Tech/Autos analyst at Global Energy Transition L/S fund; Ex-HSBC analyst; IIT-B+ Nanyang MBA; In the long term, we're all dead!

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/_ThirdSide_/status/1482291855463424002Consumer discretionary stocks have seen a lot more multiple expansion in last 5 years as compared to staples; probably not a bad time to rotate out of them back into Staples (ex-ITC); I don't like ITC if anyone cares; stocks like these break hard when big sell-down comes

Magna (MGA) is the closest peer to Motherson Sumi - offers the same products to same customers. No wonder their margins track each other.

Magna (MGA) is the closest peer to Motherson Sumi - offers the same products to same customers. No wonder their margins track each other.

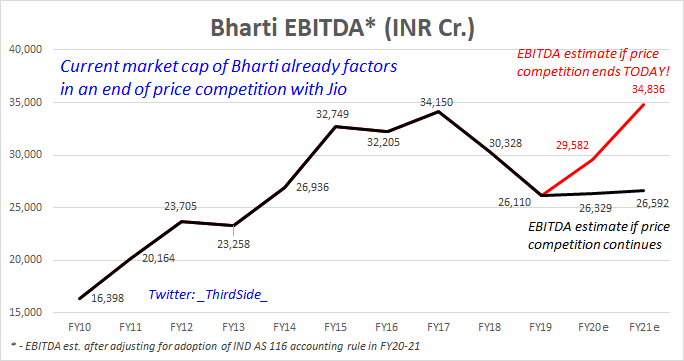

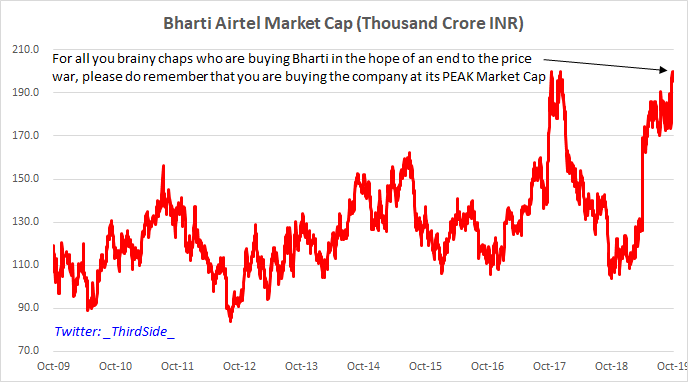

Oh! did I mention that the current PEAK market cap of Bharti Airtel already factors in an end of price competition with Jio (as if it ended today) BUT has the competition ended? And, what's the Jio management repeatedly saying? #Nifty #BigShort?

Oh! did I mention that the current PEAK market cap of Bharti Airtel already factors in an end of price competition with Jio (as if it ended today) BUT has the competition ended? And, what's the Jio management repeatedly saying? #Nifty #BigShort?