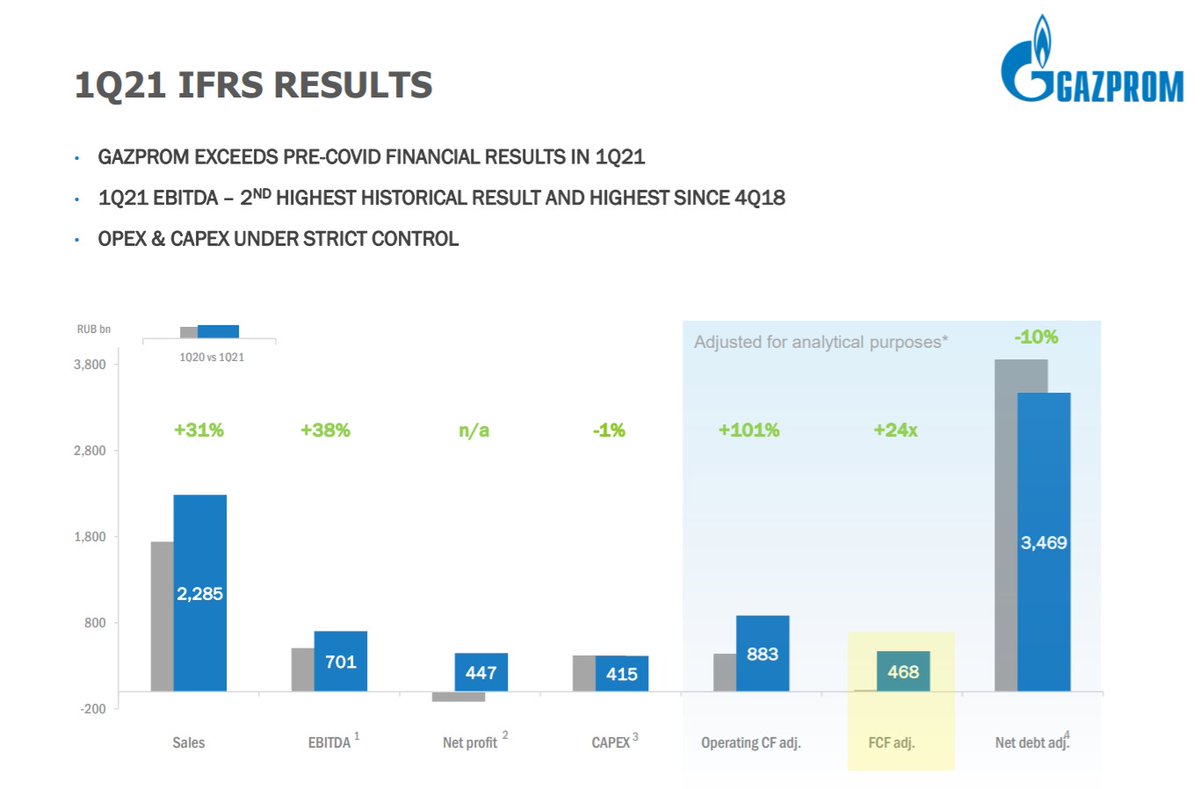

Gazpróm released the report for 1Q 2021.

The generation of operating cash is enormous... and in the 1Q alone, there are already 8.26 RUB per share for FY2021 distribution!

This is a 3.15% dividend yield in a single quarter!

@GazpromEN = Massively unvervalued

The generation of operating cash is enormous... and in the 1Q alone, there are already 8.26 RUB per share for FY2021 distribution!

This is a 3.15% dividend yield in a single quarter!

@GazpromEN = Massively unvervalued

With a Market Cap of USD 84,315 mln and a net debt of USD 43,000 mln, Gazprom's Enterprise value amounts to USD 127,000 mln. Taking the first quarter Free Cash Flow of USD 6.350bn, Gazprom is valued at 20 quarters ...

The total volume of gas sales from Q2 2020 to Q1 2021 was 507 bcm.

Taking a look at the reserves... there are 48 years of gas to sell... and with reserves growing.

