Read through Ark Invest's Big Ideas 2021 report.

Here's a tweet and chart for each of the 15 ideas 🧵

Here's a tweet and chart for each of the 15 ideas 🧵

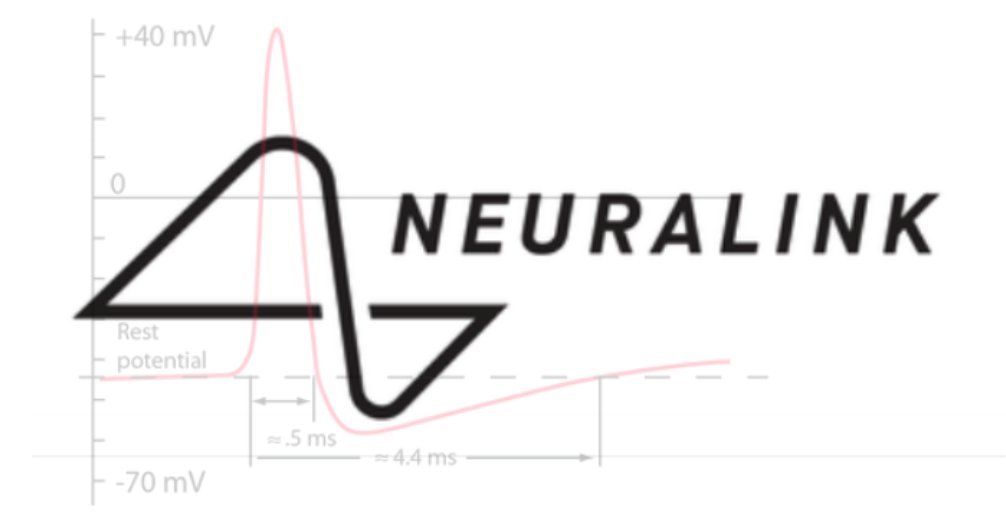

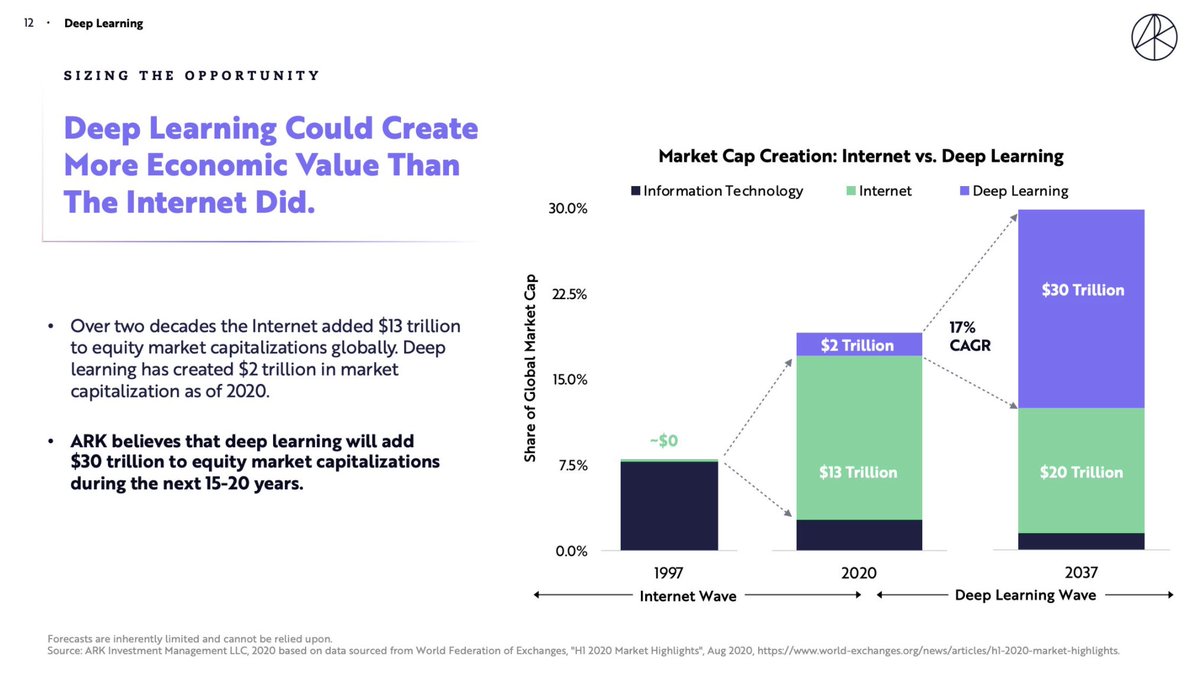

1/ Deep learning to create $30T of market value by 2037

• Automated code writing

• AI that "understands" language (GPT-3)

• Big Tech spends billions on AI chips, everyone benefits

• Automated code writing

• AI that "understands" language (GPT-3)

• Big Tech spends billions on AI chips, everyone benefits

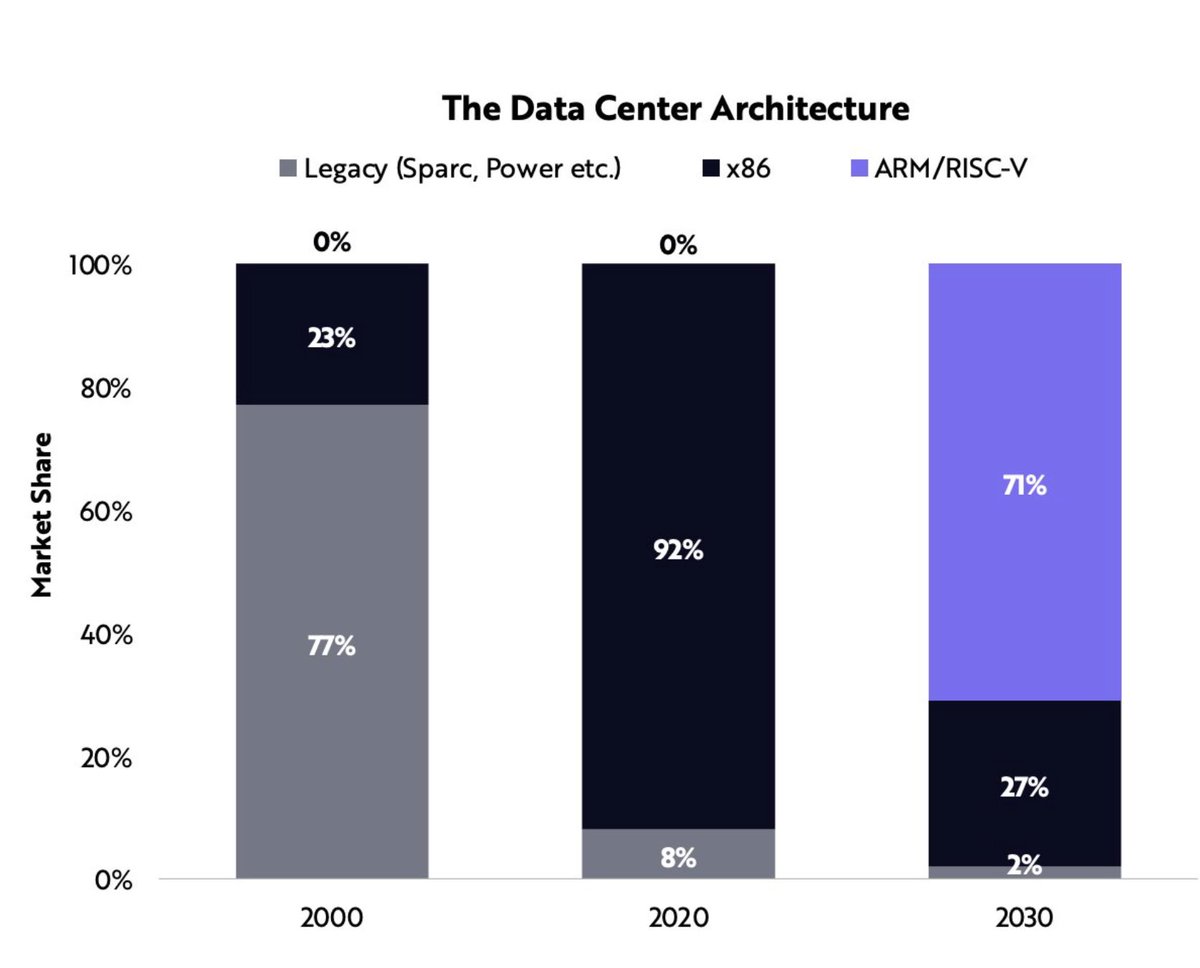

2/ Data centres will be totally transformed

• Intel (which powers 90% of data centres) has fallen behind

• Next-gen data centres/PCs will run on ARM standard

• GPUs (workhorse for AI) hits run rate of $41B in 2030

• Intel (which powers 90% of data centres) has fallen behind

• Next-gen data centres/PCs will run on ARM standard

• GPUs (workhorse for AI) hits run rate of $41B in 2030

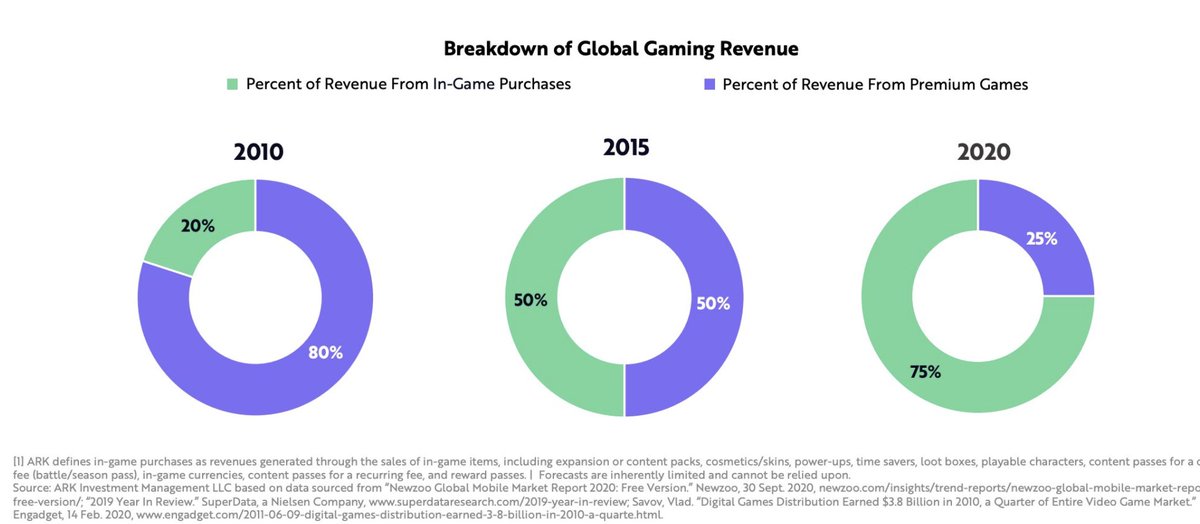

3/ Virtual world revenue hits $390B by 2025 (>2x today)

• Video game monetization shifting to in-app purchases

• Games are 3rd places (people spend 90m a day gaming in 2025)

• AR market (Snap, FB, Apple) set to explode

• Cost of VR (visual immersion) plummeting

• Video game monetization shifting to in-app purchases

• Games are 3rd places (people spend 90m a day gaming in 2025)

• AR market (Snap, FB, Apple) set to explode

• Cost of VR (visual immersion) plummeting

4/ Digital wallets are a $4.6T opportunity

• In US, digital wallets surpassing bank account holders

• Digital wallet CAC lower than banks

• Fully featured digital wallet (ecomm, payments, insurance, credit, brokerage) worth $20k/user

• 230m Americans x $20k/user = $4.6T

• In US, digital wallets surpassing bank account holders

• Digital wallet CAC lower than banks

• Fully featured digital wallet (ecomm, payments, insurance, credit, brokerage) worth $20k/user

• 230m Americans x $20k/user = $4.6T

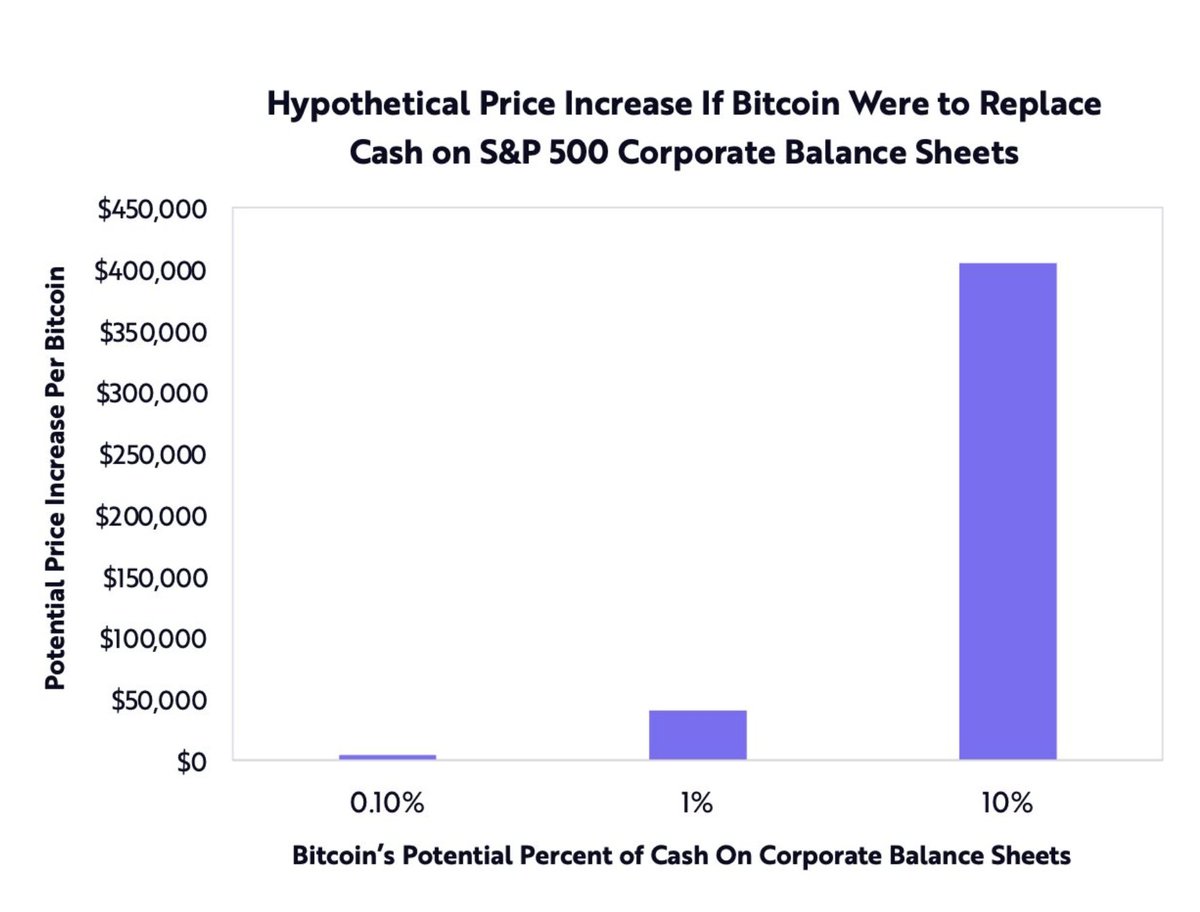

5/ Bitcoin increases by +$40k if S&P 500 companies put 1% of their balance sheet cash to BTC

• Square, Tesla and Microstrategy set the precedent

• If S&P 500 companies make 10% of balance sheet cash, BTC rises by +$400k

• Square, Tesla and Microstrategy set the precedent

• If S&P 500 companies make 10% of balance sheet cash, BTC rises by +$400k

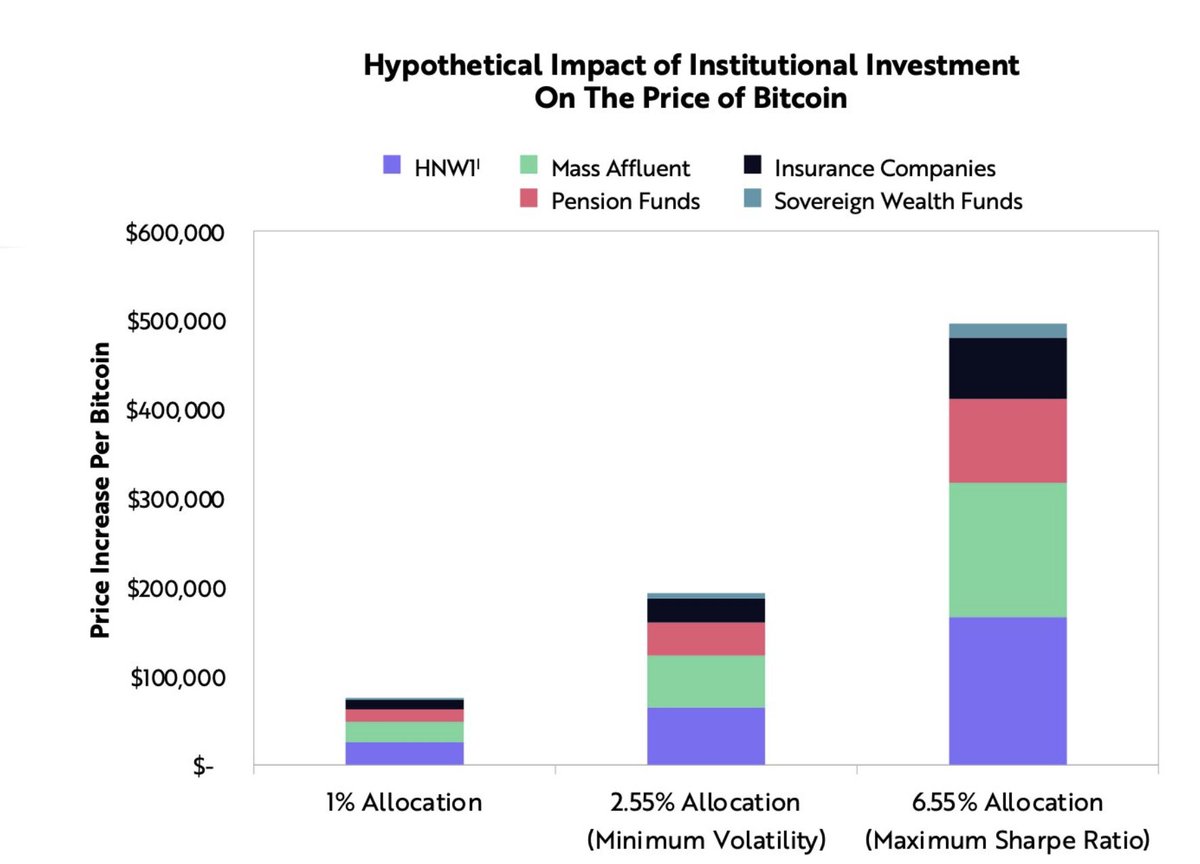

6/ Mainstreaming of BTC makes it worth up to $5T

• BTC trading volume approaching large cap stocks

• Institutions have options to access BTC (e.g., CME futures)

• If institutional money (HNW, Pensions, SWF, Insurance) allocate 2.5%-6.5% to BTC, its price could rise $200k-500k

• BTC trading volume approaching large cap stocks

• Institutions have options to access BTC (e.g., CME futures)

• If institutional money (HNW, Pensions, SWF, Insurance) allocate 2.5%-6.5% to BTC, its price could rise $200k-500k

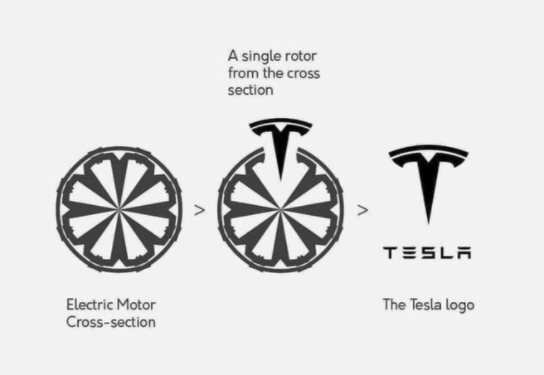

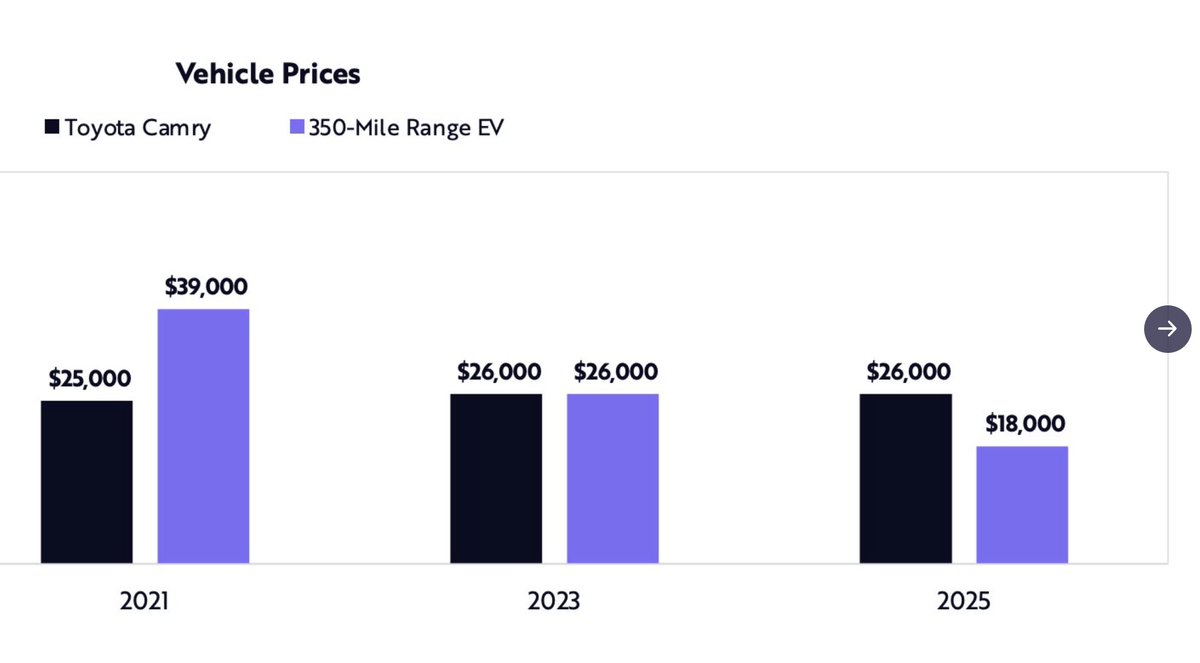

7/ EV sales will explode 20x: 2m (today) to 40m (2025)

• Total like-for-like EV ownership fell below Toyota Camry in 2019 (the sticker price will do same by 2025)

• "cell-to-vehicle" battery designs will increase volume density by 50% and further drop costs

• Total like-for-like EV ownership fell below Toyota Camry in 2019 (the sticker price will do same by 2025)

• "cell-to-vehicle" battery designs will increase volume density by 50% and further drop costs

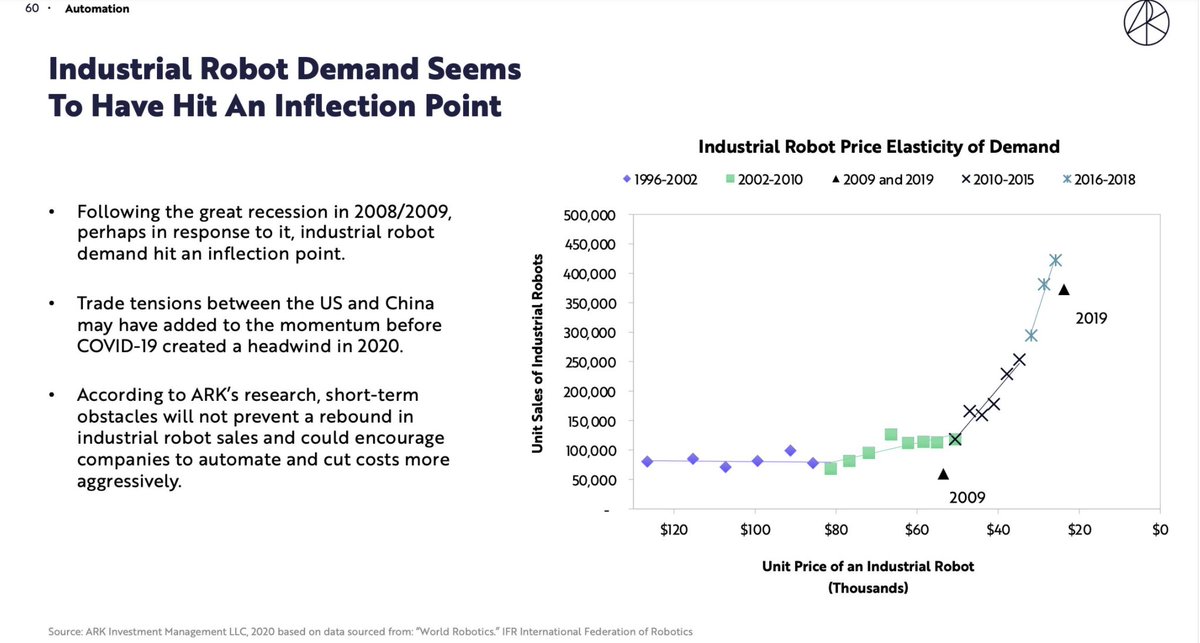

8/ Automation adds 5% (~$1.2T) to US GDP in next 5yrs

• Rate of automation in next 5yrs = past 25yrs

• Industrial robot demands has hit an inflection point (willing to pay upfront cost for automation)

• More automation = higher productivity = higher wages = lower prices

• Rate of automation in next 5yrs = past 25yrs

• Industrial robot demands has hit an inflection point (willing to pay upfront cost for automation)

