Just wanted to make sure every saw @ojblanchard1's thread on this "mini-revolution" in how we understand our fiscal situation. This goes way beyond budget wonkery and invokes smarter fiscal policy, myth busting, and even how progress occurs in economics.

https://twitter.com/ojblanchard1/status/1398563216809205760

The idea is to elevate real debt service to a prominent perch in the analysis of fiscal space. As @ojblanchard1 says, "this is what matters. If we have good uses for debt, such as the various forms of public investment in the Biden plans, this is the time to do it..."

Here's some background on the issue with links to a piece I wrote a ways back on the @ojblanchard1 paper that helped us get here.

washingtonpost.com/outlook/2019/0…

See also @jasonfurman who's also made important contributions here:

washingtonpost.com/outlook/2019/0…

See also @jasonfurman who's also made important contributions here:

https://twitter.com/jasonfurman/status/1398334380280479745

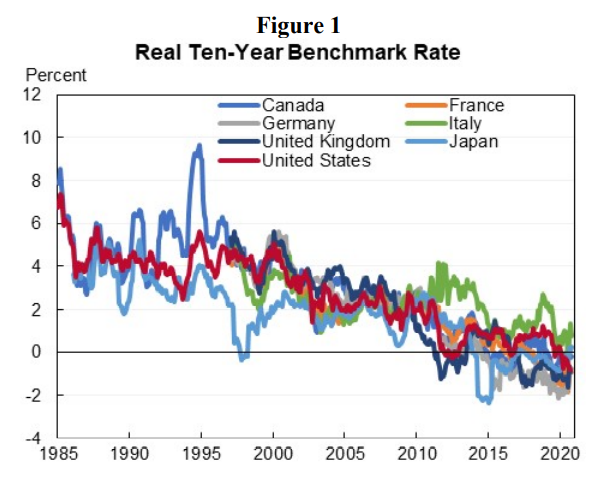

Why is real debt service so important? Because unlike other fiscal measures, it directly accounts for 1 of the most important econ developments in recent decades: the long-term decline in global interest rates. The fact that this decline occurred even as public debt was rising...

...led to an important re-evaluation of the extent to which public borrowing crowds out private borrowing, thus pushing up int rates. This was a keystone of austerity arguments, one that increasingly lacked empirical support.

piie.com/system/files/d…

piie.com/system/files/d…

As @ojblanchard1 has consistently emphasized, as have I, deficits still matter and low rates are no excuse for poorly made investments or regressive tax cuts. But real debt service & the low rate environment (w/ uncertainty caveats) add critical degrees of fiscal freedom.

I also find this evolution a good eg of how econ can make progress, with rigorous empirics, questioning assumptions, even some pretty straight-forward algebra--working its way into public policy, showing up in the president's budget! Table S-1, no less!

whitehouse.gov/wp-content/upl…

whitehouse.gov/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh