1/ Little v “value” vs Valuation Investing

Little v “value” investing focuses on buying cheap stocks Example: High B/P

Valuation investing focuses on buying undervalued, stocks trading below intrinsic value

Let’s explore the differences

#ValueInvesting

#ValuationDriven

🧵👇

Little v “value” investing focuses on buying cheap stocks Example: High B/P

Valuation investing focuses on buying undervalued, stocks trading below intrinsic value

Let’s explore the differences

#ValueInvesting

#ValuationDriven

🧵👇

2/ Little v “value” investing buys accounting variables such as book equity cheap relative to a stock’s price

But:

Value is monetary worth

Cheap is relatively low in cost

Little v “value” is Cheapness investing, not true Value investing

But:

Value is monetary worth

Cheap is relatively low in cost

Little v “value” is Cheapness investing, not true Value investing

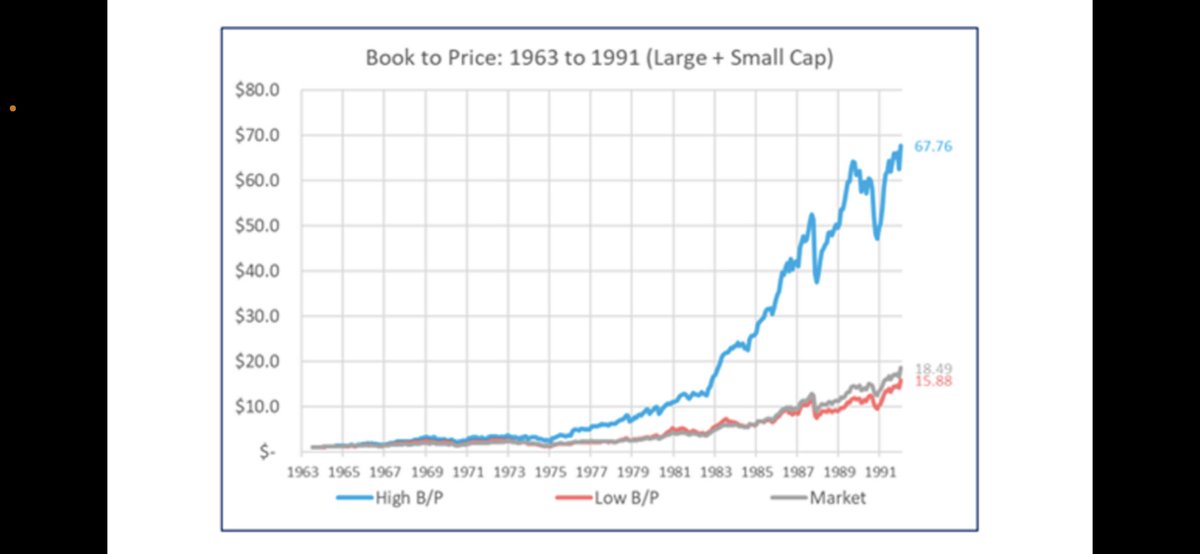

3/ Cheapness investing spawned an industry through a seminal paper from Fama/French in 1992.

It documented amazing results to buying high book to price stocks from ‘63/‘91

In the study high b/p portfolios literally printed $

Trillions of $ chased the published results since

It documented amazing results to buying high book to price stocks from ‘63/‘91

In the study high b/p portfolios literally printed $

Trillions of $ chased the published results since

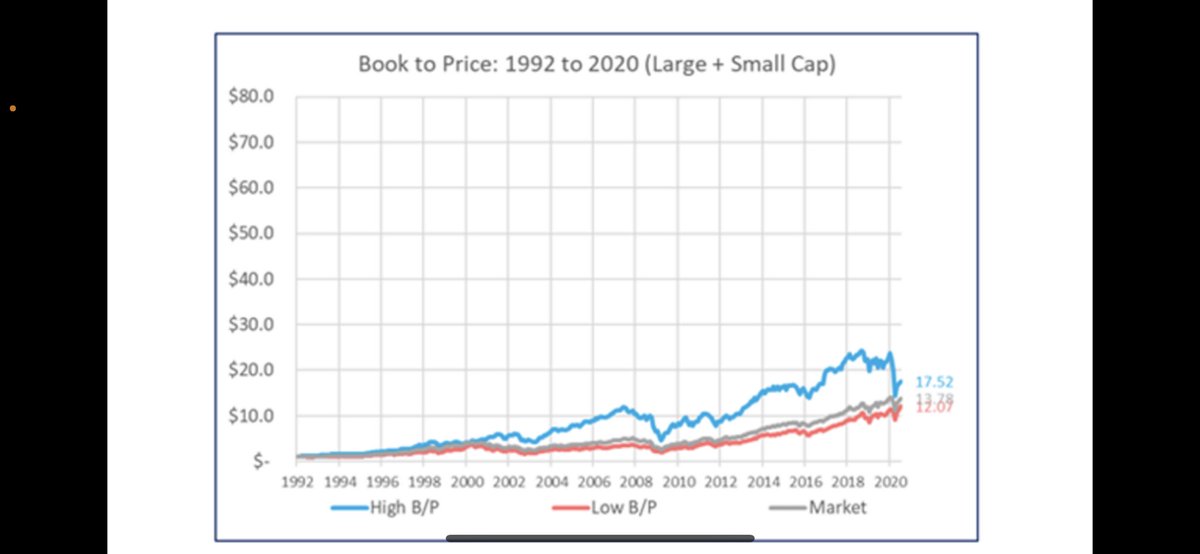

4/ Houston we have a problem…

While the high B/P stock strategy performance WAS amazing, it was born in hindsight

🤔 funny that..

Since ‘91, B/P has not been nearly as effective

Now research struggles to justify B/P or adds “new” & “improved” factors but ignores Valuation

While the high B/P stock strategy performance WAS amazing, it was born in hindsight

🤔 funny that..

Since ‘91, B/P has not been nearly as effective

Now research struggles to justify B/P or adds “new” & “improved” factors but ignores Valuation

5/ It was easy to get excited viewing Fama/French B/P results as they were really amazing during the study period

But out of sample, when answers were not known in advance, (real life), “value” investing has not impressed

“Investing is a hard way to make an easy living”

But out of sample, when answers were not known in advance, (real life), “value” investing has not impressed

“Investing is a hard way to make an easy living”

6/ Intrinsic Value

Few would argue that if one had perfect intrinsic value estimates for stocks, riches follow

Of course no one has such data, so investment research is all about developing proxies such as B/P, E/P…

But how about estimating intrinsic value directly? We have

Few would argue that if one had perfect intrinsic value estimates for stocks, riches follow

Of course no one has such data, so investment research is all about developing proxies such as B/P, E/P…

But how about estimating intrinsic value directly? We have

7/ Little v “value” vs Valuation

The Little “v” approach provides a perspective on cheapness, not Value. But

Cheap stocks are often overvalued, while undervalued stocks often seem expensive.

Which dominates? Cheap/Expensive or Under/Over Valued

It’s an important question…

The Little “v” approach provides a perspective on cheapness, not Value. But

Cheap stocks are often overvalued, while undervalued stocks often seem expensive.

Which dominates? Cheap/Expensive or Under/Over Valued

It’s an important question…

8/ What approach works better?

There are complex statistical, as well as intuitive common sense approaches to get these answers

However, both approaches reach the same conclusion - Little v “value” independent of intrinsic value destroys wealth.

There are complex statistical, as well as intuitive common sense approaches to get these answers

However, both approaches reach the same conclusion - Little v “value” independent of intrinsic value destroys wealth.

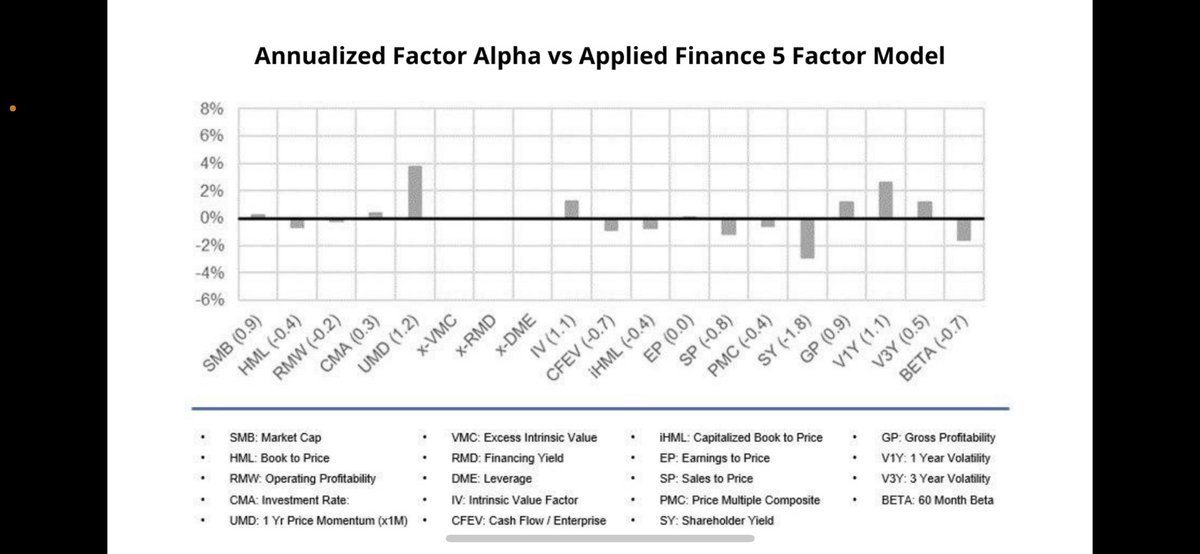

9/ Statistical Answer

The chart summarizes the confidence investors should have in the alpha to common Little v factors

The factors are so unreliable, that statistically it’s impossible to have any confidence their alpha is not = zero.

The chart summarizes the confidence investors should have in the alpha to common Little v factors

The factors are so unreliable, that statistically it’s impossible to have any confidence their alpha is not = zero.

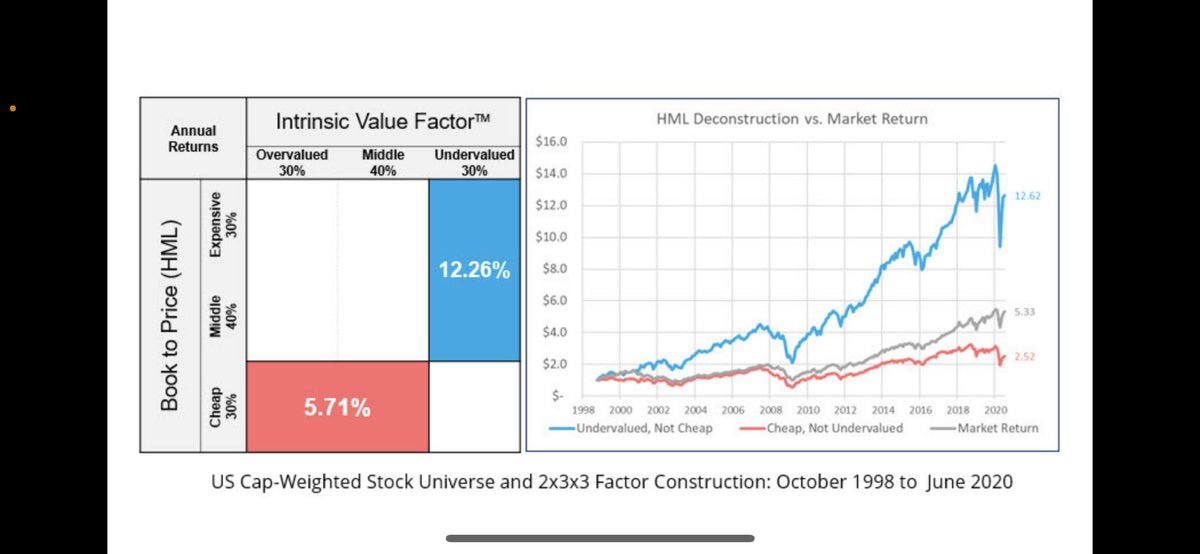

10/ Finance Thunderdome

To understand whether Little v or Valuation dominates the other is to ask

Do cheap but overvalued stocks outperformed?

Similarly we can ask do expensive but undervalued stocks outperform?

Finance Thunderdome - Two world views enter, one view leaves

To understand whether Little v or Valuation dominates the other is to ask

Do cheap but overvalued stocks outperformed?

Similarly we can ask do expensive but undervalued stocks outperform?

Finance Thunderdome - Two world views enter, one view leaves

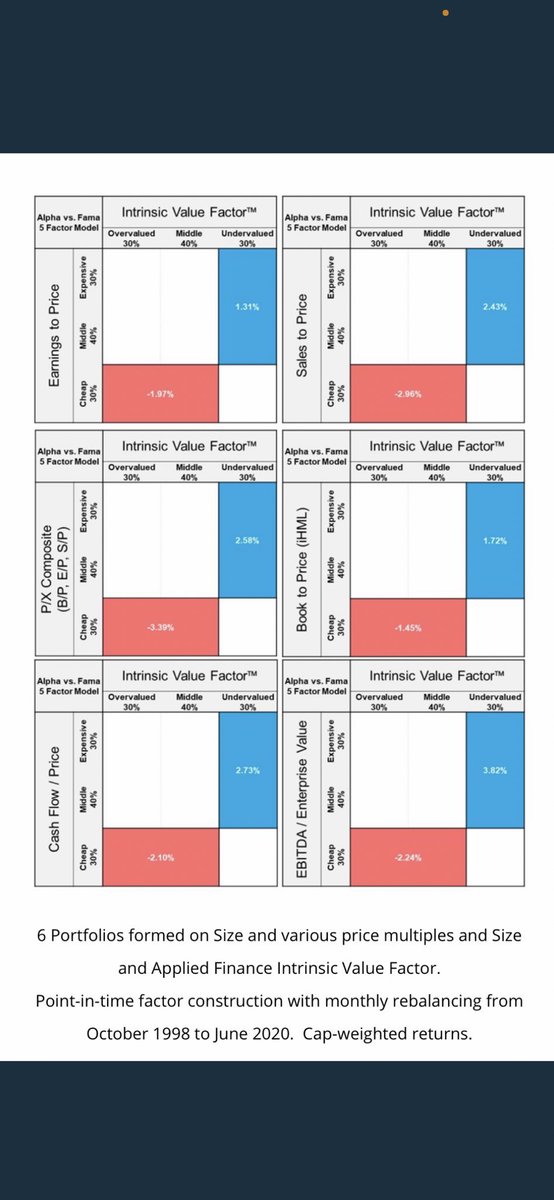

11/ Deconstructing Value™️

The charts that follow all have the same format, the universe is divided into 30/40/30 % groups, then crossed with two variables

This chart compares extreme B/P & Intrinsic Value Factor®️ groups

It’s obvious Intrinsic Value Factor®️ dominates B/P

The charts that follow all have the same format, the universe is divided into 30/40/30 % groups, then crossed with two variables

This chart compares extreme B/P & Intrinsic Value Factor®️ groups

It’s obvious Intrinsic Value Factor®️ dominates B/P

12/ Intrinsic Value Dominates Little “v” value

The Little v tribe argue that B/P is only one value proxy. Let’s look at the most popular alternatives: E/P, CF/P, S/P, & composites

Results are the same:

Intrinsic Value Factor®️ dominates Little v approaches to proxy Value

The Little v tribe argue that B/P is only one value proxy. Let’s look at the most popular alternatives: E/P, CF/P, S/P, & composites

Results are the same:

Intrinsic Value Factor®️ dominates Little v approaches to proxy Value

13/ Not Surprising

Intrinsic Value is the intersection of: Economic Profit, Growth, Risk, and Competition

Those are the forces that determine a firm’s worth.

What does last year’s book value or sales tell us about the next 40 years?

Obviously very little as the data shows

Intrinsic Value is the intersection of: Economic Profit, Growth, Risk, and Competition

Those are the forces that determine a firm’s worth.

What does last year’s book value or sales tell us about the next 40 years?

Obviously very little as the data shows

14/ Valuation

Available information for insightful valuation analysis is very thin and sketchy.

Few “experts” have sufficient data to show their skill, yet speak with authority.

We will change that dynamic soon…

If this interests you - retweet, and follow me @rresendes

Available information for insightful valuation analysis is very thin and sketchy.

Few “experts” have sufficient data to show their skill, yet speak with authority.

We will change that dynamic soon…

If this interests you - retweet, and follow me @rresendes

15 Notes

The data & concepts I reference are more fully developed in the following research reports (titles abbreviated) found at AppliedFinance.com

Valuation Beta tinyurl.com/ekt6cxe4

Quant Val Broken tinyurl.com/4r7xu3kc

End Multiples tinyurl.com/5fbs8k49

End

The data & concepts I reference are more fully developed in the following research reports (titles abbreviated) found at AppliedFinance.com

Valuation Beta tinyurl.com/ekt6cxe4

Quant Val Broken tinyurl.com/4r7xu3kc

End Multiples tinyurl.com/5fbs8k49

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh