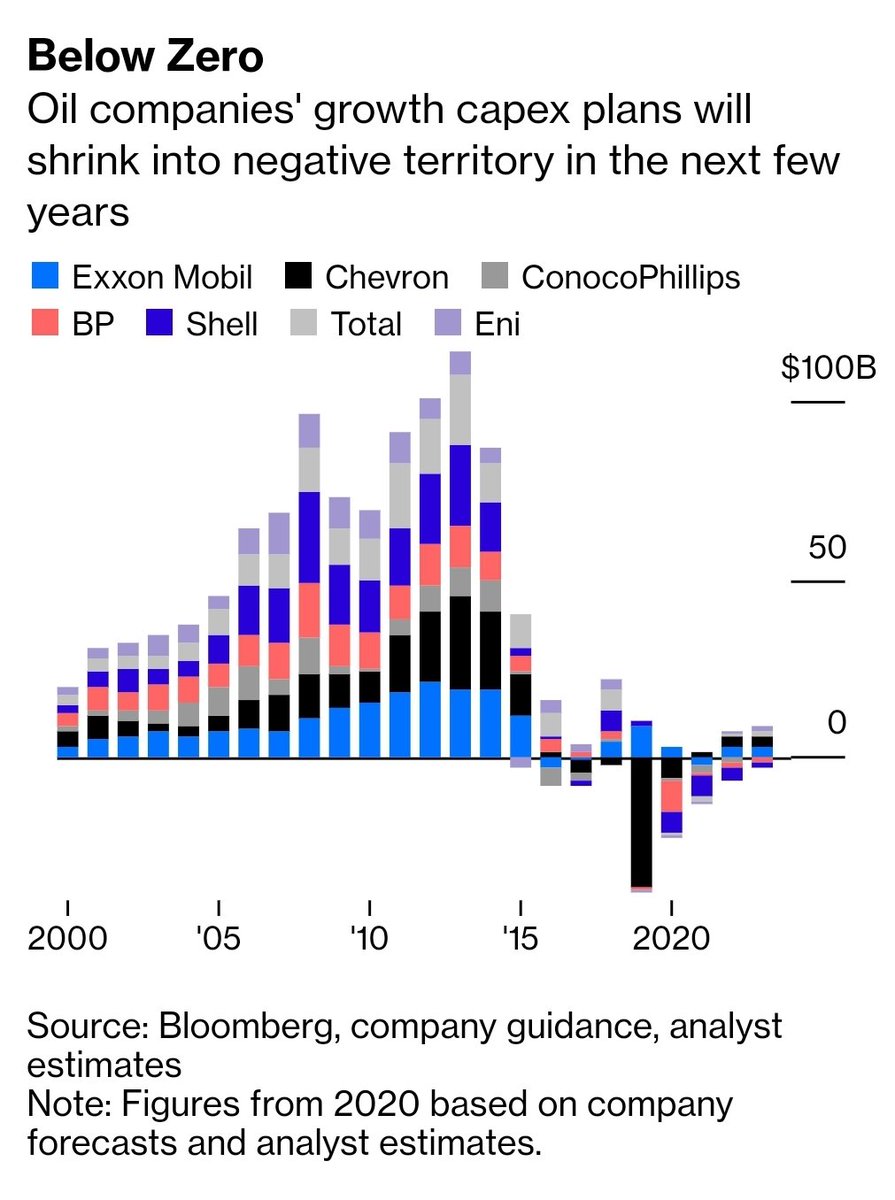

One thing worth noting about the radical-sounding @iea announcement that no new petroleum fields need to be developed any more — this is more or less the lived reality of oil majors right now, and has been for years.

Big Oil stopped investing growth capex around 2016.

Big Oil stopped investing growth capex around 2016.

@IEA There's a few definitions of "new oil" here:

1. "Investment in new fields to *increase* production levels."

2. "Investment in new fields to *maintain* production levels."

3. "Investment in new fields, production may decline."

1. "Investment in new fields to *increase* production levels."

2. "Investment in new fields to *maintain* production levels."

3. "Investment in new fields, production may decline."

@IEA Production from a typical oil field declines at 5% to 7% a year (shale is much faster, on the order of 50% or more).

So to hit the IEA net zero output decline path of 4% a year, you arguably still get a little bit of investment in new production.

So to hit the IEA net zero output decline path of 4% a year, you arguably still get a little bit of investment in new production.

@IEA It's sort of borderline, which is why the IEA forecast makes sense. For instance, the very big and old Middle Eastern fields that the IEA sees rising to more than 50% of a far smaller sum of production have the world's lowest decline rates.

@IEA The point is, though, that "1. Invest in growing output" was the norm for the oil industry through it's entire history. "2. Invest in maintaining output" has been the norm since 2016. "3. Invest only in developing existing fields", the IEA's line, isn't such a huge departure.

Here's a piece I wrote last year on the end of Big Oil's growth fetish: bloomberg.com/opinion/articl…

Also just to put this in percentage terms:

Annual oil output growth since 2000: 1.5%

Output growth without growth capex: 0%

IEA net zero target, no new fields: -4%

Output decline without new investment in even existing fields: -8%

Annual oil output growth since 2000: 1.5%

Output growth without growth capex: 0%

IEA net zero target, no new fields: -4%

Output decline without new investment in even existing fields: -8%

One last thing: The IEA -4% figure is a 2020-2050 average figure.

You'd expect the pace to be steepest in the late 2020s and 2030s, as EVs supplant the existing vehicle fleet, before slowing in the 2040s with hard-to-abate sectors.

You'd expect the pace to be steepest in the late 2020s and 2030s, as EVs supplant the existing vehicle fleet, before slowing in the 2040s with hard-to-abate sectors.

Imagine decline of 1% from 2020-2025, 5% from 2025-2035, 7% from 2035-2040, and 3% thereafter.

That gets you to the same place as 4% a year, more or less, and is a slightly more realistic picture of what may happen.

That gets you to the same place as 4% a year, more or less, and is a slightly more realistic picture of what may happen.

• • •

Missing some Tweet in this thread? You can try to

force a refresh