#SHKhelkar conducted their conference call today at 2:00 PM

"Expected to continue the momentum (~15% growth) and improve the margins"

Here are the key takeaways 😃

"Expected to continue the momentum (~15% growth) and improve the margins"

Here are the key takeaways 😃

Business Updates:

• All the segment grew well. Acquired new customer in the domestic market.

• Net debt reduce by 132cr owing to increase in CF.

• Did the acquisition of Nova in this quarter.

• Co. focus on improving the Cash Flow generation and strengthening Balance Sheet.

• All the segment grew well. Acquired new customer in the domestic market.

• Net debt reduce by 132cr owing to increase in CF.

• Did the acquisition of Nova in this quarter.

• Co. focus on improving the Cash Flow generation and strengthening Balance Sheet.

Domestic Market (Covid)

• All the domestic segment grew well, and there was no impact on customer side in domestic market.

• Covid did had little impact over the segment, however growth momentum again picked up.

• Expected to growth 12-13% over coming year.

• All the domestic segment grew well, and there was no impact on customer side in domestic market.

• Covid did had little impact over the segment, however growth momentum again picked up.

• Expected to growth 12-13% over coming year.

Fragrance Segment:

• Won some few mid and large size FMCG.

• Improving operating leverage resulted in higher profitability YoY basis.

• Domestic market has grown well, Europe remain major contributor of growth.

• Won some few mid and large size FMCG.

• Improving operating leverage resulted in higher profitability YoY basis.

• Domestic market has grown well, Europe remain major contributor of growth.

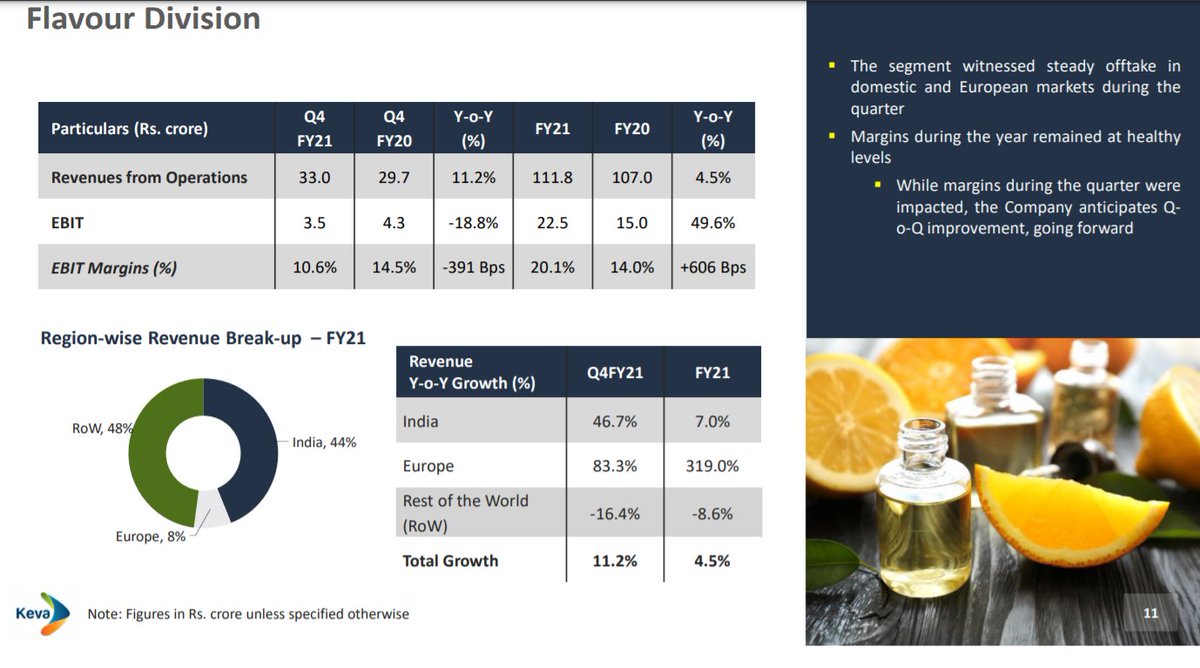

Flavour Market:

• Flavour market is expected to grow more than Fragrance market.

• Target remains 17-18% growth.

• Domestic and Europe market grew well in Q4.

+

• Flavour market is expected to grow more than Fragrance market.

• Target remains 17-18% growth.

• Domestic and Europe market grew well in Q4.

+

Nova Fragranze:

• SH has some internal sales, while incremental sales of the company stands around 10-12cr.

• Nova shares relatively higher margins and growth is expected to come in coming year.

• Effective from this quarter.

• SH has some internal sales, while incremental sales of the company stands around 10-12cr.

• Nova shares relatively higher margins and growth is expected to come in coming year.

• Effective from this quarter.

Write off:

• There are certain project which didn't worked well for the company, which has been written off.

• While there certain other new project, SH is working on increasing the CWIP.

• Certain write off expense will be carried to next year.

• There are certain project which didn't worked well for the company, which has been written off.

• While there certain other new project, SH is working on increasing the CWIP.

• Certain write off expense will be carried to next year.

CFF Segment:

• CFF segment grew at around 7-8% and is expected to grow well in Italy market.

• Target remains 9-10% growth over coming years (including Nova sales)

• CFF segment grew at around 7-8% and is expected to grow well in Italy market.

• Target remains 9-10% growth over coming years (including Nova sales)

Future Focus:

• Company has done enough capex in past and now focus remains on increasing the growth of company.

• With increasing volume margins is expected to be improve. Gross Margins target of 45% over next 5 year.

• R&D expense will increase as increase in margin.

• Company has done enough capex in past and now focus remains on increasing the growth of company.

• With increasing volume margins is expected to be improve. Gross Margins target of 45% over next 5 year.

• R&D expense will increase as increase in margin.

Isobionics:

• Sandalwood oil is unique product. Typically trees take 15-16 years and there is risk of bio-diversity.

• With this SH has tied up with Santalol, which is made other organic product.

• Guideline: 25 cr with 10% margin, and 7-8% net margin.

• Sandalwood oil is unique product. Typically trees take 15-16 years and there is risk of bio-diversity.

• With this SH has tied up with Santalol, which is made other organic product.

• Guideline: 25 cr with 10% margin, and 7-8% net margin.

Debt:

• In coming 2-3 years co. would be looking much on becoming debt free. However target remains to generate enough CF to be net debt positive.

• If co. dont find any good good acquisition, then there would be focus on reducing the debt.

• Much of the debt is at lower rate.

• In coming 2-3 years co. would be looking much on becoming debt free. However target remains to generate enough CF to be net debt positive.

• If co. dont find any good good acquisition, then there would be focus on reducing the debt.

• Much of the debt is at lower rate.

For more discussion on Equity research and OI analysis

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh