Being a VC in Crypto

A short thread looking back on my past 9 months at @TheSpartanGroup 🧵

Hopefully, this is useful to those thinking of joining a crypto fund. (Feel free to reach out if you have any questions!)

A short thread looking back on my past 9 months at @TheSpartanGroup 🧵

Hopefully, this is useful to those thinking of joining a crypto fund. (Feel free to reach out if you have any questions!)

Why Spartan? I covered that here in my previous tweet thread but basically, I joined for two things:learning and networking 🤓

What do I do at Spartan? What is a day in the life as an analyst?

There's a few things basically which I'll breakdown below👇

https://twitter.com/Darrenlautf/status/1300089717904433152

What do I do at Spartan? What is a day in the life as an analyst?

There's a few things basically which I'll breakdown below👇

Calls Calls Calls

We just raised a new DeFi venture fund so naturally, we need to find projects to deploy capital.

But with capital now being cheap, it's difficult to get the sizes you want, hence you need to invest in more projects, thus

We just raised a new DeFi venture fund so naturally, we need to find projects to deploy capital.

But with capital now being cheap, it's difficult to get the sizes you want, hence you need to invest in more projects, thus

https://twitter.com/Darrenlautf/status/1382721174178713605

BTW, as a VC, you're expected to provide more value than just retweeting / liking the projects’ tweets.

Things like:

- Researching ideas that can help/ feedback

- Participating in governance or run nodes

- Finding talent

- Tokenomics help

- Connect with other portcos

Things like:

- Researching ideas that can help/ feedback

- Participating in governance or run nodes

- Finding talent

- Tokenomics help

- Connect with other portcos

Besides having calls with new projects, we also have update calls with our portcos, where we cover stuff like:

- Marketing & Community

- Business Development

- Development & Security

- Team

- Future Priorities

h/t @maplefinance for the framework

- Marketing & Community

- Business Development

- Development & Security

- Team

- Future Priorities

h/t @maplefinance for the framework

https://twitter.com/Darrenlautf/status/1388163312165154821

But of course, it's not just calls, we also have to do research on projects, either ones that are newly listed or for ones which we already have positions in, keeping track of things like latest news, governance proposals.

We also write memos on the projects we invested in.

We also write memos on the projects we invested in.

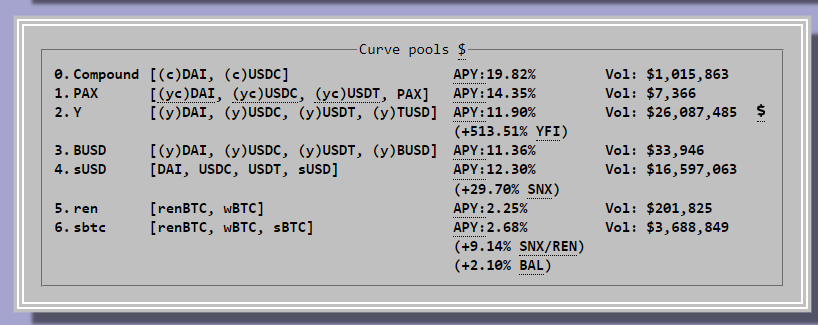

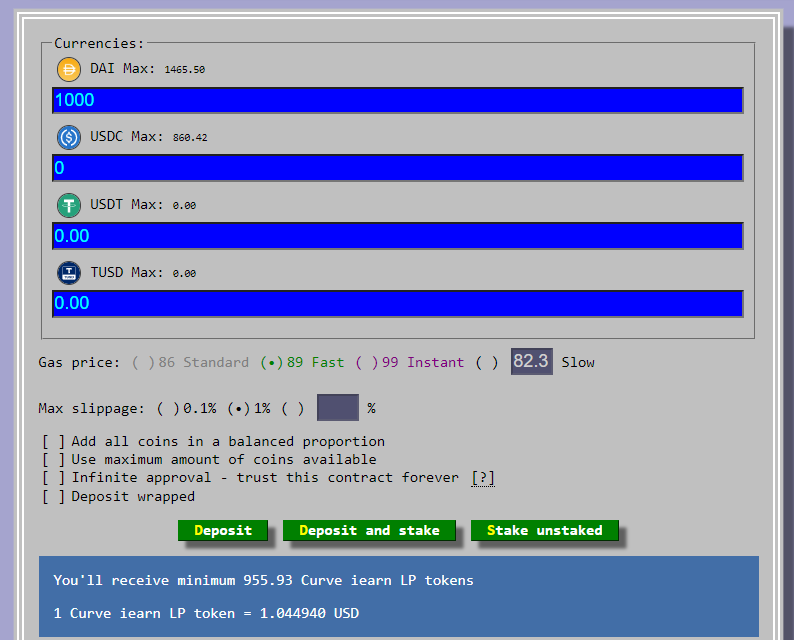

Besides that, a good part of the day is spent keeping track of metrics of projects in the space. H/t @gabrieltanhl for helping create good dashboards and looking into future catalysts.

Sample here 👇

Sample here 👇

https://twitter.com/mrjasonchoi/status/1392018542829080579

Talking to people from other funds and friends for deal flow via Telegram and Twitter also takes a good part of my day, as does reading all my emails.

Calendly's been a godsend for scheduling calls! 🙌

Calendly's been a godsend for scheduling calls! 🙌

So how do you join a fund anyway?

Some good threads here, but in essence:

- contribute to communities/leak alpha on Twitter

- be a power user of protocols (high Degen Score, etc.)

- Coding + Excel is a plus! (Dune, Covalent, etc.)

Some good threads here, but in essence:

- contribute to communities/leak alpha on Twitter

- be a power user of protocols (high Degen Score, etc.)

- Coding + Excel is a plus! (Dune, Covalent, etc.)

https://twitter.com/n2ckchong/status/1387949472651485188

https://twitter.com/lars0x/status/1392819845482287105

If your only pitch for yourself is "I bought XXX early and made 100x", that's a bullshit pitch. People have made mills just aping into dog coins this bull market. h/t

Funds want to see how you evaluate projects, what value you provide, connections, etc

https://twitter.com/ak_bull_worm/status/1391957751933267969?s=21

Funds want to see how you evaluate projects, what value you provide, connections, etc

Honestly, after this bull market I think compensation for funds is broken, especially for DeFi natives.

The simps at @weaksimpcap covered it well

So it's really more for learning from some of the best in the space and networking if you haven’t already.

The simps at @weaksimpcap covered it well

https://twitter.com/weaksimpcap/status/1383276895614107650

So it's really more for learning from some of the best in the space and networking if you haven’t already.

Something to take note of is that the expertise that you bring to the fund might be more valuable than you think.

Tradfi funds joining the space are probably not DeFi native so know your worth and don’t settle for less than your annual gas cost.

Tradfi funds joining the space are probably not DeFi native so know your worth and don’t settle for less than your annual gas cost.

https://twitter.com/tomkysar/status/1390482465832177664

Also if you're joining a fund because of co-investing opportunities, chances of that happening are prob very low because the allocations given by projects are normally too small compared to the AUMs of these funds.

Anyway, you may be wondering why am I writing a thread when it's only been 9 months (or why the market has been nuking recently...)

Well that's because I would like to announce that as of today I'm officially leaving The Spartan Group.

Wait what why?

Well that's because I would like to announce that as of today I'm officially leaving The Spartan Group.

Wait what why?

More for personal reasons, I think that taking the next step to branching out on my own would be the most +EV for my growth now.

Having been 24/7 crypto for most of the year, my health’s definitely taken a hit i.e

Having been 24/7 crypto for most of the year, my health’s definitely taken a hit i.e

https://twitter.com/Darrenlautf/status/1377263915080445958/photo

I'm going to take some time off to find some work life balance and also learn new things that I’ve never had the chance to.

Huge shout out to @SpartanBlack_1 and @mrjasonchoi for teaching me so much, it was a great experience working with you guys and I wish Spartan the best!

Huge shout out to @SpartanBlack_1 and @mrjasonchoi for teaching me so much, it was a great experience working with you guys and I wish Spartan the best!

What's the plan next?

Not the right time to start @Not3Lau_Capital especially since we don't want to be a generational top signal and launch a fund now but it's definitely something I'll explore

So, for now I'm going to be a free degen and ape listings / angel invest

Not the right time to start @Not3Lau_Capital especially since we don't want to be a generational top signal and launch a fund now but it's definitely something I'll explore

So, for now I'm going to be a free degen and ape listings / angel invest

For surviving until the end of this thread, here’s a Free Alpha Leak 👀👇

darrenlautf.com

I’m still looking to angel invest in projects that I find interesting!

darrenlautf.com

I’m still looking to angel invest in projects that I find interesting!

I value add to projects by the networks i have built across my journey, and further exposure through my personal channels such as t.me/thedailyape and twitter

Here's a list of projects that i have personally invested in and worked with and more projects w Spartan :)

Here's a list of projects that i have personally invested in and worked with and more projects w Spartan :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh