We published a new substack on recent intervention trends in China, with implications for $CNY and $USD.

A short thread on the key points.

@michaelxpettis @M_C_Klein @sobel_mark @GagnonMacro @MarketInterest @reziemba @SunnyOhHK @adamkwolfe @TomOrlik

moneyinsideout.exantedata.com/p/china-bop-pa…

A short thread on the key points.

@michaelxpettis @M_C_Klein @sobel_mark @GagnonMacro @MarketInterest @reziemba @SunnyOhHK @adamkwolfe @TomOrlik

moneyinsideout.exantedata.com/p/china-bop-pa…

https://twitter.com/EtraAlex/status/1398099925976727552

There has been a lot of confusion around FX policy as we approached 6.40 in USDCNY. In particular whether China might *strengthen* the RMB to deal with rising import/commodity/PPI/CPI prices. See @martin_lynge's here:

https://twitter.com/martin_lynge/status/1397208856657371137

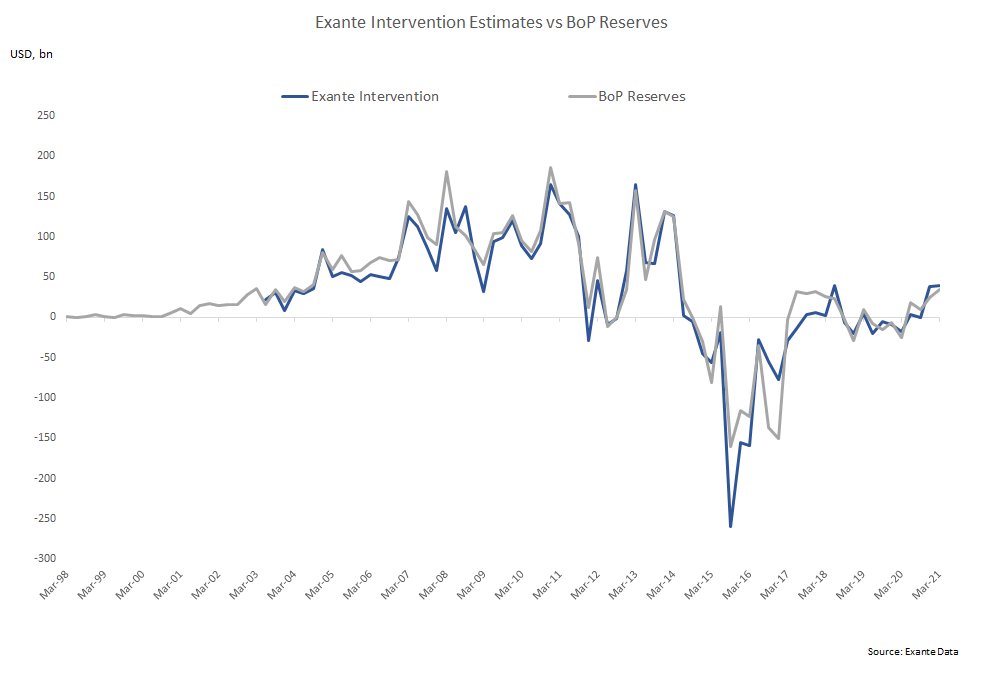

But our proprietary real-time intervention model has shown an acceleration in FX buying ( $CNY selling) of >$15bn since mid-April (move below 6.50).

This is not news to our clients (who have access to the model) or to those who have been following these trends closely.

This is not news to our clients (who have access to the model) or to those who have been following these trends closely.

The official monthly data had shown a meaningful pickup in FX buying since last fall. Especially by the state-banks.

The latter were reportedly back in the market this week. reuters.com/article/china-…

The latter were reportedly back in the market this week. reuters.com/article/china-…

Meanwhile, the official BoP data show reserve accumulation since Q4 2020 averaging about $30bn per quarter which is the highest since 2017/18.

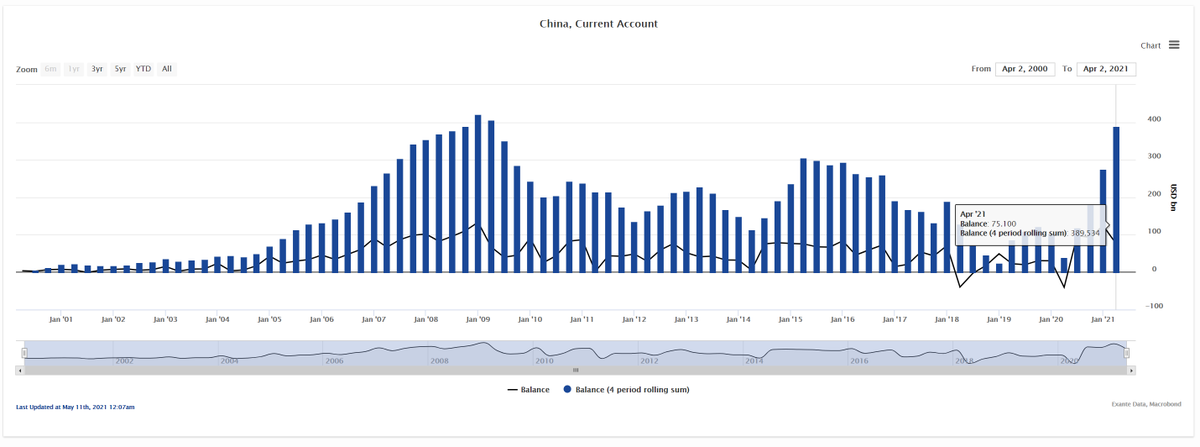

Noteworthy though it is, this is nowhere near enough to offset recent FX inflows on the current account, FDI and portfolio flows. On a 4Q sum basis the CA is highest since the GFC and probably will pickup further in Q2

Details: moneyinsideout.exantedata.com/p/chinas-balan…

Details: moneyinsideout.exantedata.com/p/chinas-balan…

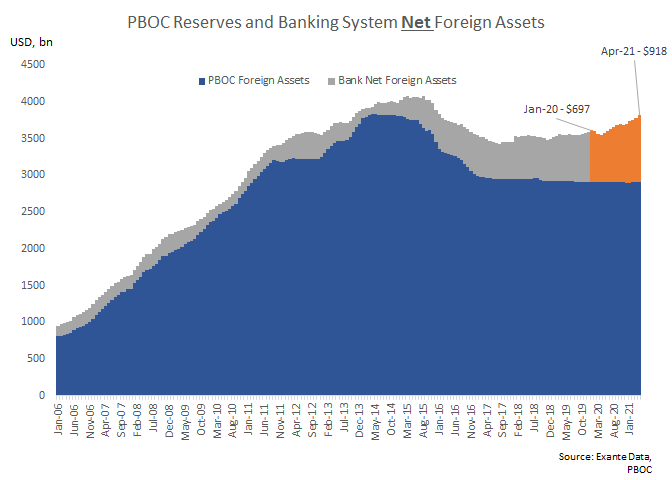

But it's not just the central bank. Chinese state/commercial banks are now behind the biggest portion of FX asset accumulation, with *net* foreign assets up more than $200bn since the start of 2020.

Details: moneyinsideout.exantedata.com/p/chinas-balan…

Details: moneyinsideout.exantedata.com/p/chinas-balan…

The messaging remains muddled, but data suggests efforts to limit USDCNY⬇️. Not surprising: a stronger RMB would further compress margins amid already rising PPI.

If they draw a line on CNY this may limit broad USD weakness but could it mean a return to the manipulation game?

If they draw a line on CNY this may limit broad USD weakness but could it mean a return to the manipulation game?

• • •

Missing some Tweet in this thread? You can try to

force a refresh