33% of the gas consumed in Europe is gas from @GazpromEN and and the transport has yet to start via @NordStream2

Taking a look at the reserves... there are 48 years of gas to sell... and with reserves growing.

33% of the gas consumed in Europe is gas from @GazpromEN and and the transport has yet to start via @NordStream2

The volume of gas in underground storage facilities in Europe has reached the lowest level in history - about 30%, according to the European Association Gas Infrastructure Europe (GIE)

vesti.ru/finance/articl…

vesti.ru/finance/articl…

Russia doesn’t plan to shut off gas to Ukraine after @NordStream2 pipeline complete, top diplomat insists

rt.com/russia/525261-…

rt.com/russia/525261-…

Dmitry Birichevsky, the director of economic co-operation at Russia Foreign Ministry, said that fears Russia could turn off the tap on supplies to its neighbor were unfounded. “We have no plan to suspend gas supplies through Ukraine,”

He said, insisting that “Russia has never used energy or natural resources as a tool of pressure or blackmail.”

Russia will gain even more market share in Europe with @NordStream2

@GazpromEN it will not give up transport via Ukraine

Russia will gain even more market share in Europe with @NordStream2

@GazpromEN it will not give up transport via Ukraine

Gazprom, Mongolia discussed Soyuz Vostok gas pipeline

CEO of Gazprom Alexei Miller and Foreign Minister of Mongolia Batmunkh Battsetseg discussed the project of Soyuz-Vostok gas pipeline construction for supplies of Russian gas to China through Mongolia.

tass.com/economy/1297503

CEO of Gazprom Alexei Miller and Foreign Minister of Mongolia Batmunkh Battsetseg discussed the project of Soyuz-Vostok gas pipeline construction for supplies of Russian gas to China through Mongolia.

tass.com/economy/1297503

The offshore segment of the first string of the Nord Stream 2 gas pipeline is technically completed, and the startup for gas-in will start on June 11, Nord Stream 2 AG, the gas pipeline operator

tass.com/economy/1301425

tass.com/economy/1301425

tass.com/economy/1303401

Natural gas prices on European spot markets climbed to $360 per 1,000 cubic meters and continue growing on the back of high demand and low reserves in underground gas storages.

Natural gas prices on European spot markets climbed to $360 per 1,000 cubic meters and continue growing on the back of high demand and low reserves in underground gas storages.

The price is almost $100 above the February maximum, Gazprom told reporters on Wednesday.

vesti.ru/finance/articl…

Gas prices will rise in Russia from July 1. The cost of fuel produced by Gazprom and its affiliated companies will rise by three percent, Rossiya 24 reports . The corresponding order was published by the Federal Antimonopoly Service.

Gas prices will rise in Russia from July 1. The cost of fuel produced by Gazprom and its affiliated companies will rise by three percent, Rossiya 24 reports . The corresponding order was published by the Federal Antimonopoly Service.

RUSSIAN GAZPROM BOOKS ENTIRE ADDITIONAL TRANSIT CAPACITY OFFERED VIA UKRAINE FOR JULY AT JUNE VOLUME

open4business.com.ua/russian-gazpro…

open4business.com.ua/russian-gazpro…

Analysts of the investment group VTB Capital believe that Gazprom can pay dividends for 2021 in the amount of more than 45 rubles per share, which is almost 3.5 times higher than the value of 2020 (12.55 rubles)."

According to experts, gas prices in Europe have reached their maximum since March 2018 amid hot weather, and the observed trends are generally positive for Gazprom, which carries out 80% of gas supplies to Europe pegged to spot prices.

The demand for gas is still driven by the need to replenish gas storage facilities (their fill rate is currently 44%, which corresponds to a long-term seasonal minimum), as well as the high demand for electricity to provide air conditioning due to hot weather," analysts write...

Assuming that the average gas price for TTF in the second half of 2021 will be $ 344 per thousand cubic meters (slightly below the current forward curve)

Gazprom may pay dividends in the amount of more than 45 rubles per share, which implies a dividend yield of 16.7% - the highest in the Russian oil and gas sector, "- says the investment bank's review.

Russian natural gas giant Gazprom GAZP.MM has set the yield on its Swiss franc Eurobond at 1.54%, Interfax new agency reported on Wednesday, citing a source.

The company has been in touch with investors regarding its six-year, 500 million Swiss franc ($545 million) issue since June 21.

The yield of this new bond accounts for how much risk large investors see in Gazprom?

All the news with testimonies that Russia wants to earn money with gas, like any business in the world. But none complain that "gas supplies are tight as more cargoes of LNG sail to Asia rather than Europe."

ft.com/content/c023ba…

ft.com/content/c023ba…

The candidates for the chancellor of Germany, Armin Laschet (CDU) and Olaf Scholz (SPD) warned Russia that in the event of actions violating Ukraine's interests, gas imports from Nord Stream 2 could be suspended at any time.

m.dw.com/pl/kandydaci-n…

m.dw.com/pl/kandydaci-n…

Don't worry, Gazprom will surely fill all the gas pipelines to Europe and increase its market share.

Demand for Russian energy giant Gazprom's GAZP.MM 10-year dollar-denominated Eurobond exceeded $1.95 billion.

The yield guidance for the issue was lowered to 3.65-3.7% from 3.875% earlier, the source said.

nasdaq.com/articles/deman…

The yield guidance for the issue was lowered to 3.65-3.7% from 3.875% earlier, the source said.

nasdaq.com/articles/deman…

tass.com/economy/131461…

Gazprom notes the slow pace of recovery of gas reserves in underground gas storage facilities (UGS) in Europe, by mid-July, only a third of the volume taken last winter had been replenished.

Gazprom notes the slow pace of recovery of gas reserves in underground gas storage facilities (UGS) in Europe, by mid-July, only a third of the volume taken last winter had been replenished.

"Gas reserves in Europe's underground storage facilities are recovering extremely slowly.

Gazprom noted that the low level of reserves in UGS facilities in Europe is one of the factors supporting the price of gas on the European market.

Spot gas prices in Europe at the TTF hub in the Netherlands have surpassed $ 400 per thousand cubic meters since June 22, according to ICE.

The price per thousand cubic meters of gas on TTF on July 15 was $ 451.17, according to ICE data

The price per thousand cubic meters of gas on TTF on July 15 was $ 451.17, according to ICE data

tass.ru/ekonomika/1191…

Gas exports to non-CIS countries for 6.5 months increased by 24.3% (by 21 billion cubic meters), to 107.5 billion cubic meters. m, approaching a historical maximum, the holding said in a statement.

Gas exports to non-CIS countries for 6.5 months increased by 24.3% (by 21 billion cubic meters), to 107.5 billion cubic meters. m, approaching a historical maximum, the holding said in a statement.

Gazprom continues to supply gas at a level close to its historic record (108.9 billion cubic meters in 6.5 months of 2018), "the gas company said.

In particular, since the beginning of the year, Gazprom has increased gas supplies to Turkey (by 205.2%), Germany (by 43.3%), Italy (by 15%), Romania (by 294.8%), Poland (by 16.5%), Serbia (123.5%), France (10.3%), Bulgaria (44.1%), Greece (21.3%).

Gas supplies to China through the Power of Siberia gas pipeline also continue to grow.

m.dw.com/en/baltic-pipe…

Copenhagen’s decision to withdraw a permit for the Danish section of the Baltic Pipe gas pipeline from Poland to Norway could mean Warsaw remains a buyer of Russian gas. That was not part of the plan.

Copenhagen’s decision to withdraw a permit for the Danish section of the Baltic Pipe gas pipeline from Poland to Norway could mean Warsaw remains a buyer of Russian gas. That was not part of the plan.

Putin and Merkel talked about Nord Stream 2

"They discussed the possibility of extending the agreement between Gazprom and Naftogaz of Ukraine on the transportation of gas through the territory of Ukraine."

vesti.ru/finance/articl…

"They discussed the possibility of extending the agreement between Gazprom and Naftogaz of Ukraine on the transportation of gas through the territory of Ukraine."

vesti.ru/finance/articl…

The USA clarified the details of the agreements with the FRG on the "Nord Stream-2"

US Deputy Secretary of State Victoria Nuland clarified the details of the agreements with the FRG on Nord Stream 2.

vesti.ru/finance/articl…

US Deputy Secretary of State Victoria Nuland clarified the details of the agreements with the FRG on Nord Stream 2.

vesti.ru/finance/articl…

She said that Berlin will seek EU sanctions against Russia if it uses energy to put pressure on Ukraine.

Another aspect of the agreement between the United States and Germany is the intention to seek a 10-year extension of the agreement on the transit of Russian gas through Ukrainian territory . It expires in 2024.

We insist on our point of view: Gazprom will supply gas through all pipelines that allow it, including those that pass through Ukraine.

In @ResGloStocks we said many times: Russia will not stop gas transit through Ukraine... Gazprom will gain market share in Europe.

Now, the Gazprom CEO says same: "Gazprom is ready to transport gas through Ukraine after 2024 for delivery under new contracts."

"The head of the corporation stressed that the company has always emphasized its readiness to continue gas transit, based on the economic feasibility and technical condition of the Ukrainian gas transportation system."

Negotiations on the transit of Russian gas through Ukraine after 2024 are largely related to decarbonization processes in Europe and changes in gas demand in Europe, said Dmitry Peskov, press secretary of the Russian President.

vesti.ru/finance/articl…

vesti.ru/finance/articl…

"Consumers in Germany are the largest consumers of gas in Europe. Therefore, the volume of (transit - editor's note) will largely depend on their demand," Peskov said.

Gazprom said yesterday that if Europe shows interest in increasing purchases of Russian gas, then gas transit through Ukraine may increase.

Gazprom confirmed its readiness to supply gas through Ukraine after 2024, subject to the economic feasibility and technical readiness of the Ukrainian GTS.

Peskov recalled that the topic of Nord Stream 2 and gas transit through Ukraine was raised during a telephone conversation between President Vladimir Putin and German Chancellor Angela Merkel.

Gas prices in Europe have surpassed the psychologically important $ 500 mark. In the Netherlands, 1,000 cubic meters for delivery this Friday costs $ 505.

The rise in the price of LNG in Asia remains the key growth factor. The reason for this is the hot summer, which forces the air conditioners to be turned on at full capacity, which leads to surges in electricity consumption.

In the first five months of this year, supplies of mineral fuels, oil and petroleum products from Russia to America increased by 78%. Such data are provided by the US statistical office.

Gazprom increased gas production by 18.4% in seven months

Gas exports increased by 23.2% and amounted to 115.3 billion cubic meters

tass.ru/ekonomika/1203…

Gas exports increased by 23.2% and amounted to 115.3 billion cubic meters

tass.ru/ekonomika/1203…

Since the beginning of the year, according to preliminary data, Gazprom has increased gas production by 18.4% (46.4 billion cubic meters) compared to the same period last year, to 298.2 billion cubic meters.

Gas exports to non-CIS countries for seven months increased by 23.2% (by 21.7 billion cubic meters), to 115.3 billion cubic meters. m, approaching a historical maximum, the holding said in a statement.

"Thus, supplies from Gazprom continue in volumes close to the historically record high (117.1 billion cubic meters in seven months of 2018)," the gas company said.

since the beginning of the year, Gazprom has increased gas supplies to Turkey (by 203.9%), Germany (by 42.2%), Italy (by 16.2%), Romania (by 318.3%), Poland (by 14.6%), Serbia (by 118.1%), France (by 6%)

Gas supplies to China through the Power of Siberia gas pipeline also continue to grow.

"Low rates of pumping into European underground storage facilities are pushing prices up. At the end of July, day-ahead contracts reached the $ 500 milestone," stresses Gazprom.

"According to Gas Infrastructure Europe, as of July 31, the rate of filling underground gas storages in the EU and Ukraine on the eve of the last summer month remains extremely low,"

• • •

Missing some Tweet in this thread? You can try to

force a refresh