• More automation = higher productivity = higher wages = lower prices

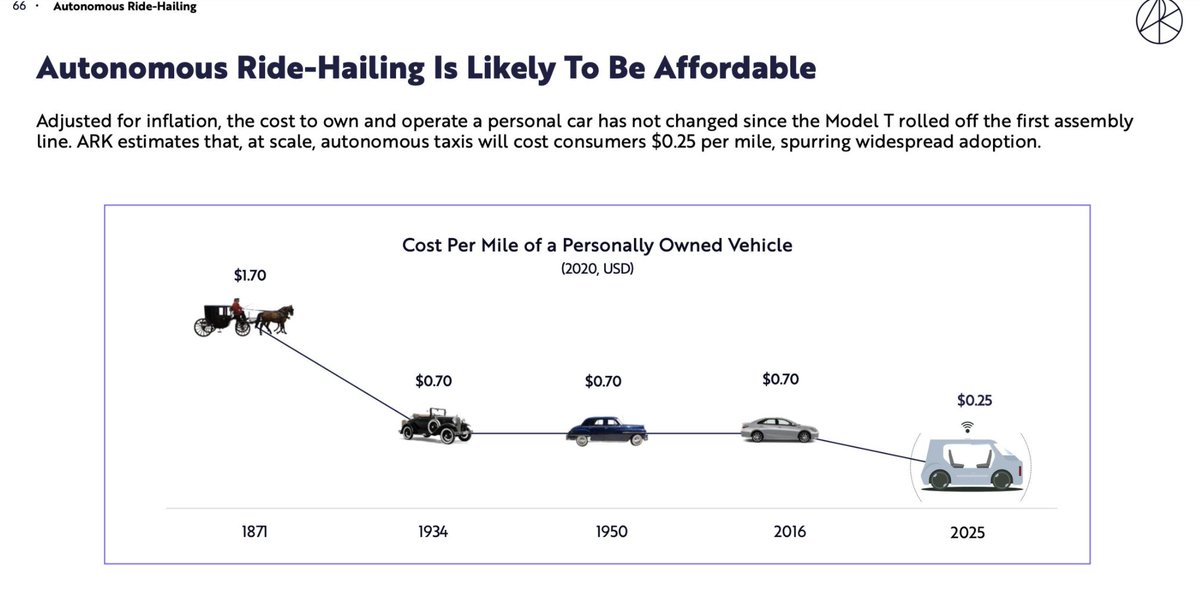

9/ Autonomous ride-hailing profits $1T per year by 2030

• Ride hailing already $150B industry

• Improvements in AV make economics of robotaxis work

• Cost per mile of personally owned vehicle plummeting ($1.70 on a horse, 1871 vs. $0.25 for AV, 2025)

• Ride hailing already $150B industry

• Improvements in AV make economics of robotaxis work

• Cost per mile of personally owned vehicle plummeting ($1.70 on a horse, 1871 vs. $0.25 for AV, 2025)

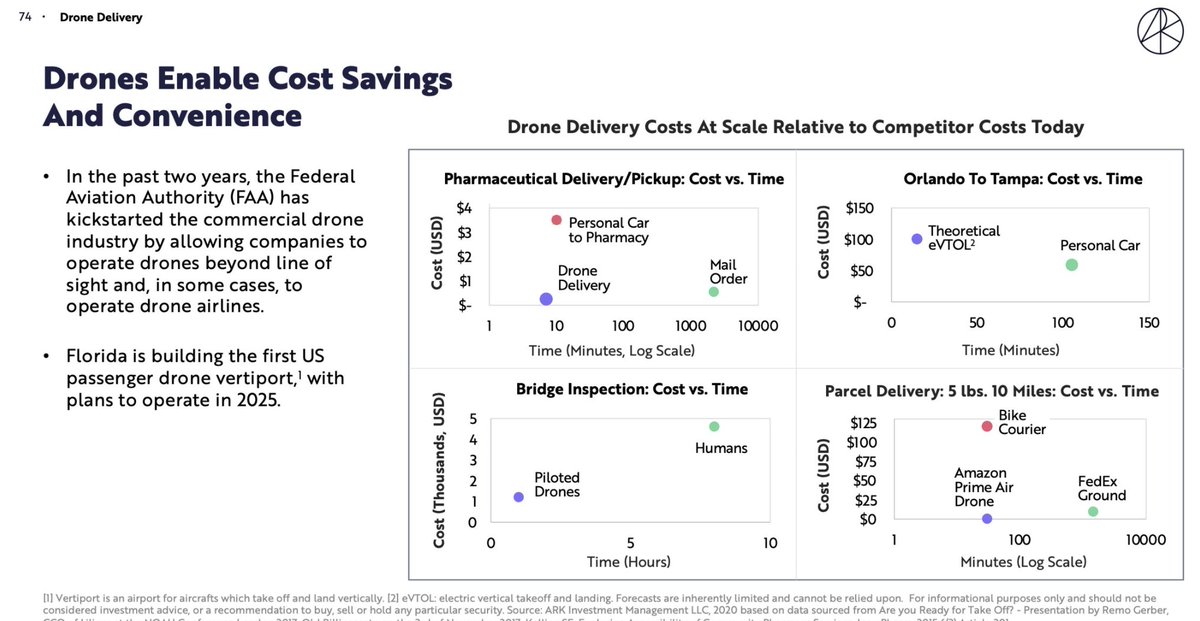

10/ Drone drastically reduce transportation costs

• Revenue by 2030: $275B (delivery), $50B (hardware sales), $12B (mapping)

• With improvements in AI and batteries, drones to be cheaper than cars, trucks, bike courier

• Revenue by 2030: $275B (delivery), $50B (hardware sales), $12B (mapping)

• With improvements in AI and batteries, drones to be cheaper than cars, trucks, bike courier

11/ Orbital space hit $370B annually

• Global connectivity via satellites (provide internet for other 50% of population)

• Hypersonic point-to-point travel (turn 10hr+ flights into 2-3hr flights)

• Re-usable rocket prices dropping (= more satellites)

• Global connectivity via satellites (provide internet for other 50% of population)

• Hypersonic point-to-point travel (turn 10hr+ flights into 2-3hr flights)

• Re-usable rocket prices dropping (= more satellites)

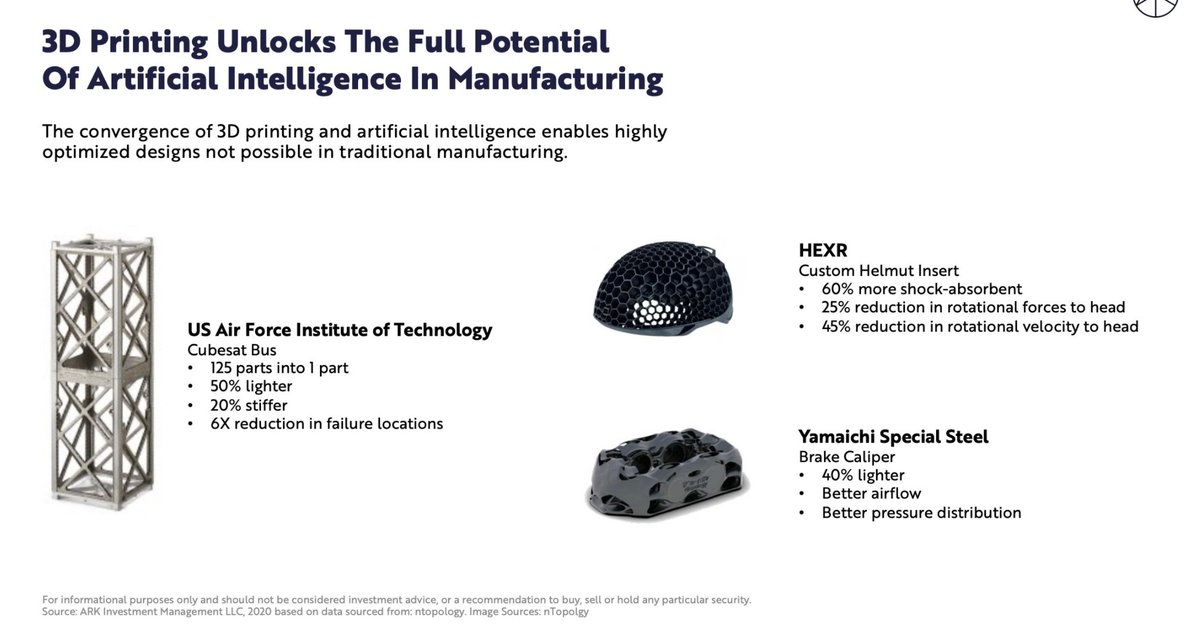

12/ 3D printing worth $120B by 2025

• Collapses time from design to production

• Shifts power to designers

• Reduces supply chain complexity

• Penetration levels: 50% in prototypes (market potential = $12.5B), 4% in molds/tools ($30B), 1% in end-use parts ($490B)

• Collapses time from design to production

• Shifts power to designers

• Reduces supply chain complexity

• Penetration levels: 50% in prototypes (market potential = $12.5B), 4% in molds/tools ($30B), 1% in end-use parts ($490B)

