Affirm Holdings [$AFRM] Mar 21 Earnings Highlights:

I just finished reviewing the report and the call.

Thread Outline⬇️

i) 10 key takeaways from the report;

ii) What trends are happening across the Fintech & BNPL Industry;

iii) And Key observations from Shopify & Peloton.

🧵

I just finished reviewing the report and the call.

Thread Outline⬇️

i) 10 key takeaways from the report;

ii) What trends are happening across the Fintech & BNPL Industry;

iii) And Key observations from Shopify & Peloton.

🧵

1/ $AFRM Top-line highlights - Revenue:

Jun 20 - 120% YoY Growth

Sep 20 - 98% YoY "

Dec 20 - 57% YoY "

Mar 21 - 67% YoY "

*8 sequential QoQ growth

Yes, growth slowed down but it was primarily due to the Covid shutdown. But now, it is accelerating as the economy is reopening.

Jun 20 - 120% YoY Growth

Sep 20 - 98% YoY "

Dec 20 - 57% YoY "

Mar 21 - 67% YoY "

*8 sequential QoQ growth

Yes, growth slowed down but it was primarily due to the Covid shutdown. But now, it is accelerating as the economy is reopening.

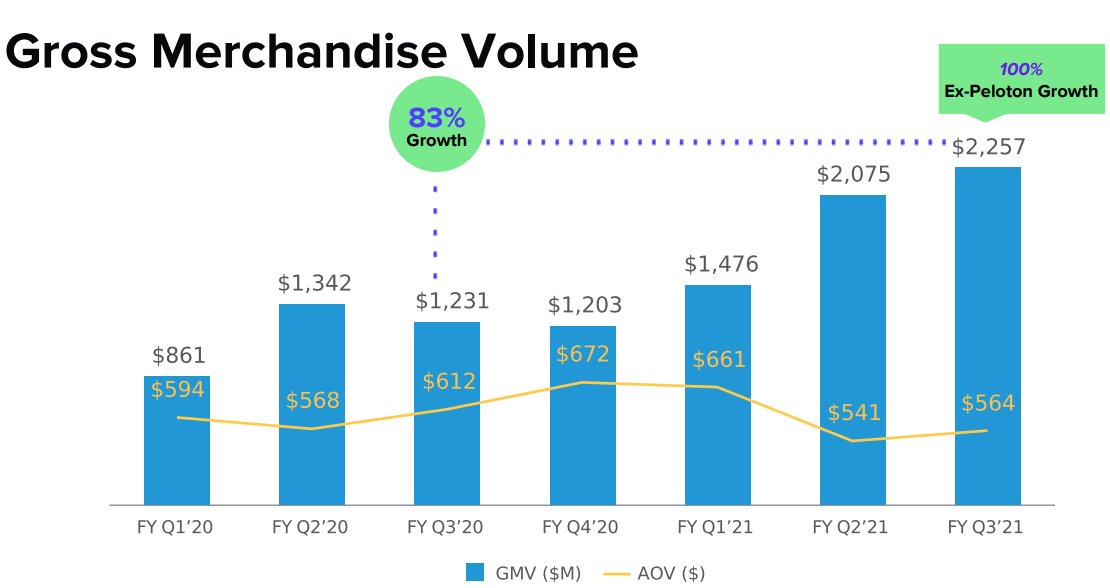

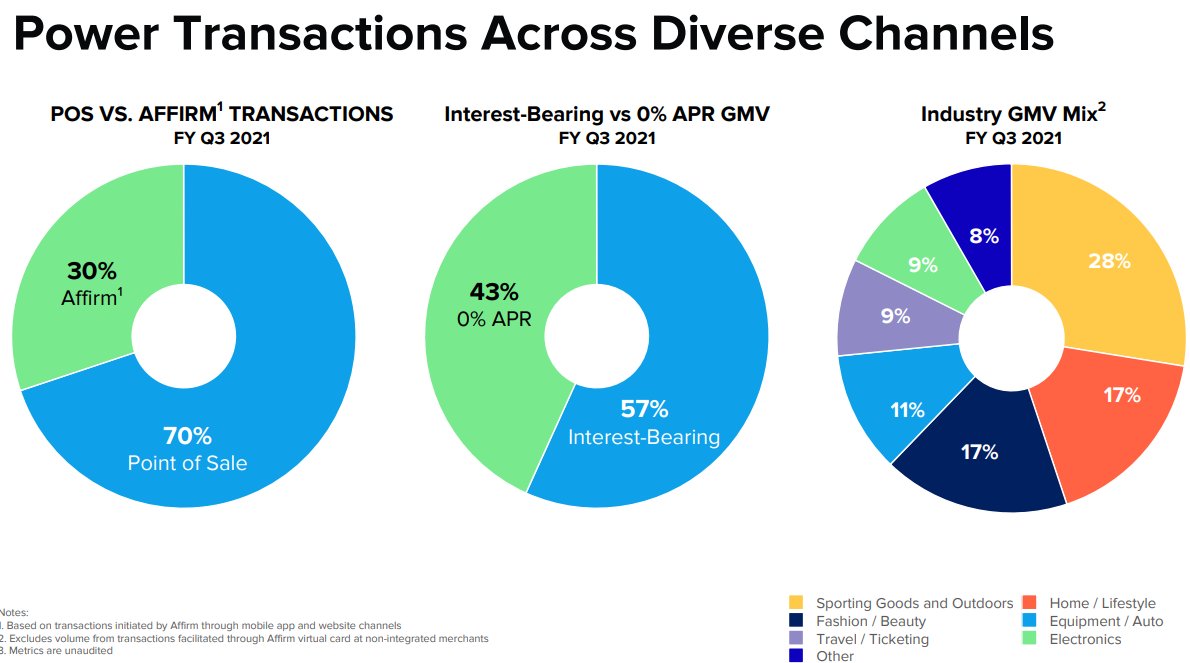

2/ $AFRM Gross Merchandise Volume (GMV)

• GMV is growing 83% YoY though AoV slowed down

+ Increases in network revenue

• Travelling is growing triple digits (already in Feb!)

• Everyone talks about $PTON, but if you remove $PTON, the business is accelerating over 100% YoY.

• GMV is growing 83% YoY though AoV slowed down

+ Increases in network revenue

• Travelling is growing triple digits (already in Feb!)

• Everyone talks about $PTON, but if you remove $PTON, the business is accelerating over 100% YoY.

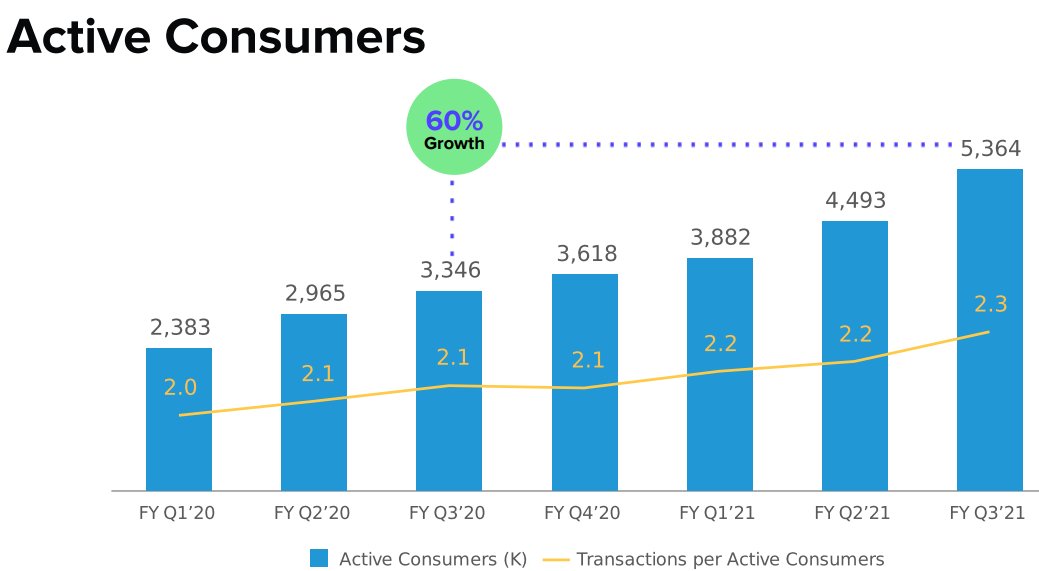

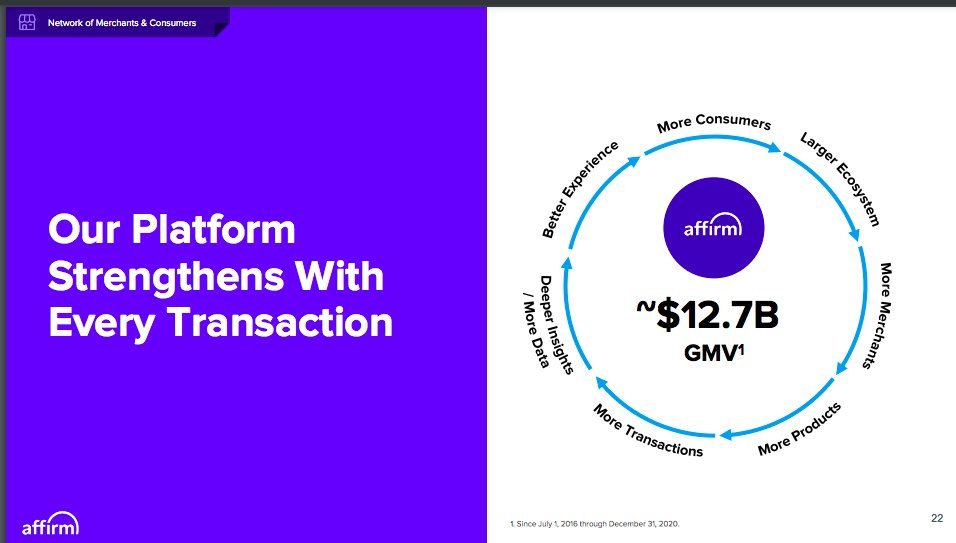

3/ $AFRM GMV is driven by these:

