Premine: 63% of existing ETH were premined. (ICO 72m ETH, current 'supposed' supply 115m). In comparison, 0% of existing BTC were premined ('excluding the unspendable genesis block').

2/n

2/n

Unsafe development: Ethereum's clients have a long history of bugs that have caused unintentional forks taking the network practically down. The last such bug on Bitcoin was over 8 years ago; the last on Ethereum was 4 weeks ago. coindesk.com/open-ethereum-…

3/n

3/n

One telling story is from last November, when Geth team had silently pushed a change to the consensus implementation, causing a split and taking the ecosystem on halt.

coindesk.com/ethereums-hard…

4/n

coindesk.com/ethereums-hard…

4/n

Frequent hard forks, centralized development, changes to the consensus mechanism and releasing buggy software are all against the Bitcoin ethos. Yes, activating Taproot is slow, but atleast it's well tested to make sure nothing will break.

5/n

5/n

The DAO bailout. Do you remember when a blockchain was supposed to be immutable and bailouts shouldn't happen? Ethereum essentially killed this idea in 2016, rolling back the blockchain to bailout the DAO investors (devs among them).

cryptohustle.com/5-reasons-why-…

6/n

cryptohustle.com/5-reasons-why-…

6/n

In comparison, the genesis block of Bitcoin has an anti-bailout message recorded in it. There will never be a bailout on Bitcoin - the blockchain is immutable. (Sidenote: the DAO bailout was personally the moment I became a vocal anti-etherean)

7/n

7/n

Unsound money (unpredictable monetary policy):

I can tell what's Bitcoin monetary policy 100 years from now.

I can't tell what will be Ethereum's monetary policy 1 year from now, let alone 10 years from now.

8/n

I can tell what's Bitcoin monetary policy 100 years from now.

I can't tell what will be Ethereum's monetary policy 1 year from now, let alone 10 years from now.

8/n

Ethereum is basically a hydra with a new marketing scheme popping up when a previous one has been slain. Not long ago, the Ethereans frowned upon Bitcoin's "Store-of-Value", "high tx fees", "L2 solutions" - now basically they're all marketed by the Ethereans.

9/n

9/n

Proof-of-Stake is the unicorn Ethereum's been chasing since the beginning. There's a great reason why it's been years and hasn't still been deployed: it's inherently less secure than PoW and much, much more complex: download.wpsoftware.net/bitcoin/pos.pdf

10/n

10/n

While I can see why none of the previous points is bad enough to avoid Ethereum, by far the worst of Ethereum is its fundamental flaw that had it birthed in the first place: executing code on the blockchain and stuffing everything in it.

11/n

11/n

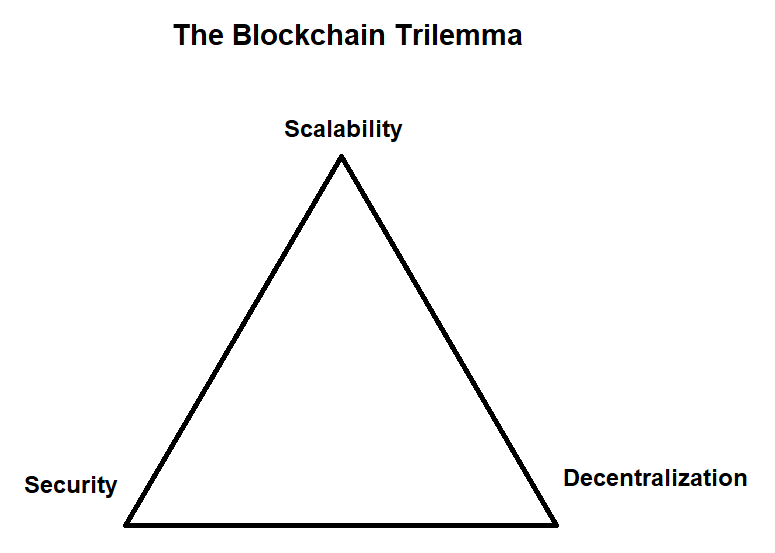

The blockchains have a trilemma (Scalability-Security-Decentralization). For example, Bitcoin is maximizing security and decentralization, and scaling is to be done on the layers above by using the blockchain as a settlement layer.

12/n

12/n

Simply put: stuffing everything in the blockchain will increase its size which will reduce decentralization and security. Ethereum has compromised its security and decentralization in the name of scalability.

13/n

13/n

The current size of the Ethereum blockchain is 7.2 terabytes. One year ago it was 4.2 terabytes (and accelerating). In comparison, the Bitcoin blockchain size is 0.34 terabytes.

etherscan.io/chartsync/chai…

14/n

etherscan.io/chartsync/chai…

14/n

The larger the size, the fewer the nodes. Everytime the Ethereum blockchain has become congested, the gas limit has been increased accelerating the blockchain size. And it's still not enough:

15/n

https://twitter.com/VeetiPitkoilija/status/1392410354999775241

15/n

Sharding (Ethereum's 2nd biggest dream after PoS) is a prime example of this; basically it multiples scalability by decreasing security and decentralization.

16/n

16/n

A more radical example of a "smart contract blockchain" is Binance Smart Chain that's far less secure and decentralized than Ethereum while being much more scalable. Still, not enough. Actually, the most scalable "smart chain" is Amazon AWS.

17/n

17/n

There's only two possible future paths for Ethereum: 1) ever increasing gas limit by compromising security and decentralization (becoming more and more BSC-like), 2) layerization (becoming more BTC-like).

18/n

18/n

The latter has one fundamental flaw: the layers above can't be more decentralized or secure than the base layer is (blockchain). With Ethereum blockchain being magnitudes less secure and decentralized than the Bitcoin blockchain, Ethereum L2 solutions will also *always* be.

19/n

19/n

Thus, Ethereum is essentially cornered - it must choose whether to compete with BSC or BTC, but it'll always be inferior to both. The likely outcome is just to choose the easiest path - to keep increasing the gas limit which will make it more BSC-like.

20/n

20/n

There's an alternative, a more viable path to execute trustless, secure and scalable 'smart contracts'; on the layers above the Bitcoin blockchain. Atm, many are attempting to create such layers, my personal favorite of them being so far being #RGB

rgbfaq.com

21/21

rgbfaq.com

21/21

• • •

Missing some Tweet in this thread? You can try to

force a refresh