Bagaimana saya mula melabur sebagai pelajar?

This thread is purely based on my own experience. The investing style and allocation may differ with others.

This thread is purely based on my own experience. The investing style and allocation may differ with others.

Don't take this purely as an investment advice. It's just a guidance for all of you. Yang mana bagus, you can take it. Yang mana kurang bagus, just leave it 😬

Back in 2014, waktu tu umur 21 tahun. Saya ada duit lebihan sedikit dan nak melabur. Waktu tu I've no idea about pelaburan dan the only orang yang saya percaya hanyalah bankers.

So saya bawak duit cash, pergi ke bank dan tanya di kaunter pertanyaan...

So saya bawak duit cash, pergi ke bank dan tanya di kaunter pertanyaan...

Kisah di CIMB Alor Setar depan Pekan Rabu :

" Assalamualaikum Encik, saya nak mula melabur. Boleh bantu"

Kemudian dia terus redirect me ke bahagian sales unit trust. Orang tu pun mula lah cerita pasal produk mana bagus etc....

" Assalamualaikum Encik, saya nak mula melabur. Boleh bantu"

Kemudian dia terus redirect me ke bahagian sales unit trust. Orang tu pun mula lah cerita pasal produk mana bagus etc....

Kemudian dia suruh isi borang 'risk profile' untuk tahu tahap risk tolerance saya. Lepas isi semua, dia cakap lebih kurang macam ni :

Najib more to long term and moderately aggressive. Jadinya dia cadang dekat saya 2 funds from CIMB :

Najib more to long term and moderately aggressive. Jadinya dia cadang dekat saya 2 funds from CIMB :

1. CIMB Islamic Al-Azzam Equity Fund

2. CIMB Islamic Pacific Equity Fund

Katanya no 1 tu more tu low risk dan yang kedua more to high risk and potential growth.

Jujur saya cakap, waktu ni apa saja dia cakap saya angguk ja. Dia tipu pun tipulah😂

2. CIMB Islamic Pacific Equity Fund

Katanya no 1 tu more tu low risk dan yang kedua more to high risk and potential growth.

Jujur saya cakap, waktu ni apa saja dia cakap saya angguk ja. Dia tipu pun tipulah😂

Maka bermulalah pelaburan saya di unit trust. The moment I put in money ja, duit terus negatif 😭

Ada sales charge etc. This screenshot 6 bulan lepas saya mula melabur...

Nak tahu apa jadi with this investment now after 8 years?

Ada sales charge etc. This screenshot 6 bulan lepas saya mula melabur...

Nak tahu apa jadi with this investment now after 8 years?

Well, saya withdraw my investmen July 2019.

Look at the performance, Al-Azzam Equity Fund masih negatif after 5 years dan Asia Pacific Equity Fund positive 14.91%....

Nak tahu why saya withdraw?

Look at the performance, Al-Azzam Equity Fund masih negatif after 5 years dan Asia Pacific Equity Fund positive 14.91%....

Nak tahu why saya withdraw?

CIMB Asia Pacific Equity Fund is one of the best fund for CIMB but kenapa performance hanyalah 14.91%?

14.91% is equal to 2.8% annualized return,very poor....

14.91% is equal to 2.8% annualized return,very poor....

Kalau kita tengok performance dalam ni, mesti kita pelik kan why tak tally dengan saya punya pelaburan?

Well actually performance ni tak ambil kira all the charges and fees every year... Sorry I won't elaborate more on this.

Well actually performance ni tak ambil kira all the charges and fees every year... Sorry I won't elaborate more on this.

To give you the idea, waktu saya masuk melabur tu ada all the fees. For example saya melabur RM4000, tolak fees etc tinggal RM3600+-(yesss the fees is huge).

So kalau kira balik performance saya from RM3600, the performance increases a lot, it's 27%!!!

So kalau kira balik performance saya from RM3600, the performance increases a lot, it's 27%!!!

So saya decide to pullout from Unit Trust back in 2019. Maaf if this one really hurt anybody here. Those yang looking for Unit Trust, pelase do consider all the fees jugak. Very huge different tu.

Saya bagi gambar ni sebagai ilustrasi...

Saya bagi gambar ni sebagai ilustrasi...

Between 2014 till now, ada tak pelaburan lain yang saya buat? Yes ada, tahun 2015 saya mula buat ASBF.

One thing I want to let you know, this is one of my best major step till now. I never regret it.... Why?

One thing I want to let you know, this is one of my best major step till now. I never regret it.... Why?

1. Sebab the return is pedictive

2. Jaminan modal

3. The power of compounding after few years, now in 2021 saya dah mula rasa manisnya return from ASBF sebab my return is from principal+dividen last years....

2. Jaminan modal

3. The power of compounding after few years, now in 2021 saya dah mula rasa manisnya return from ASBF sebab my return is from principal+dividen last years....

2019, after pulling out my unit trust. Saya terus add another ASBF full margin. But this step you kena hati-hati jangan buat financing kalau tak mampu nak bayar bulan-bulan.

Teknik rolling dividen is not advisable sebab you tak merasa teknik compounding tu...

Teknik rolling dividen is not advisable sebab you tak merasa teknik compounding tu...

Now ASBF will stay as my long term investment plan until saya retire insyaAllah...Best ASBF, even dividen makin low kan but once you dah mula compound, nothing can stop you...

Jom kita move to next one, back in 2016 saya mula buat tourguide di Paris. Ter guide seorang broker saham from Amequities(Ambank).

This one menarik, saya nak cerita sikit background pasal this story boleh? Sikit saja, nanti kena buat thread asing pasal ni sebab very menarik.

This one menarik, saya nak cerita sikit background pasal this story boleh? Sikit saja, nanti kena buat thread asing pasal ni sebab very menarik.

Long story short : I didnt know he is a remisier(broker) until we met another Malaysian. So dalam cerita ni kami 3 orang : Najib, broker saham dan another Malaysian.

Saya tanya another Malaysian tu : "Abang kerja apa?"

Dia cakap, 'Aku trader. Aku travel ni semua dengan guna duit trade. Untung trade, travel'

Cakap besar betul tapi takpa lah tu cara dia😂

Dia cakap, 'Aku trader. Aku travel ni semua dengan guna duit trade. Untung trade, travel'

Cakap besar betul tapi takpa lah tu cara dia😂

Obviously lepas tu dia tak tanya aku buat apa sebab dia tahu aku guide. Dia tanya lah si broker saham ni(waktu ni dia dan saya tak tahu lagi yang customer saya ni broker"

So dia tanya, "Abang kerja apa?"

Broker saham ni jawab, "Saya broker saham...."

So dia tanya, "Abang kerja apa?"

Broker saham ni jawab, "Saya broker saham...."

So dari situlah bermulanya kisah saya terlibat saham. Dia terus cerita details bab saham sepanjang perjalanan kami di Paris. A to Z dia cerita. Yes my introduction pasal saham adalah depan Eiffel Tower dan Museum of Louvre.😆

So saya mula melabur 2017, waktu tu letak duit lebihan dulu. Tahun pertama macam biasa loss. Struggle jugak saham ni sebenarnya. Baru saya faham perasan fund manager unit trust tadi, very difficult nak maintain good return....

Saya mula gain steady return di saham back in 2018 but still, saya masih tak all in di saham sebab I know the risk. Saya mitigate the risk well here dengan stay still di ASBF tanpa ganggu my investment flow.

Jadinya sebelum pergi lebih jauh, kita recap jap :

1. Unit Trust 2014 - 2019

2. ASBF 2015 till now for first one, 2019 till now for the second one

3. Saham 2017 till now

So let me tell you the fourth one...

1. Unit Trust 2014 - 2019

2. ASBF 2015 till now for first one, 2019 till now for the second one

3. Saham 2017 till now

So let me tell you the fourth one...

Obviously it's Wahed. Saya antara orang awal yang terlibat with Wahed back in 2019, seingat saya November 2019.

This one really advantage in term of fees compared to unit trust. Takda fund manager fees, takda sales charge etc. Purely transparence annual fees...

This one really advantage in term of fees compared to unit trust. Takda fund manager fees, takda sales charge etc. Purely transparence annual fees...

And to be frank, Wahed is one of the best outperform fund yang saya hold. This one saya akan hold for long term same as ASBF.

Cerita panjang wahed saya serahkan to this thread :

Cerita panjang wahed saya serahkan to this thread :

https://twitter.com/najibfazail/status/1398618977149100034?s=20

Jadinya now, saya dah umum yang ke 4, actually ada yang ke 5 tetapi saya taknak cerita panjang sangat. Ada yang nak tahu kah?

Well yang ke 5 is Tabung Haji. Saya takmau cerita panjang sebab this one saya tak fokus sangat on pelaburan what so ever, saya fokus on nak bagi cukup pergi Haji, insyaallah....

To recap :

1. Unit Trust 2014 - 2019

2. ASBF 2015 till now

3. Saham 2017 till now

4. Wahed 2019 till now

5. Tabung Haji dari kecik till now

Let me classify mana yang sesuai for students to start from my point of view...

1. Unit Trust 2014 - 2019

2. ASBF 2015 till now

3. Saham 2017 till now

4. Wahed 2019 till now

5. Tabung Haji dari kecik till now

Let me classify mana yang sesuai for students to start from my point of view...

1. Tabung Haji - jadikan sebagai tempat simpanan kecemasan kita. Tak kisah lah sebulan RM10 pun janji menabung. Hujung ada jugak dividen dan modal terjamin

2. ASB - This one pun boleh consider jugak sebab modal terjamin dan dividen agak 'kompetitif'

2. ASB - This one pun boleh consider jugak sebab modal terjamin dan dividen agak 'kompetitif'

3. Wahed Invest - with RM100 dah boleh mula melabur and very low fees. This one kena ada basic knowledge jugak pasal market sebab nak tahu when is the best time to topup.

Saya personally akan update jugak kadang-kadang bila perlu topup. Follow me ya di Twitter!😬

Saya personally akan update jugak kadang-kadang bila perlu topup. Follow me ya di Twitter!😬

4. ASBF - Bila dah ada duit lebih baru consider. ASBF ni saya suggest dekat student yang ada side income, biasiswa dan juga mungkin ada back up savings. Since benda ni melibatkan financing, tak boleh bayar nanti rosak credit ratings.

5. Unit trust - Saya suggest jugak sebab UT ni kita boleh melabur through EPF. Just ambil kira semua fees dan don't simply jump like I did in 2014. Saya waktu tu buta tuli lagi pasal pelaburan😂

6. Saham - Ada yang letak this as priority. Yes it's priority for you to gain knowledge on this as young as you can but make sure, you're ready for a higher risk of investment.

Itu sahaja pelaburan yang saya start as student. I start as low as RM1000 back in 2014 dan sikit demi sikit saya saving, business part time etc dan topup di pelaburan. Nak kata dah kaya tu idokk ler tetapi Alhamdulillah, I'm on track....

Saya tak suka over diversify sebab takut diworsification. Susah untuk saya open to new opportunity of investment now since saya dah cuba yang ideal for me. I just need to stay calm and keep on topup knowledge and surely, topup money😆

Along the way, I meet a lot of people but one person yang saya nak give very big credit adalah @IsxzuddinMY

Both of us selalu catch up about our investment journey, portfolio balancing etc.

Both of us selalu catch up about our investment journey, portfolio balancing etc.

Not to forget, saya dengan Isz predicted Wahed could outperform the market and yes, our prediction is right....

To conclude, thank you for reading my thread. My advice for students :

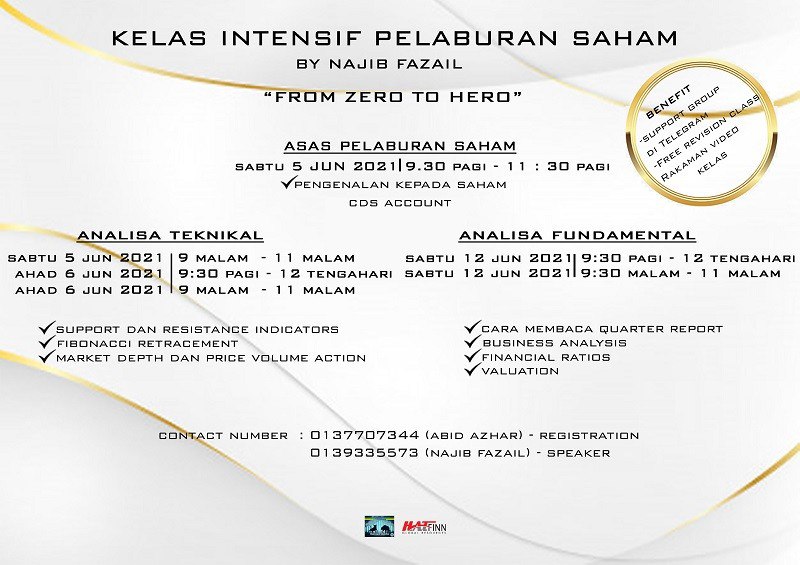

1. Gain knowledge as much as you can through reading, webinar, youtube, twitter etc;

2. Find a mentor/buddy untuk support each other;

3. Know what you do.

Any question, just hit me up!

1. Gain knowledge as much as you can through reading, webinar, youtube, twitter etc;

2. Find a mentor/buddy untuk support each other;

3. Know what you do.

Any question, just hit me up!

Sorry salah quote tweet, cerita Wahed here :

https://twitter.com/najibfazail/status/1383233582294962181?s=20

Maaf, ada kesilapan di atas berkenaan thread pasal Wahed. Saya tersilap quote tweet. Here's the details pasal Wahed :

https://twitter.com/najibfazail/status/1383233582294962181?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh