Nubank is the biggest digital bank in the world.

- 40 million users

- $1.5B in projected revenue

- Growing +100% annually

- Disrupting lazy incumbents

It’s a story that could only have happened in Brazil.

readthegeneralist.com/briefing/nuban…

- 40 million users

- $1.5B in projected revenue

- Growing +100% annually

- Disrupting lazy incumbents

It’s a story that could only have happened in Brazil.

readthegeneralist.com/briefing/nuban…

/1

David Vélez founded Nubank in 2013.

Most people thought he was crazy to try and build a neobank in Brazil. Why?

Because of the “Big Five,” incumbent banks with huge control.

David Vélez founded Nubank in 2013.

Most people thought he was crazy to try and build a neobank in Brazil. Why?

Because of the “Big Five,” incumbent banks with huge control.

/2

Stats on the Big Five:

- Controlled +80% of assets

- Held +85% of loans

- Interest rates of up to 450% per year (!)

These banks had oligopolistic power, as well as regulatory and political influence. Trying to disrupt them was considered as possible.

Stats on the Big Five:

- Controlled +80% of assets

- Held +85% of loans

- Interest rates of up to 450% per year (!)

These banks had oligopolistic power, as well as regulatory and political influence. Trying to disrupt them was considered as possible.

/3

Vélez disagreed.

He realized that consumers hated these banks, both for the exorbitant fees/interest and the terrible service. They had so much power that they’d gotten lazy.

He thought they could be disrupted.

Vélez disagreed.

He realized that consumers hated these banks, both for the exorbitant fees/interest and the terrible service. They had so much power that they’d gotten lazy.

He thought they could be disrupted.

/4

It didn’t hurt that Vélez had the education and experience to challenge the status quo.

Before starting Nubank, he’d worked for Sequoia, trying to build a presence in Brazil. Though that didn’t work — the ecosystem was too immature — he knew what made great companies.

It didn’t hurt that Vélez had the education and experience to challenge the status quo.

Before starting Nubank, he’d worked for Sequoia, trying to build a presence in Brazil. Though that didn’t work — the ecosystem was too immature — he knew what made great companies.

/5

Sequoia agreed to invest in Vélez’s idea, though apparently, it wasn’t unanimous. They also had a precondition: he had to find a Latam investor to co-lead.

Kaszek Ventures, founded by ex-Meli leaders, jumped aboard. Each firm put in $1M.

Sequoia agreed to invest in Vélez’s idea, though apparently, it wasn’t unanimous. They also had a precondition: he had to find a Latam investor to co-lead.

Kaszek Ventures, founded by ex-Meli leaders, jumped aboard. Each firm put in $1M.

/6

Sequoia also wanted Vélez to add some co-founders, particularly with banking experience. Roelof Botha was apparently adamant on this point.

Vélez delivered. He brought in Cris Junqueira, an exec with credit card experience & Ed Wible, a killer engineer.

The team was set.

Sequoia also wanted Vélez to add some co-founders, particularly with banking experience. Roelof Botha was apparently adamant on this point.

Vélez delivered. He brought in Cris Junqueira, an exec with credit card experience & Ed Wible, a killer engineer.

The team was set.

/7

Rather than get a swanky office, Vélez had the team work out of a small house on “California Street” in Sao Paulo.

It was essentially a Palo-Alto-style hacker house. That created a scrappy culture that hasn’t left the company.

Rather than get a swanky office, Vélez had the team work out of a small house on “California Street” in Sao Paulo.

It was essentially a Palo-Alto-style hacker house. That created a scrappy culture that hasn’t left the company.

/8

Initially, Vélez expected Nu to be a sales-driven organization.

During his days investing, he’d gotten to know Nigel Morris, founder of Capital One. Morris had turned C1 into a giant through incredible customer targeting.

Vélez planned to do the same. He hired marketers.

Initially, Vélez expected Nu to be a sales-driven organization.

During his days investing, he’d gotten to know Nigel Morris, founder of Capital One. Morris had turned C1 into a giant through incredible customer targeting.

Vélez planned to do the same. He hired marketers.

/9

As it turned out, Nubank didn’t need them.

Consumers loved Nu’s first product: a purple credit card you could get thru your mobile phone. That was a huge upgrade over the traditional process of visiting a bank branch 3-4 times.

The product went viral.

As it turned out, Nubank didn’t need them.

Consumers loved Nu’s first product: a purple credit card you could get thru your mobile phone. That was a huge upgrade over the traditional process of visiting a bank branch 3-4 times.

The product went viral.

/10

Nubank rode that initial wave incredibly well, but regulatory issues almost forced them to shut down in 2016.

The Big Five lobbied to change the country’s credit deadlines, which would have put Nubank out of business.

Customers revolted and regulators sided with Nubank.

Nubank rode that initial wave incredibly well, but regulatory issues almost forced them to shut down in 2016.

The Big Five lobbied to change the country’s credit deadlines, which would have put Nubank out of business.

Customers revolted and regulators sided with Nubank.

/11

Over time, Nubank has added a ton of new products to its suite.

- Credit card

- Checking account

- Investing

- Loans

- Rewards

- Business account

Over time, Nubank has added a ton of new products to its suite.

- Credit card

- Checking account

- Investing

- Loans

- Rewards

- Business account

/12

Nu’s product strategy is simple but effective.

Start with high-frequency products (credit cards), establish a consumer relationship, then layer on higher margin products (insurance).

This eventually skews LTV: CAC favorably.

Nu’s product strategy is simple but effective.

Start with high-frequency products (credit cards), establish a consumer relationship, then layer on higher margin products (insurance).

This eventually skews LTV: CAC favorably.

13/

This eventually skews LTV: CAC favorably. Today…

- $9 CAC

- $305 LTV (and rising)

- 34x ratio

Impressive.

This eventually skews LTV: CAC favorably. Today…

- $9 CAC

- $305 LTV (and rising)

- 34x ratio

Impressive.

/14

Ok, so the numbers are good. What about management?

- Vélez is a beast. Hyper-disciplined and visionary.

- Junqueira is the drill sergeant. Keeps the team ticking.

- Wible runs a tight engineering team.

Very strong team by all accounts.

Ok, so the numbers are good. What about management?

- Vélez is a beast. Hyper-disciplined and visionary.

- Junqueira is the drill sergeant. Keeps the team ticking.

- Wible runs a tight engineering team.

Very strong team by all accounts.

/15

Nubank does competition.

The Big 5 have improved their offerings and are becoming more tech-savvy.

But Nubank's model is so different. No physical branches, and lower headcount.

That gives them 95% lower opex.

Nubank does competition.

The Big 5 have improved their offerings and are becoming more tech-savvy.

But Nubank's model is so different. No physical branches, and lower headcount.

That gives them 95% lower opex.

/16

Nubank has tech challengers, too. Some interesting ones…

- Mercado Pago

- Stone Co

- XP

- Totvs

Each has unique advantages. Some seem better equipped to offer credit given proprietary data streams.

Nubank has tech challengers, too. Some interesting ones…

- Mercado Pago

- Stone Co

- XP

- Totvs

Each has unique advantages. Some seem better equipped to offer credit given proprietary data streams.

/17

Pago is particularly scary. In last week's piece, I talked about how Meli's offering "forks" into many different spaces.

Meli is a great, tech-native operator. Very different to the Big 5.

Pago is particularly scary. In last week's piece, I talked about how Meli's offering "forks" into many different spaces.

https://twitter.com/mariodgabriele/status/1394017764973498368

Meli is a great, tech-native operator. Very different to the Big 5.

/18

Nubank is already the 2nd-most valuable private fintech in the world, valued at $25 billion. (Behind Stripe.)

It still has a ton of opportunities in Brazil but it wants to go regional. In the last 2 years, it’s expanded to Mexico and Colombia.

Is that a good idea?

Nubank is already the 2nd-most valuable private fintech in the world, valued at $25 billion. (Behind Stripe.)

It still has a ton of opportunities in Brazil but it wants to go regional. In the last 2 years, it’s expanded to Mexico and Colombia.

Is that a good idea?

/19

Unclear.

Though businesses like Meli have made it look easy, regional expansion requires an understanding of different customs, competitions, and regulations.

Even some members of the Big 5 have struggled outside of Brazil.

Unclear.

Though businesses like Meli have made it look easy, regional expansion requires an understanding of different customs, competitions, and regulations.

Even some members of the Big 5 have struggled outside of Brazil.

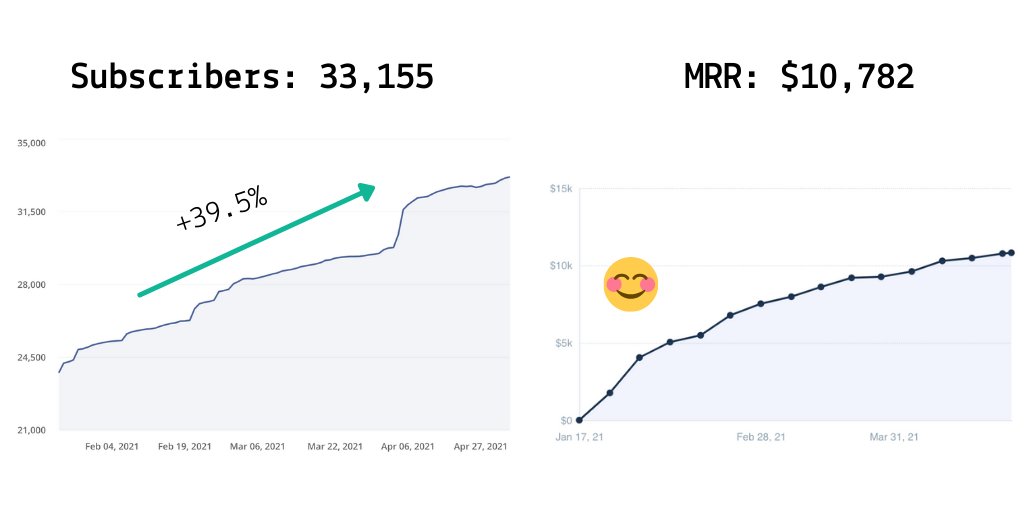

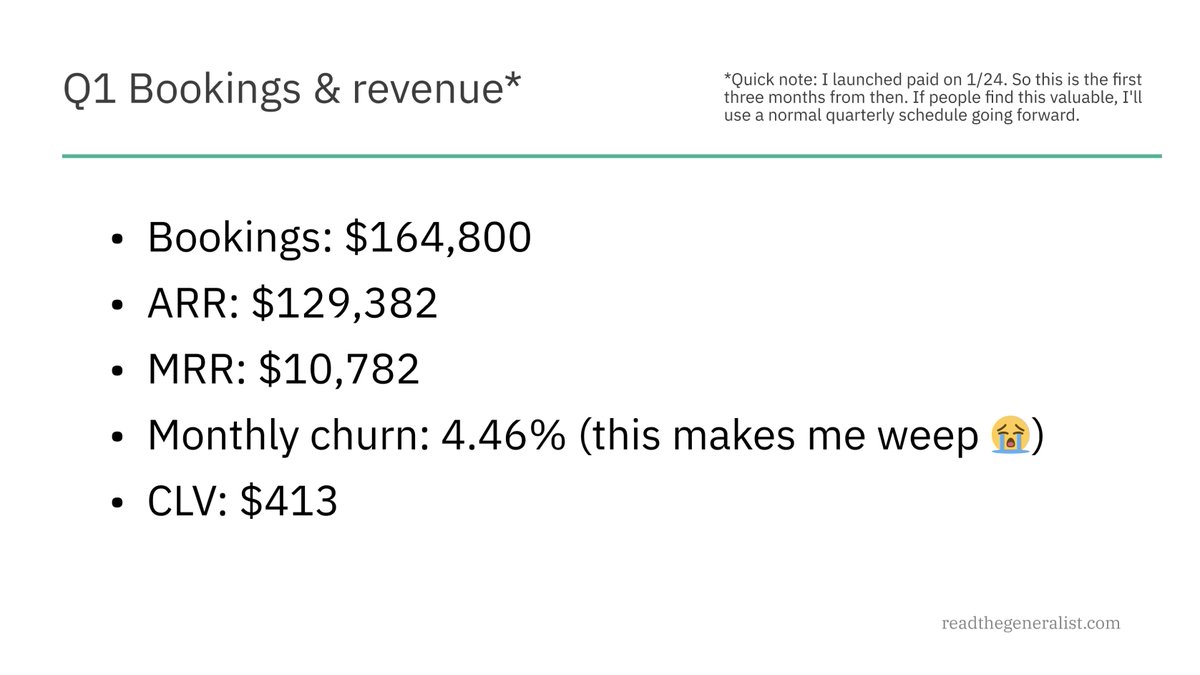

This was one of my favorite pieces to write. I had the chance to talk with some impressive investors and sources — I think that shows.

Join +35,000 by subscribing, and become a member to unlock exclusive briefings like this one.

readthegeneralist.com/briefing/nuban…

Join +35,000 by subscribing, and become a member to unlock exclusive briefings like this one.

readthegeneralist.com/briefing/nuban…

• • •

Missing some Tweet in this thread? You can try to

force a refresh