4th Post on Q4FY21 Results

Businesses covered:

~Apcotex

~Blue Star

~Tata Consumer Products

~Ultratech Cement

Businesses covered:

~Apcotex

~Blue Star

~Tata Consumer Products

~Ultratech Cement

1/

Apcotex

• Revenues for the quarter were up 61.5% YoY

• Reported its highest-ever revenues, export volumes, EBITDA, PBT & PAT in a quarter in Q4

• Plants running at full capacity for XNB latex for gloves

Detailed Notes: bit.ly/3w98SGY

Apcotex

• Revenues for the quarter were up 61.5% YoY

• Reported its highest-ever revenues, export volumes, EBITDA, PBT & PAT in a quarter in Q4

• Plants running at full capacity for XNB latex for gloves

Detailed Notes: bit.ly/3w98SGY

2/

Blue Star

• Q4FY21 Consol Rev up 26% YoY

• Order book at Rs 2952 Cr

• RAC sales grew 33% YoY & market share @ 13.25%

• Launched new range of pharma cold rooms, medical freezers, ice-lined refrigerators, & vaccine transporters

Detailed Notes: bit.ly/2QqnL8Q

Blue Star

• Q4FY21 Consol Rev up 26% YoY

• Order book at Rs 2952 Cr

• RAC sales grew 33% YoY & market share @ 13.25%

• Launched new range of pharma cold rooms, medical freezers, ice-lined refrigerators, & vaccine transporters

Detailed Notes: bit.ly/2QqnL8Q

3/

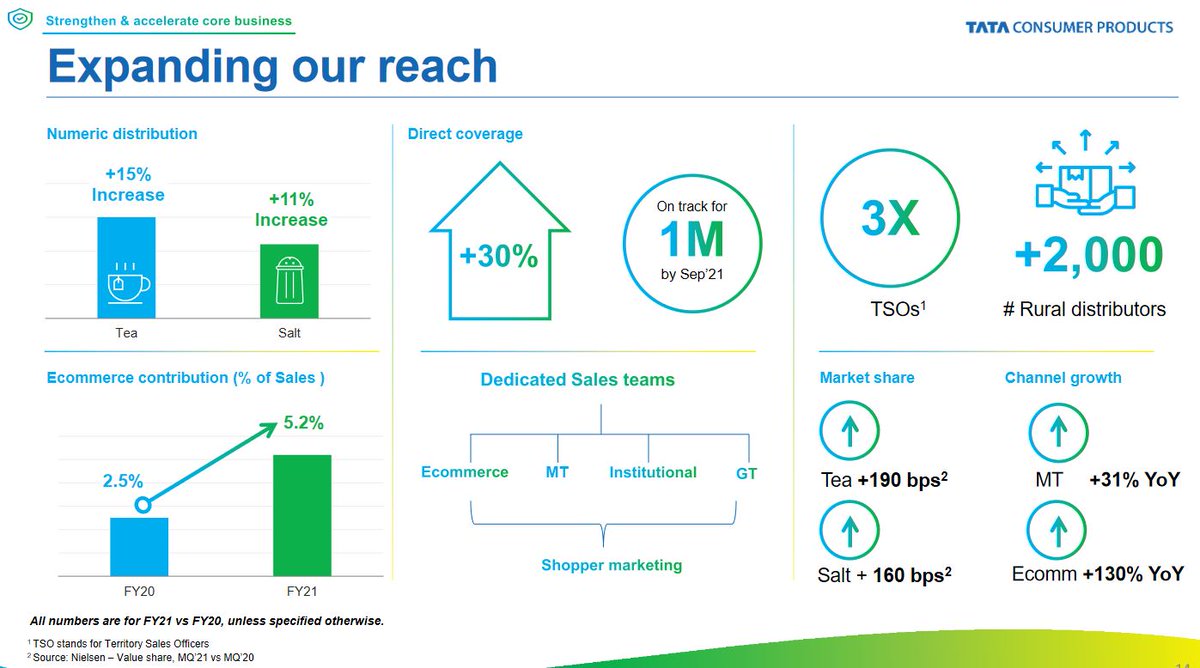

Tata Consumer Products

• Consol Rev growth of 20% YoY & PAT growth of 102% YoY

• India business grew 29% YoY with a volume growth of 12% in beverages & 11% in foods

• Tea grew 32% YoY & Pulses grew 26% YoY in FY21 in sales

Detailed Notes: bit.ly/2RVTkHQ

Tata Consumer Products

• Consol Rev growth of 20% YoY & PAT growth of 102% YoY

• India business grew 29% YoY with a volume growth of 12% in beverages & 11% in foods

• Tea grew 32% YoY & Pulses grew 26% YoY in FY21 in sales

Detailed Notes: bit.ly/2RVTkHQ

4/

Ultratech Cement

• Rev up 31% YoY in Q4. PAT up 61% YoY

• Capacity utilization at 93% in Q4 and 99% in March

• Reduced Rs 10624 Cr of debt in FY21

• Dividend of Rs 37 per share

Detailed Notes: bit.ly/3tMo5MB

Ultratech Cement

• Rev up 31% YoY in Q4. PAT up 61% YoY

• Capacity utilization at 93% in Q4 and 99% in March

• Reduced Rs 10624 Cr of debt in FY21

• Dividend of Rs 37 per share

Detailed Notes: bit.ly/3tMo5MB

All the four updates together here:

bit.ly/2RX4OLn

L&R for wider reach if you find value in our work.

bit.ly/2RX4OLn

L&R for wider reach if you find value in our work.

• • •

Missing some Tweet in this thread? You can try to

force a refresh