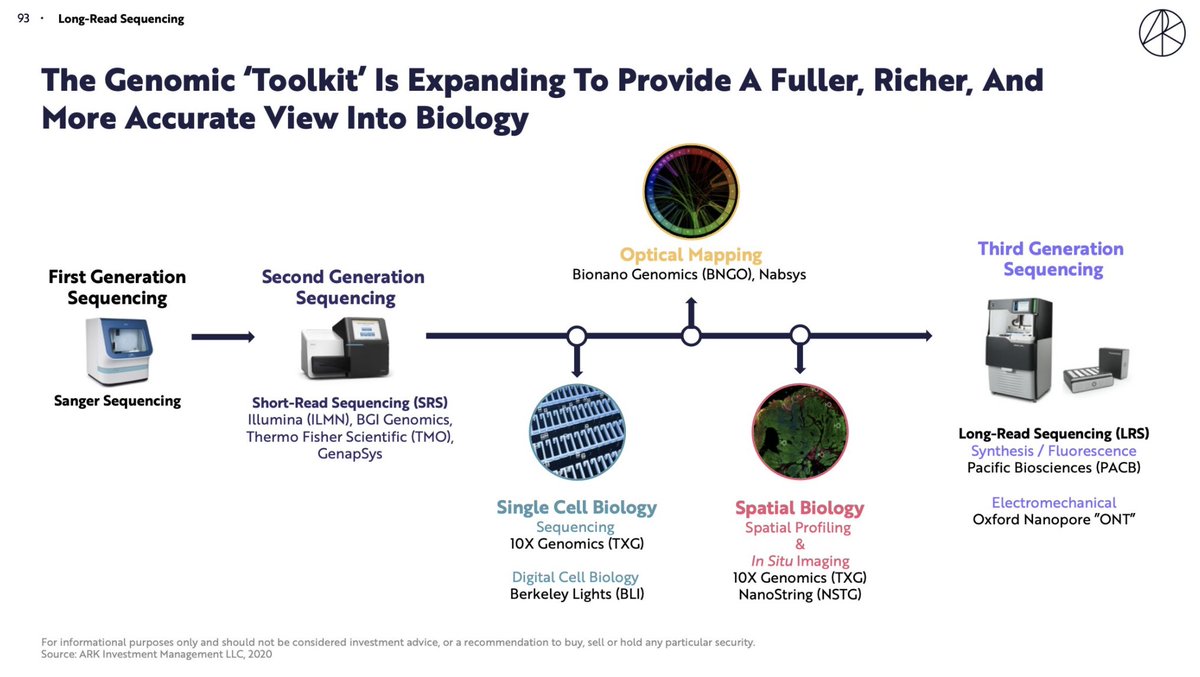

13/ Next-gen DNA sequencing worth $25B in 2025

• Shift from short-read (SRS) to long-read DNA sequencing (LRS) powers genomics revolution

• Bigger toolkit gives richer view into biology

• Used to be trade-off between accuracy (SRS) to comprehensiveness (LRS). No more tradeoff

• Shift from short-read (SRS) to long-read DNA sequencing (LRS) powers genomics revolution

• Bigger toolkit gives richer view into biology

• Used to be trade-off between accuracy (SRS) to comprehensiveness (LRS). No more tradeoff

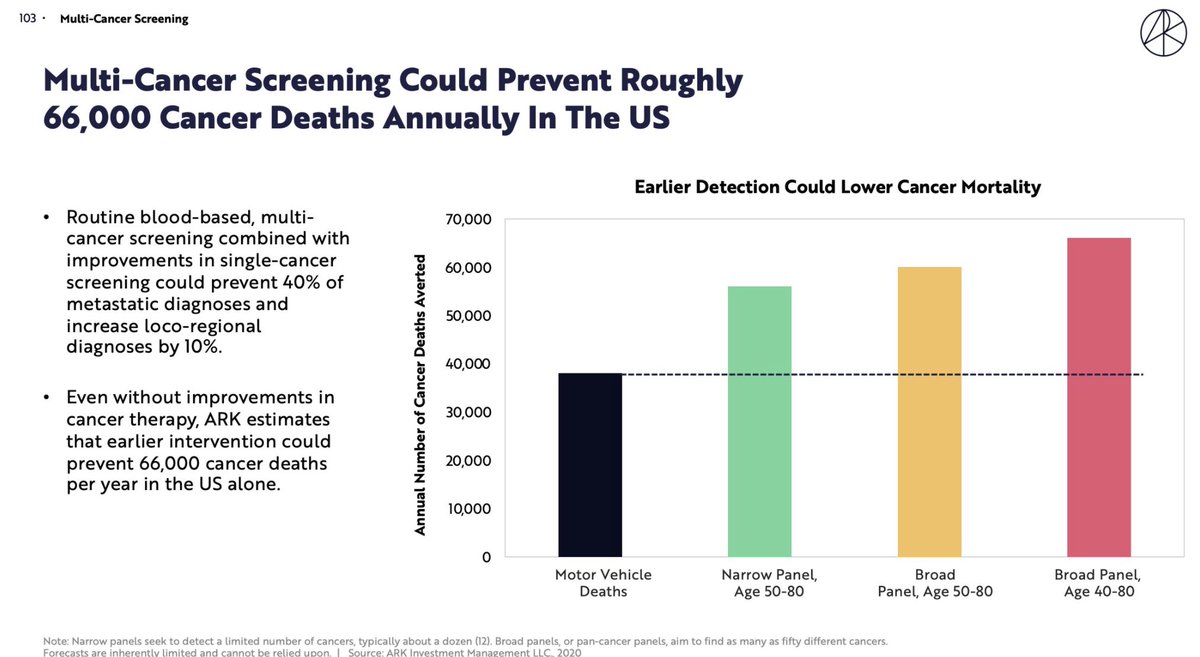

14/ Liquid Biopsies to avert 66k cancer deaths per year

• ML-power DNA sequencing will allow liquid biopsies that can find cancer early (before solid tumor stage)

• Multi-cancer screening prices dropping

• Could prevent 66k deaths a year = 1.4m human life years

• ML-power DNA sequencing will allow liquid biopsies that can find cancer early (before solid tumor stage)

• Multi-cancer screening prices dropping

• Could prevent 66k deaths a year = 1.4m human life years

15/ TAM for oncology gene therapy rise 20x to $250B+

• This slide made no sense to me but here it is: "ARK Estimates That Allogeneic. Cells And Cellular Immunotherapies Could Create $250 Billion In Incremental Revenues."

• This slide made no sense to me but here it is: "ARK Estimates That Allogeneic. Cells And Cellular Immunotherapies Could Create $250 Billion In Incremental Revenues."

16/ Follow @TrungTPhan for other hot business takes (and really dumb memes).

Original Ark Doc: research.ark-invest.com/hubfs/1_Downlo…

Original Ark Doc: research.ark-invest.com/hubfs/1_Downlo…

• • •

Missing some Tweet in this thread? You can try to

force a refresh