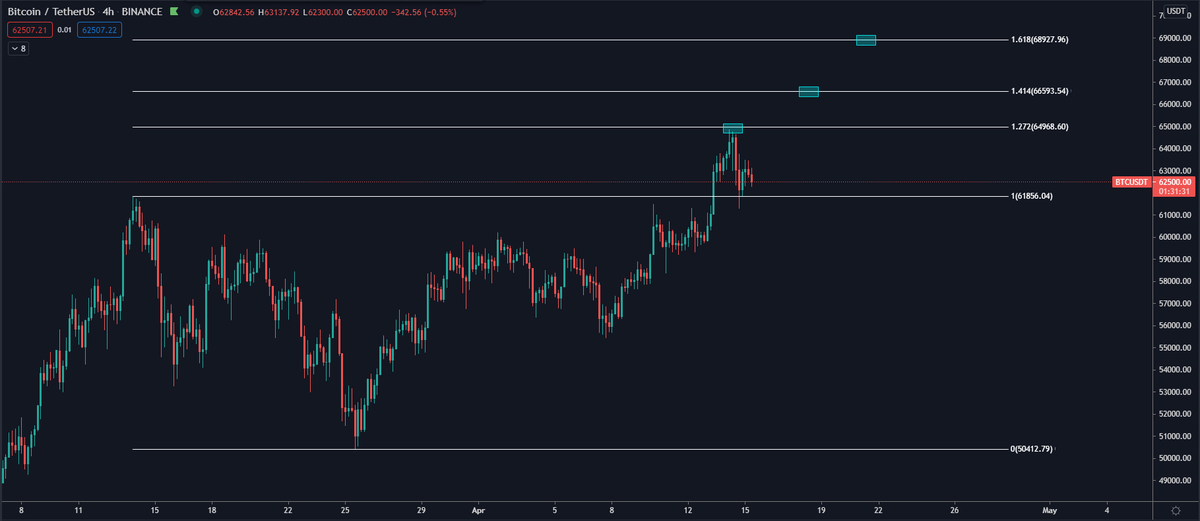

I feel like $BTC will trade at $70K+ in May.

Don't ask me for my exact reasoning. It's a bit of a mix between seeing the PA, some indicators and a gut feeling.

Don't ask me for my exact reasoning. It's a bit of a mix between seeing the PA, some indicators and a gut feeling.

Of course it should be obvious this is no signal to all in long or go out of your regular trading risk management.

Just a though by me I wanted to share.

Just a though by me I wanted to share.

For everyone asking about how this would affect $alts:

$BTC and alts can move together but if BTC starts pumping out some big numbers each day, expect alts to go more risk-off and more money to flow into BTC.

ALT/BTC pairs may suffer a bit but USDT pairs should still be good.

$BTC and alts can move together but if BTC starts pumping out some big numbers each day, expect alts to go more risk-off and more money to flow into BTC.

ALT/BTC pairs may suffer a bit but USDT pairs should still be good.

Until $BTC breaks out of this massive range I'm not selling any $alts.

Just play them until they don't work anymore. Bit of a waste to sell them just on an assumption of what may happen while they are so strong vs BTC right now.

I'm mostly in alts myself still.

Just play them until they don't work anymore. Bit of a waste to sell them just on an assumption of what may happen while they are so strong vs BTC right now.

I'm mostly in alts myself still.

• • •

Missing some Tweet in this thread? You can try to

force a refresh