2020 SOMA annual report is worth the wait!!!

so good

so good

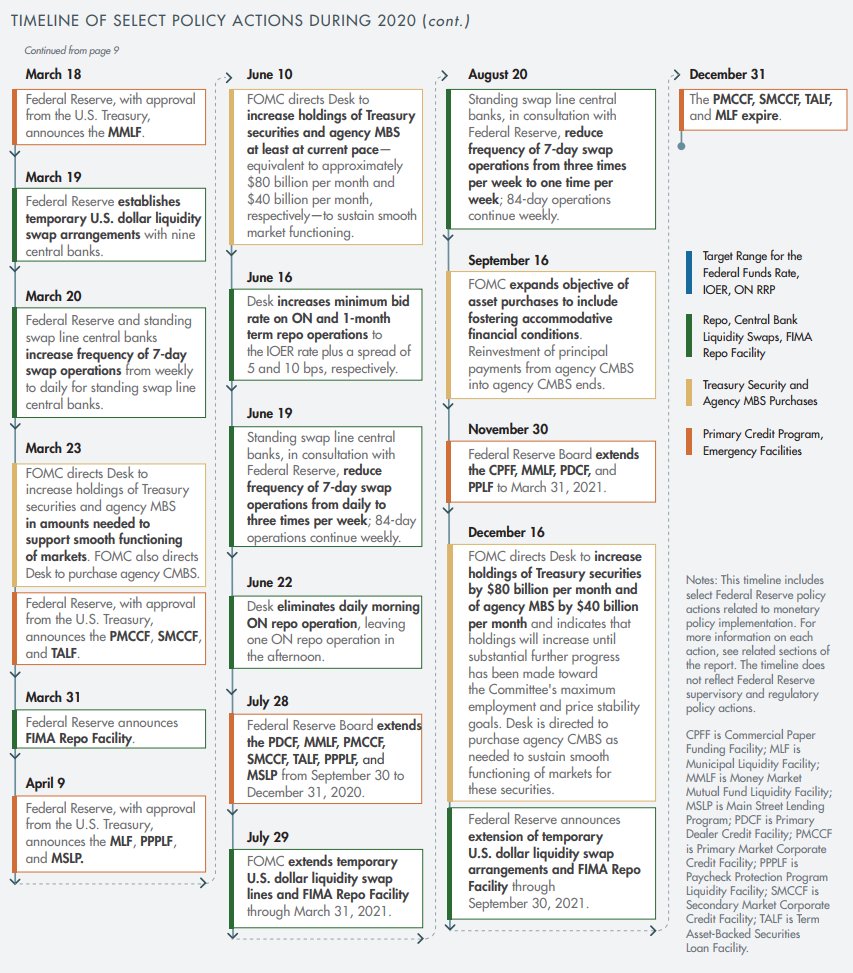

There is a covert Operation Twist hidden here. Will explain how it works and the magnitude of it in a fed.tips article hopefully this weekend.

these cyan bars in 2020 were genuine money printing that contributed to inflation quickly (i.e. lumber price).

BAC matched it dollar by dollar in 2nd half of 2020.

so 2x the amount shown here.

BAC matched it dollar by dollar in 2nd half of 2020.

so 2x the amount shown here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh