Risk Free Projection (RFP) Ver. 2.0

RFP basically a way where we can reduce/remove our losses from position but it can be only possible by time and profit running only. This is also subpart of Time-Warp option strategy. Lets explore in detail

RFP basically a way where we can reduce/remove our losses from position but it can be only possible by time and profit running only. This is also subpart of Time-Warp option strategy. Lets explore in detail

https://twitter.com/sanjufunda/status/1307136977129660416

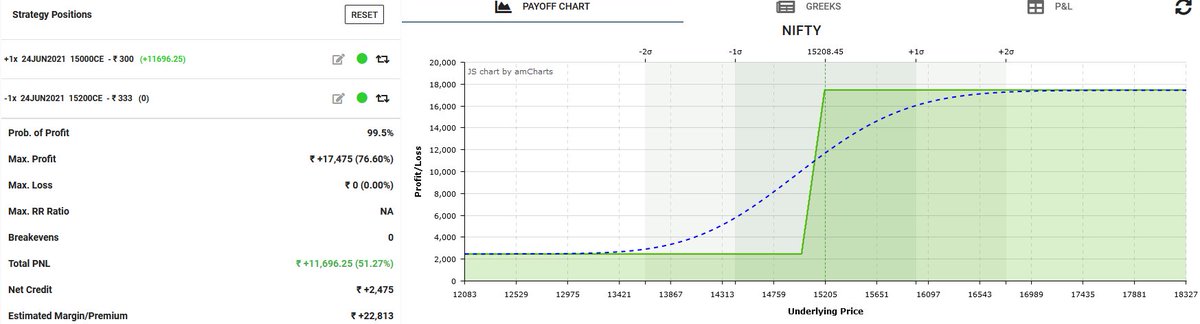

1. Locking Profit

When your long call/put position already in profit then simple buy hedge (convert to spread). this addon make spread formation where ur loss almost offset. advice only do when 50% premium gain and view still sideways to directional.

When your long call/put position already in profit then simple buy hedge (convert to spread). this addon make spread formation where ur loss almost offset. advice only do when 50% premium gain and view still sideways to directional.

2. Moving Leg

When you have spread and already running profit. you can even move your any leg closure and this will make almost risk free. cons- theta of position reduced; so profit potential going down with this move.

When you have spread and already running profit. you can even move your any leg closure and this will make almost risk free. cons- theta of position reduced; so profit potential going down with this move.

3. Move Overall Position

Even we move overall profitable position with time and view still directional can be done. Objective just using past profit and trying to make some more value on direction side. Cons.- if remain sideways then no meaningful.

Even we move overall profitable position with time and view still directional can be done. Objective just using past profit and trying to make some more value on direction side. Cons.- if remain sideways then no meaningful.

4. Reduce winning position size.

Its bring your delta more flat also we can hold position longer duration even after profit target hit to squeeze more theta. Mostly done if you are trading multiple set of lots.

Its bring your delta more flat also we can hold position longer duration even after profit target hit to squeeze more theta. Mostly done if you are trading multiple set of lots.

5. Extra hedge on loss side with time.

Typically when ppl trade ratio kind of setup this one can be good. Note: trading with calendar sometimes payoff can be misleading as well.

Typically when ppl trade ratio kind of setup this one can be good. Note: trading with calendar sometimes payoff can be misleading as well.

Few simple tricks can do the magic here. Objective is understanding the view and why and when to do which one is more important. every setup hv some pros and cons- with respect of margin and profit potential increasing/decreasing. So choose wisely.

Few explain process also using more often in adjustment process as well. so read it carefully. There are so many more way like profitable strangle to Ironcondor/fly conversion etc. just increase your thinking ability here more important.

Thanks!

Thanks!

• • •

Missing some Tweet in this thread? You can try to

force a refresh