📢Our first Annual Trading Conference will take place on June 12th and June 13th next month. 📢

More Info: traderlion.com/annual-trading…

Hosted Live on our YouTube: bit.ly/3wwyJsT

More Info: traderlion.com/annual-trading…

Hosted Live on our YouTube: bit.ly/3wwyJsT

Featuring Presentations from:

@jfahmy

@AnthonyCrudele

@KGD_Investor

@PatternProfits

@irusha

@Upticken

@alphatrends

@cperruna

@1charts6

@Trader_mcaruso

@alphacharts365

@PatrickWalker56

@LeifSoreide

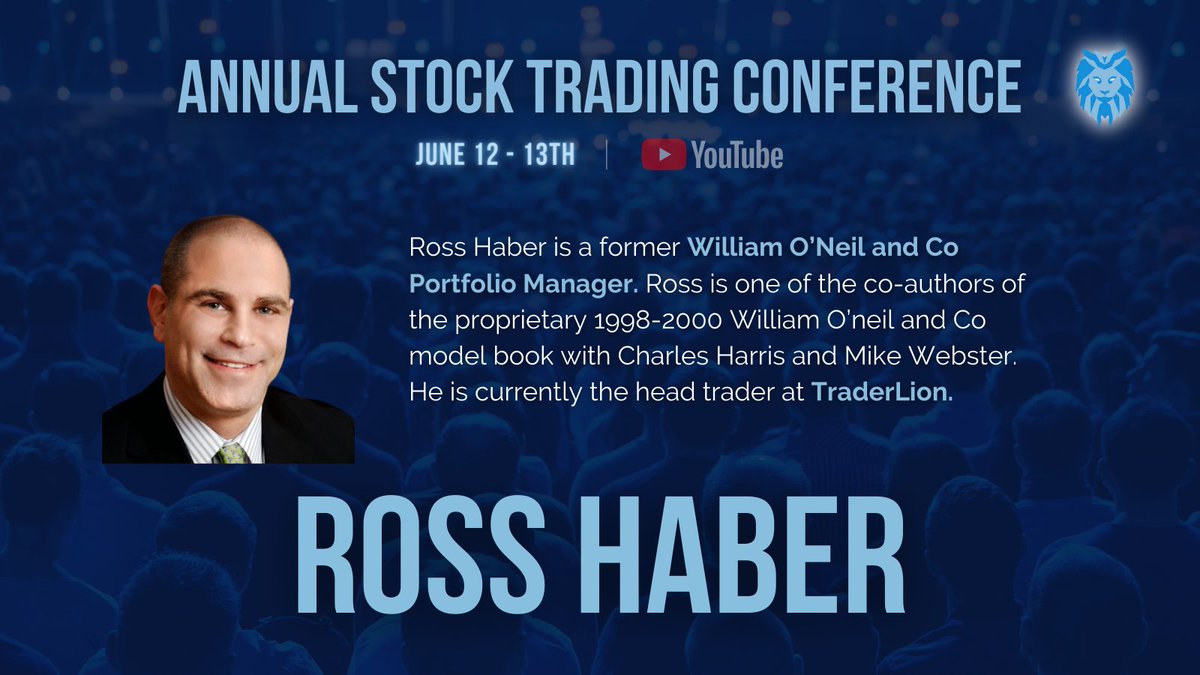

@RossHaber_

And more!

@jfahmy

@AnthonyCrudele

@KGD_Investor

@PatternProfits

@irusha

@Upticken

@alphatrends

@cperruna

@1charts6

@Trader_mcaruso

@alphacharts365

@PatrickWalker56

@LeifSoreide

@RossHaber_

And more!

Anthony Crudele | @AnthonyCrudele

Kathy Donnelly | @KGD_Investor

Joseph Fahmy | @jfahmy

Ben Bennett | @PatternProfits

Irusha Peiris | @irusha

Jim Roppel | @Upticken

Brian Shannon | @alphatrends

Oliver Kell | @1charts6

Chris Perruna | @cperruna

Matt Caruso | @Trader_mcaruso

Jack | @alphacharts365

Patrick Walker | @PatrickWalker56

Leif Soreide | @LeifSoreide

Ross Hober | @RossHaber_

Dr. Eric Wish | @WishingWealth

• • •

Missing some Tweet in this thread? You can try to

force a refresh