Introducing The 50.

Where I share the story and lessons of a top 50 largest company in the world.

Time for #3.

What started as a failing textile business became the 6th largest company in the world.

Let's dive in 🧵

Where I share the story and lessons of a top 50 largest company in the world.

Time for #3.

What started as a failing textile business became the 6th largest company in the world.

Let's dive in 🧵

Berkshire Hathaway is a multinational conglomerate that owns 60+ well-known businesses like Geico, Duracell, Kraft Heinz, and Dairy Queen.

It's also a highly coveted stock with one Class A share priced in at $430,000.

And it all began with Warren Edward Buffett...

It's also a highly coveted stock with one Class A share priced in at $430,000.

And it all began with Warren Edward Buffett...

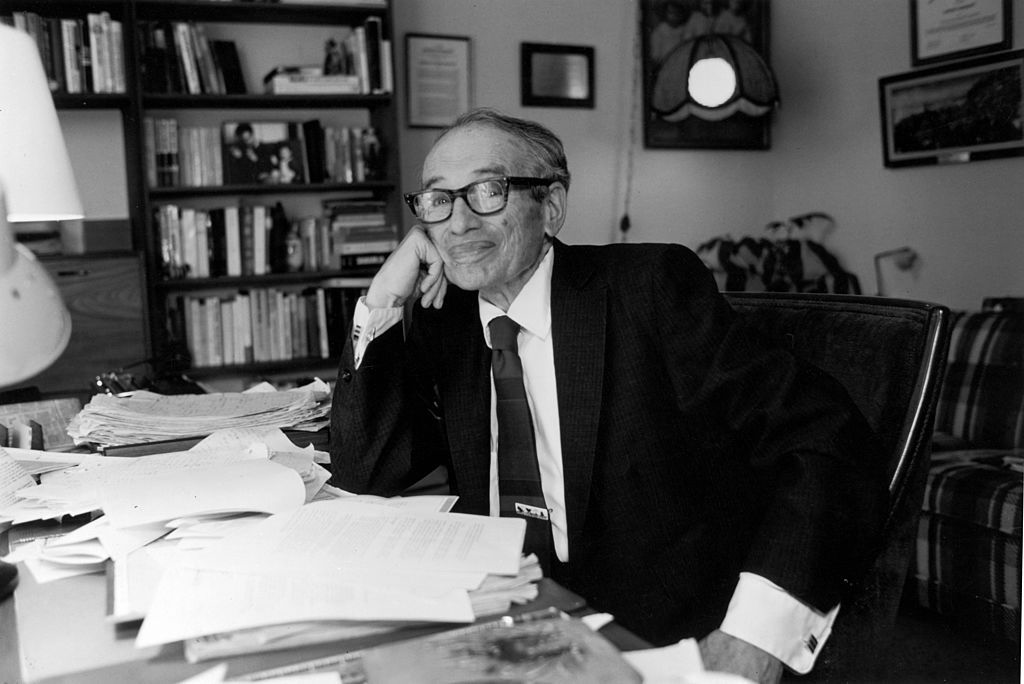

• The Greatest Investor of All Time

• The Oracle of Omaha

• The Dumbledore of Investing (my personal fav)

Warren Buffett is a value investing legend and is responsible for growing Berkshire Hathaway into the $655 bn behemoth that it is today.

• The Oracle of Omaha

• The Dumbledore of Investing (my personal fav)

Warren Buffett is a value investing legend and is responsible for growing Berkshire Hathaway into the $655 bn behemoth that it is today.

Born during the height of the Depression, Buffett watched his parents struggle to make ends meet in their hometown of Omaha, NE.

One night, a young Warren declared that he would make $1 million by the age of 35 or throw himself off the tallest building he could find in Omaha.

One night, a young Warren declared that he would make $1 million by the age of 35 or throw himself off the tallest building he could find in Omaha.

Buffet had a passion for numbers from a young age.

He collected bottle caps left outside of soda machines and analyzed for which brands and flavors customers preferred most.

This soon turned into tracking and recording stock prices that he would see in his father’s newspapers.

He collected bottle caps left outside of soda machines and analyzed for which brands and flavors customers preferred most.

This soon turned into tracking and recording stock prices that he would see in his father’s newspapers.

At 13, Buffett began working as a paperboy.

He quickly realized he could maximize profit by expanding revenue streams.

So he started selling magazine subscriptions to his customers.

Before he knew it, Buffett was earning $175/month (≈$3,000 today) from his paper route.

He quickly realized he could maximize profit by expanding revenue streams.

So he started selling magazine subscriptions to his customers.

Before he knew it, Buffett was earning $175/month (≈$3,000 today) from his paper route.

Buffett used these earnings to buy a 40-acre farm in Nebraska for $1,200.

He was 15 years old...

After graduating from high school, he used the profits from the farm to pay his way through the University of Nebraska.

He was 15 years old...

After graduating from high school, he used the profits from the farm to pay his way through the University of Nebraska.

After being rejected from Harvard Business School, Buffett was accepted into and attended Columbia Business School.

While in New York, he opted to stay at a local YMCA for free rather than paying for room and board.

While in New York, he opted to stay at a local YMCA for free rather than paying for room and board.

Buffett returned to the University of Nebraska after graduating from Columbia to study public speaking and teach a course on Investing.

It was there that his former professor and mentor Benjamin Graham offered him a job as an Investment Salesman and Securities Analyst.

It was there that his former professor and mentor Benjamin Graham offered him a job as an Investment Salesman and Securities Analyst.

By the time he was 26, Buffett had accumulated over $174,000 in savings.

That's just over $1.5M today.

In 1956, he launched his investment company Buffett Partnership.

He put in $100 of his own & raised $10,000 from ten doctors.

That's just over $1.5M today.

In 1956, he launched his investment company Buffett Partnership.

He put in $100 of his own & raised $10,000 from ten doctors.

The company focused on growing wealth by investing in businesses with proven earning potential and tangible assets.

His most influential deal was the acquisition of Berkshire Hathaway in 1964.

His most influential deal was the acquisition of Berkshire Hathaway in 1964.

At the time, Berkshire Hathaway was a struggling textile company.

Buffett continued operations after taking control, but knew he would need to shift focus towards investing in other companies.

By 1985, the textile biz was liquidated and BH was established as a holding company.

Buffett continued operations after taking control, but knew he would need to shift focus towards investing in other companies.

By 1985, the textile biz was liquidated and BH was established as a holding company.

Buffet grew Berkshire Hathaway by buying equity in undervalued companies for the purpose of long-term holding.

Insurance companies make up a good chunk of BH’s portfolio but Buffett has diversified with non-financial brands as well.

Insurance companies make up a good chunk of BH’s portfolio but Buffett has diversified with non-financial brands as well.

Here are many of Berkshire Hathaway's companies:

• Benjamin Moore

• Brooks

• Duracell

• Fruit of the Loom

• GEICO

• Dairy Queen

• Kraft Heinz

• NetJets

And largest investments:

• Bank of America

• Apple

• Coca-Cola

• Verizon

• AmEx

• GM

• Kroger

• Benjamin Moore

• Brooks

• Duracell

• Fruit of the Loom

• GEICO

• Dairy Queen

• Kraft Heinz

• NetJets

And largest investments:

• Bank of America

• Apple

• Coca-Cola

• Verizon

• AmEx

• GM

• Kroger

Berkshire Hathaway is successful for 3 reasons:

1) Buffett’s investment philosophy

2) Insurance float

3) Lack of dividends

1) Buffett’s investment philosophy

2) Insurance float

3) Lack of dividends

BUFFETT'S PHILOSOPHY

Focus, patience, track record.

Warren stays in his circles of competence: financials & consumer staples.

Warren is patient AF. He lets his investments do the talking over decades not days.

Warren invests in proven businesses with cash flow & moats.

Focus, patience, track record.

Warren stays in his circles of competence: financials & consumer staples.

Warren is patient AF. He lets his investments do the talking over decades not days.

Warren invests in proven businesses with cash flow & moats.

INSURANCE FLOAT

Float = $ insurance companies receive as premiums, but haven't been paid out as claims.

This money can be invested.

Sitting at over $138B, Berkshire Hathaway’s float is the biggest in the world and allows them to quickly acquire and revitalize ailing brands.

Float = $ insurance companies receive as premiums, but haven't been paid out as claims.

This money can be invested.

Sitting at over $138B, Berkshire Hathaway’s float is the biggest in the world and allows them to quickly acquire and revitalize ailing brands.

NO DIVIDENDS

Shares of Berkshire Hathaway do not pay out dividends.

Buffett believes this money can be better spent reinvesting in the companies BH controls.

+ this strategy encourages long-term investors in BH.

Shares of Berkshire Hathaway do not pay out dividends.

Buffett believes this money can be better spent reinvesting in the companies BH controls.

+ this strategy encourages long-term investors in BH.

Despite the immense success of Berkshire Hathaway and a $108bn net worth, Buffett maintains a humble lifestyle.

He loves to eat at McDonalds.

He’s lived in the same house since 1958.

He averages five cans of coke per day.

He drives a used car.

He loves to eat at McDonalds.

He’s lived in the same house since 1958.

He averages five cans of coke per day.

He drives a used car.

THE PUNCHLINE: By picking great businesses and great stocks, you can deliver outsized results if you invest for the long-term.

And by delivering outsized results while explaining things simply & maintaining humility, you can build a legacy for the long-term.

And by delivering outsized results while explaining things simply & maintaining humility, you can build a legacy for the long-term.

If you enjoyed this thread & want to see future breakdowns of big businesses follow me on Twitter!

@businessbarista

@businessbarista

• • •

Missing some Tweet in this thread? You can try to

force a refresh