Why did no one realize there was a world-class palladium deposit on the outskirts of the mining city of Perth? Turns out, no one was really looking. Great piece from @JamesThornhill6 bloomberg.com/news/articles/… via @business

@JamesThornhill6 @business The crazy context for this is that platinum-group metals like palladium are supposedly found in really only two places on the planet: Siberia and South Africa.

@JamesThornhill6 @business There's a third small area in Montana and another in Ontario, the latter of which is thought to have come about because of a freaking *meteorite impact*.

But no one really thought you'd find commercial quantities of platinum in Australia, yet here it is.

But no one really thought you'd find commercial quantities of platinum in Australia, yet here it is.

@JamesThornhill6 @business And it's just a short drive away from Perth, one of the world's capitals of mining investment and geological expertise! It's mind-blowing.

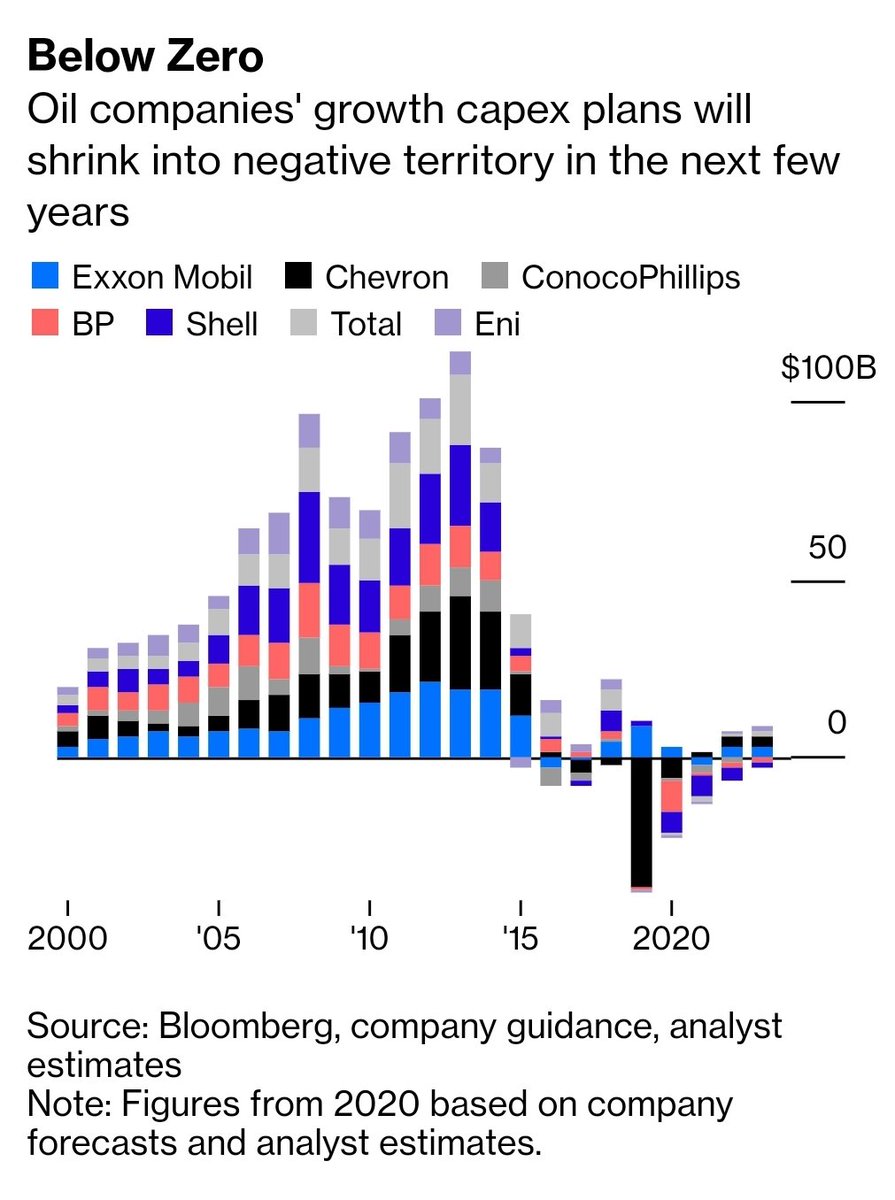

Any time you think a mineral is facing fundamental scarcity, reflect that no one even noticed this massive deposit on their doorstep.

Any time you think a mineral is facing fundamental scarcity, reflect that no one even noticed this massive deposit on their doorstep.

By the way, looking for stuff like palladium is supposedly one of the best arguments for asteroid mining.

Platinum-group metals are rare in Earth's crust because they tend to bind to iron and sink towards the planet's core.

Platinum-group metals are rare in Earth's crust because they tend to bind to iron and sink towards the planet's core.

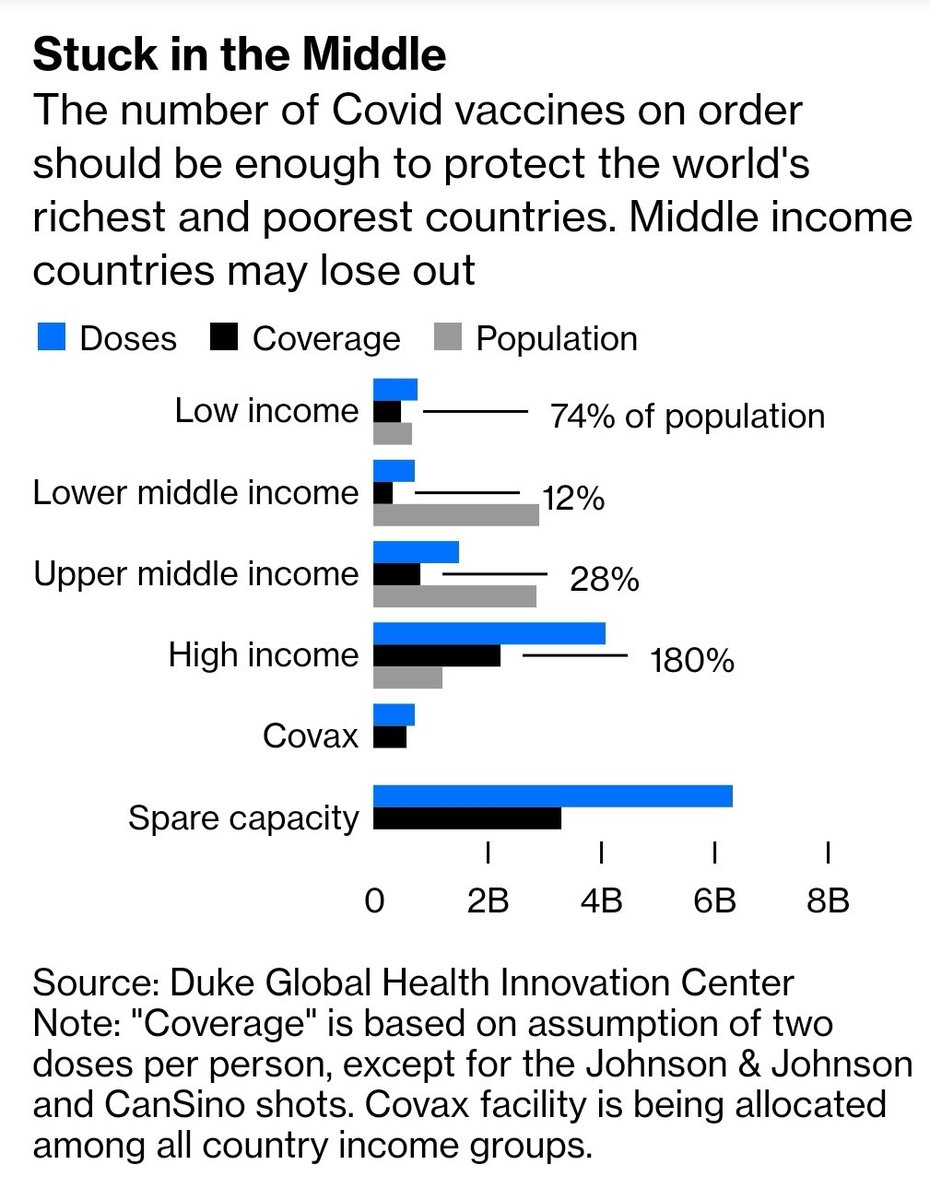

Imagine what would happen to your space-mining operation if this thing turned up in the middle of a funding round:

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh