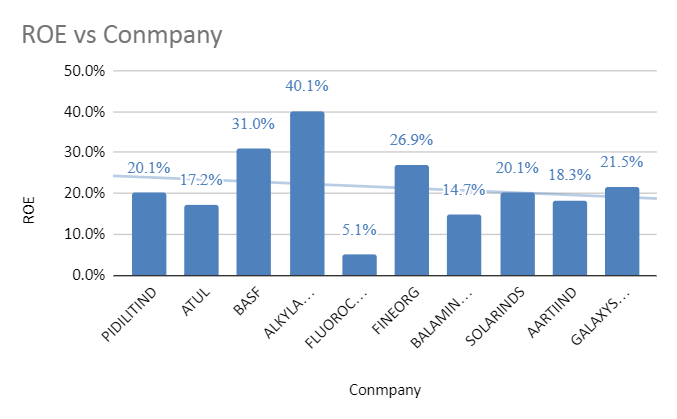

Atul, Pidilite, Alkyl amine, Fine Org and Aarti Ind have among the best margins in the sector.

https://twitter.com/techlunatic/status/1370644064740077568

Pidilite, Aarti, Atul, Alkyl amines have cornered most of the sector's market cap.

Question : Does it imply that Pidilite must be making the largest revenues?

Question : Does it imply that Pidilite must be making the largest revenues?

BASF makes the largest revenues and gets a relatively miniscule market cap

Reason? BASF's low margins (~2%) vs Pidilite's margins of 21%

Lesson : Revenues ain't everything. It is margins (i.e ability to convert revenues into shareholder wealth) that fetches premium valuations.

Reason? BASF's low margins (~2%) vs Pidilite's margins of 21%

Lesson : Revenues ain't everything. It is margins (i.e ability to convert revenues into shareholder wealth) that fetches premium valuations.

• • •

Missing some Tweet in this thread? You can try to

force a refresh