True Gem on #ShitManagementSays from Motherson Sumi 3QFY21 Presentation, emptiest words ever:

"Industry outlook: OEMs continue to work with suppliers, given challenges in supply of certain critical components"

Wut?

"Industry outlook: OEMs continue to work with suppliers, given challenges in supply of certain critical components"

Wut?

Magna (MGA) is the closest peer to Motherson Sumi - offers the same products to same customers. No wonder their margins track each other.

Both reported multi-year high margins in Dec Qtr but note the sharp QoQ fall in MGA margins Mar Qtr as input cost benefits prove temporary.

Both reported multi-year high margins in Dec Qtr but note the sharp QoQ fall in MGA margins Mar Qtr as input cost benefits prove temporary.

Magna is four times bigger compared to Motherson on sales & has structurally had better margins than the latter. So, its a much more formidable player. Still Magna trades at EV/EBITDA of 6-7x vs. Motherson at 13-14x!

Trade away as you wish but don't forget the big picture

Trade away as you wish but don't forget the big picture

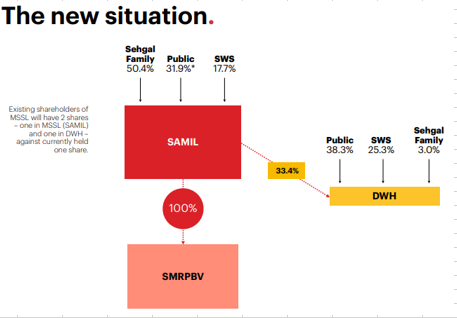

Has anyone worked out Motherson Sumi's number post restructuring?

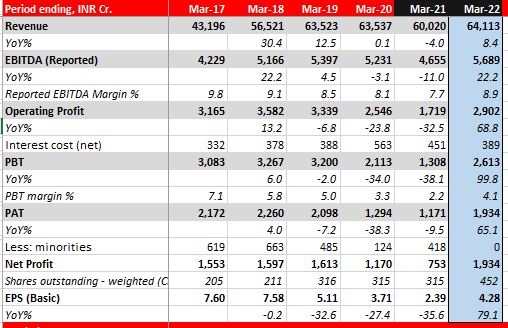

I am bit confused but this is unlikely to be an EPS accretive business. Net Profit likely 20% higher than previous record in 2019 but shares count increasing by 43%! EPS ~ 4.2-4.5/share

I am bit confused but this is unlikely to be an EPS accretive business. Net Profit likely 20% higher than previous record in 2019 but shares count increasing by 43%! EPS ~ 4.2-4.5/share

2 parts to be valued in Motherson post-restructuring:

1) Domestic Wiring biz: Each shareholder gets a share of DWH for a share of Motherson

2) Residual biz: To acquire 49% promoter stake in the International biz as well as other promoter biz 👇with Consol. EBITDA of 126Cr in FY20

1) Domestic Wiring biz: Each shareholder gets a share of DWH for a share of Motherson

2) Residual biz: To acquire 49% promoter stake in the International biz as well as other promoter biz 👇with Consol. EBITDA of 126Cr in FY20

Valuing the Domestic Wiring Biz (DWH) is easy. 750-800Cr of annual EBITDA valued at EV/EBITDA of, say, 15x.

This will get you to EV of 12,000Cr or a market cap of about 11,000Cr. Splitting it into 315Cr outstanding shares, every share holder gets a DWH share worth 35/share

This will get you to EV of 12,000Cr or a market cap of about 11,000Cr. Splitting it into 315Cr outstanding shares, every share holder gets a DWH share worth 35/share

The non-DWH biz of Motherson (to be named SAMIL) will acquire 49% stake in SMRPBV as well as some other entities from the promoters by issuing 136.5Cr new shares to promoters . This will bring the total shares in SAMIL to 452Cr

Estimated SAMIL (Motherson ex-DWH ) to have FY22 EBITDA/Net Profit about 10/20% higher than last record reflecting continued growth in SMRPBV (was already consolidated) & new businesses with annual EBITDA of around 130Cr but the resulting dilution gets me to EPS of only 4.28

👆 Even if I value SAMIL (Motherson ex-DWH) at EV/EBITDA of 14x (twice the valuation of Magna International, its closest peer) which is about FY22 PE of 40x, I get to a share price of only about 170/share!

To summarize, Motherson Sumi worth 244/share will be split into:

1) Domestic Hiring Biz (DWH) of 35/share (EV/EBITDA~15x) and

2) SAMIL potentially valued at 170/share (EV/EBITDA~14x, twice that of peer Magna International)

Anyone else got any views on restructuring?

1) Domestic Hiring Biz (DWH) of 35/share (EV/EBITDA~15x) and

2) SAMIL potentially valued at 170/share (EV/EBITDA~14x, twice that of peer Magna International)

Anyone else got any views on restructuring?

@threadreaderapp unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh