How to identify the next Market Leaders (Thread)

After a basing/corrective period in the market, new merchandise will start to emerge and show itself as the market is setting up for another uptrend.

Some leaders from the previous run may continue their moves, but often it's the new leaders which will provide the most alpha.

Some leaders from the previous run may continue their moves, but often it's the new leaders which will provide the most alpha.

So keep an open mind and search for the stocks that are standing out from the crowd with the strongest combination of superior price + volume action and fundamentals.

Here is how to find these next leaders:

Here is how to find these next leaders:

First, market leaders by definition lead the market. They will often be making new price and relative strength highs as the market starts moving up from a potential bottom.

Keep an eye on Relative Strength Lines especially. A Relative Strength New High Before Price is a key Leadership Blueprint. For instance, $TSLA showed this characteristic before advancing 350% in 2020

The RS Line is calculated by the Price of the stock/ SPX

The RS Line is calculated by the Price of the stock/ SPX

Leading stocks will appear again and again on the price new highs list. Scan through this list every evening and flag ones that are emerging from constructive bases with strong technicals and fundamentals.

Leaders will also try to buck the overall downtrend as institutions support them. Watch for Relative Strength on down days and stress tests.

Leading stocks will have the appearance of "beach balls under water" as they fight to make highs but are being pulled back by the market.

Leading stocks will have the appearance of "beach balls under water" as they fight to make highs but are being pulled back by the market.

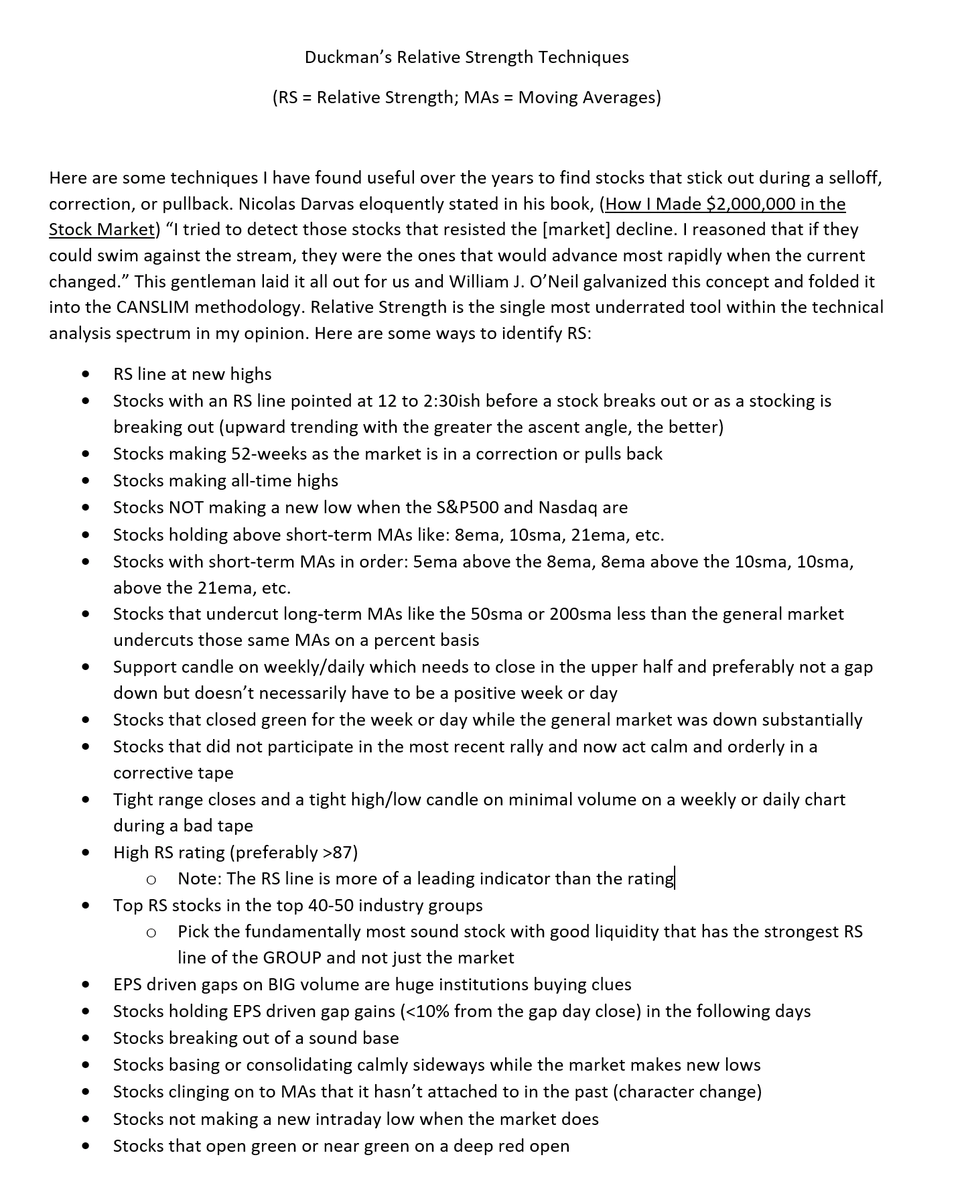

Relative Strength (RS) in of itself is a whole topic so check out our RS Blog as well as @duckman1717’s Relative Strength Techniques Sheet

RS Blog: traderlion.com/basics/relativ…

RS Blog: traderlion.com/basics/relativ…

In addition to Relative strength, be on the lookout for big volume gap ups and high volume moves.

This could be an indication that the story has changed in a particular stock; a sign that the N in CANSLIM factor has come into play.

This could be an indication that the story has changed in a particular stock; a sign that the N in CANSLIM factor has come into play.

Outside of Price and Volume Strength, you also want to consider liquidity levels and CANSLIM characteristics such as Quarterly Earnings Growth + Sales Growth as well as Annual EPS estimates and institutional sponsorship.

The more of these elements that are present, the higher the probability that the stock could be a big winner once the market pressure lifts

Also take into account the company's story. What is New? What is their competitive advantage? What is the total addressable market?

Also take into account the company's story. What is New? What is their competitive advantage? What is the total addressable market?

Many leaders are also part of overall strong groups which are riding larger industry tailwinds. Look for group themes and focus your attention on the leaders within that group.

William O’Neil’s research indicated that 49% of a stocks performance is tied to the performance of it’s sector and industry group. To increase the probability of the stock becoming a leader, there should also be other stocks within its group showing RS with strong fundamentals.

Additionally, focus on stocks with proper bases with depths from highs to lows of less than 40%.

A proper base depth indicates support from institutions and ensures that there is not too much overhead supply which could impede a rally.

A proper base depth indicates support from institutions and ensures that there is not too much overhead supply which could impede a rally.

Looking at the base on a weekly chart, there should be more above average volume weeks of accumulation versus distribution. Take note of closing ranges. A weekly closing range of > 40% during a corrective period is an indication of institutional support.

As a potential leader moves up the right side of its base, take note of volume to the upside and the slope of the RS line. The strength should be obvious.

In summary, A potential leader should match the leadership blueprints of the greatest winning stocks of all time. It should show superior price & volume action, have a compelling story, and be part of an entire group of strong stocks with strong fundamentals.

Focus on finding these leaders early, entering at proper pivots points where risk can be managed. From there you have a recipe to take full advantage of the next big move.

For much more detail on how to find and manage these leaders, check out Leadership Blueprints to learn how to identify each market cycles’ True Market Leaders.

traderlion.com/leadership-blu…

traderlion.com/leadership-blu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh