I know it seems like there is a lot happening on the @unusual_whales website, so I will try to highlight some of the sections that may not get as much attention as others.

In addition to showing you the details of every transaction occurring across the exchanges, you can see how the flow is looking for the sectors and for specific tickers. unusualwhales.com/flow/sectors

unusualwhales.com/flow/hot_chains

unusualwhales.com/flow/hot_chains

You can configure your notification settings anyway you like. Here are some examples. To receive push notifications you will need to download the mobile application (Unusual Whales). unusualwhales.com/settings/notif…

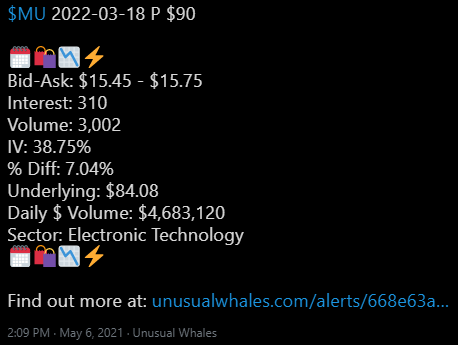

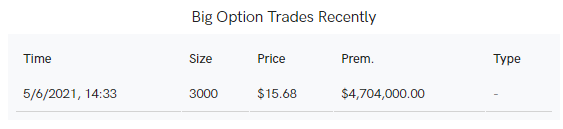

Using the search bar you can look up any ticker, which will take you to the company page. From here you can see everything from past alert history, technical charts, FURU data, stocks alerts, and more.

unusualwhales.com/company/AAPL/a…

unusualwhales.com/company/AAPL/a…

The EOD reports page will give you a birds-eye view of the bot's daily activity. You could use this to see if a particular sector has been being pushed and to get an idea of the daily bot performance. unusualwhales.com/reports

And lastly, you can refer friends and reduce your own subscription costs. unusualwhales.com/referrals As always, you can email support@unusualwhales.com or reach out in the Discord if you have any questions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh