Today I'm tweeting about @BichlerNitzan's buy-to-build indicator.

If you're not familiar, this is an indicator that quantifies the portion of 'investment' spent buying other corporations.

#buytobuild

#capitalaspower

If you're not familiar, this is an indicator that quantifies the portion of 'investment' spent buying other corporations.

#buytobuild

#capitalaspower

Notice the scare quotes around 'investment'. To many people, 'investment' means to 'build new capacity'. Hence, governments are always chasing 'investment' dollars.

But here's the thing: 'investment' is purely about transferring property rights.

But here's the thing: 'investment' is purely about transferring property rights.

The word 'invest', @BichlerNitzan observe, has feudal origins. In feudal societies, 'investiture' was the "symbolic ceremony of transferring property rights from the lord to the vassal".

blairfix.github.io/capital_as_pow…

blairfix.github.io/capital_as_pow…

OK, so 'investment' is everywhere and always a transfer of property rights. Still, there are many kinds of property rights, so 'investment' can have many different forms.

I can 'invest' in land, houses, machines, factories, etc.

I can 'invest' in land, houses, machines, factories, etc.

Here is the twist: if I own a corporation, I can also get that corporation to invest in *other corporations*.

In corporate speak, the act of buying up other corporations is call 'mergers and acquisitions'.

In corporate speak, the act of buying up other corporations is call 'mergers and acquisitions'.

But why would I want to buy other corporations? In a word, *power*. The drive to merge is about acquiring the power to set prices.

Cory @doctorow has a nice way of putting it:

pluralistic.net/2021/02/21/pal…

Cory @doctorow has a nice way of putting it:

pluralistic.net/2021/02/21/pal…

This price-setting power is written in the data. Big firms tend to have a higher 'markup' (profit as a portion of sales) than smaller firms. Here's the trend in US firms.

capitalaspower.com/forum_archived…

capitalaspower.com/forum_archived…

It's not a new trend, by the way. The link between firm size and markup goes back at least to the 1950s.

capitalaspower.com/forum_archived…

capitalaspower.com/forum_archived…

Back to mergers and acquisitions. An important question to ask is --- to what extend are corporations buying other corporations rather than investing in 'stuff'? And what is the trend?

These are the questions behind @BichlerNitzan's 'buy-to-build' indicator.

These are the questions behind @BichlerNitzan's 'buy-to-build' indicator.

The first published stab at constructing a 'buy-to-build' indicator was in a 2001 paper by Jonathan Nitzan

called 'Regimes of Differential Accumulation.'

Here's the US results. Notice two things:

1. the trend is upward

2. there are big oscillations

bnarchives.yorku.ca/3/

called 'Regimes of Differential Accumulation.'

Here's the US results. Notice two things:

1. the trend is upward

2. there are big oscillations

bnarchives.yorku.ca/3/

In 2009, @BichlerNitzan updated the 'buy-to-build' indicator, with much the same results.

blairfix.github.io/capital_as_pow…

blairfix.github.io/capital_as_pow…

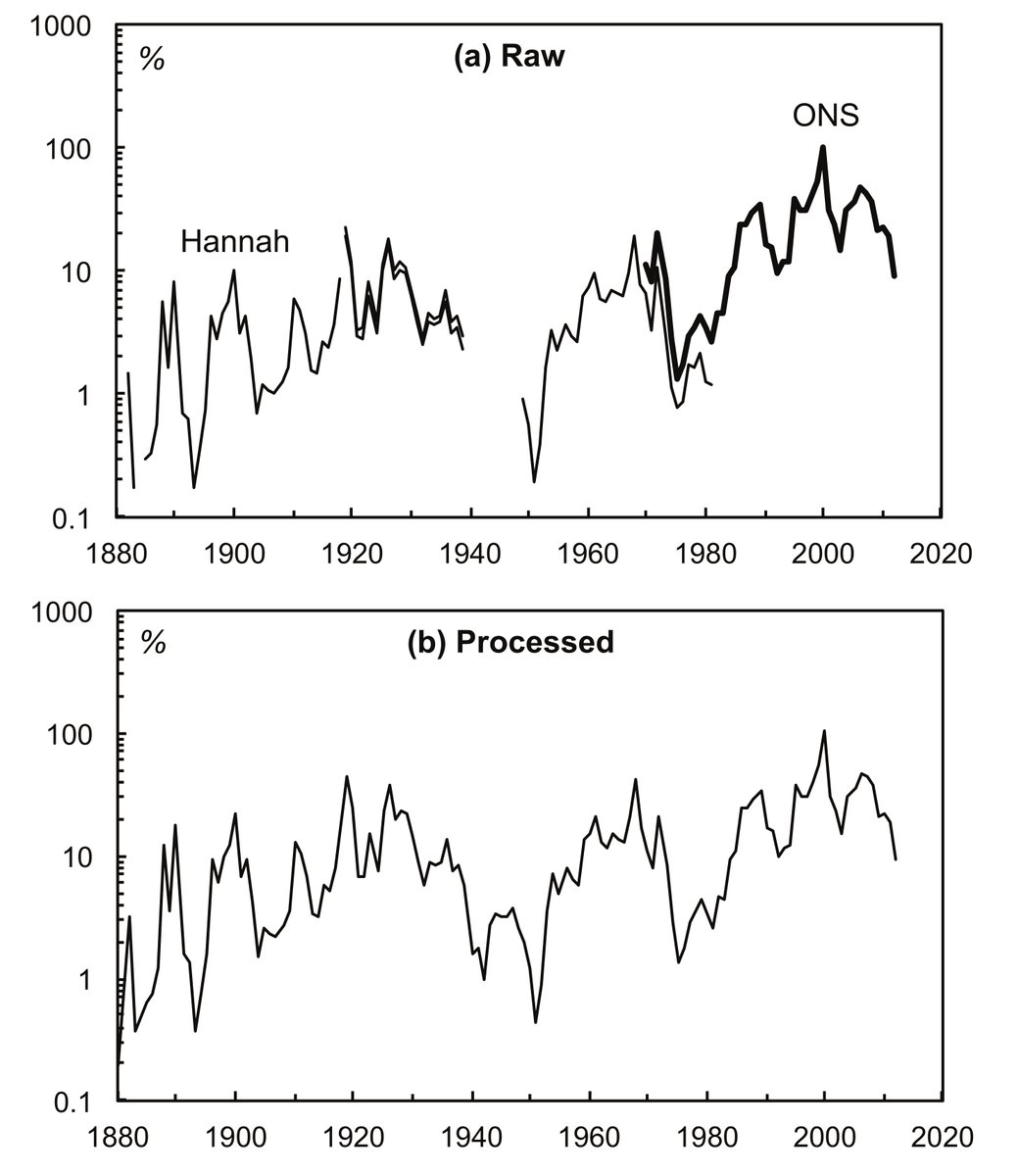

In 2013, @joefrancis505 added new estimates for the buy-to-build indicator in the US (left) and Britain (right).

As you can see, the estimates require splicing together many different sets of data.

capitalaspower.com/2013/03/the-bu…

As you can see, the estimates require splicing together many different sets of data.

capitalaspower.com/2013/03/the-bu…

Much of the underlying data above is proprietary. Noting this fact, @joefrancis505 later constructed buy-to-build indicators using open source data. US trends are on the left, UK trends on the right.

joefrancis.info/buy-to-build-i…

joefrancis.info/buy-to-build-i…

You can download @joefrancis505's most recent data here, updated to 2020: joefrancis.info/data/Francis_b…

Like me, Joe Francis is an independent researcher and blogger.

His blog: joefrancis.info

Support him on Patreon: patreon.com/jafrancis

Like me, Joe Francis is an independent researcher and blogger.

His blog: joefrancis.info

Support him on Patreon: patreon.com/jafrancis

Back to the buy-to-build indicator. @joefrancis505 uncovered a calculation error in @BichlerNitzan's original estimates. His new estimates differed slightly from the original. @BichlerNitzan noted this in an accompanying commentary:

capitalaspower.com/2013/02/franci…

capitalaspower.com/2013/02/franci…

In their commentary, @BichlerNitzan also noted that the US and Britain have very similar buy-to-build trends.

The long-term growth rates are similar, as are the short-term fluctuations. In other words, capitalism is a global system.

capitalaspower.com/2013/02/franci…

The long-term growth rates are similar, as are the short-term fluctuations. In other words, capitalism is a global system.

capitalaspower.com/2013/02/franci…

A side note here about this commentary. As @joefrancis505 himself showed, debate and commentary is becoming increasingly rare in economics. Here's its rise and fall in the big 5 economics journals.

joefrancis.info/economics-deba…

joefrancis.info/economics-deba…

Now lets back up 20 years. In Jonathan Nitzan's first paper on the buy-to-build indicator, he looked at it's short term fluctuation. Turns out that it correlates negatively with a 'stagflation' index --- a measure of inflation and unemployment.

bnarchives.yorku.ca/3/

bnarchives.yorku.ca/3/

In other words, when corporations merge more, unemployment and inflation tend to decrease. And when corporations fail to merge, they turn to inflation to make money.

@BichlerNitzan updated the data in 2009, finding much the same thing:

blairfix.github.io/capital_as_pow…

@BichlerNitzan updated the data in 2009, finding much the same thing:

blairfix.github.io/capital_as_pow…

When @joefrancis505 did new estimates, he found the same thing. The buy-to-build indicator moves inversely with stagflation. Here's the US and Britain.

capitalaspower.com/2013/03/the-bu…

capitalaspower.com/2013/03/the-bu…

.@BichlerNitzan use these results to classify different regimes of capitalism. Firms' goal is always to increase their capitalization relative to other firms. But there are different ways to do it. Here's @BichlerNitzan's classification:

'Greenfield' investment is building new factories. When people think of 'investment', that's their default. But the other major option for getting bigger is to buy other firms: 'Mergers and acquisitions'.

The trend has been towards more mergers, less greenfield.

The trend has been towards more mergers, less greenfield.

Alternatively, instead of getting larger, firms can try to boost their profitability per employee. Economists will tell you that firms do this by 'cost-cutting'. The dirty secret, though, is that firms have a secret weapon for increasing profits: *inflation*.

That brings us today. @BichlerNitzan and @joefrancis505 have shown that:

1. the buy-to-build indicator tends to increase over the long term

2. short-term movements in the buy-to-build indicator correlate negatively with stagflation.

1. the buy-to-build indicator tends to increase over the long term

2. short-term movements in the buy-to-build indicator correlate negatively with stagflation.

What we need now is for researchers to see if this research replicates in other countries.

If you complete such research, please consider submitting it to the Review of Capital as Power.

capitalaspower.com/recasp/

If you complete such research, please consider submitting it to the Review of Capital as Power.

capitalaspower.com/recasp/

• • •

Missing some Tweet in this thread? You can try to

force a refresh