• 60% YoY in active consumers adopting BNPL (growth QoQ)

• Transactions per active consumer was 2.3 as of Mar, 2021, up 10%

• Merchants growth grew >90% (12.5K today)

• Ticketing grew 50% YoY

Great network effect btw merchants x consumers!

• 60% YoY in active consumers adopting BNPL (growth QoQ)

• Transactions per active consumer was 2.3 as of Mar, 2021, up 10%

• Merchants growth grew >90% (12.5K today)

• Ticketing grew 50% YoY

Great network effect btw merchants x consumers!

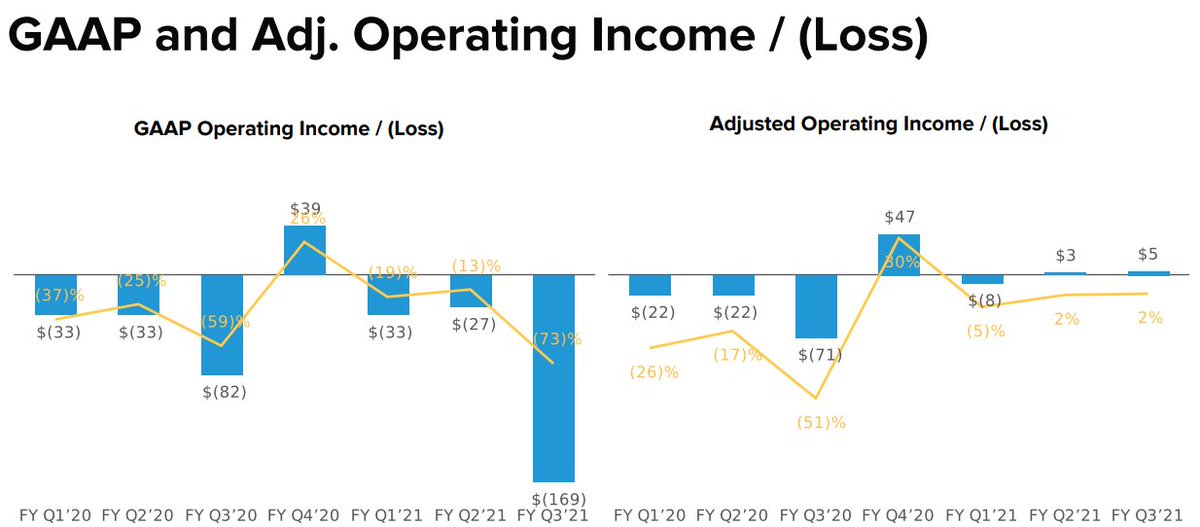

4/ $AFRM Bottom-line highlights:

• Net loss for fiscal 2021 was $247M (getting too big, but this is growth stage)

• Operating loss: $169M

• On a QoQ, Adjusted operating income for the quarter was $4.9M which actually improved

+ Transaction Costs as a % of GMV was 4.3%

• Net loss for fiscal 2021 was $247M (getting too big, but this is growth stage)

• Operating loss: $169M

• On a QoQ, Adjusted operating income for the quarter was $4.9M which actually improved

+ Transaction Costs as a % of GMV was 4.3%

5/ $AFRM x $SHOP

- $AFRM's partnership allowed them to bring more Shopify merchants on $AFRM’s platform to more than 10,000K (10k growth)

- Almost all $SHOP Merchants will have $AFRM Shop Pay Installed.

Gradually, I personally see $SHOP driving $AFRM to new heights! This is big

- $AFRM's partnership allowed them to bring more Shopify merchants on $AFRM’s platform to more than 10,000K (10k growth)

- Almost all $SHOP Merchants will have $AFRM Shop Pay Installed.

Gradually, I personally see $SHOP driving $AFRM to new heights! This is big

6/ On Peloton:

The impact is much smaller than feared.

They expect revenue loss of $3.5M in relation to the financial impact of $PTON's recall of Tread+ & Tread products.

As mentioned, $PTON's Rev impact is getting smaller, but $PTON's business is doing well & it still helps

The impact is much smaller than feared.

They expect revenue loss of $3.5M in relation to the financial impact of $PTON's recall of Tread+ & Tread products.

As mentioned, $PTON's Rev impact is getting smaller, but $PTON's business is doing well & it still helps

7/ $AFRM acquired Returnly: a leader in online return experiences & post-purchase payments that serves 1,800 merchants and used by over 8-million shoppers.

This is a great acquisition bc'os if you buy expensive products, if you want to return it, you can now easily use $AFRM.

This is a great acquisition bc'os if you buy expensive products, if you want to return it, you can now easily use $AFRM.

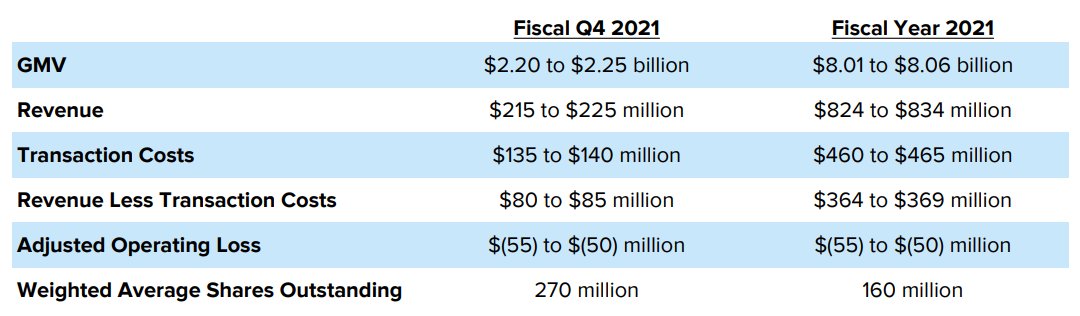

8/ Outlook & Guidance:

- $AFRM raised guidance by a slightly big mile. They have incorporated impact of $PTON.

- Next Qtr: $225M - 63% YoY

- They expect to beat the guide since Economic reopening is getting stronger - More marriages & demand for expensive items are expected.

- $AFRM raised guidance by a slightly big mile. They have incorporated impact of $PTON.

- Next Qtr: $225M - 63% YoY

- They expect to beat the guide since Economic reopening is getting stronger - More marriages & demand for expensive items are expected.

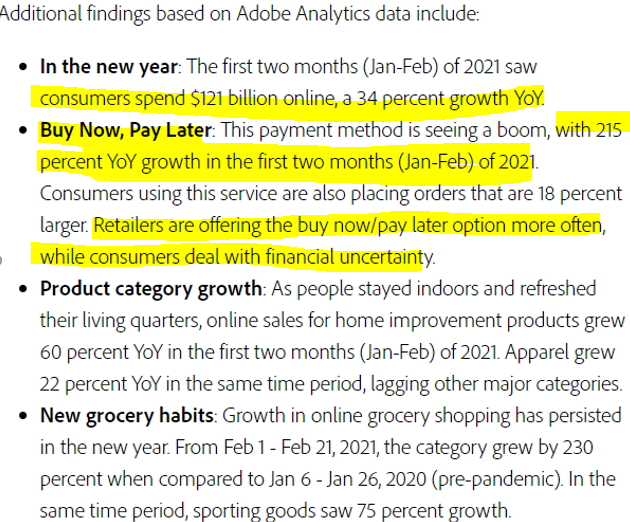

9/ As it relates to BNPL & FinTech trends according to Adobe Industry Trends.

- The first couple months of 2021 has seen over 215% growth in adoption of BNPL Solutions. $PYPL also showed this too

- There are major trends also happening across e-Commerce providers.

More below⬇️

- The first couple months of 2021 has seen over 215% growth in adoption of BNPL Solutions. $PYPL also showed this too

- There are major trends also happening across e-Commerce providers.

More below⬇️

10/ Finally, my thesis on affirm is intact.

$AFRM is unique because of the flexibility they provide for high/ low transactions that consumers and merchants need. A great network effect flywheel with superior tech.

I've mentioned it before that $AFRM is a great reopening play.

$AFRM is unique because of the flexibility they provide for high/ low transactions that consumers and merchants need. A great network effect flywheel with superior tech.

I've mentioned it before that $AFRM is a great reopening play.

Lastly, I'll just insert this extra piece:

1) Thread on $AFRM by @pinnyeow -

2) Secondly, I am a big believer in the Founder to maximize the optionality, scale and competitive advantage of $AFRM to be a leader in the BNPL Market!

1) Thread on $AFRM by @pinnyeow -

https://twitter.com/pinnyeow/status/1386590389356818433

2) Secondly, I am a big believer in the Founder to maximize the optionality, scale and competitive advantage of $AFRM to be a leader in the BNPL Market!

https://twitter.com/InvestiAnalyst/status/1391887999265173507

@pinnyeow @UnrollThread Unroll

@threadreaderapp Unroll

@threadreaderapp Unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh