Listened to the latest OddLots with @econjared (thanks @BRzymelka for h/t).

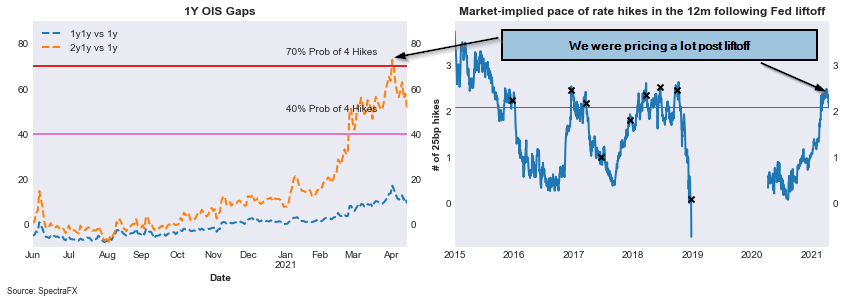

The inflation discussion continues as the data keeps its variance. One thing is certain: the Fed will struggle like us to read any short term dynamics out of those prints.

1/x

The inflation discussion continues as the data keeps its variance. One thing is certain: the Fed will struggle like us to read any short term dynamics out of those prints.

1/x

I believe we can take two points out of this podcast:

a)The WH wants workers to get back bargaining power

b)Companies/Investors are cash rich but don’t invest in long term projects: taxes are a way for government to fix that

2/x

a)The WH wants workers to get back bargaining power

b)Companies/Investors are cash rich but don’t invest in long term projects: taxes are a way for government to fix that

2/x

There has been a confiscation over the last decades of the bargaining power of workers by companies (same trend everywhere) as we moved into more services economies.

But the latest “gig economy” only amplified this issue.

3/x

But the latest “gig economy” only amplified this issue.

3/x

Bargaining power is important because otherwise it is for the government to try and fix strong persistent inequalities in wage implementation which is never easy to vote for but also to enforce. The wage inequality of women is a perfect example of that.

4/x

4/x

I don’t expect the gvt to be much opposed to the current wage hotness we’re seeing. Amazon as the top supply chain leader it is, is raising wages bc it knows it has to compete with others and hates disruptions.

But is also offering something not far from the current levels.

5/x

But is also offering something not far from the current levels.

5/x

On the left chart you can see how Production and NonSup Warehouse employees are already making on average more than what Amazon is offering with its $17/h.

The right chart is the waiters. Those guys work less hours (circa 26h/w). For them the current benefits is hard to beat.

6/x

The right chart is the waiters. Those guys work less hours (circa 26h/w). For them the current benefits is hard to beat.

6/x

But the orange line is what they would earn with their current wage working an extra 5 hours per week.

It barely beats what Amazon can offer!

That’s why we’re seeing such shortages of jobs. The government is happy to see this dynamic play out.

7/x

It barely beats what Amazon can offer!

That’s why we’re seeing such shortages of jobs. The government is happy to see this dynamic play out.

7/x

The furlough was implemented to prevent wage decreasing in the reopening (from too many workers competing to work again with fewer jobs available).

The lengthening of the scheme as such is having a strong effect but I don’t see any issue with that at the moment.

8/x

The lengthening of the scheme as such is having a strong effect but I don’t see any issue with that at the moment.

8/x

We are also not far from stopping those extra benefits and as such it will push back a large balance of arbitraging workers into the jobs market.

9/x

9/x

The other part of the discussion which I think is relevant is to how the government is doing infrastructure and other long term projects because it has to, as either some are badly funded (highways) or investors don’t want to because the ROI is unclear.

10/x

10/x

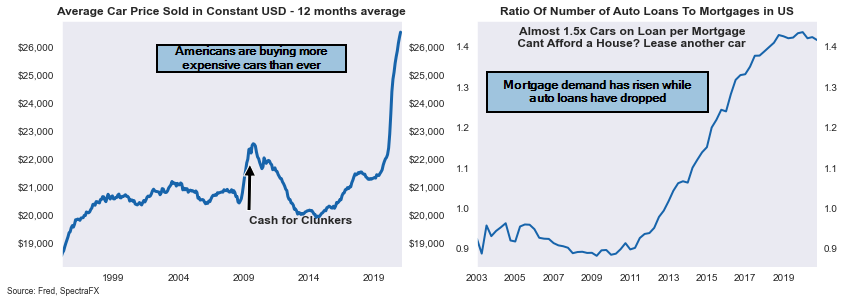

And that I believe is why we’ll see a continued increase in taxes. Apple for example is a great company making very large profits. Yet it doesn’t seem to be building much for the future.

The first iPhone was launched in 2007. Not much else since has been revolutionary.

11/x

The first iPhone was launched in 2007. Not much else since has been revolutionary.

11/x

In the meantime the low rates enable such companies to borrow money to buy back stock.

If they can’t find better use of their cash because they are short sighted in their race towards profits, then maybe the government can find a better use for those dollars via taxation.

12/x

If they can’t find better use of their cash because they are short sighted in their race towards profits, then maybe the government can find a better use for those dollars via taxation.

12/x

Overall I'm happy with the current treatment of inflation and I still think we are "transitory".

What if we are not until year-end? Then it will mean that those wages ought to have been risen before.

And it will put middle-class workers in a much stronger bargaining position

13/x

What if we are not until year-end? Then it will mean that those wages ought to have been risen before.

And it will put middle-class workers in a much stronger bargaining position

13/x

Also fair to cc @TheStalwart and @tracyalloway for their work.

I wasn’t jogging just walking the dogs.

I wasn’t jogging just walking the dogs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh