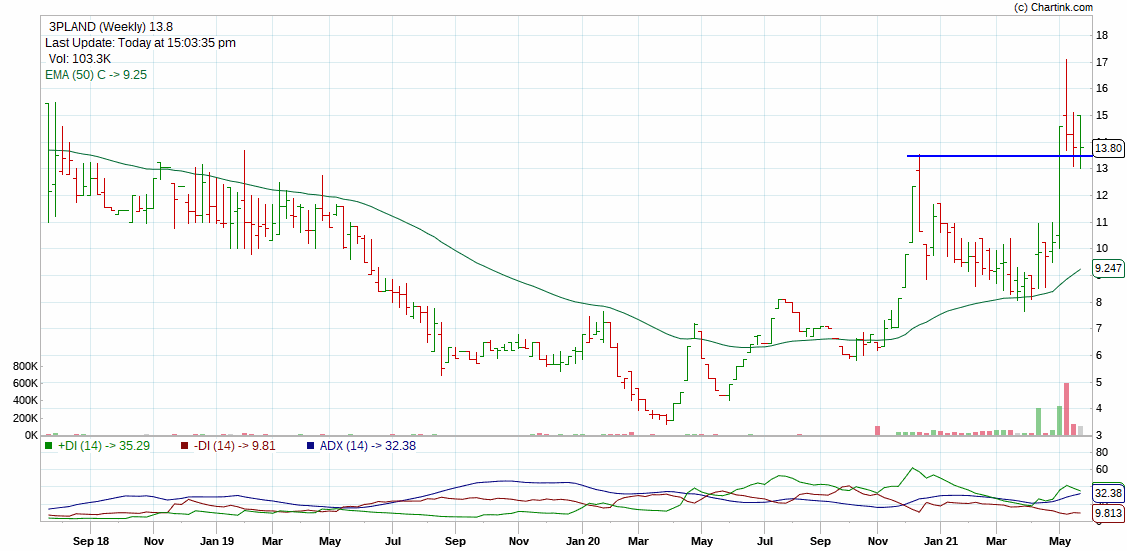

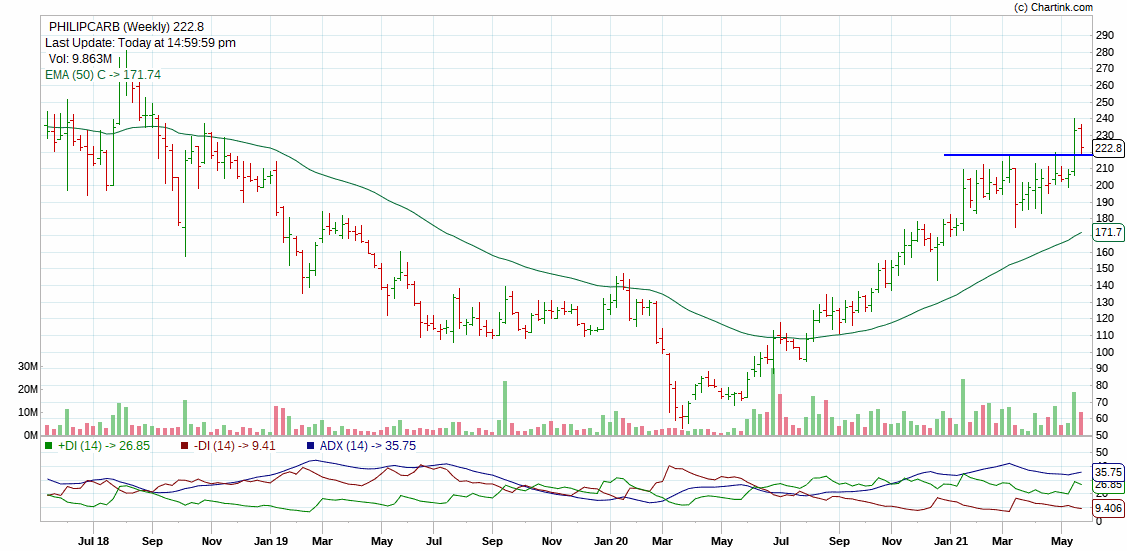

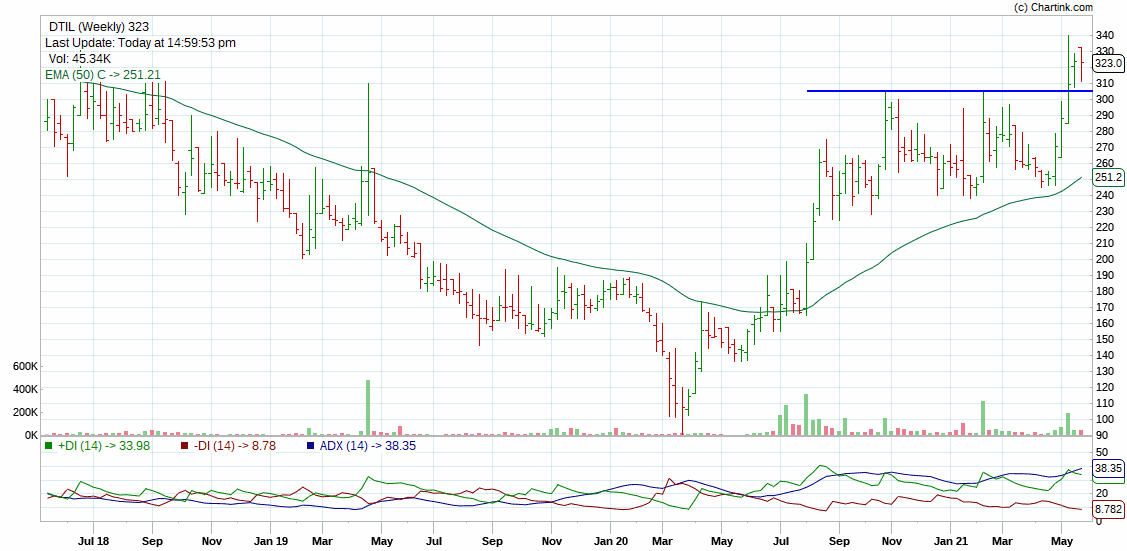

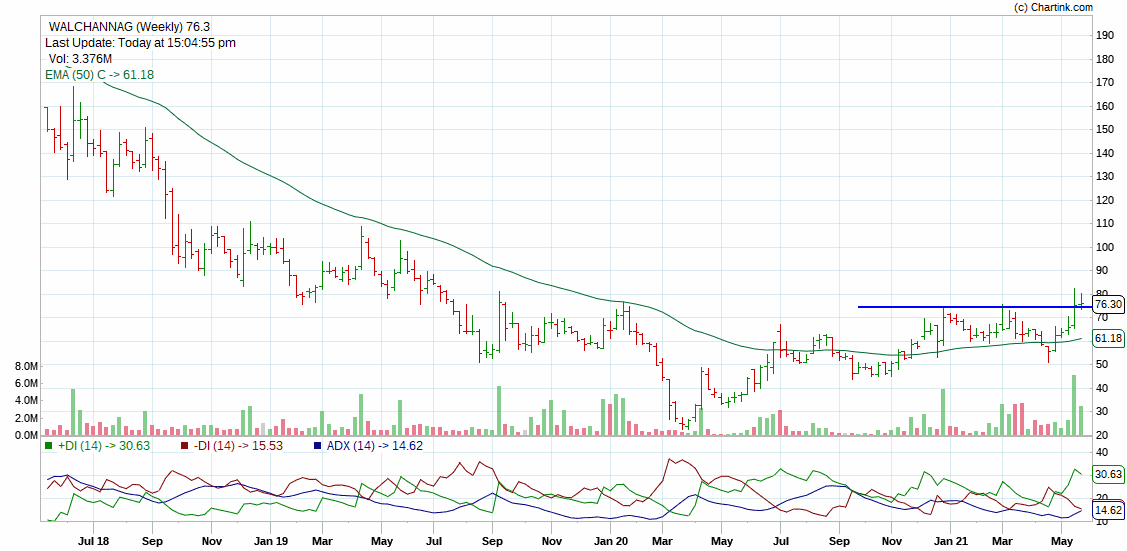

Excellent retesting candidates after strong breakouts

Filtered based on Price, volume and momentum

Retests allows a retail trader to buy the stock cheapest after the trend is set.

one of the most powerful set up in classical technical analysis

1/5

Filtered based on Price, volume and momentum

Retests allows a retail trader to buy the stock cheapest after the trend is set.

one of the most powerful set up in classical technical analysis

1/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh