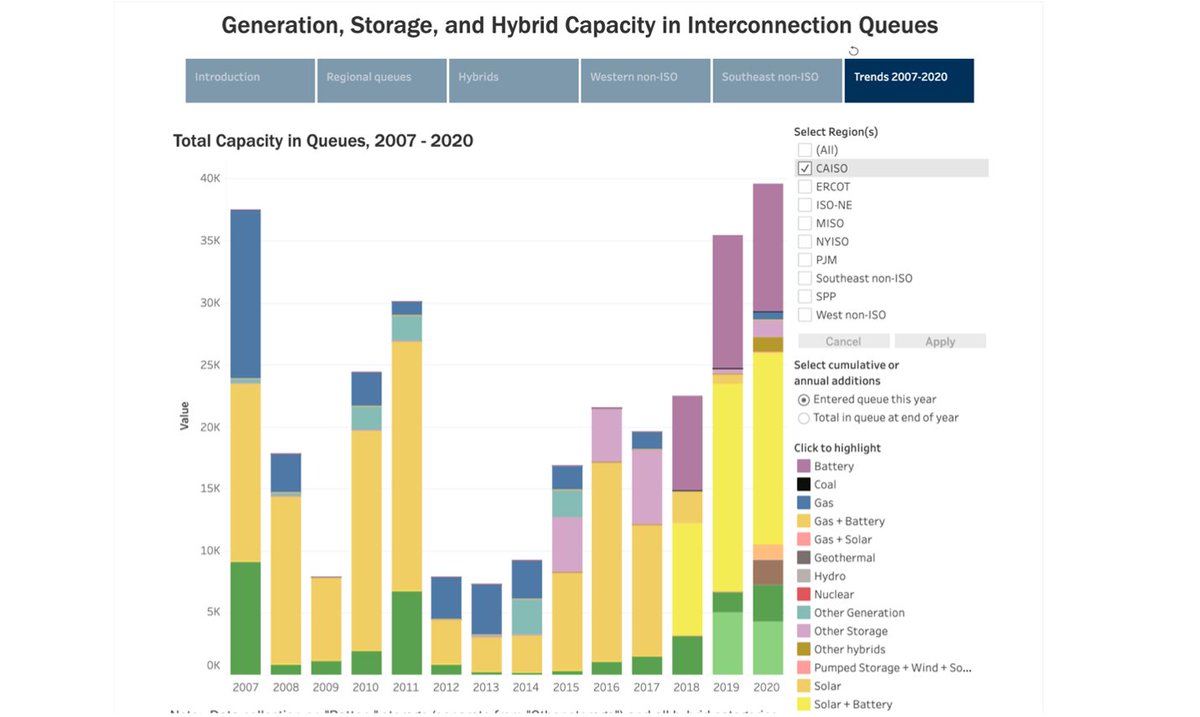

We have new data on utility interconnection queues! THREAD! There is now over 750 GW of generation and 200 GW of storage capacity in interconnection queues in the US – a new record. For full data and more, see QUEUED UP at emp.lbl.gov/publications/q…. 1/x

To put that in perspective, the US had a total of 1,117 GW of utility-scale capacity operating last year. While not all projects will get built, it shows strong commercial interest in new development. See the interactive data visualization at emp.lbl.gov/publications/q… 2/x

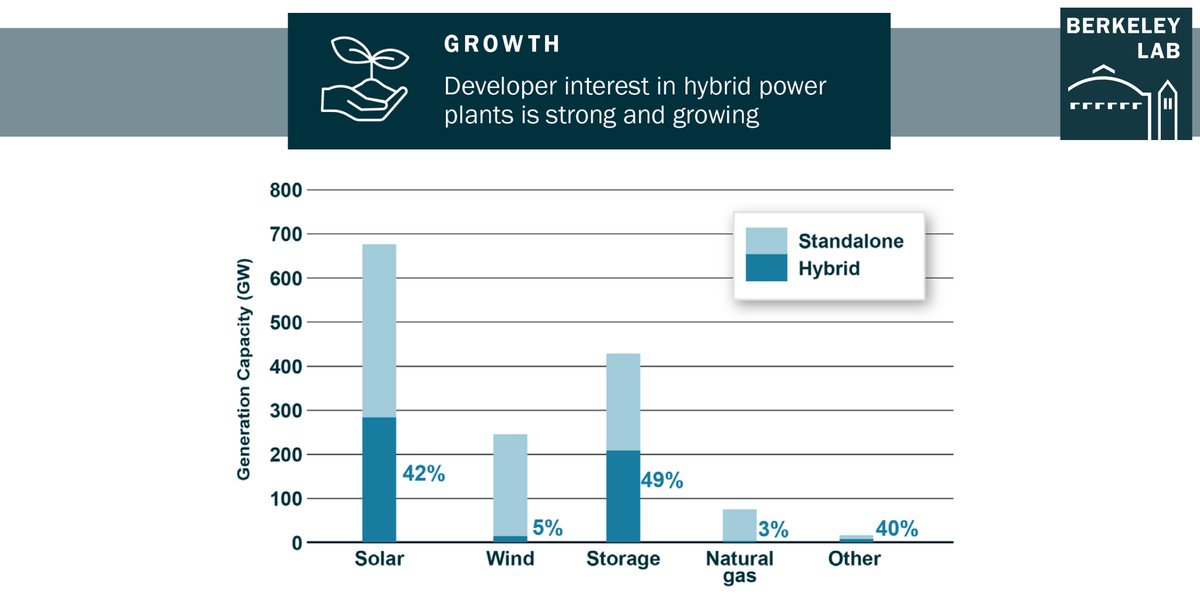

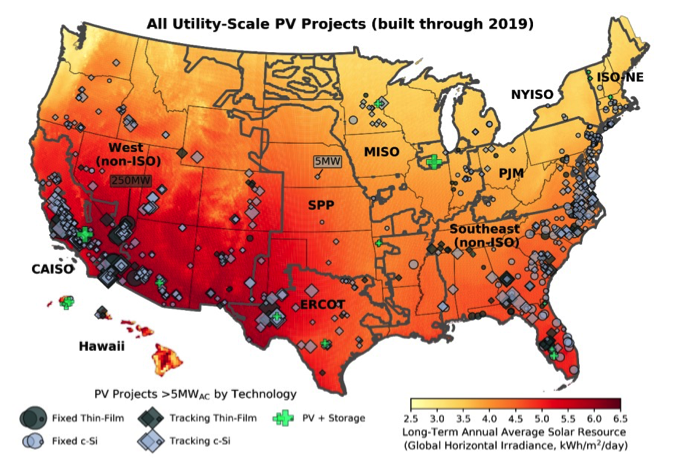

Solar and wind dominate the queues. Solar is booming, and increasingly paired with storage. Wind queues are consistent around 200 GW, while gas projects in queues have declined. Including estimated battery capacity for some hybrid projects, proposed storage exceeds 200 GW. 3/x

Over half of proposed capacity is for solar or solar+storage projects. PJM and MISO saw the most newly proposed solar in 2020 while queues in California and the West are dominated by hybrid solar+storage and standalone batteries. 4/x

Wind is still booming in most regions. Now offshore wind projects account for 29% of wind capacity in queues, with 61 GW of projects proposed, mostly along the East Coast.

For full data and more, see emp.lbl.gov/publications/q…. 5/x

For full data and more, see emp.lbl.gov/publications/q…. 5/x

Unlike solar and storage, proposed natural gas power capacity has declined in most regions. The Southeast region is a notable exception – where nearly 40 GW of gas capacity is in development. For full data and more, see emp.lbl.gov/publications/q…. 6/x

Hybrid gen + storage projects are getting more common. Over 1/3 of proposed solar capacity is paired with batteries, and over half of proposed battery capacity is paired with generation. This is most true in the West, where hybrid projects outweigh solar-only by 3 to 1. 7/x

The hybrid trend is accelerating in the West. @California_ISO saw over 15 GW of solar + storage hybrids enter the queue in 2020, compared to only 5 MW of standalone solar, and 10 GW of standalone batteries. See our interactive data viz at emp.lbl.gov/generation-sto… 8/x

But how many will get built? We looked back at five RTOs and found only 24% of queued projects in 2000-2015 were built. Completion rates have declined since and are lower for wind and solar. Wait times are on the rise, from ~1.9 years in the 2000s to ~3.5 years in the 2010s. 9/x

For the full details on QUEUED UP, our data roundup of power generation capacity in grid interconnection queues, see a slide deck, data sets and interactive data tool at emp.lbl.gov/publications/q… /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh