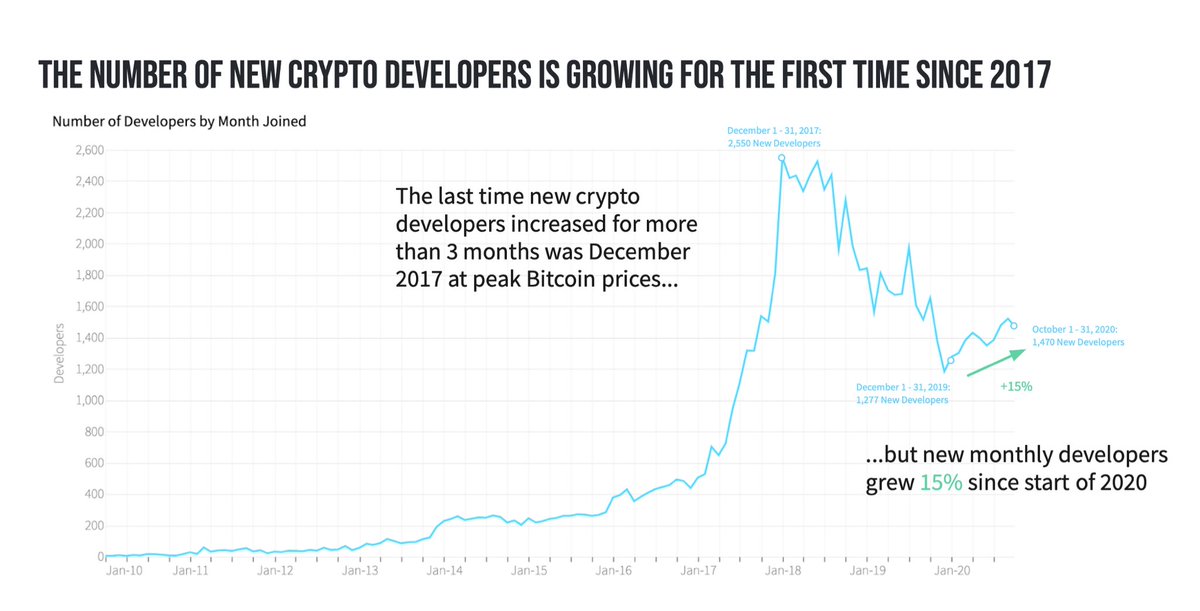

6. Developers

Whether you like it or not, no serious project is building (primarily) on a network like $BSC, $ETH has all of the attention in the space

A total of 94 out of the top 100 crypto projects are built on $ETH, with more than:

-3,000 dapps

-200K ERC20’s

Whether you like it or not, no serious project is building (primarily) on a network like $BSC, $ETH has all of the attention in the space

A total of 94 out of the top 100 crypto projects are built on $ETH, with more than:

-3,000 dapps

-200K ERC20’s

7. Yield Farming

Users on $ETH can take advantage of various protocols on the network to lend, borrow, or stake and earn interest on their holdings

Entire billion dollar protocols have been created for this purpose, & yield is significantly higher than other traditional sources

Users on $ETH can take advantage of various protocols on the network to lend, borrow, or stake and earn interest on their holdings

Entire billion dollar protocols have been created for this purpose, & yield is significantly higher than other traditional sources

8. DEX’s

The introduction of automated market makers such as $SUSHI and $UNI has made swapping tokens easier than ever before

DEX’s are now accounting for a total of $432B worth of trading volume on $ETH in the last 12 months

& there are over 2M addresses trading on them

The introduction of automated market makers such as $SUSHI and $UNI has made swapping tokens easier than ever before

DEX’s are now accounting for a total of $432B worth of trading volume on $ETH in the last 12 months

& there are over 2M addresses trading on them

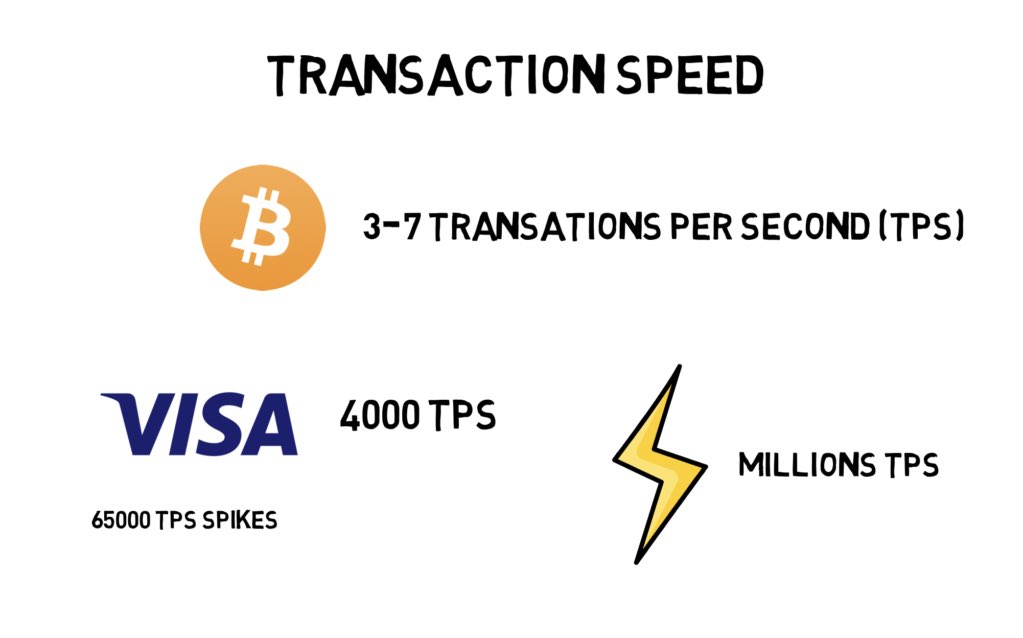

9. Layer Two

Protocols are being built to help scale $ETH to institutional capabilities by handling txs off chain

Most notably Optimism, which is planned for main-net in a matter of days

These protocols claim to be able to bring $ETH to 1M txs per second (currently 15 tps)

Protocols are being built to help scale $ETH to institutional capabilities by handling txs off chain

Most notably Optimism, which is planned for main-net in a matter of days

These protocols claim to be able to bring $ETH to 1M txs per second (currently 15 tps)

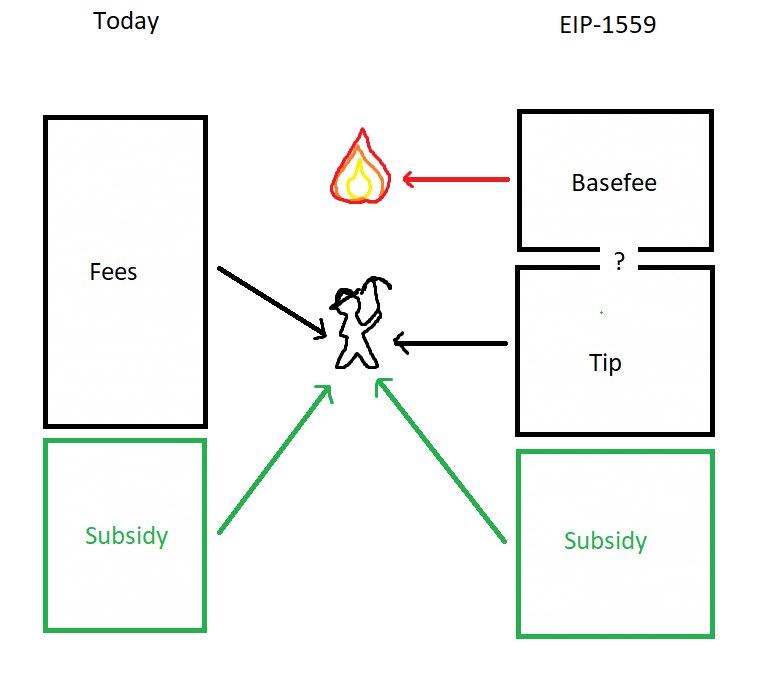

10. EIP-1559 (July)

EIP-1559 is a proposal from Vitalik Buterin which introduces a massive change to the way gas fees work on $ETH

The model could actually prove $ETH to be a deflationary asset 👀

Had it already been live, over 1M would have been burned just last year alone

EIP-1559 is a proposal from Vitalik Buterin which introduces a massive change to the way gas fees work on $ETH

The model could actually prove $ETH to be a deflationary asset 👀

Had it already been live, over 1M would have been burned just last year alone

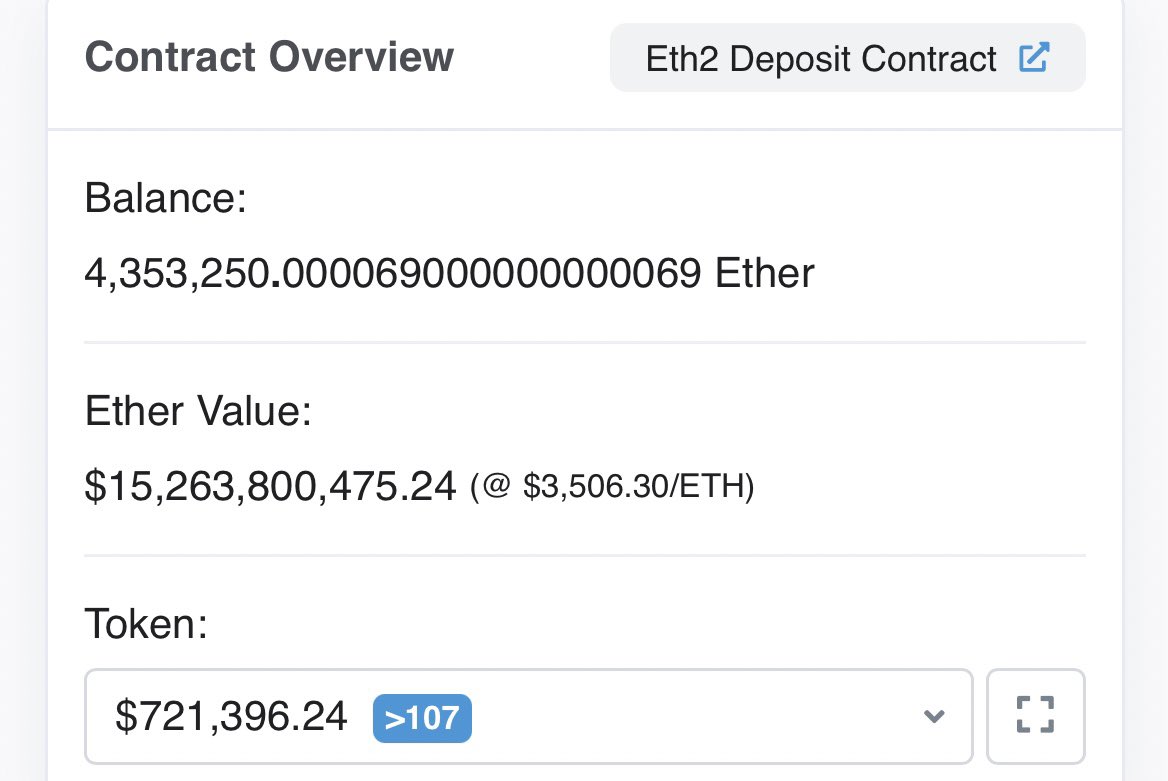

11. ETH 2.0

$ETH 2.0 refers to a major protocol upgrade which may just help to scale it to institutional levels

The upgrade introduces sharding, proof of stake, & other enhancements to the security of the network

With it, $ETH will become infinitely more scalable.

$ETH 2.0 refers to a major protocol upgrade which may just help to scale it to institutional levels

The upgrade introduces sharding, proof of stake, & other enhancements to the security of the network

With it, $ETH will become infinitely more scalable.

12. POS

$ETH will transition from the energy intensive proof of work consensus model to proof of stake this year

Users can then earn interest on their $ETH by staking it, becoming a node in the network

We are about to see a significant amount of $ETH taken out of the supply

$ETH will transition from the energy intensive proof of work consensus model to proof of stake this year

Users can then earn interest on their $ETH by staking it, becoming a node in the network

We are about to see a significant amount of $ETH taken out of the supply

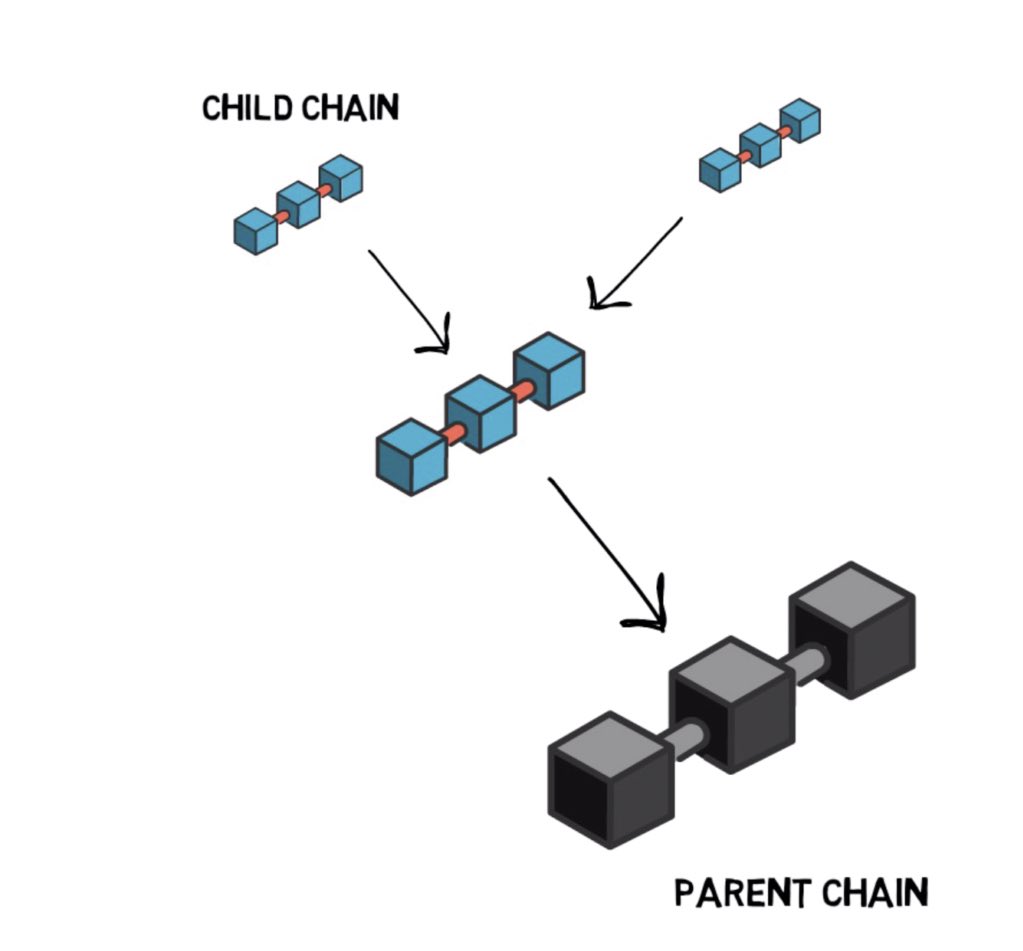

13. Sharding

Sharding is a concept popular in computer science, which when implemented for $ETH, will essentially “split” the network into multiple shards, increasing its capability to store data

Furthermore it will allow many more users to become nodes than previously possible

Sharding is a concept popular in computer science, which when implemented for $ETH, will essentially “split” the network into multiple shards, increasing its capability to store data

Furthermore it will allow many more users to become nodes than previously possible

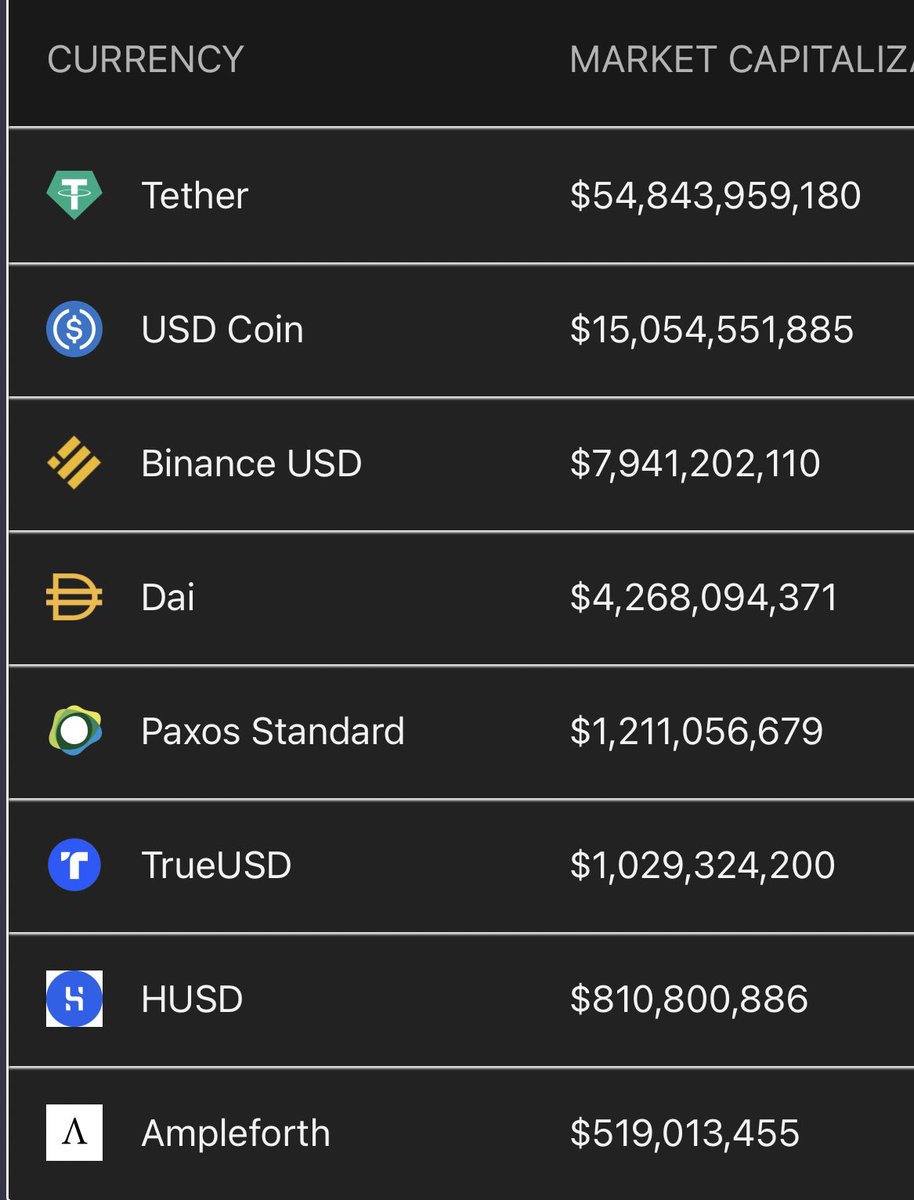

14. Stablecoins

Right now more than $80B worth of assets are represented in stable coins on $ETH

These stable coins make up over $100B worth of trading volume on the network

Additionally, VISA has recently announced that they will be accepting $USDC for transaction settlement

Right now more than $80B worth of assets are represented in stable coins on $ETH

These stable coins make up over $100B worth of trading volume on the network

Additionally, VISA has recently announced that they will be accepting $USDC for transaction settlement

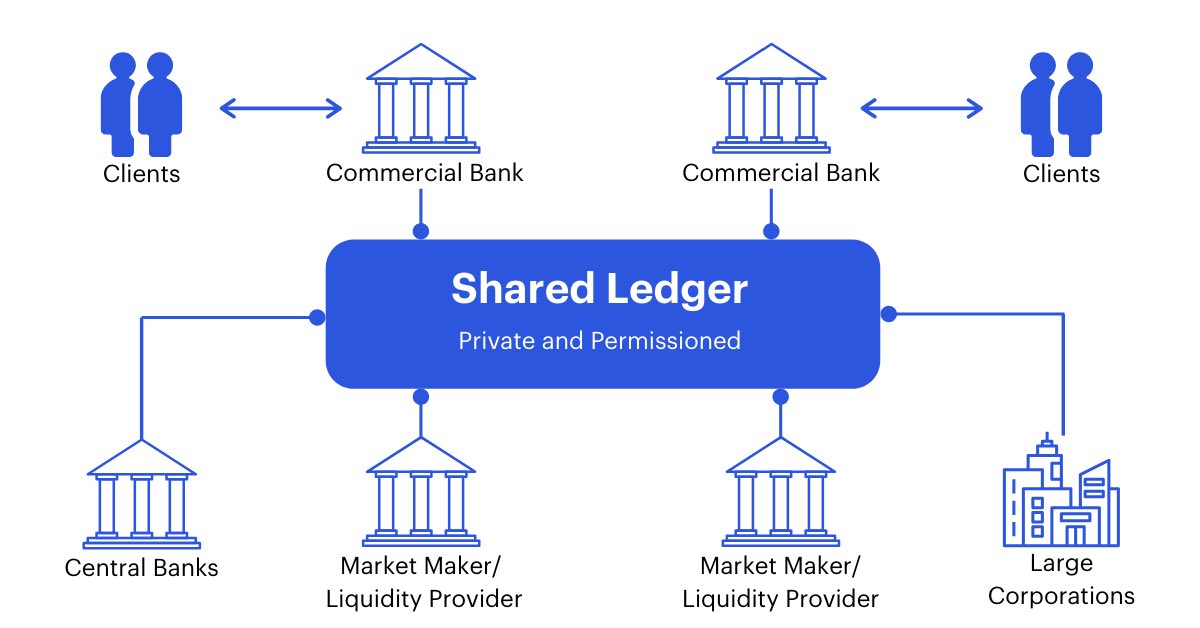

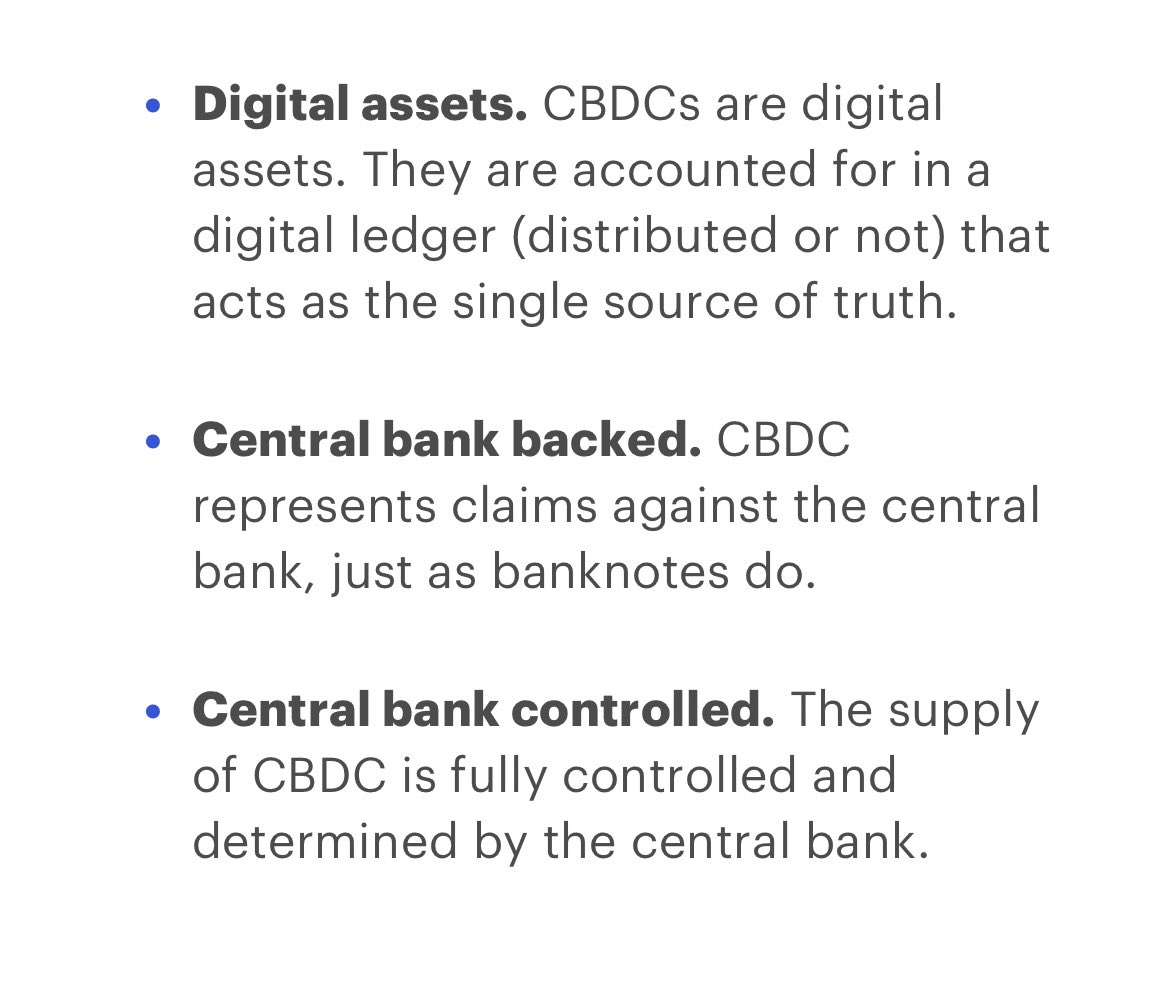

15. CBDC’s

Digital Bank currencies are something I think we will begin to see a lot more commonly.

These tokens could include built in mechanisms like an auto tax system, rewards & incentives, or even geographically implemented economic policy.

(China & USA are working on one)

Digital Bank currencies are something I think we will begin to see a lot more commonly.

These tokens could include built in mechanisms like an auto tax system, rewards & incentives, or even geographically implemented economic policy.

(China & USA are working on one)

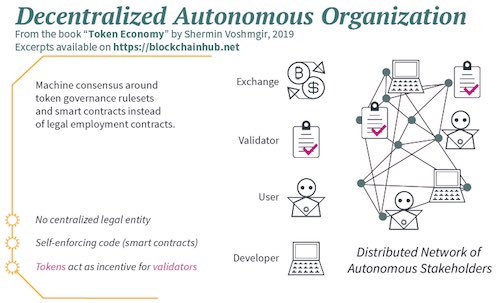

16. DAO’s

A decentralized autonomous organization is a group of individuals who have ownership over a given protocol

The individuals holding the most votes (represented in a token) governs the ultimate decisions of the group

Maker DAO is a popular example of this, worth $4.6B

A decentralized autonomous organization is a group of individuals who have ownership over a given protocol

The individuals holding the most votes (represented in a token) governs the ultimate decisions of the group

Maker DAO is a popular example of this, worth $4.6B

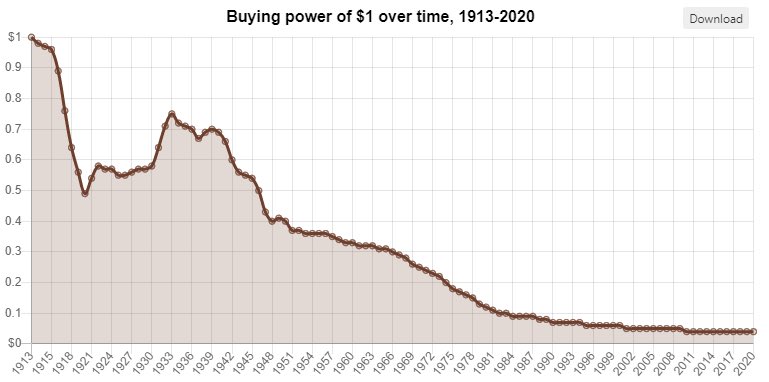

17. Inflation

With the rampant inflation of the USD in response to the coronavirus, people are looking for places to hedge

Right now you are quite literally losing money holding on to USD and not investing it

Silver + Gold, $BTC, and $ETH are the obvious hedges against this

With the rampant inflation of the USD in response to the coronavirus, people are looking for places to hedge

Right now you are quite literally losing money holding on to USD and not investing it

Silver + Gold, $BTC, and $ETH are the obvious hedges against this

18. ETF’s

Investors in the US are patiently awaiting the launch of $ETH and $BTC ETF’s, which would be game changing for the laymen’s access to crypto

Last week, the Ontario Securities Commission approved the launch of three ETFs offering investors direct exposure to $ETH

Investors in the US are patiently awaiting the launch of $ETH and $BTC ETF’s, which would be game changing for the laymen’s access to crypto

Last week, the Ontario Securities Commission approved the launch of three ETFs offering investors direct exposure to $ETH

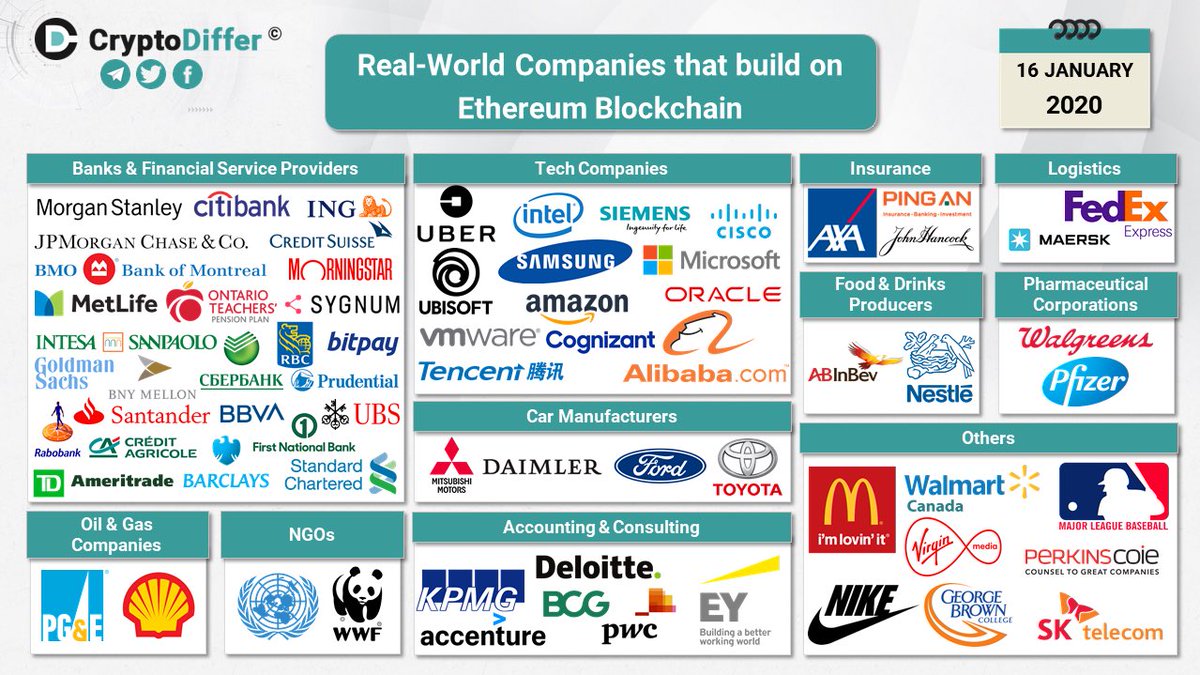

19. Adoption

Contrary to the last run of crypto in 2017, we didn’t have the real world use that blockchain is now seeing today.

IOT, DID, and DLT’s will be massive.

VISA, PayPal, & Amazon are just a few high value examples of some top companies taking an interest in $ETH tech

Contrary to the last run of crypto in 2017, we didn’t have the real world use that blockchain is now seeing today.

IOT, DID, and DLT’s will be massive.

VISA, PayPal, & Amazon are just a few high value examples of some top companies taking an interest in $ETH tech

20. Universal Market Access

No matter who or where you are, nothing is restricting you access to a global network of any market to choose from.

DeFi includes everything from insurance, prediction markets, to the stock market

This is something few understand the implications of

No matter who or where you are, nothing is restricting you access to a global network of any market to choose from.

DeFi includes everything from insurance, prediction markets, to the stock market

This is something few understand the implications of

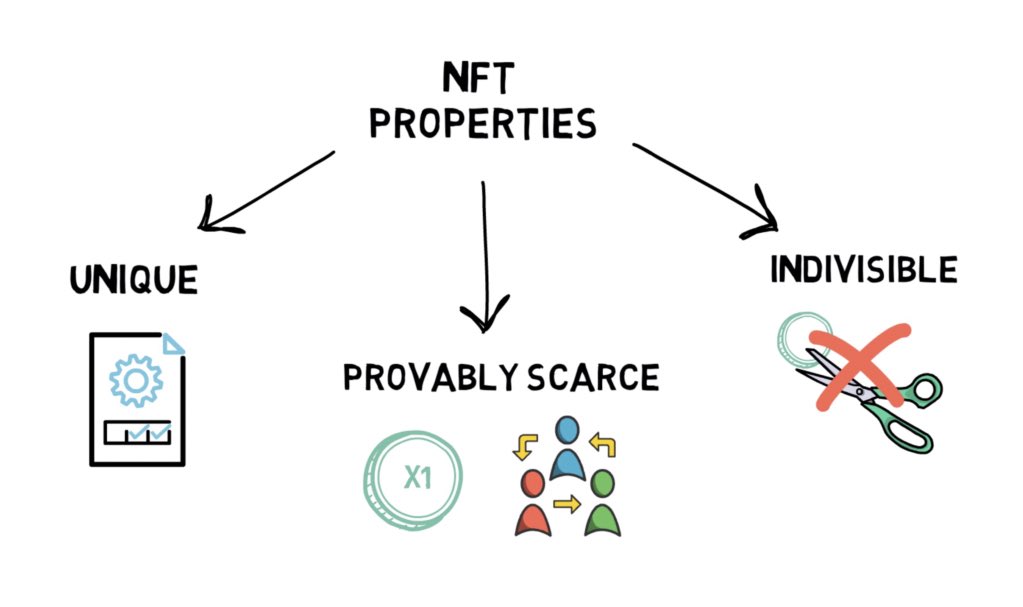

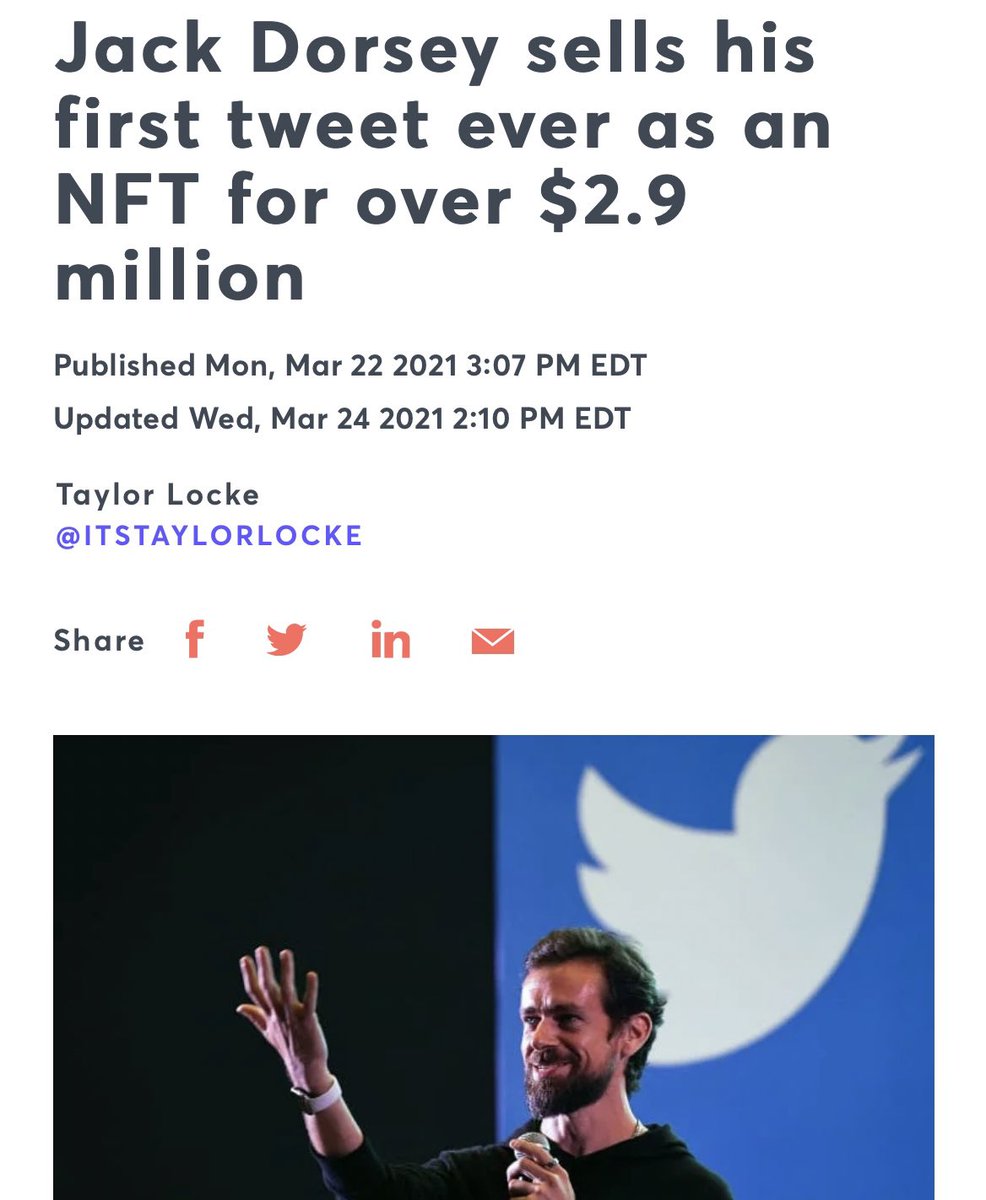

21. NFT’s

If we’ve learned anything from this cycle, it’s the fact that #NFT’s are here to stay.

NFT’s represent anything that can be stored digitally

Some of the worlds most influential individuals including Mark Cuban, Elon Musk, & Jack Dorsey have explored their use cases

If we’ve learned anything from this cycle, it’s the fact that #NFT’s are here to stay.

NFT’s represent anything that can be stored digitally

Some of the worlds most influential individuals including Mark Cuban, Elon Musk, & Jack Dorsey have explored their use cases

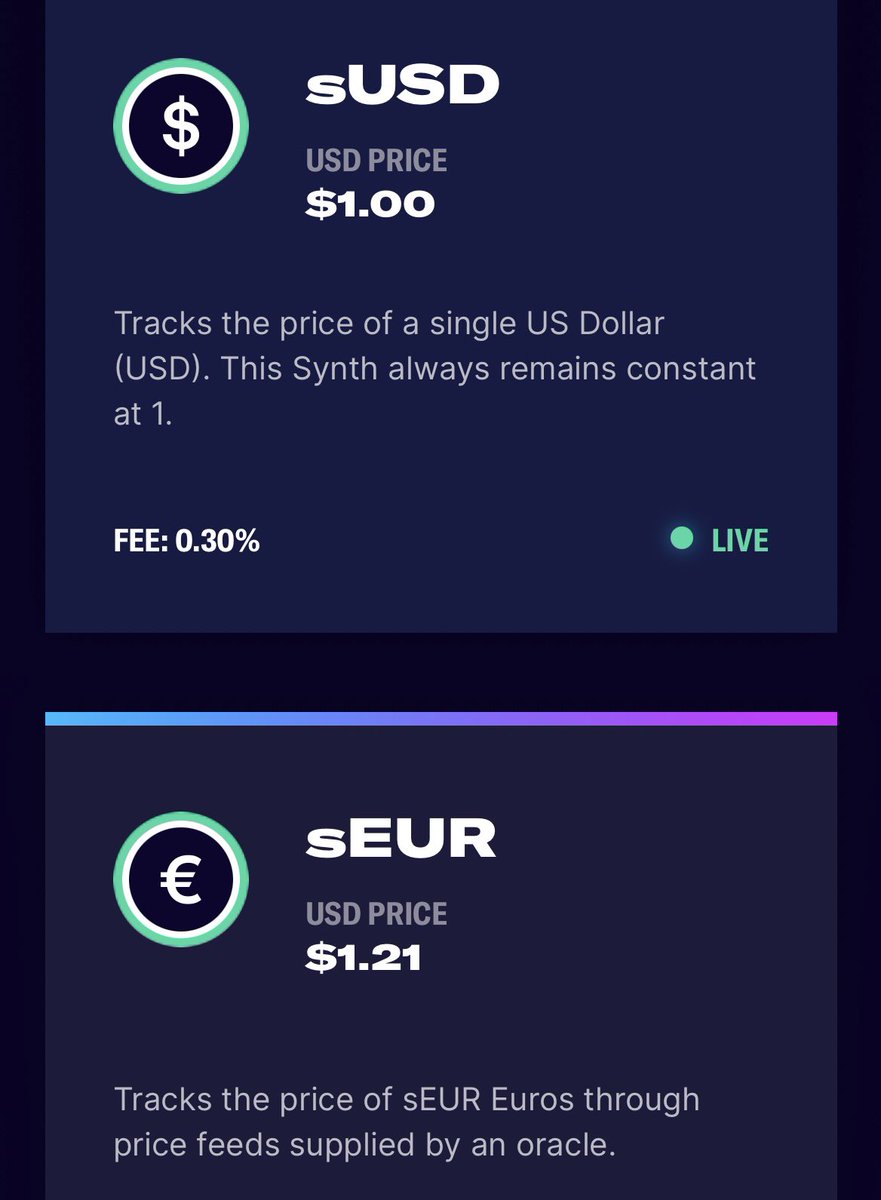

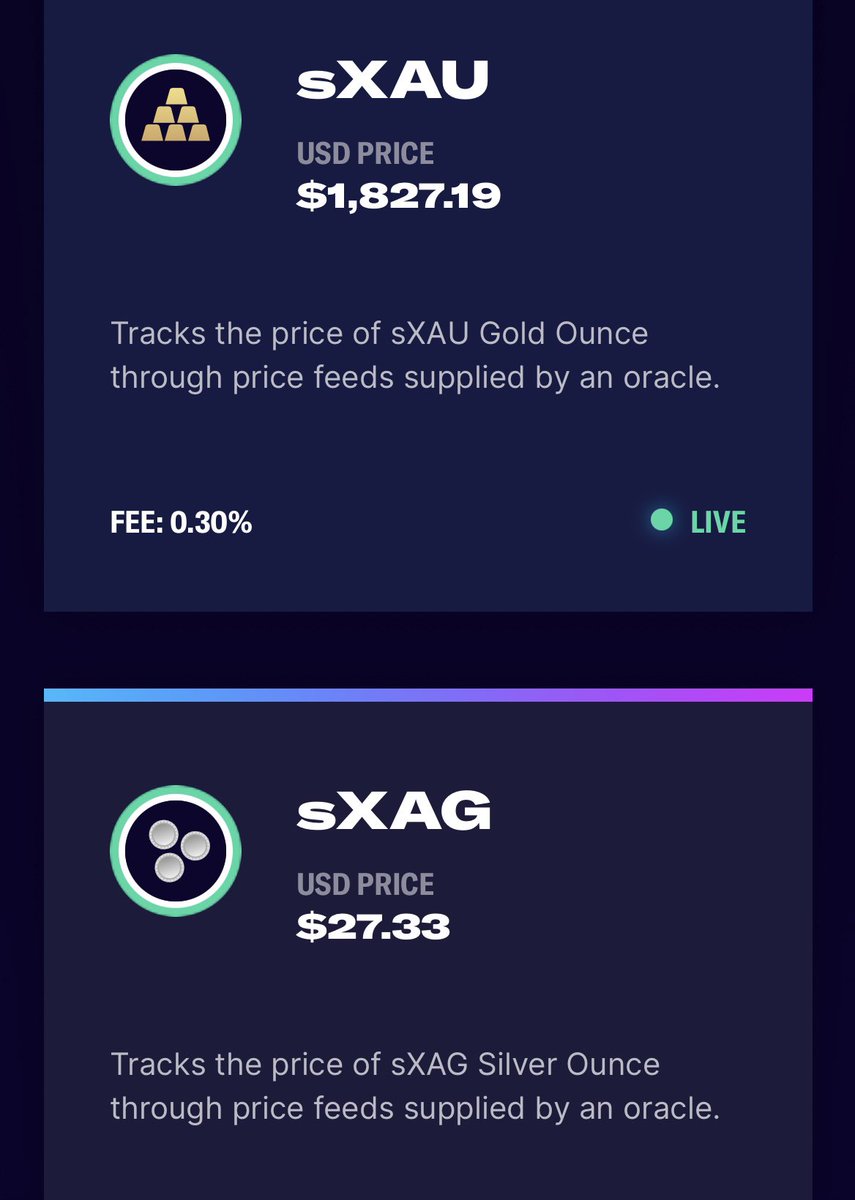

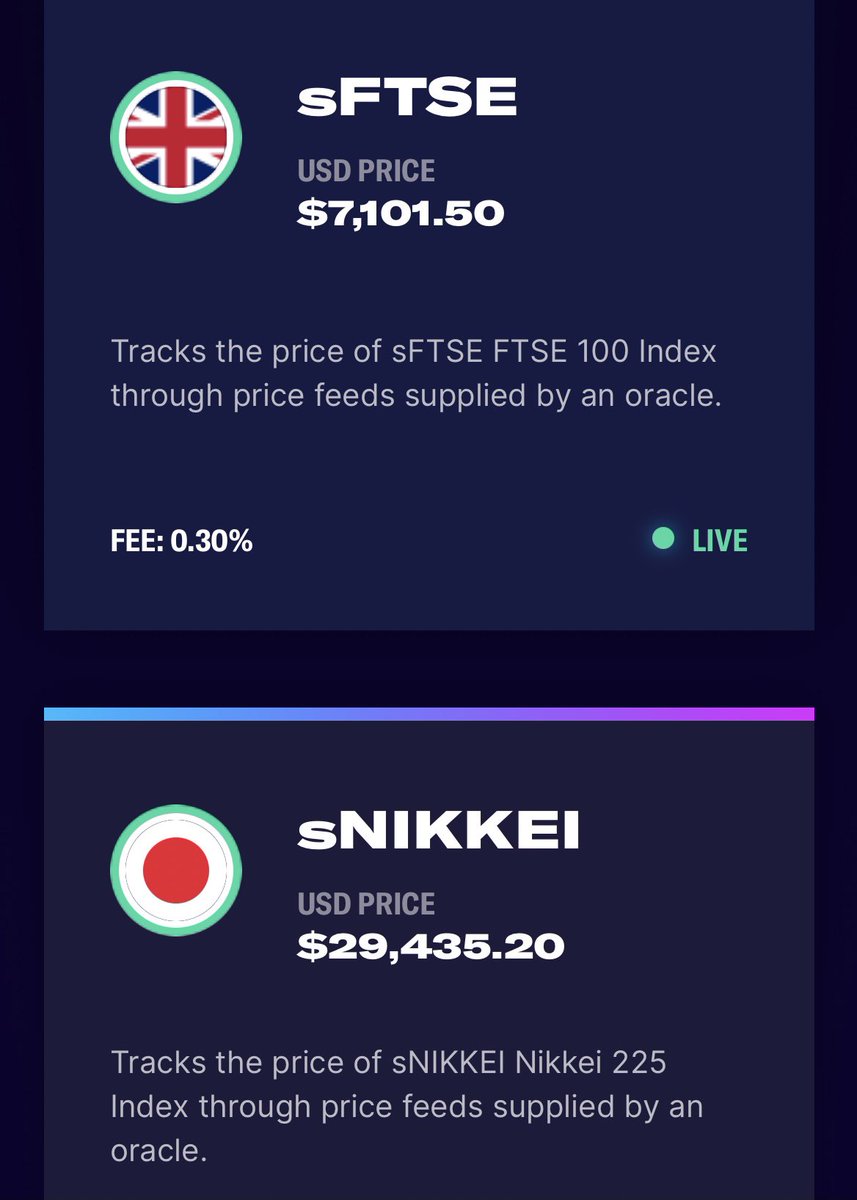

22. Synthetics

Utilizing oracles which relay off chain data to $ETH, people can trade “synthetics” that are pegged to the price of real world assets

This can consist of many markets including:

Precious Metals - $20T

Stock Market - $100T

Forex - $1.9Q (yes, Q)

& much more!

Utilizing oracles which relay off chain data to $ETH, people can trade “synthetics” that are pegged to the price of real world assets

This can consist of many markets including:

Precious Metals - $20T

Stock Market - $100T

Forex - $1.9Q (yes, Q)

& much more!

23. Tokenization

We are entering the true “digital age” with cashless tech, and soon businesses may begin using $ETH to issue digital assets

This is already becoming more present with things like Venmo, PayPal, & Apple Pay

After all, tokenization can fit many business models

We are entering the true “digital age” with cashless tech, and soon businesses may begin using $ETH to issue digital assets

This is already becoming more present with things like Venmo, PayPal, & Apple Pay

After all, tokenization can fit many business models

24. Supercomputer

I like to think of $ETH as the world supercomputer. Vitalik took ideals from $BTC, & added a programmable base layer for devs to build on top of

This continues to add a whole new level of functionality to blockchain as we know it today...

I like to think of $ETH as the world supercomputer. Vitalik took ideals from $BTC, & added a programmable base layer for devs to build on top of

This continues to add a whole new level of functionality to blockchain as we know it today...

• • •

Missing some Tweet in this thread? You can try to

force a refresh